Infectious Disease In Vitro Diagnostics Market Share, Size, Trends, Industry Analysis Report

By Product (Instruments, Reagents, Software); By Application (MRSA, VRE, Streptococcus); By Technology; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 112

- Format: PDF

- Report ID: PM2573

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

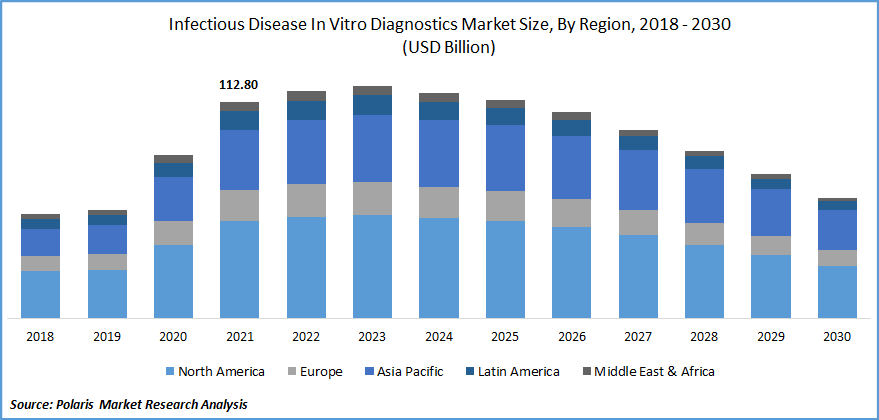

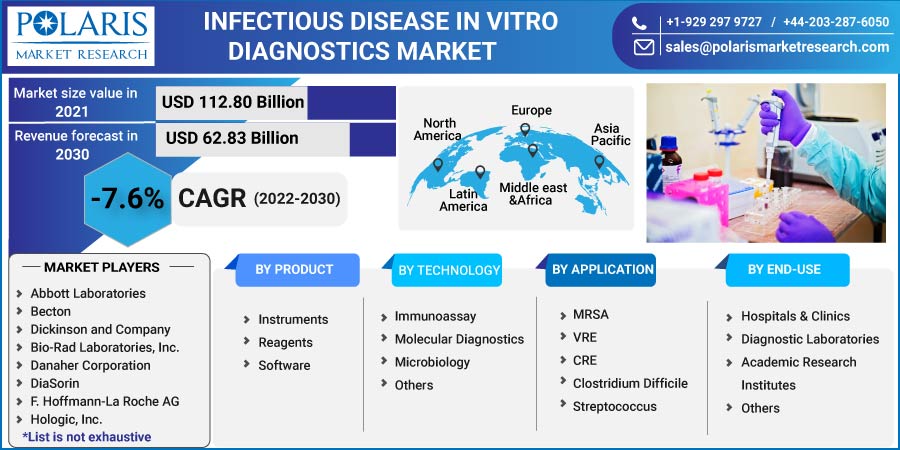

The global infectious disease in vitro diagnostics market was valued at USD 112.80 billion in 2021 and is expected to decline at a CAGR of -7.6% during the forecast period. The global industry is noticing a boost in IVD devices due to the factors such as the growing geriatric population, chronic and infectious diseases, high demand for PoC testing owing to the pandemic, rising awareness about early testing, and rising prevalence of infectious diseases. The continuous development of IVD devices also plays an essential role as it replaces the traditional method and concludes the results in a few hours, which helps users to save time.

The infectious disease in vitro diagnostics market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Know more about this report: Request for sample pages

As the geriatric population is growing and the awareness among the people has increased in developing economies, the peak pandemic time steadily led to the demand for infectious disease in vitro diagnostics market in countries such as Brazil, India, Japan, and North America, among others. In addition, the growing awareness and development activities in Asia is likely to complement infectious disease in vitro diagnostics market growth over the forecast period.

The COVID-19 pandemic positively impacted the expansion of the infectious disease in vitro diagnostics market. The IVD devices were operated at higher rates for detection of the cases at the time of the pandemic. The regulatory authorities made the test compulsory to control the spread of diseases, which gradually increased the demand for IVD devices.

However, there will be a shortfall in demand for diagnostics mainly because of the decline in COVID-19 cases. Excluding the COVID-19 cases, the infectious disease in vitro diagnostics market is expected to grow as many new diseases gradually increase. People are becoming aware and are regularly checking their health; this helps in the growth of demand.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

An increase in infectious diseases in regions will positively influence the growth of the IVD device market. Diagnosing diseases increases the use of the device as it helps in the proper detection and helps to know the cause and side effects. The self-help kits for COVID-19 detection are easily handled and used to prevent the disease's spread.

With modern and advancing technology, North America helps generate largest market revenue. The spread of awareness of tourist health and the demand for IVD devices is anticipated to lead the market growth.

Report Segmentation

The market is primarily segmented based on product, application, technology, end-use, and region.

|

By Product |

By Technology |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Reagents segment accounted for the largest share in 2021

The reagent segment accounted for the highest revenue share in 2021, owing to the increase in the test for COVID-19 and other In-Vitro diagnostics. Reagents are a vital part of the diagnostics of any diseases or tests conducted; thus, reagents continue to contribute to the growth and the highest revenue share. The tests for deadly virus continued to be essential; for the test to be negative or positive, the need for reagents remains constant.

The instrument segment is projected to expand over the forecast period due to the rapid innovation as well as technological advancements. Innovation of new instruments and upgrading of old devices are increasing, which is expected to offer promising avenues in segment growth. Inspect IR COVID-19 Breathalyzer, one of the examples for the rapid testing of COVID, was approved by the FDA.

Molecular diagnostics accounted the highest share in market, by technology

The molecular diagnostics technology segment dominates the market share. Molecular diagnostics remains to dominate the market as the increase of acute and chronic diseases is increasing day by day. Molecular diagnostics were used in the COVID test as contributing to the highest share. These tests are advanced and overcome the faults of traditional techniques, thus saving time as well as money.

Immunoassay is expected to grow at a significant CAGR over the forecast period. Immunoassay is used to test infectious diseases, develop novel immunodiagnostic tests, increase health and fitness awareness, and increase automation trends.

Infectious diseases accounted the highest revenue share

Infectious diseases contributed a higher share of the revenue owing to the rise of COVID-19 testing across the globe. Diagnostics was used at a higher rate with the increase in the COVID-19 test, whether positive or negative. The launch of an innovative product and the government policies of compulsory testing were the primary drivers of the segment's growth.

Furthermore, the rising prevalence of heart disease, oncology, gynecology, and tuberculosis are the major diseases that are spreading at higher rates. Many people are affected by those diseases, and to cure and diagnose, in vitro diagnostics applications are used. The increasing number of blood donations, increasing geriatric population, growing awareness among the people, along with the other offered benefits are expected to propel the growth in the segment.

Hospitals and clinics is expected to account for the largest share in 2030

Among all the end-users, the standalone laboratories showed the highest market share in the past. It is anticipated that hospitals and clinics will outstand in the segments. Clinical laboratories have the highest accuracy level of the tests, and with advanced technology and well-equipped clinical requirement, it continues to dominate the market.

In the emergency, hospitals play an important role in fast testing. During COVID-19, tests were being done with high accuracy and high speed in the clinics and hospitals.. Since maximum hospitals aim to provide all the essential services under one roof for patients, hospitals are advancing their laboratories. Also, the tests are becoming simpler in use, and clinics and hospitals are adopting them rapidly, therefore, demand for the market is projected to grow

North America exhibits the highest share in IVD market

North America accounted for the maximum share and dominated the industry and is expected to grow more during the forecast period. The key drivers for North America are better diagnostics infrastructure, flexible and favorable government regularities, the presence of major companies, and the adoption of advanced technology.

North America was the largest affected region during the pandemic, and the increase in tests and technological advancements also contributed. Further, Asia Pacific is evaluated to grow at a faster CAGR during the forecast period as a high rate of infectious diseases is found.

Further, the growing geriatric population in Japan is the critical driver for IVD tests. India is prone to many infectious diseases, and as people's awareness is increasing, the number of tests & diagnostics is also growing. As the tests are readily available at a low cost, the services are affordable for the maximum population.

Competitive Insight

Some of the major players operating in the global market include Abbott Laboratories, Becton Dickinson and Company, Bio-Rad Laboratories, Inc., Danaher Corporation, DiaSorin, F. Hoffmann-La Roche AG, Hologic, Inc., Illumina, Inc., InBios International, Inc., Koninklijke Philips N.V., Laboratory Corporation of America Holdings, Merck KGaA, OraSure Technologies, Inc., PerkinElmer, Inc., Qiagen N.V., Quest Diagnostics, Quidel Corporation, Siemens Healthcare AG, Sysmex Corporation, Thermo Fisher Scientific Inc.

Recent Developments

In August 2022, Becton Dickinson announced a commercial collaboration with Accelerate Diagnostics with the agreement that Becton Dickinson will provide a rapid testing solution for antibiotic resistance and susceptibility that will show results just in a few hours, whereas traditional methods used to take one to two days.

In August 2022, Bio-Rad Laboratories, Inc. introduced a range of type 1 antibodies, also known as Anti-Evolocumab Antibodies, used in preclinical and clinical drug development. The Antibodies introduced by Bio-Rad help in the diagnostics of In-Vitro infectious diseases.

Infectious Disease In Vitro Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 112.80 billion |

|

Revenue forecast in 2030 |

USD 62.83 billion |

|

CAGR |

-7.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Application, By Technology, By End-Use, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Abbott Laboratories, Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Danaher Corporation, DiaSorin, F. Hoffmann-La Roche AG, Hologic, Inc., Illumina, Inc., InBios International, Inc., Koninklijke Philips N.V., Laboratory Corporation of America Holdings, Merck KGaA, OraSure Technologies, Inc., PerkinElmer, Inc., Qiagen N.V., Quest Diagnostics, Quidel Corporation, Siemens Healthcare AG, Sysmex Corporation, Thermo Fisher Scientific Inc. |

Want to check out the infectious disease in vitro diagnostics market report before buying it? Then, our sample report has got you covered. It includes key market data points, ranging from trend analyses to industry estimates and forecasts. See for yourself by downloading the sample report.