Infectious Disease Diagnostic Market Share, Size, Trends & Industry Analysis Report

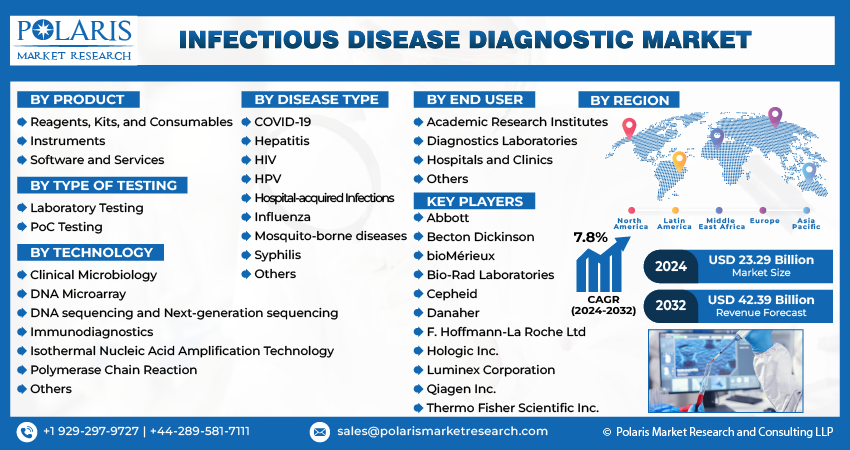

By Product; By Type of Testing (Laboratory Testing, PoC Testing); By Technology; By Disease Type; By End User; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM4280

- Base Year: 2024

- Historical Data: 2020-2023

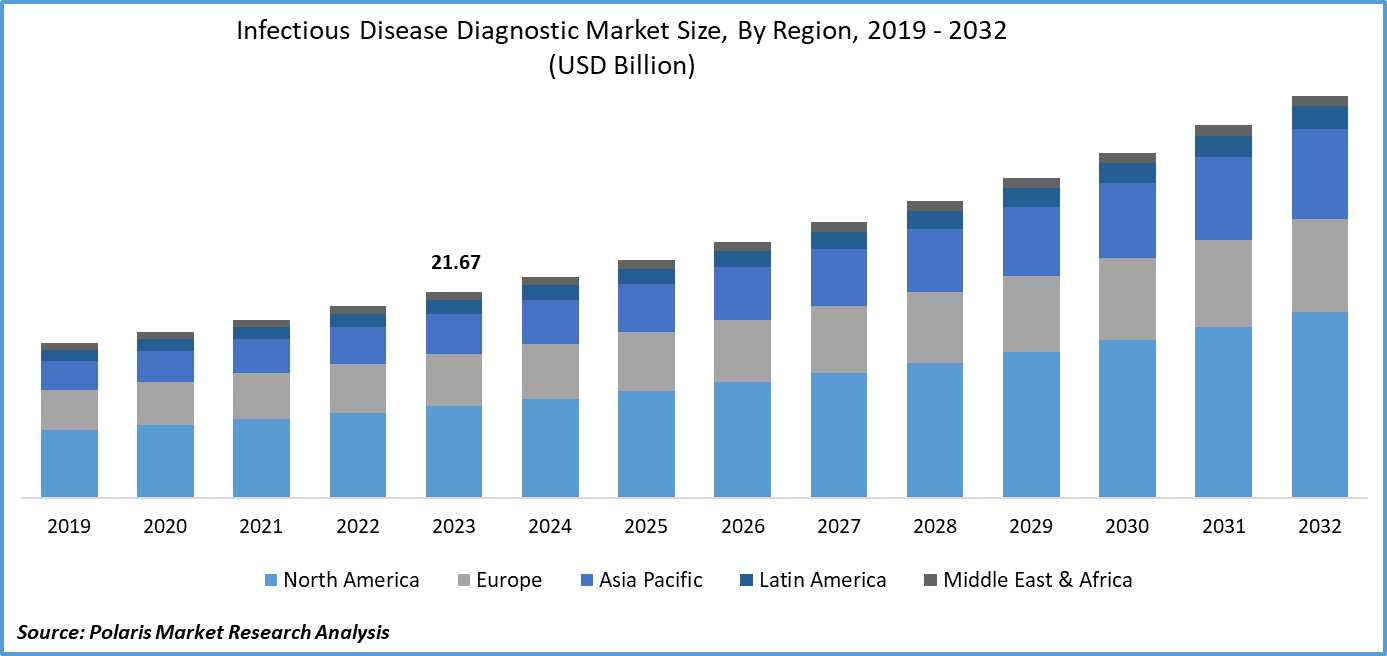

The global Infectious Disease Diagnostics Market was valued at USD 25.5 billion in 2024 and is anticipated to grow at a CAGR of 2.75% from 2025 to 2034. Ongoing pandemic preparedness, increasing prevalence of viral infections, and technological advancements in rapid testing methods are driving expansion.

Industry Trends

Infectious disease diagnostics involves various laboratory tests and techniques to identify and diagnose infections or diseases caused by pathogens such as bacteria, viruses, fungi, or parasites. Healthcare providers use a combination of physical examination, medical history, laboratory tests, imaging studies, microscopy, serology, point-of-care testing, genomic sequencing, and contact tracing to determine the cause of illness and develop an effective treatment plan.

The global infectious disease diagnostic market is rapidly growing, driven by several factors, such as the increasing prevalence of infectious diseases, advancements in technology, and growing awareness about early diagnosis and treatment. The rising incidence of infectious diseases such as HIV, influenza, and hepatitis are major drivers of the infectious disease diagnostic market growth. In addition, the emergence of new diseases and the threat of pandemics have increased the demand for rapid and accurate diagnostic tests. Moreover, technological advancements in molecular diagnostics, such as PCR-based assays, next-generation sequencing, and point-of-care testing, have improved the accuracy and speed of diagnostic tests, making them more accessible and affordable.

Also, government initiatives and funding for infectious disease control and prevention programs have contributed to the growth of the infectious disease diagnostic market. For instance, the U.S. government has established the Centers for Disease Control and Prevention (CDC), which provides funding and support for infectious disease research, surveillance, and prevention activities.

To Understand More About this Research: Request a Free Sample Report

For instance, based on recent statistical data published by the National Centre for Biotechnology Information, the global annual death toll is approximately 60 million, with roughly 25% of these fatalities being attributed to infectious diseases.

The emergence of such diseases has posed significant challenges to both public health and socioeconomic stability. While vaccines and therapies such as antimicrobial and antiviral drugs have been developed to combat infections, their effectiveness has been observed to decrease with the emergence of new pathogenic agents and drug-resistant pathogens.

However, the major restraint on the growth of the infectious disease diagnostic market is the high cost of advanced diagnostic tests, which limits their adoption in resource-poor locations. Additionally, the need for more awareness and limited access to healthcare services in developing countries reduces the demand for infectious disease diagnostic tests.

Key Takeaways

- North America dominated the market and contributed over 39% of the share in 2024

- By product category, the reagents, kits, and consumables segment accounted for the largest market share in 2024

- By type of testing category, the laboratory testing segment held the dominating revenue share in 2024

- By technology category, the immunodiagnostics segment is expected to grow with a significant CAGR over the forecast period

- By disease type category, COVID-19 segment held the significant market revenue share in 2024

- By end-user category, the academic research institutes segment is experiencing substantial growth over the forecast period

What are the Market Drivers Driving the Demand for the Infectious Disease Diagnostic Market?

The Increasing Prevalence of Infectious Diseases Drives Infectious Disease Diagnostic Market Growth

The rising incidence of infectious diseases has emerged as a significant driver for the growth of the infectious disease diagnostics market. Infectious diseases such as COVID-19, influenza, hepatitis, and others continue to pose a major threat to public health globally. The rapid spread of these diseases highlights the need for accurate and timely diagnosis, which can help prevent further transmission and reduce the risk of outbreaks. As a result, there is an increased demand for effective diagnostic tools and techniques that can detect and monitor infectious diseases promptly and accurately. This growing demand creates opportunities for companies operating in the market to develop innovative solutions, such as DNA sequencing, immunodiagnostics, polymerase chain reaction, and other advanced technologies. Moreover, governments and healthcare organizations are investing heavily in research and development, infrastructure, and awareness campaigns to combat infectious diseases, further fueling the growth of the market.

Which Factor is Restraining the Demand for Infectious Disease Diagnostic?

The High Cost of Advanced Diagnostic Tests Limits Infectious Disease Diagnostic Market Growth

Advanced diagnostic tests, such as molecular diagnostics and next-generation sequencing, can be prohibitively expensive for both patients and healthcare systems, particularly in low-resource settings. This poses a significant challenge to providing accurate and timely diagnoses to patients who need access to these tools. Additionally, the high cost of these tests can discourage healthcare providers from ordering them, leading to underutilization and reduced adoption rates. Addressing the high cost of advanced diagnostic tests is crucial for increasing their adoption and growth in the infectious disease diagnostic market.

Report Segmentation

The market is primarily segmented based on product, type of testing, technology, disease type, end user, and region.

|

By Product |

By Type of Testing |

By Technology |

By Disease Type |

By End User |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Product Insights

Based on product analysis, the market is segmented on the basis of kits, reagents, & consumables, instruments, and software & services. The kits, reagents, and consumables segment accounted for the largest revenue share in the infectious disease diagnostics market in 2023 due to the increasing prevalence of infectious diseases, which has led to a surge in demand for diagnostic tests, which in turn has driven the sales of reagents, kits, and consumables.

Also, advancements in molecular diagnostics have resulted in the development of new and innovative assays that require specialized reagents and consumables, further contributing to the growth of this segment. The repeated use of these products in various diagnostic tests and procedures has ensured a steady demand for them, making them a crucial component of the market. Along with this, the presence of a large number of players in the infectious disease diagnostic market offering a wide range of reagents, kits, and consumables has created a competitive landscape, leading to increased product offerings and affordability, thereby contributing to the dominance of this segment.

By Type of Testing Insights

Based on the type of testing analysis, the market has been segmented on the basis of laboratory testing and PoC (Point-of-Care) testing. The laboratory testing segment accounted for the dominating share of the infectious disease diagnostics market in 2024, owing to its crucial role in detecting and monitoring various infectious diseases. Laboratory tests are essential for diagnosing and managing infectious diseases, as they provide accurate and reliable results that enable healthcare professionals to make informed decisions regarding treatment and patient care. The increasing prevalence of infectious diseases has led to an increased demand for laboratory testing, driving the growth of this market segment.

In addition, advancements in diagnostic techniques have improved the accuracy and speed of lab tests, such as the RT-PCR test for COVID-19, making them more effective in detecting and monitoring infectious diseases. Also, government initiatives aimed at strengthening healthcare infrastructure and improving access to quality healthcare services have contributed to the dominant share of the laboratory testing segment.

By Disease Type Insights

Based on disease type analysis, the market has been segmented on the basis of COVID-19, hepatitis, HIV, hospital-acquired infections, HPV, influenza, mosquito-borne diseases, syphilis, and others. The pandemic has had a deep impact on the infectious disease diagnostics market, with the COVID-19 segment dominating the market in 2024. This is primarily due to the unprecedented scale of the pandemic and the urgent need for accurate and rapid diagnosis of the virus. For instance, according to the WHO statistics, till December 2023, there were approximately 773.8 million COVID-19 cases globally. As a result, there was a surge in demand for diagnostic tests, including PCR tests, antibody tests, and rapid antigen tests. In addition, the development of vaccines and treatments for COVID-19 has also driven the growth of the market. Similarly, governments and healthcare organizations worldwide have invested heavily in COVID-19 testing and contact tracing, which has further fueled the growth of this market segment.

Regional Insights

North America

The North American region emerged as the dominant player in the global market in 2024, owing to the presence of well-established healthcare infrastructure and advanced medical facilities in countries such as the United States and Canada, which contributed significantly to the region's infectious disease diagnostic market share. Moreover, the increasing prevalence of infectious diseases such as COVID-19, influenza, and others in the region has created a heightened demand for effective diagnosis and treatment options. Also, the region is home to many prominent players in the infectious disease diagnostics industry, including Abbott Laboratories, Roche Diagnostics, and Thermo Fisher Scientific, among others. These companies have been investing heavily in research and development, leading to the introduction of innovative diagnostic technologies and products that cater to the needs of clinicians and patients.

Asia Pacific

The Asia Pacific region is expected to experience substantial growth in the market during the forecast period due to the high prevalence of infectious diseases in the region, particularly in countries such as India, China, and Indonesia. The increasing incidence of dengue fever, hepatitis, and malaria in these countries has led to a growing demand for effective diagnostic tools and techniques. Additionally, the rising awareness about the importance of early diagnosis and treatment of infectious diseases among healthcare professionals and patients is also contributing to the growth of the infectious disease diagnostic market.

Competitive Landscape

The infectious disease diagnostic market is a rapidly evolving field with several key players actively engaged in developing and commercializing novel diagnostic tests and technologies. Some of the prominent players, such as Roche Diagnostics, Abbott Laboratories, bioMérieux, and Cepheid, are focused on developing innovative diagnostic solutions that can detect a wide range of infectious diseases, including viral, bacterial, and fungal infections. They are investing heavily in research and development to improve the accuracy, speed, and ease of use of their diagnostic tests, as well as expanding their product portfolios through strategic acquisitions and partnerships.

Some of the major players operating in the global market include:

- Abbott

- Becton Dickinson

- bioMérieux

- Bio-Rad Laboratories

- Cepheid

- Danaher

- F. Hoffmann-La Roche Ltd

- Hologic Inc.

- Luminex Corporation

- Qiagen Inc.

- Thermo Fisher Scientific Inc.

Recent Developments

- In May 2025, SSI Diagnostica Group acquired Florida-based Gulf Coast Scientific, integrating its Urea Breath Test technology for Helicobacter pylori detection. This move expanded SSI's gastrointestinal infectious disease testing portfolio and strengthened its U.S. manufacturing and R&D capabilities

- In January 2024, bioMérieux, a leading player in the in vitro diagnostics industry, revealed its acquisition of LUMED - a software company specialized in developing clinical decision support systems. The system created by LUMED assists healthcare providers in optimizing antimicrobial prescriptions and tracking healthcare-associated infections within hospitals.

- In April 2023, Abbott acquired Cardiovascular Systems, Inc., which is a medical device company known for its cutting-edge atherectomy system, which is used to treat peripheral and coronary artery disease. The system is designed to remove plaque build-up from arteries using a minimally invasive approach, making it a highly effective and innovative solution for patients dealing with these conditions.

- In May 2022, Becton Dickinson, a renowned global medical technology firm, announced the release of a highly advanced, fully automated, and high-throughput infectious disease molecular diagnostics platform in the United States.

- In April 2021, Roche introduced the Cobas 5800 System, a molecular laboratory instrument capable of conducting infectious disease tests. The company has received the CE mark for the product, making it available in countries that recognize this certification.

Report Coverage

The Infectious Disease Diagnostic market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, type of testing, technology, disease type, end user, and their futuristic growth opportunities.

Infectious Disease Diagnostic Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 26.2 billion |

|

Revenue Forecast in 2034 |

USD 33.46 billion |

|

CAGR |

2.75% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Product, By Type of Testing, By Technology, By Disease Type, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global infectious disease diagnostic market size is expected to reach USD 33.46 Billion by 2034

Key players in the market are Abbott, Becton Dickinson, bioMérieux, Bio-Rad Laboratories, Cepheid, Danaher, F. Hoffmann-La Roche Ltd

North American contribute notably towards the global infectious disease diagnostics market

Infectious Disease Diagnostic Market exhibiting a CAGR of 2.75% during the forecast period

The infectious disease diagnostics market report covering key segments are product, type of testing, technology, disease type, end user, and region.