Laboratory Freezers Market Share, Size, Trends, Industry Analysis Report

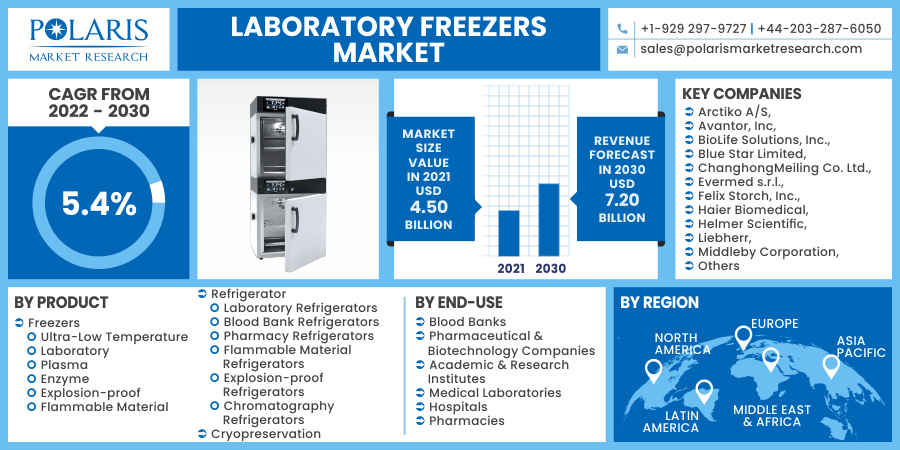

End-Use (Blood Banks, Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Medical Laboratories, Hospitals, Pharmacies), By Product; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 111

- Format: PDF

- Report ID: PM2204

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

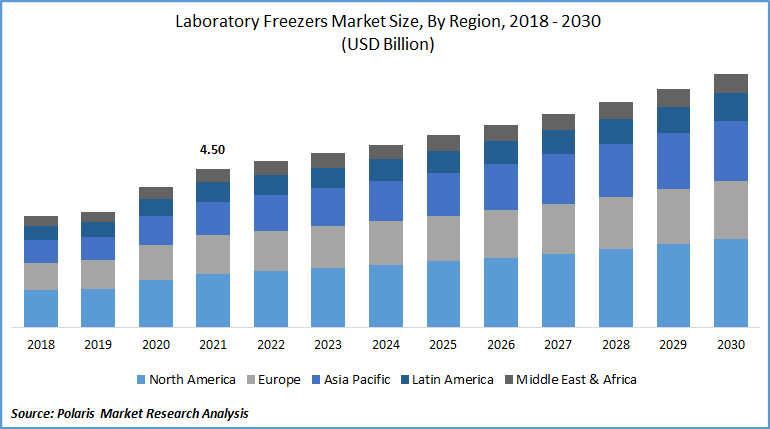

The global laboratory freezers market was valued at USD 4.50 billion in 2021 and is expected to grow at a CAGR of 5.4% during the forecast period. Laboratory freezers are chilled cabinets that operate at extremely low temperatures and are used to store biological samples and volatile laboratory reagents at temperatures ranging from -40°C to 10°C.

Know more about this report: request for sample pages

These refrigerated cabinets store and retain biological samples such as blood, tissues, serums, vaccinations, enzymes, and others in good working order. Hospitals, blood banks, laboratories, research and academic institutes, and industries all employ laboratory refrigerators. Strong market demand for blood and cell components for transplantation and transfusion in cancer therapies has led to laboratory freezers market growth.

As per the American Red Cross, someone in the U.S. requires blood or platelets every two seconds. Surgery, cancer therapy, chronic illnesses, and catastrophic traumas all need it. It all starts with a kind contribution from one person, whether it's whole blood, red cells, platelets, or plasma. Besides, as per the American Red Cross, approximately 36,000 units of red blood cells are required in the United States every day.

Further, as per the American Cancer Society, around 1.9 million cancer cases and 608,570 cancer deaths are estimated in 2021. Patients undergoing cancer surgery, as well as those with blood cancers like leukemia and lymphoma, have a high demand for blood and blood components.

According to the WHO, in 2020, around 118 Mn blood donations were collected across the global market, with around 40% of such, being collected from developed countries. Children under five years old receive approximately accounting 54% of all blood transfusions in low-income nations. Still, it is most frequently used in over 60 years old, accounting for up to 75% of all transfusions. This rise in global market demand for blood and blood products and an increase in blood collection will boost the demand for lab freezers at blood banks to store them.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The laboratory freezers industry has observed extensive developments in the last few decades supported by various factors such as a rise in the focus of manufacturers on developing novel products for preserving different cells, rising FDA approvals for cell therapies. For instance, BioLife Solutions introduced “High-Capacity Controlled Rate Freezers” (HCRF) in April 2021. Besides, in July 2020, Kite announced that it had received the US FDA for its Tecartus (formerly known as KTE-X19) CAR-T cell therapy. Adults with relapsed mantle cell lymphoma (MCL) will benefit from the treatment.

Further, in February 2021, Breyanzi, CAR-T treatment, gained FDA approval from Juno Therapeutics. It is used to treat adults with re-lapsed large B cell lymphoma. In April 2021, Novartis got clearance from Singapore's “Health Sciences Authority” to commercialize Kymriah. This first CAR-T therapy is said to be a one-time treatment process performed uniquely for each patient. The treatment was authorized under the new regulatory framework for cell, tissue, and gene therapy products (CTGTP).

In May 2021, Vericel Corporation received approval for MACI (autologous cultured chondrocytes on porcine collagen membrane). Thus, the rising approvals for cell-based therapies for the treatment of various diseases have led to an increase in demand for laboratory freezers as it is required to preserve cells, which is driving the industry growth during the forecast period.

Report Segmentation

The market is primarily segmented based on the product, end-use, and region.

|

By Product |

By End-Use |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product

Based on the product market segment, the refrigerator segment is expected to be the most significant revenue contributor in the global laboratory freezers industry in 2021 and is expected to retain its dominance in the foreseen period. The refrigerator market segment is classified into laboratory refrigerators, blood bank refrigerators, pharmacy refrigerators, flammable material refrigerators, explosion-proof refrigerators, and chromatography refrigerators. Among these, laboratory refrigerators are in high demand due to their frequent use in medical laboratories, hospitals, and clinics for the short-term preservation of samples for COVID-19 testing.

Geographic Overview

In terms of geography, North America had the highest share in 2021. The laboratory freezers industry for the North American region is anticipated to grow significantly as a result of the presence of prominent players in the regions. For instance, in February 2021, PHC Corp. of North America has established a cooperation with Follett Products, LLC, to sell the PHCbi brand of ultra-low temperature (ULT) pharmaceutical and biological freezers to Follett's consumers.

Follett's existing line of high-performance refrigerators, freezers, and associated goods will be supplemented by these new items. Follett will expand its current line of medical-grade freezers in the global market with a variety of models that can store Pfizer COVID-19 vaccines and other significant medical items and specimens in the healthcare and life science industries.

Apart from that, the region's high healthcare spending and increasing R&D spending on medicines and biotechnology fuel laboratory freezers market growth. For instance, as per the estimates of nodal agency “National Health Expenditure Accounts” (NHEA), the annual healthcare spending in the U.S., including products and services, public services, administration, and health insurance net costs, and healthcare investment rose 4.6 percent to USD 3.8 trillion in 2019, standing at USD 11,582 per person.

Moreover, Asia Pacific is expected to witness a high CAGR in the global laboratory freezers market in 2021. The region is expanding as a result of increased government initiatives and attractive financial conditions. Furthermore, the market's rapid growth will be assisted by several local distributors selling branded goods. The region is expected to expand further as cell collections and cryopreservation for stem cell banks increase. Thailand, Malaysia, India, and other rising markets have untapped potential that will likely fuel market expansion.

Competitive Insight

Some of the major players operating in the laboratory freezers market include Arctiko A/S, Avantor, Inc, BioLife Solutions, Inc., Blue Star Limited, ChanghongMeiling Co. Ltd., Evermed s.r.l., Felix Storch, Inc., Haier Biomedical, Helmer Scientific, Liebherr, Middleby Corporation, PHC Holdings Corp, Philipp Kirsch Gmbh, Standex International Corp., and Thermo Fisher Scientific, Inc.

Laboratory Freezers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 4.50 billion |

|

Revenue forecast in 2030 |

USD 7.20 billion |

|

CAGR |

5.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Arctiko A/S, Avantor, Inc, BioLife Solutions, Inc., Blue Star Limited, ChanghongMeiling Co. Ltd., Evermed s.r.l., Felix Storch, Inc., Haier Biomedical, Helmer Scientific, Liebherr, Middleby Corporation, PHC Holdings Corp, Philipp Kirsch Gmbh, Standex International Corp., and Thermo Fisher Scientific, Inc. |