Konjac Market Share, Size, Trends, Industry Analysis Report

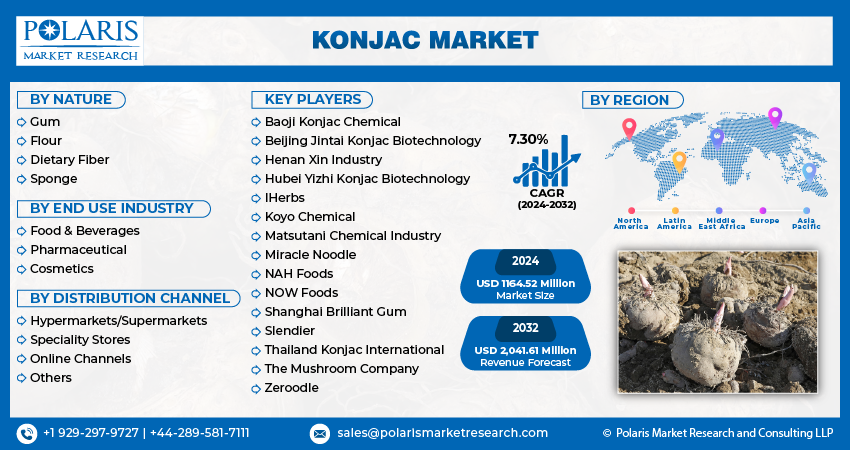

By Nature (Gum, Flour, Dietary Fiber, Sponge); By End Use Industry (Food & Beverages, Pharmaceutical, Cosmetics); By Distribution Channel; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3965

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

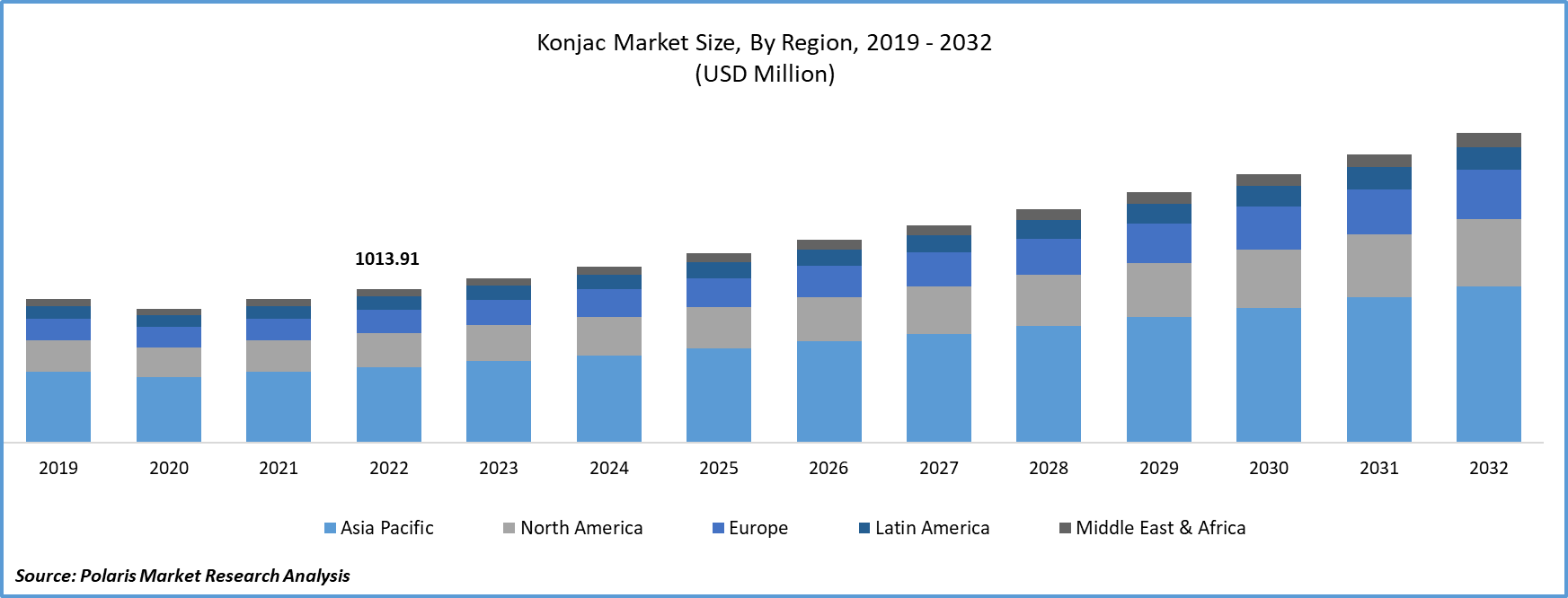

The global konjac market was valued at USD 1086.51 million in 2023 and is expected to grow at a CAGR of 7.30% during the forecast period.

Konjac is a common ingredient for those who are dieting, want to detoxify their body, or want to have beautiful skin because it is high in dietary fibre and low in calories. It is becoming more popular in the US as a low-calorie, gluten-free dish. In fact, according to research from the Department of Agriculture, 95% of Americans don't get the required amount of fibre daily. The growth in demand for konjac is attributable to its higher nutritional content, primarily fibre. Furthermore, growing innovations in the pharmaceutical industry to cure chronic diseases like cancer are driving further research on Konjac's ability to assist in the treatment of various diseases.

To Understand More About this Research: Request a Free Sample Report

For instance, in September 2022, konjac, a prepared jelly formed from the konjac plant's bulb, was successfully used by a research team from Nagoya University to create a surgical teaching model. The group has developed a training model that resembles tissue to allow doctors to practice fluorescence-guided surgery, a crucial method in the treatment of cancer.

Moreover, it is used as a food ingredient and dietary supplement in the West to increase glucose metabolism, reduce plasma cholesterol, and promote regular bowel motions. In addition to being added to food products like pasta and flour, glucomannan is also sold as a dietary supplement and in drink mixes. It is the primary ingredient in shirataki noodles, fuelling demand for konjac in the future.

The konjac market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

However, as a soluble fiber, glucomannan must be eaten with plenty of water and other liquids to lessen the chance of cramping and bowel blockage. Bloating, flatulence, and stomach pain can occur in those who are not accustomed to eating enough fiber in their diets. The lack of awareness and medical advice may lead to health complications, which will hamper demand from the users in the future.

Growth Drivers

Rising Applications of Konjac in the Food Industry Due to Ongoing Research Findings

There is a wide usage of konjac in various applications to treat health issues due to its nutritional content. In the food manufacturing industry, konjac flour is a component of gluten-free bread. According to research published in 2021, the bread with roughly 37.5% of its flour in the form of konjac had the optimal composition in terms of color, texture, and volume. It is not only used in the food industry but also in the pharmaceutical industry. Based on the study published in Food Science & Technology in 2022, researchers created a new thought process to test the ability of konjac to treat diabetes. As researchers examine the potential benefits of konjac, it will further drive research activities to use its effectiveness in treating health problems.

Report Segmentation

The market is primarily segmented based on nature, end use industry, distribution channel, and region.

|

By Nature |

By End Use Industry |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Nature Analysis

Dietary Fiber Segment is Expected to have the Highest Growth During the Forecast Period

The dietary fiber segment is projected to grow at a higher CAGR during the forecast period, mainly attributable to the rising health consciousness among consumers with the rise in awareness of nutritional foods and their functioning in the body driven by the emergence of internet availability for a larger number of people. Dietary supplements are gaining traction due to the deficiency of various vitamins, minerals, and carbohydrates due to the lower concentration of nutrition in food intake driven by the hierarchy of working hours. This will further fuel the demand for dietary supplements with konjac as one of the ingredients in the coming years.

By End Use Industry Analysis

Food & Beverages Segment Witnessed the Largest Market Share in 2022

The food and beverage segment accounted for the largest market share. Konjac is known to have the ability to work on weight reduction processes, fuelling manufacturers of weight reduction food items with low calories and driving its use by consumers interested in lower-calorie food. This fruit is known to be a naturally gluten-free product, which is primarily utilized by vegetarians in their diets to cater to their nutritional needs and is suitable for companies specialized in product formulations with these dietary preferences, driving its demand in the future.

By Distribution Channel Analysis

Online Segment Held the Significant Market Revenue Share in 2022

The online segment registered a significant konjac market share in revenue in 2022, which is primarily attributable to the growing awareness about the products with the online sales channels, fueled by festival discount offers, customized recommendations, and the availability of single products with multiple brands at one place without the need for the consumers to transport to other places, driving demand for products like konjac by consumers. Furthermore, companies are working on creating customized market baskets with reasonable prices, attracting sales of multiple commodities at once and fuelling their demand soon.

Regional Insights

Asia Pacific Region Registered the Global Market in 2022

The Asia Pacific region is expected to have the largest share. In Asia, konjac is a plant that has long been used as both food and traditional medicine. According to research, it might aid in reducing cholesterol and relieving constipation. For more than 2,000 years, traditional Chinese medicine has employed glucomannan to treat a variety of ailments, including skin problems, blood disorders, and asthma, driving its use in medical formulations of supplements.

Growing research studies to increase production of konjac in the region are providing new growth potential for the market. For instance, in China, researchers are working on a space breeding technology project designed by the China Aerospace Science and Industry Corporation to support Qujing City's Fuyuan County, the largest konjac planting base. Using space breeding technologies, scientists hope to find solutions to issues including konjac seed deterioration and risky diseases. The ongoing study may fuel the cultivation of konjac seeds in the region, increase supply in this region, and stabilise the price fluctuations in turn, which will fuel demand in the coming years.

The Europe region is expected to witness the fastest growth with a significant growth rate during the forecast period due to the growing demand for food products with a higher concentration of fibre to recover the deficiency in food intake of consumers in the region. The growing awareness about the various functional and healthy advantages of konjac is encouraging people to purchase healthy food items like konjac. The rise in the number of people facing obesity may further drive the demand for konjac food products, as they may add it to their daily food intake to control their colorie consumption. The existence of research studies revealing the potential of konjac in assisting weight reduction is one of the factors driving demand for it from the wider population in the region.

Key Market Players & Competitive Insights

The Konjac market is fragmented and expected to witness higher competition compared to a decade ago owing to the evolution of new companies and product launches by the companies to expand their market coverage and facilitate reasonable prices with the equation of demand and supply in the marketplace. Companies are using technology to meet target audiences with effective marketing strategies, fueling product awareness among a wider audience. Partnerships, mergers, and acquisitions are enhancing product innovations.

Some of the major players operating in the global market include:

- Baoji Konjac Chemical

- Beijing Jintai Konjac Biotechnology

- Henan Xin Industry

- Hubei Yizhi Konjac Biotechnology

- IHerbs

- Koyo Chemical

- Matsutani Chemical Industry

- Miracle Noodle

- NAH Foods

- NOW Foods

- Shanghai Brilliant Gum

- Slendier

- Thailand Konjac International

- The Mushroom Company

- Zeroodle

Recent Developments

- In May 2023, Life Extension introduced Easy Fibre, made from konjac fruit. In order to improve satiety, cardiovascular health, and digestive health, it contains glucomannan from konjac root. Additionally, Easy Fibre does not include any artificial flavors, colors, or sweeteners in its manufacturing process.

Konjac Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1164.52 million |

|

Revenue forecast in 2032 |

USD 2041.61 million |

|

CAGR |

7.30% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Nature, By End-Use Industry, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

The analysis of konjac market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.