Irrigation Automation Market Share, Size, Trends, Industry Analysis Report

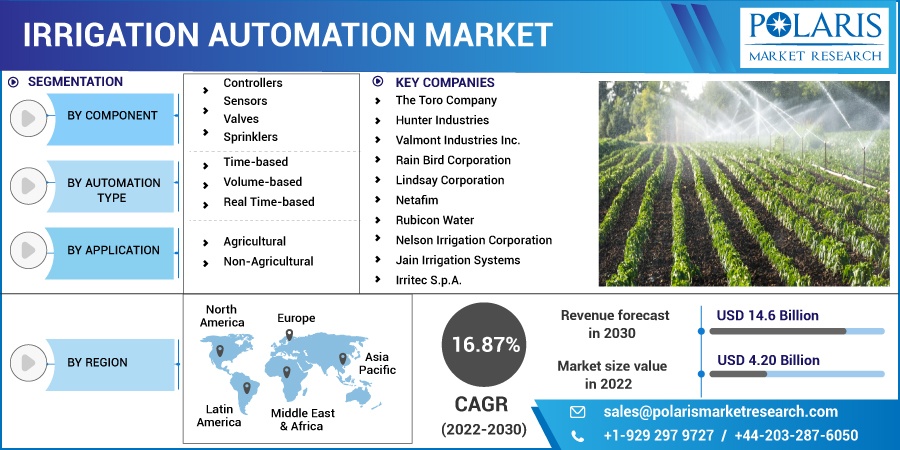

By Component (Controllers, Sensors, Valves, Sprinklers, and others); By Automation Type; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 114

- Format: PDF

- Report ID: PM2811

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

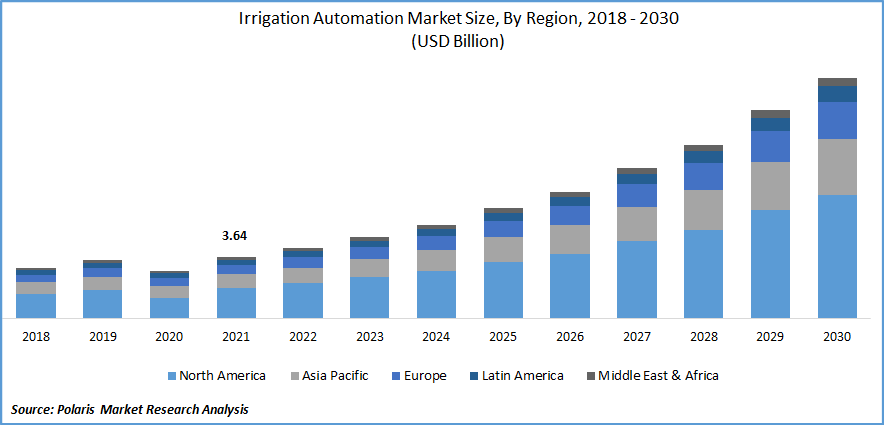

The global irrigation automation market was valued at USD 3.64 billion in 2021 and is expected to grow at a CAGR of 16.87% during the forecast period.

An incremental surge in the demand for irrigation automation systems owing to increased scarcity of water instances and a shift in consumer trends towards the mechanization of agricultural processes around the world are projected to drive the growth. Moreover, the increasing number of water crises, along with the unpredictable rainfall patterns, is hampering the use of conventional irrigation techniques. Therefore, the demand for advanced irrigation techniques for cultivation worldwide is escalating rapidly.

Know more about this report: Request for sample pages

Furthermore, several types of government efforts to support the installation of advanced irrigation systems and taking initiatives to promote conservation of water due to the growing issues regarding water, are also expected to have a positive impact on the global market over the coming years. For instance, the Australian Government announced its On-farm Irrigation Efficiency Program for supporting individual irrigators to enhance and improve the production and higher efficiency of on-farm irrigation water use and management. The new program will help individual irrigators change irrigation infrastructure and practices to save water.

Furthermore, several benefits associated with advanced irrigation automation systems, such as lowering labor expenses, constant monitoring, and minimizing water wastage, are attracting consumers to adopt these systems in place on conventional techniques across the globe.

The outbreak of the COVID-19 pandemic has significantly impacted the growth and demand of the market. The outbreak has created many disruptions in primary industries including construction, manufacturing, energy & power, and automotive. This has also negatively impacted the irrigation industry as the virus continues to have an impact on water-energy ecosystems. Moreover, lacking labor availability, disruptions in supply chain, and fiscal constraints were other factors limiting the growth of the irrigation automation market during the pandemic.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising awareness of farmers regarding automated irrigation techniques and technologies, coupled with the rising government efforts and campaigns to promote water conservation across the globe, are key major factors expected to drive the growth of the global market during the forecast period. With the help of irrigation automation techniques, farmers are able to reduce the total number of visits to farms, which has resulted in lowering labor costs and increased productivity.

Furthermore, the rising usage of various smart sprinklers, which are completely controllable and respond quickly to changes in climatic conditions, is also anticipated to fuel the adoption of these systems exponentially across the globe over the coming years. High advancements in manufacturing processes of automated irrigation products and growing investment in developing new products are propelling the market growth. They are expected to contribute significantly to the market in the coming years.

Report Segmentation

The market is primarily segmented based on component, automation type, application, and region.

|

By Component |

By Automation Type |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Controllers Segment Accounted for the Largest Market Share in 2021

The controller segment led the market and accounted for the largest global revenue share in 2021 and is expected to maintain its dominance over the forecast period. The growth of the segment is majorly driven by increasing demand and prevalence for semi-automatic systems such as volume-based and time-based systems across the globe. Moreover, controllers help to provide sufficient and required amounts of water at the right time according to the desired schedule, which is likely to fuel the growth of the segment over the coming years.

Furthermore, the sensors segment is anticipated to grow at fastest growth rate during the forecast period owing to its several beneficial features like real-time soil moisture levels and determining needs of irrigations. In addition, along with the precise soil moisture temperature and measurement with the help of sensors, dripping systems can work together with automated and advanced technology, which results in higher productivity with a minimum need of a manual workforce, and is anticipated to augment market growth extensively.

Time-Based Automation Segment Held the Largest Market Share in 2021

The growth of the segment market is highly attributable to the benefits like full control of the irrigation process, less fuel required, and low labor costs, among others. The ability of time-based systems to allow the user to monitor crops, intervene, and better control at a regular interval of time at various irrigation stages are key major factors driving the growth of the segment market at a significant growth rate during the forecast period.

Moreover, the real-time-based segment registered the fastest growth rate over the study period, owing to the increasing demand for using tensiometers and sensors for temperature, weather, and rain. The real-time-based automation irrigation systems are more sustainable than others available in the market and water consumption is lesser in this system.

Non-agricultural Sector is Expected to Hold the Significant Revenue Share

The growth of the non-agricultural segment is mainly attributed to the upsurge in the number of golf courses, gardens, sports grounds, residential, and turf across the world. Automated non-agricultural systems also ensure timely watering with an optimum amount of water in such applications. Also, automatic irrigation techniques enable golf course owners to modify the volume and control it remotely on an irrigation-based, which is projected to contribute positively to the growth of the segment in the coming years.

Furthermore, the agricultural segment held the largest market share in 2021 and accounted for a healthy share because agriculture is one of the major occupations in many countries across the globe. Additionally, the standardized and low production cost of agricultural applications make them affordable to consumers, especially those belonging to emerging economies such as India, China, and Indonesia.

The Demand in North America is Expected to Witness Fastest Growth

Increasing adoption rate of irrigation systems owing to growing number of initiatives taken by government in the region for better water conservation is a major factor projected to drive the growth of the irrigation automation market in the region exponentially during the forecast period. For instance, EPA issued few specifications to recognize certification programs for irrigation professionals in the installation process, design process, and system maintenance. Various initiatives encourage people to conserve water and adopt better sustainable irrigation practices. In addition, presence of many large pool players such as The Toro Company, Valmont Industries Inc., Rain Bird Corporation, and Lindsay Corporation is also propelling the expansion of the market in the region.

However, Asia Pacific region dominated the irrigation automation market in 2021 and accounted for a healthy market share and is projected to maintain its dominance throughout the forecast period. The growth of the market is majorly driven by a large presence of vast agricultural lands, changing climatic conditions, increasing penetration of reducing water wastage, and strong government support in the region. Also, high population burden and lowering water levels in the countries such as India and China force people towards sensor-based irrigation systems, which is likely to fuel the growth of the regional market over the coming years.

Competitive Insight

Some of the key players operating in the global market include The Toro Company, Hunter Industries, Valmont Industries, Rain Bird Corporation, Lindsay Corporation, Netafim, Rubicon Water, Nelson Irrigation, Jain Irrigation Systems, Irritec S.p.A., Superior, HydroPoint Data Systems, Calsense, Stevens Water Monitoring., Lawn Genie, Orbit Irrigation, Weathermatic, and Holman Industries.

Recent Developments

- In February 2021, Rain Bird Corporation, a global producer of irrigation products, announced the launch of its mobile app for professional of landscape professional to provide easy and better access to information. Irrigation professionals, contractors, and distributors will be able to get information through this app, regarding irrigation equipment and many other types of materials.

- In December 2021, Hunter Industries introduced full suite of pro-spray bodies, the first one to be Water Sense and certified by U.S. Environmental Protection Agency. The new system helps and ensures conservation of water up to 30% more than the other non-regulated systems.

Irrigation Automation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 4.20 billion |

|

Revenue forecast in 2030 |

USD 14.6 billion |

|

CAGR |

16.87% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Automation Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

The Toro Company, Hunter Industries, Valmont Industries Inc., Rain Bird Corporation, Lindsay Corporation, Netafim, Rubicon Water, Nelson Irrigation Corporation, Jain Irrigation Systems, Irritec S.p.A., Superior, HydroPoint Data Systems, Calsense, Stevens Water Monitoring Systems Inc., Lawn Genie, Orbit Irrigation Products Inc., Weathermatic, and Holman Industries. |