Smart Grid Market Size, Share, Trends, Industry Analysis Report

: By Component (Software, Hardware, and Services), Technology, Application, End User, and Region – Market Forecast, 2025-2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5667

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

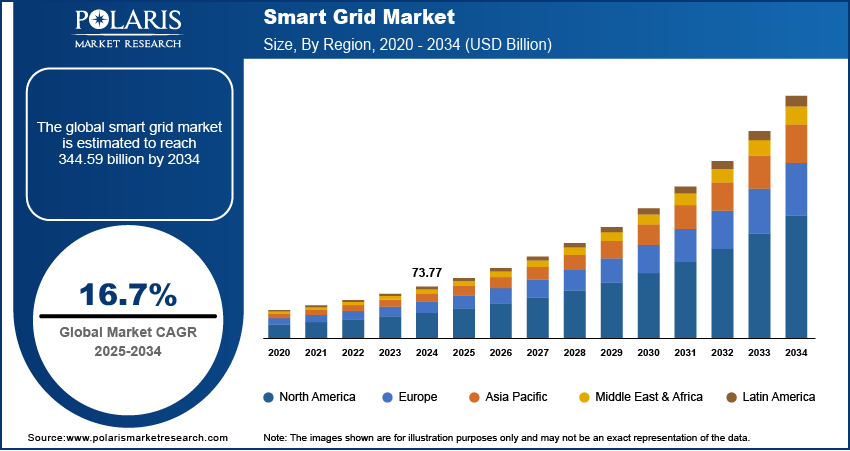

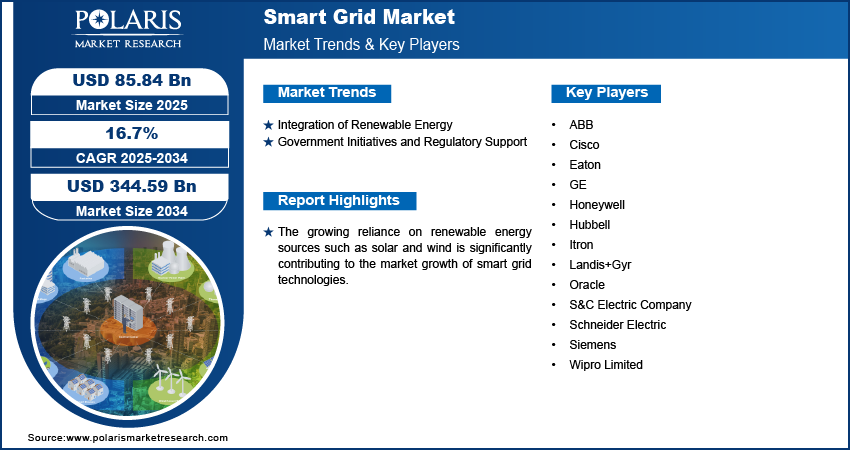

Smart Grid market size was valued at USD 73.77 billion in 2024 and is expected to reach USD 85.84 billion by 2025 and USD 344.59 billion by 2034, exhibiting a CAGR of 16.7% during the forecast period (2025-2034). Innovations in the Internet of Things (IoT), machine learning, and big data analytics have accelerated the deployment of intelligent grid solutions, enabling predictive maintenance, grid optimization, and dynamic pricing models which is further contributing to the market expansion. Additionally, the rising EV penetration demands robust charging infrastructure and smart load management, further pushing the need for smart grid capabilities, thereby propelling the market growth.

Key Insights

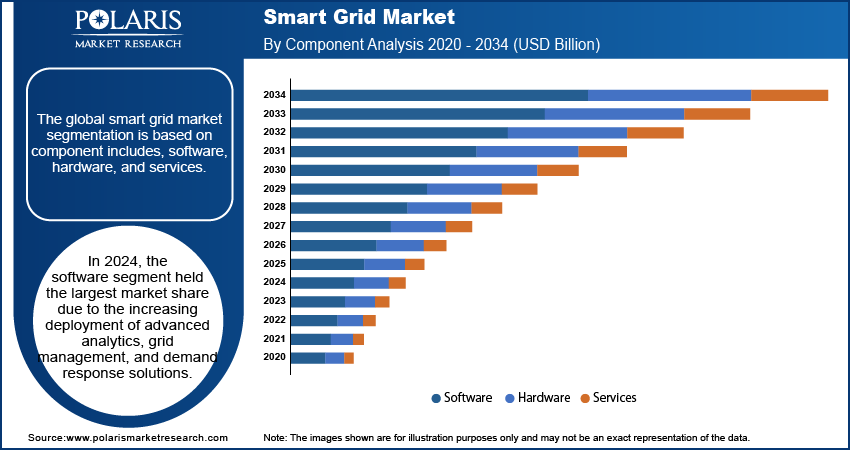

- The software segment dominated the market in 2024, driven by the increasing use of advanced analytics, grid management systems, and demand response solutions that improve operational efficiency and grid stability.

- The utility segment held the largest market share in 2024 due to widespread adoption of digital technologies aimed at enhancing power delivery and reliability.

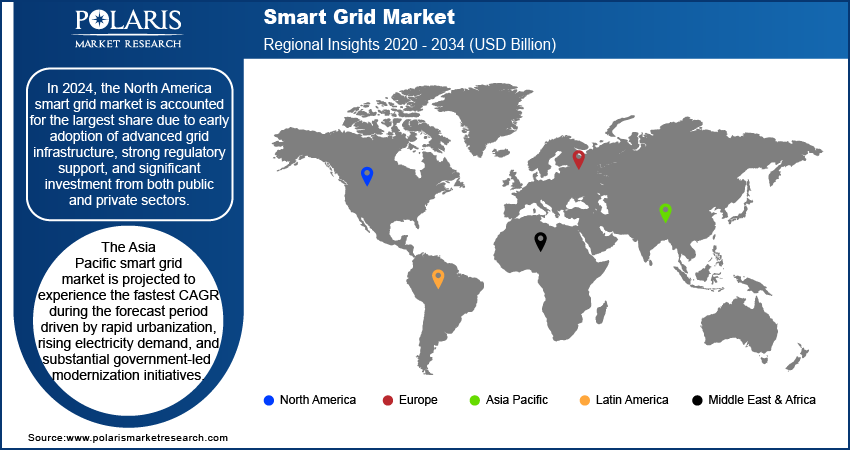

- North America led the market in 2024, supported by early adoption of advanced grid infrastructure, strong regulatory frameworks, and substantial investments from both public and private sectors.

- The Asia Pacific region is expected to register the fastest CAGR during the forecast period, fueled by rapid urbanization, growing electricity demand, and extensive government-led efforts to modernize grid infrastructure.

Industry Dynamics

- The increasing integration of renewable energy sources and growing demand for efficient energy management systems are driving the smart grid market, enabling better grid stability and reduced carbon emissions.

- Advancements in IoT and AI technologies are enhancing smart grid capabilities, enabling real-time monitoring and predictive maintenance, which in turn boosts overall grid reliability.

- High initial investment costs and the complexity of upgrading existing infrastructure pose significant challenges to the widespread adoption of smart grids.

- Expanding government initiatives and incentives to promote sustainable energy infrastructure offer substantial growth opportunities for smart grid deployment worldwide.

Market Statistics

- 2024 Market Size: USD 73.77 billion

- 2034 Projected Market Size: USD 344.59 billion

- CAGR (2025-2034): 16.7%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The smart grid market refers to the global industry focused on the development, deployment, and integration of intelligent energy systems that use digital communication, automation, and advanced analytics to enhance the efficiency, reliability, and sustainability of electricity distribution and consumption. Smart grids enable real-time monitoring, two-way communication between utilities and consumers, integration of renewable energy sources, and improved demand response. Components of this market include advanced metering infrastructure (AMI), distribution automation systems, grid cybersecurity, energy storage solutions, and smart substations. Rising demand for energy efficiency and reliability is driving market growth. There is an increasing pressure to enhance energy efficiency and minimize transmission losses as energy consumption grows globally. Smart grid technologies enable real-time monitoring and automated fault detection, reducing outages and improving grid reliability.

Market Dynamics

Integration of Renewable Energy

The growing reliance on renewable energy sources such as solar and wind is significantly contributing to the market growth of smart grid technologies. For instance, according to the National Renewable Energy Laboratory, in 2023, renewable energy sources accounted for approximately 41% of the total electricity generation in the US. Notably, wind and solar energy contributed over 16% of the overall generation mix. These energy sources are inherently intermittent and unpredictable, requiring advanced grid infrastructure capable of managing variable power flows. Smart grids offer real-time monitoring, dynamic load balancing, and responsive control mechanisms that ensure stability and efficiency in electricity distribution. Their ability to seamlessly integrate distributed energy resources enhances grid reliability and supports decentralized generation models. As nations increase their renewable capacity to meet climate goals, the demand for intelligent grid systems is expected to surge, thereby fueling market expansion and driving innovation in grid automation, energy storage integration, and smart inverters.

Government Initiatives and Regulatory Support

Strong government backing and evolving regulatory frameworks are playing a critical role in contributing to the market growth of the smart grid sector. For instance, according to the US Department of Energy, the Biden-Harris Administration announced a USD 2.2 billion investment to strengthen the electrical grid, enhancing resilience to extreme weather, lowering operational costs, and preparing for rising energy demand. Authorities across regions are implementing policies that mandate the deployment of smart meters, modernize grid infrastructure, and provide financial incentives for smart grid adoption. These initiatives are aligned with broader sustainability targets, including emission reductions and energy efficiency improvements. Regulatory mandates are also encouraging utilities to adopt grid modernization practices and invest in advanced technologies. Public-private partnerships and funding for pilot projects are further accelerating smart grid deployment.

Segment Insights

By Component Outlook

The global smart grid market segmentation is based on component includes, software, hardware, and services. In 2024, the software segment held the largest market share due to the increasing deployment of advanced analytics, grid management, and demand response solutions. Utilities and energy providers are leveraging software platforms to enable real-time grid monitoring, predictive maintenance, outage management, and integration of distributed energy resources. The growing complexity of power networks, particularly those incorporating renewable energy, has intensified the need for robust software to enhance operational efficiency and grid resilience. Moreover, the surge in smart meter installations and the need for secure, scalable data management platforms are further contributing to the expansion of the software segment across developed and emerging markets.

The hardware segment is expected to record the fastest CAGR over the forecast period, driven by increased investments in physical grid modernization and infrastructure upgrades. Rising demand for smart meters, advanced sensors, distribution automation devices, and energy storage systems is accelerating hardware deployment across utility networks. Expansion of electric vehicle charging infrastructure and integration of renewable energy sources necessitate high-performance hardware to support grid stability and load balancing. Government funding initiatives focused on grid reliability and modernization are also pushing procurement of new hardware solutions, making this segment a critical component in the transformation toward intelligent energy systems.

By End User Outlook

The global smart grid market segmentation is based on end user includes, utility, industrial, residential, commercial, and others. The utility segment accounted for the largest market share in 2024 due to widespread adoption of digital grid technologies to enhance power delivery and grid reliability. Utilities are at the forefront of smart grid implementation, driven by regulatory mandates, aging infrastructure, and the need for real-time visibility into power consumption and system performance. Deployment of advanced metering infrastructure (AMI), substation automation, and outage management systems is central to improving service reliability and operational efficiency. The transition to decarbonized energy sources and the integration of distributed generation further necessitate intelligent control and monitoring tools, solidifying the utility sector’s dominant role in the market.

The industrial segment is expected to grow significantly over the forecast period due to increasing adoption of smart grid technologies to enhance energy efficiency, ensure uninterrupted power supply, and support sustainability initiatives. Industrial facilities, particularly those in energy-intensive sectors like manufacturing, mining, and data centers, are integrating smart grid components to optimize energy usage and reduce operational costs. Deployment of smart meters, demand response systems, and automated energy management tools is enabling industries to monitor power quality and manage peak load demands. Growing awareness of energy resilience and cost control is encouraging industrial users to invest in advanced grid solutions, driving substantial market expansion.

Regional Analysis

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North America smart grid market is accounted for the largest share due to early adoption of advanced grid infrastructure, strong regulatory support, and significant investment from both public and private sectors. Utilities across the US and Canada have implemented large-scale smart meter rollouts, grid automation projects, and demand response programs to enhance energy efficiency and grid reliability. For instance, the Smart Renewables and Electrification Pathways Program (SREPs), launched by the Government of Canada in 2021, is a USD 4.5 billion initiative focused on advancing grid modernization, energy storage, and renewable energy across Canada. It aims to enhance the electrical grid's capacity sustainably and reliably, supporting the transition to a cleaner energy future while promoting infrastructure development. Federal initiatives such as the US Department of Energy’s smart grid investments and state-level decarbonization mandates have accelerated technology deployment. Additionally, growing integration of renewable energy and electric vehicle infrastructure is increasing the demand for intelligent grid management, further strengthening the region’s market position.

The Asia Pacific smart grid market is projected to experience the fastest CAGR during the forecast period driven by rapid urbanization, rising electricity demand, and substantial government-led modernization initiatives. Countries like China, India, Japan, and South Korea are investing heavily in upgrading outdated transmission infrastructure and implementing nationwide smart meter programs. Expanding renewable energy capacity and growing emphasis on grid stability are pushing regional governments to adopt advanced grid technologies. Initiatives such as India’s National Smart Grid Mission and China's push for digital energy transformation are accelerating market penetration. The region’s large population base and industrial expansion are also contributing to the strong market growth trajectory.

Key Market Players & Competitive Analysis Report

The competitive landscape of the market is characterized by dynamic industry analysis and strategic plans aimed at consolidating market position and raising technological innovation. Companies are focusing on market expansion strategies that include joint ventures, mergers and acquisitions, and strategic alliances to strengthen their capabilities across software, hardware, and service domains. Post-merger integration efforts are increasingly aligned with digital transformation goals, ensuring seamless deployment of integrated grid management systems and data platforms.

Continuous investment in technology advancements particularly in AI-based analytics, blockchain-enabled security, and IoT-driven monitoring solutions is redefining operational efficiencies and grid responsiveness. The landscape is further shaped by the launch of next-generation products such as intelligent substations, cloud-based grid management platforms, and decentralized energy control systems. Industry participants are also forming strategic collaborations with governments, research institutions, and energy providers to accelerate adoption of renewable energy and enhance grid resilience. The emphasis on cybersecurity, interoperability, and scalability is encouraging innovation, while policy-driven modernization initiatives are opening new regional opportunities.

ABB is a global technology and automation company, providing solutions across industries like power generation, electrification, automation, and robotics. ABB has grown into a multinational corporation with a presence in over 100 countries. The company's mission is to deliver advanced technology that enables sustainable growth while addressing the world's energy and industrial challenges. ABB offers integrated solutions for vessel automation, power management, and propulsion systems, contributing to more energy-efficient and environmentally friendly shipping operations. The company provides electrical and automation systems that enable offshore rigs and production units to operate more efficiently and safely. ABB's services extend to remote monitoring, condition based maintenance, and predictive analytics, ensuring reliable operations in the harsh and challenging offshore environment. ABB is actively engaged in smart grid development through its smart grid center offering utilities advanced solutions for distribution management, outage management, microgrids, and substation automation, as well as investing in innovative communication technologies for grid reliability and efficiency.

General Electric is a global industrial company that operates in China, Europe, the Americas, the Middle East, Asia, and Africa. The compnay has four segments: Renewable Energy, Aviation, Power, and Healthcare. The Power segment offers gas and steam turbines, as well as software solutions for power generation, industrial, government, and other customers. It also provides upgrade and service solutions. The Renewables segment supplies diverse solutions for its customers by combining blade manufacturing, offshore and onshore wind, grid solutions, hybrid renewables, hydro, storage, and digital services offerings. The Aviation segment produces and designs military and commercial aircraft engines, electric power, integrated engine components, and mechanical aircraft systems; and provides aftermarket services. General Electric (GE) is a provider of digital energy solutions for smart grids, partnering with companies like CGI to advance real-time grid operations, cybersecurity, and integration of renewable energy sources. GE’s smart grid initiatives include demonstration centers, advanced metering infrastructure, and grid-wide management software, focusing on enhancing reliability, efficiency, and reducing the carbon footprint of energy delivery worldwide

List of Key Companies

- ABB

- Cisco

- Eaton

- GE

- Honeywell

- Hubbell

- Itron

- Landis+Gyr

- Oracle

- S&C Electric Company

- Schneider Electric

- Siemens

- Wipro Limited

Market Developments

In April 2024, ABB invested in GridBeyond, a technology firm that uses AI and data analytics for energy management, enabling clients to optimize distributed energy resources and industrial loads.

In March 2025, ABB introduced InSite Energy Pro, a cloud-based platform for multi-site energy management powered by AWS. This solution offers real-time monitoring, automated load optimization, and customizable dashboards, streamlining energy management across various locations.

In March 2025, Honeywell and Verizon Business partnered to integrate Verizon's 5G connectivity into Honeywell smart meters. This integration enables utilities and end users to remotely access critical data, optimize energy consumption, and enhance operational efficiency. The sophisticated real-time data exchange facilitated by 5G technology aims to mitigate grid strain and improve overall resource management.

Market Segmentation

By Component Outlook (Revenue USD Billion 2020 - 2034)

- Software

- Hardware

- Services

By Technology Outlook (Revenue USD Billion 2020 - 2034)

- Wireline

- Wireless

By Application Outlook (Revenue USD Billion 2020 - 2034)

- Generation

- Transmission

- Distribution

- Consumption

- Others

By End User Outlook (Revenue USD Billion 2020 - 2034)

- Utility

- Industrial

- Residential

- Commercial

- Others

By Regional Outlook (Revenue USD Billion 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 73.77 billion |

|

Market Size Value in 2025 |

USD 85.84 billion |

|

Revenue Forecast in 2034 |

USD 344.59 billion |

|

CAGR |

16.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue, USD billion; and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global smart grid market size was valued at USD 73.77 billion in 2024 and is projected to grow to USD 85.84 billion by 2034.

The global market is projected to grow at a CAGR of 16.7% during the forecast period.

In 2024, the North America smart grid market is accounted for the largest share due to early adoption of advanced grid infrastructure, strong regulatory support, and significant investment from both public and private sectors.

Some of the key players in the market are Arcosa Inc.; Argex; Ashtech Pvt. Ltd.; Boral Industries Inc.; Buildex, LLC; Cemex S.A.B. DE C.V.; Heidelberg Materials; Holcim Group; Laterlite S.P.A.; Leca International; Litagg Industries Pvt Ltd; Northeast Solite Corporation; Rock Solid Processing Ltd; Stalite Lightweight Aggregate; Utelite Corporation.

In 2024, the software segment held the largest market share due to the increasing deployment of advanced analytics, grid management, and demand response solutions.

The utility segment accounted for the largest market share in 2024 due to widespread adoption of digital grid technologies to enhance power delivery and grid reliability.