LBS and Air Load Break Switch Market Size, Share, Trends, & Industry Analysis Report

: By Installation (Outdoor and Indoor), By Voltage, By Mechanism, By Mounting Type, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 113

- Format: PDF

- Report ID: PM5740

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

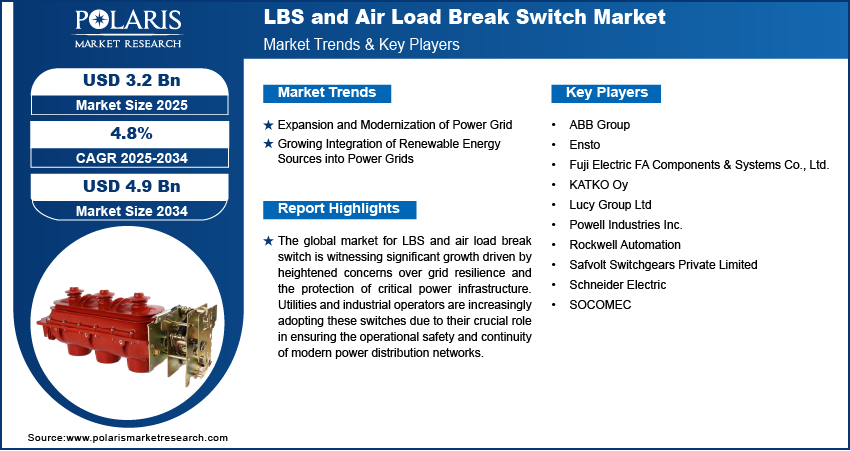

The global LBS and air load break switch market size was valued at USD 3.1 billion in 2024, exhibiting a CAGR of 4.8% during 2025–2034.

Growing demand for reliable power distribution, increasing investments in grid modernization, and the need for efficient electrical infrastructure in industrial and commercial sectors are encouraging LBS and Air load break switch demand. Additionally, rising urbanization and stricter safety regulations are boosting their adoption worldwide.

A load break switch (LBS) is a crucial electrical device used primarily in medium-voltage power distribution networks and power distribution units (PDUs) to switch electrical circuits under normal load conditions. It provides a means to safely interrupt or isolate sections of a power system without interrupting the entire network, enhancing operational flexibility and maintenance safety. The air load break switch (Air LBS) is a specific type of LBS that uses air as the dielectric (insulating) and arc-extinguishing medium. Air LBS is favored in environments where simplicity, low cost, and minimal maintenance are desired.

The increasing development of eco-friendly load break switches is driving the LBS and air load break switch market growth. In December 2020, ABB, a technology company focused on electrification and automation, introduced a ring main unit (RMU) with a LBS that uses sustainable alternative gases to SF6 for enhanced performance and reduced environmental impact. This product innovation is driving power distribution networks, renewable energy projects, and smart grids to deploy these eco-friendly load break switches for safe, efficient, and sustainable operations.

LBS and air load break switches contribute to system protection and operational flexibility by acting as intermediate switching devices between substations, feeders, and end users. Furthermore, accessories such as earthing switches, fuse combinations, and current transformers are integrated into LBS setups to further enhance protection and monitoring capabilities.

Market Dynamics

Expansion and Modernization of Power Grid

Countries across the globe are constructing more substations and extending transmission lines to accommodate growing populations. This is creating the need for reliable switching devices to isolate faults, manage load flows, and ensure smooth operation across power grids. LBS and air load break switches offer these functionalities with high reliability, making them essential components in modern power grids and traditional power grids.

Governments worldwide are investing heavily to modernize power grids and strengthen distribution infrastructure, contributing to demand for LBS and air load break switches. India in 2022 announced an investment of USD 36.8 billion (INR 3.03 trillion) for power distribution companies to modernize and strengthen distribution infrastructure. Similarly, Japan in 2022 created a YEN 20 trillion (USD 155 billion) fund to encourage investments in new power grid technologies, energy-efficient homes, and other carbon footprint-reduction technologies. Modern or new power grids require robust switching mechanisms to isolate faults, reroute power, and minimize downtime, which LBS and air load break switches offer by safely interrupting load currents without complete shutdown, ensuring uninterrupted power supply. Therefore, the expansion and modernization of the power grid is driving demand for LBS and air load break switches by helping utilities manage and distribute electricity.

Growing Integration of Renewable Energy Sources into Power Grids

Utilities are facing challenges related to variability, bidirectional power flows, and grid stability as they are incorporating more solar, wind, and other distributed energy resources (DERs) into their networks. This drives utilities to adopt LBS and air load break switches to manage these complex flows effectively. LBS and air load break switches provide the necessary control, allowing utilities to isolate, reroute, and balance loads in a grid environment that constantly changes due to fluctuating renewable generation.

Renewable energy sources operate intermittently, with generation levels shifting rapidly based on weather conditions. These fluctuations create imbalances and stress the distribution infrastructure. Utilities address this challenge by installing sectionalizing equipment that quickly isolates affected areas or redirects power flows to maintain stability. LBS and air load break switches perform these functions reliably. They allow utilities to divide their networks into smaller sections, which improves fault management and reduces the impact of variability on the larger grid. Therefore, the growing integration of renewable energy sources into power grids is driving the demand for LBS and air load break switches.

Segmental Insights

By Voltage Analysis

The high voltage segment accounted for the share of 43.8% in 2024, as these are primarily used for interrupting load currents in transmission and sub-transmission networks. High-voltage load break switches play an essential role in ensuring safe and controlled disconnection of power under load conditions in large-scale utility and industrial systems. According to a November 2024 report by Nextgen Highways in Texas, the construction of transmission lines for clean, renewable energy zones contributed to an additional USD 5 billion in economic growth. The need for reliable high-voltage switchgear components increases as nations invest in strengthening cross-border grids and integrating renewable energy sources.

The low voltage segment is projected to grow at a significant pace during the forecast period, as these are essential components in ensuring operational safety within commercial and small-scale industrial electrical networks. These switches are installed in distribution panels and low-voltage switchboards to allow controlled disconnection under load conditions. Their compact design, ease of installation, and user-friendly operation make them highly suitable for confined spaces such as control rooms and commercial buildings. The increasing focus on workplace electrical safety and adherence to low-voltage system standards in commercial infrastructure further boosts the demand.

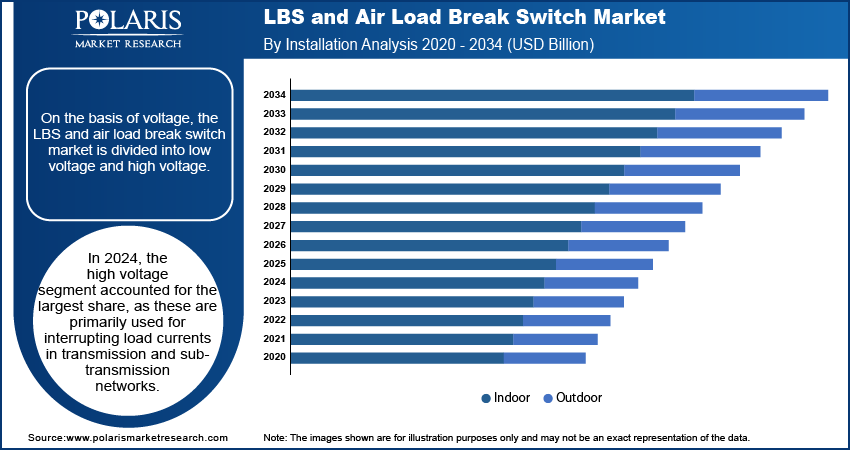

By Installation Analysis

The outdoor segment accounted for the largest share of 65.1% in 2024 and is expected to register a CAGR of 4.6% during the forecast period. Outdoor installation of load break switches is essential for overhead distribution lines and substations located in open environments. These switches are built with weather-resistant enclosures and high dielectric strength to ensure uninterrupted operation despite exposure to temperature fluctuations, dust, and moisture. Their application supports grid reliability in remote or semi-urban areas where access to enclosed electrical infrastructure is limited. Additionally, the expansion of rural electrification investments and the need for grid resilience in extreme weather conditions are boosting this industry value.

The indoor segment is estimated to hold a substantial market share in 2034. Indoor LBS and air load break switch units are primarily used in environments where space is optimized and protection from external elements is ensured, such as power distribution grids, industrial plants, and commercial buildings. These switches offer safe and efficient interruption of current in commercial buildings, manufacturing plants, and utility facilities with enclosed electrical systems. The growing emphasis on compact and space-efficient switchgear solutions in urban and industrial infrastructures is driving the demand for LBS and air load break switches.

By Mechanism Analysis

The manual load break switches segment is estimated to hold a significant market share in 2034. Manual LBS and air load break switch units are often used where simplicity, reliability, and cost-efficiency are essential operational needs. These switches are suitable for installations that do not require frequent switching or remote control, such as secondary substations, rural grids, or small industrial units. The demand for low-maintenance and cost-effective solutions in less automated power systems further contributes to the growth opportunities.

The motorized/automatic load break switches segment is projected to register a CAGR of 9.8% during the forecast period. These devices are often integrated into power SCADA or other automation systems to allow real-time fault detection, remote switching, and load management. The accelerating adoption of grid automation and digital control systems across utilities and industrial sectors further contributes to the market value.

By Mounting Type Analysis

The pole-mounted segment is estimated to hold a significant market share of 44.3% in 2034. Pole-mounted switches are required for segmenting and protecting overhead lines, especially in rural or suburban areas with extensive pole-line infrastructure. These switches are engineered for accessibility and weather resistance, allowing utility crews to operate them from the ground or via pole-mounted controls. The ongoing need for cost-effective fault isolation in remote or distributed power systems drives this industry demand.

The pad mounted segment is projected to register a CAGR of 5.3% during the forecast period. Pad-mounted switches provide a safe and compact switching solution for urban and industrial applications where overhead lines are either restricted or avoided. These units are typically housed in weather-resistant enclosures and are placed on concrete pads, making them easy to access for maintenance and control. The increasing demand for underground power distribution in urban and suburban developments further boosts the LBS and air load break switch market value.

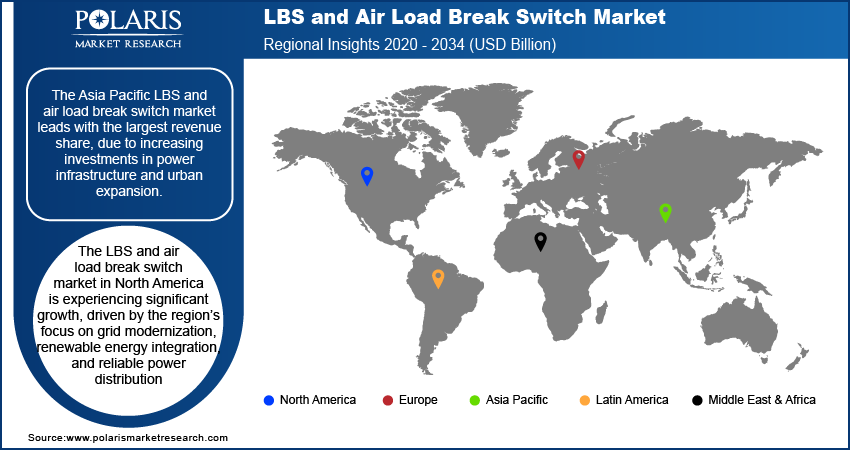

Regional Analysis

The LBS and air load break switch market in Asia Pacific size reached USD 1.2 billion in 2024. The regional industry growth is driven by increasing investments in power infrastructure, including offsite data center power infrastructure, and urban expansion. According to an April 2025 IBEF report, India aims to invest USD 107 billion in transmission infrastructure by 2032 to facilitate its target of nearly tripling renewable energy capacity. Also, a report by the Asian Development Bank stated that in 2022, the urban population reached 56.9%. Several countries in this region are undergoing rapid industrialization and urban migration, leading to a surge in electricity demand. As a result, governments and private stakeholders are focusing on strengthening distribution networks to ensure a stable and uninterrupted power supply. This demand for improved grid reliability is encouraging the adoption of modern switching equipment, such as LBS and air-based variants.

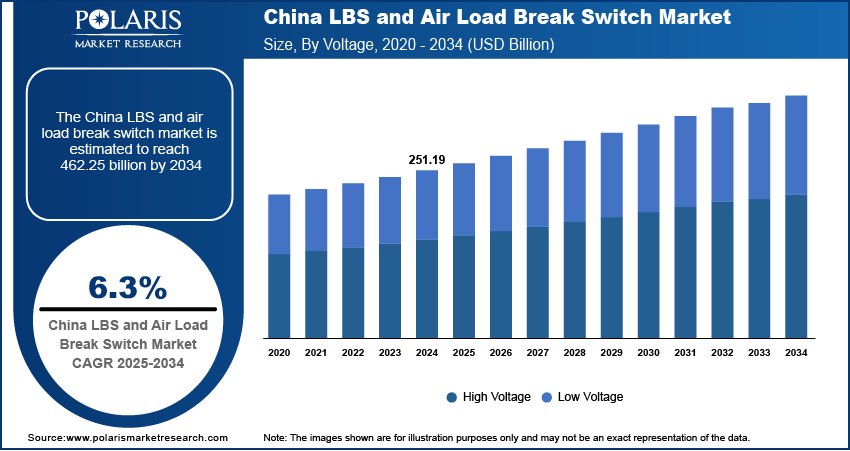

China LBS and Air Load Break Switch Market Insight

The LBS and air load break switch market in China is experiencing steady growth, driven by rapid urbanization, grid modernization, and increased investments in power infrastructure. Government initiatives supporting renewable energy integration and smart grid development further propel demand. Rising electricity consumption and industrial expansion also contribute to this industry expansion, while strict regulatory standards ensure quality and reliability across installations in utilities, commercial, and industrial sectors.

Europe LBS and Air Load Break Switch Market Insight

The LBS and air load break switch market in Europe is projected to reach USD 982.91 million by 2034 due to the region’s focus on renewable energy, smart grid development, and reliable power distribution. Rising focus on grid modernization is driving the demand for the LBS and air LBS. Much of Europe’s power infrastructure is aging and in need of upgrades. According to the European Commission, around 40% of Europe's distribution grids are over 40 years old and need to be modernized. Load break switches, including air-insulated types, are being widely installed as part of these upgrades to ensure safe and efficient operation of medium-voltage distribution networks. These switches allow for isolation and sectionalizing of circuits, making maintenance easier and reducing outage times.

Smart grid expansion across countries such as Germany, France, the UK, and the Nordic nations is also increasing demand. Smart grids rely on automation and real-time control, and LBS devices are major components in enabling fault detection, remote switching, and improved energy flow management.

North America LBS and Air Load Break Switch Market Overview

North America accounted for 31.2% share of the global LBS and air load break switch market in 2024, owing to the region’s focus on grid modernization, including smart grid deployment, renewable energy integration, and reliable power distribution. The governments of the US and Canada are investing in renewable energy as a way out of import dependency. According to the International Energy Agency, in 2023, the Infrastructure Investment and Jobs Act allocated USD 75 billion to clean energy, under which projects related to grid modernization and expansion were allocated USD 21.3 billion.

Key Players and Competitive Analysis Report

The competitive landscape of the load break switch and air load break switch market is propelled by rising demand for reliable power distribution and increasing investments in transmission and distribution infrastructure. Manufacturers are focused on delivering high-performance, compact, and maintenance-free switchgear solutions to meet the evolving needs of smart grid networks and renewable energy integration. Innovation in switchgear technology, such as the development of eco-efficient air-insulated alternatives to traditional gas-insulated systems, has intensified competition, particularly among players emphasizing sustainability and regulatory compliance.

A few major companies in the market include Fuji Electric FA Components & Systems Co., Ltd.; Ensto; KATKO Oy; ABB Group; SOCOMEC; Lucy Group Ltd; Powell Industries Inc.; Schneider Electric; Rockwell Automation; and Safvolt Switchgears Private Limited.

Key Players

- ABB Group

- Ensto

- Fuji Electric FA Components & Systems Co., Ltd.

- KATKO Oy

- Lucy Group Ltd

- Powell Industries Inc.

- Rockwell Automation

- Safvolt Switchgears Private Limited

- Schneider Electric

- SOCOMEC

Industry Developments

March 2025: Tata Power & Schneider Electric entered into an agreement to deploy 11kV SF6-Free Ring Main Units (RMUs) in Mumbai and Delhi around a new generation of Medium Voltage (MV)/Low Voltage (LV) substation equipment as an alternative to the use of SF6 (sulphur hexafluoride) gas.

March 2025: Schneider Electric's planned investment of over US$700 million in its US operations through 2027. This substantial investment aims to expand manufacturing capabilities, enhance energy infrastructure, and support the growing demands of digitalization and automation in the energy sector.

May 2023: ABB acquired Siemens' low-voltage NEMA motor division, which had generated approximately US$63 million in revenue in 2021. This move enhances ABB's position in North America and complements its existing LBS and substation equipment offerings.

LBS and Air Load Break Switch Market Segmentation

By Voltage Outlook (Revenue, USD Billion, 2020–2034)

- Low Voltage

- High Voltage

By Installation Outlook (Revenue, USD Billion, 2020–2034)

- Outdoor

- Indoor

By Mechanism Outlook (Revenue, USD Billion, 2020–2034)

- Manual Load Break Switches

- Motorized/Automatic Load Break Switches

By Mounting Type Outlook (Revenue, USD Billion, 2020–2034)

- Pad-mounted

- Pole-mounted

- Panel-mounted

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Utilities

- Industrial

- Commercial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

LBS and Air Load Break Switch Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.1 Billion |

|

Market Size Value in 2025 |

USD 3.2 Billion |

|

Revenue Forecast by 2034 |

USD 4.9 Billion |

|

CAGR |

4.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global LBS and air load break switch market size was valued at USD 3.1 billion in 2024 and is projected to grow to USD 4.9 billion by 2034.

The global market is expected to register a CAGR of 4.8% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few key players in the market are Fuji Electric FA Components & Systems Co., Ltd.; Ensto; KATKO Oy; ABB Group; SOCOMEC; Lucy Group Ltd; Powell Industries Inc.; Schneider Electric; Rockwell Automation; and Safvolt Switchgears Private Limited.

The high voltage segment dominated the market in 2024.

The outdoor segment held the largest share of the global market in 2024.