Jars Market Share, Size, Trends, Industry Analysis Report

By Material Type (Plastic, Glass, Metal, Paper); By Capacity; By End Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Aug-2023

- Pages: 116

- Format: PDF

- Report ID: PM3690

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

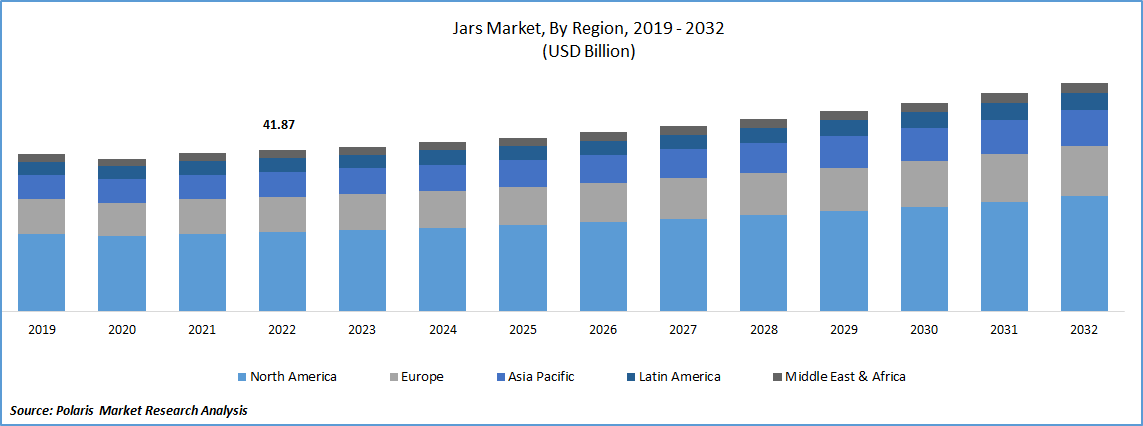

The global jars market was valued at USD 41.87 billion in 2022 and is expected to grow at a CAGR of 3.71% during the forecast period.

The food and beverage industry are experiencing significant growth, driven by changing dietary habits, increased disposable income, and the popularity of convenience foods. Jars are widely used for packaging jams, sauces, spreads, pickles, beverages, and other products. The expansion of the food and beverage industry fuels the demand for jars, leading to market growth. The launch of new food jars by Aegg at Packaging Innovations in Birmingham is playing a significant role in driving the growth of the jar market. These innovative products offer unique features and cater to various consumer needs, thereby expanding the market's potential.

To Understand More About this Research: Request a Free Sample Report

Aegg is introducing two new mini jam jars, available in sizes of 31ml and 41ml eco. These jars provide consumers with options for smaller portions or single-serving products. Additionally, Aegg is unveiling a new 185ml hexagonal jar, specifically designed for jam, honey, and chutney. This jar's distinctive shape adds visual appeal and uniqueness to the packaging, further attracting consumers. By offering a diverse range of sizes and incorporating sustainable practices, Aegg is positioning itself as a leading player in the industry. This drives competition, encourages other companies to innovate, and ultimately contributes to the overall growth of the jar market.

For Specific Research Requirements, Speak With Research Analyst

Industry Dynamics

Growth Drivers

Advancements in packaging design and materials have significantly impacted the jars market

Companies are introducing innovative jar shapes, sizes, and closures to enhance product differentiation and shelf appeal. Moreover, the development of lightweight, durable, and sustainable packaging materials has expanded the range of options available for jars, attracting both consumers and manufacturers. The introduction of recycled content packaging by Berry Global and Mars, Incorporated is making a significant impact on the growth of the jar market.

By collaborating on the development of M&M'S, SKITTLES, and STARBURST packaging with 15% recycled plastic, these companies are driving positive societal change while meeting consumer demands for sustainable solutions. The new jars, available in three sizes (60-, 81-, and 87-ounces), retain the same attractive appearance and quality as their non-recycled counterparts. By incorporating recycled plastic into their production, these jars will help eliminate approximately 300 tons of virgin plastic each year. This initiative not only promotes environmental sustainability but also showcases the potential for recycled content packaging in the jar market. Consumers are increasingly seeking eco-friendly alternatives, and the introduction of these recycled plastic jars demonstrates that sustainable packaging solutions can be both visually appealing and functional.

Report Segmentation

The market is primarily segmented based on material type, capacity, end use, and region.

|

By Material Type |

By Capacity |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Type Analysis

Glass Jars Segment is Expected to Witness Fastest Growth During Forecast Period

Glass jars segment is expected to have faster growth for the market. These jars are often favored for their aesthetic appeal and the perception of high quality. They provide a clear and transparent view of the contents, allowing customers to see the product inside. This transparency enhances the visual appeal, especially for food products, as customers can assess the quality, freshness, and color of the contents. Increasing consumer awareness and concerns about environmental sustainability have propelled the demand for eco-friendly packaging options. Glass jars are considered environmentally friendly as they are reusable, recyclable, and do not leach harmful chemicals into the contents. The emphasis on reducing plastic waste has driven the growth of glass jars as an alternative packaging choice.

By Capacity Analysis

10 to 50 OZ Segment Accounted for the Largest Market Share in 2022

10 to 50 OZ segment hold the largest market share for the market in the study period. Jars within the 10 to 50-ounce capacity range are highly versatile and suitable for a wide range of products. They are commonly used for packaging sauces, condiments, spreads, pickles, jams, preserves, nut butters, honey, and other food items. Additionally, they find applications in the cosmetics, personal care, and household product industries. The versatility of this segment allows it to cater to diverse consumer needs and industry requirements. In this capacity range strike a balance between portion size and storage convenience. They are often preferred by consumers who want a reasonable quantity of the product without excessive waste or storage challenges. This capacity range is suitable for both individual consumers and families, providing enough product for multiple servings or prolonged use without the need for frequent replenishment.

By End-Use analysis

Food & Beverages Segment is Expected to Hold the Larger Revenue Share in 2022

Food & Beverages segment is projected to witness a larger revenue share in the coming years. Jars offer convenience in packaging food and beverages. Jars provide an effective barrier against moisture, air, and contaminants, helping to protect the quality and freshness of food and beverages. The airtight seal of jars helps to extend the shelf life of perishable items, preserving their taste, texture, and nutritional value. This aspect is crucial in the food and beverages industry, where maintaining product quality and safety is paramount. With increasing awareness of environmental sustainability, there is a growing demand for sustainable packaging solutions in the food and beverages industry.

Regional Insights

Apac is Projected to Witness Highest Growth Rate in the Study Period

APAC is projected to witness a higher growth rate for the market. The launch of the "Welcome Home Jars" by Kraft Peanut Butter, in collaboration with Duolingo and Nav Bhatia, a well-known Canadian immigrant, is driving the growth of the jars market in Asia Pacific. While the initiative is specifically targeted towards welcoming Canadian newcomers, it demonstrates the potential impact of customized jars in addressing the needs of diverse communities.

By translating the labels of the Kraft Peanut Butter jars into five commonly spoken languages among Canada's newcomers (simplified Chinese, Hindi, Tagalog, Arabic, and Spanish), the initiative showcases a culturally sensitive approach. This highlights the importance of customization and localization in packaging, which can be applied to other markets in the Asia Pacific region with diverse language and cultural backgrounds. As more countries welcome immigrants, similar initiatives that address the needs of diverse communities through customized packaging have the potential to drive the growth of the jars market in the region.

North America is expected to witness a larger revenue share for the market. There is a growing awareness and concern about environmental sustainability among consumers in the region. They are actively seeking products with sustainable packaging options, including jars made from recyclable or reusable materials. The demand for eco-friendly packaging solutions is driving the growth of the jars market as brands respond to consumer preferences and incorporate sustainable practices into their packaging strategies.

Olay, in partnership with Walmart, is unveiling its groundbreaking line of 100% recycled jars. These eco-friendly jars are manufactured using materials sourced entirely from Walmart and certified by the Forest Stewardship Council (FSC). This innovative collaboration between Olay and Walmart demonstrates a shared commitment to sustainability and offers consumers an environmentally conscious choice for their skincare products. By introducing these 100% recycled jars and utilizing FSC-certified packaging, Olay and Walmart are driving the industry towards greater sustainability and setting a positive example for other brands in North America.

Key Market Players & Competitive Insights

The jars market is fragmented and is anticipated to witness competition due to several players' presence. Key players in the market are constantly extending their product lines to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- Anchor Hocking Company

- Ardagh

- Bormioli Rocco

- Jarden Home Brands

- Kilner Jars

- Libbey

- O-I Glass

- Weck

Recent Developments

- In April 2023, Rage Coffee, a company based in Delhi that specializes in caffeine innovation in the FMCG sector, is excited to unveil its latest product line. Introducing the all-new beautifully designed jars, adorned with lively and invigorating brand colors, which perfectly encapsulate the essence of energy

- In May 2023, Albéa Group, a personal care and beauty packaging company headquartered in France, introduced its latest environmentally conscious innovation, the 'Twirl' sustainable and refillable jar.

Jars Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 42.81 billion |

|

Revenue forecast in 2032 |

USD 59.42 billion |

|

CAGR |

3.71% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Material Type, By Capacity, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Ball, Anchor Hocking Company, O-I Glass, Ardagh, Libbey, Weck Jars, Bormioli Rocco, Kilner Jars & Jarden Home Brands. |

FAQ's

key companies in jars market are Anchor Hocking Company, O-I Glass, Ardagh, Libbey.

The global jars market is expected to grow at a CAGR of 3.71% during the forecast period.

The jars market report covering key segments are material type, capacity, end use and region.

key driving factors in jars market are advancements in packaging design and materials.

The global jars market size is expected to reach USD 59.42 billion by 2032.