Life Science Analytics Market Size, Share, Trends, & Industry Analysis Report

By Component (Software, Services), By Type, By Application, By End-Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 119

- Format: PDF

- Report ID: PM1980

- Base Year: 2024

- Historical Data: 2020-2023

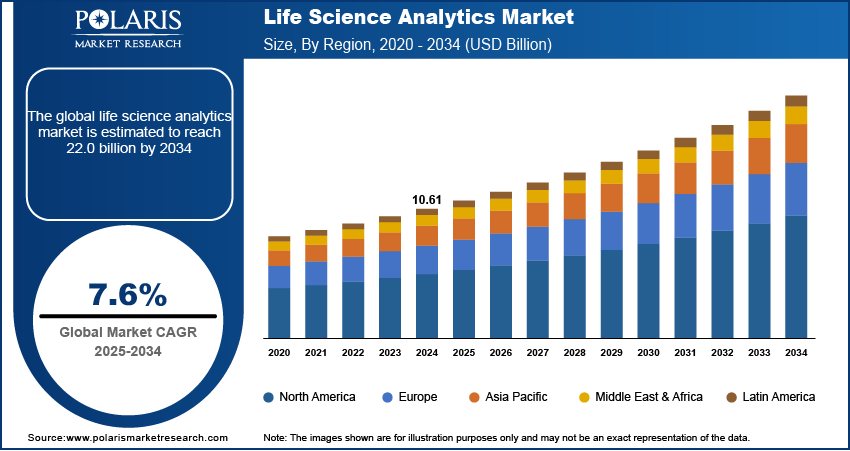

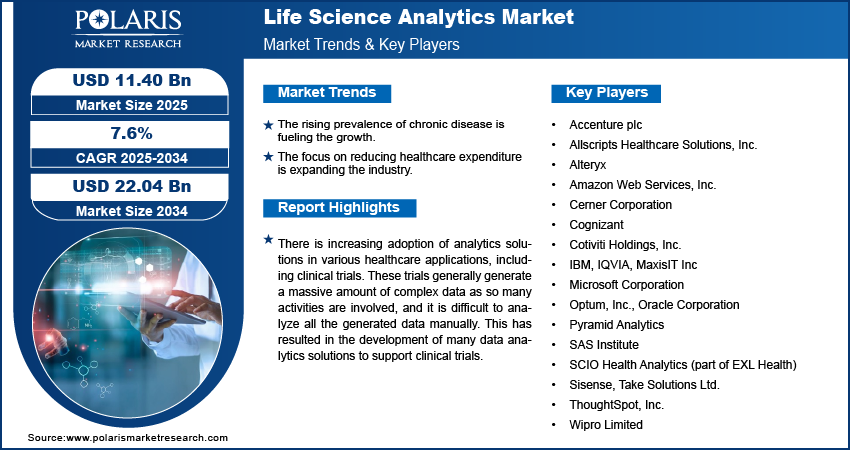

The global life science analytics market was valued at USD 10.61 billion in 2024 and is expected to grow at a CAGR of 7.6% during the forecast period. The surging acceptance of analytic solutions in clinical trials, rising prevalence of chronic diseases, advancement in technology, the demand for improved data standardization, increasing adoption of analytical solutions in various applications, reducing healthcare expenditure, and growing demand for the improved patient outcome are some of the critical factors that drive the growth of the life science analytics market.

Key Insights

- The sales & marketing support dominated with largest share in 2024 due to growing use of technology by life science firms for marketing strategies.

- The predictive type segment is expected to record significant growth due to increasing adoption of advanced solutions for possible future event estimation.

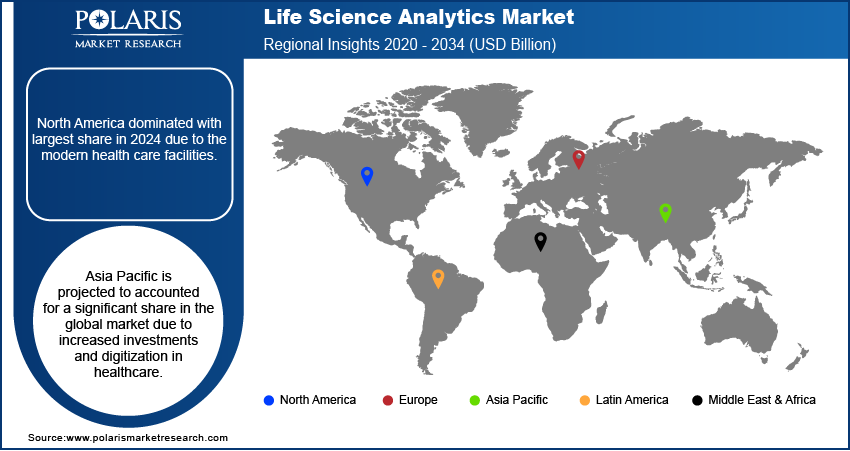

- North America dominated with largest share in 2024 due to the modern health care facilities.

- Asia Pacific is projected to accounted for a significant share in the global market due to increased investments and digitization in healthcare.

Industry Dynamics

- The rising prevalence of chronic disease is fueling the growth.

- The focus on reducing healthcare expenditure is expanding the industry.

- Technological advancement is driving the growth.

- Data privacy and security concerns is limiting the adoption.

Market Statistics

- 2024 Market Size: USD 10.61 Billion

- 2034 Projected Market Size: USD 22.04 Billion

- CAGR (2025-2034): 7.6%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

Impact of AI on Industry

- AI helps to improve the pace of drug discovery and development.

- AI is expected to improve the clinical trial efficiency which is expected to fuels its adoption.

- AI enables continuous analysis of real-world and real-time data from wearables, EMRs, and remote patient monitoring systems

There is increasing adoption of analytics solutions in various healthcare applications, including clinical trials. These trials generally generate a massive amount of complex data as so many activities are involved, and it is difficult to analyze all the generated data manually. This has resulted in the development of many data analytics solutions to support clinical trials.

Industry Dynamics

Growth Drivers

The growth of the global market is driven by the factors such as the increasing adoption of technology in the biotechnology and pharmaceutical industries. This companies worldwide are adopting advance technology such as analytical solutions. This rise in adoption is driven by need for faster drug discovery and development, and optimizing clinical trials. Moreover, rising investment in the pharmaceutical and biotechnology companies are further driving the demand. This increase in investment is supporting companies to spend more on advance analytics solutions and skilled workforce that are needed to operate it, thereby driving the growth..

The adoption of analytic solutions will help the companies evaluate and find potential drug candidates that will significantly reduce the expenditure and time for pharmaceutical companies and contract research organizations (CROs). At each stage of drug discovery and development, the analysis evaluates the safety and efficacy of the drug before proceeding to the next step. All these factors augment the growth of the market for life science analytics.

Pharmaceutical companies have adopted digitization in every department as they help in research and development activities and play a critical part in improving the efficiency of manufacturing capabilities, marketing, and sales. The adoption of the technology in research & development and the manufacturing process has helped to increase productivity and reduce errors.

The life science analytics industry players are following various strategies, including new product launches such as Amazon HealthLake, which will help facilitate big data solutions and standardize patient information in healthcare. The rise in funding for major players is further driving growth. For example, Inference raised USD 60 million in Series B funding in December 2020 to help the company further develop its AI-powered software platform that has applications in clinical research, drug discovery, and operations.

Report Segmentation

The market is primarily segmented on the basis of type, component, application, delivery, end-use, and region.

|

By Type |

By Component |

By Application |

By Delivery |

By End-use |

By Region |

|

|

|

|

|

|

Know more about this report:request for sample pages

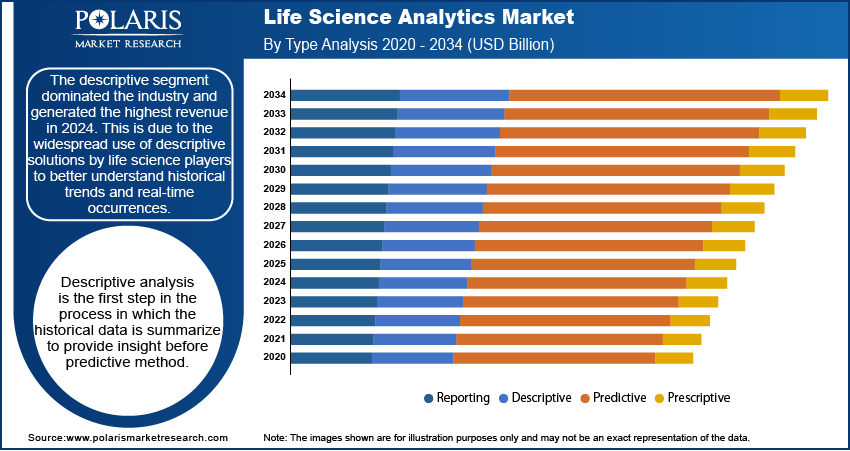

Insight by Type

The descriptive segment dominated the industry and generated the highest revenue in 2024. This is due to the widespread use of descriptive solutions by life science players to better understand historical trends and real-time occurrences. Descriptive analysis is the first step in the process in which the historical data is summarize to provide insight before predictive method. The industry players in the life science analytics industry forecast future trends and opportunities using data mining techniques on these descriptive datasets, thereby driving the segment growth.

The predictive type segment is projected to grow at the highest growth rate in life science analytics industry during the projected period. Increasing use of advanced solutions to estimate possible future events and to assist players in developing strategies and approaches to maintain and improve industry performance. Moreover, this type of method is use in personalized medicine. The growth in demand for the personalized medicine is further fueling the demand for this method, thereby boosting the life science analytics industry growth.

Insight by Application

The sales & marketing support segment holds the largest revenue share for life science analytics and generated the highest revenue in 2024. The rapid growth of this segment in the life science analytics industry can be ascribed to the growing use of technology by life science firms to synchronize their sales and marketing strategies. The need for post-marketing surveillance is driving up the use of technology in sales & marketing. The research & development segment of the life science analytics industry is projected to grow at a high growth rate during the projected period due to rising pipeline products of medical devices, biotechnology, and pharmaceutical companies.

Insight by End-use

The pharmaceutical companies segment dominated the industry for life science analytics and generated the highest revenue, in 2024 due to these companies' high adoption of the solutions for resource management, increasing drug utilization, and improving clinical trial efficacy. Additionally, rising investment in this companies is further driving the demand for the analytics solutions. This investment supoort the compnaies to spend more on advance solutions and workforce needed to handle it, thereby driving the segment growth.

The biotechnology companies segment is projected to grow at a high growth rate during the projected period due to the increased use of the technology in genome analysis and sequencing to reduce costs. Also, the availability of customized data analytic solutions is boosting the growth of the segment.

Geographic Overview

North America dominated the market and generated the highest revenue in 2024, owing to the availability of modern health care facilities, upsurge in the elderly population, increasing cases of non-communicable diseases, the existence of prominent players, and the adoption of advanced analytical solutions in countries like the U.S. and Canada. The increasing number of clinical trials will also help in the growth of the market for life science analytics.

Which factors contribute to the dominance of the U.S. life science analytics market in North America?

The U.S. dominated the revenue share in North America in 2024. Massive growth in life science data, increase in regulatory pressures, and growing demand for faster and more efficient R&D prompt pharmaceutical, biotech, and medical device companies to invest in analytics solutions. In addition, AI-enabled insights, precision medicine initiatives, and cloud adoption propel the adoption of life science analytics solutions and services in the U.S. Further, the presence of major players in the country propels the industry expansion in the U.S. The following table provides information on key stakeholders, their roles, and notable examples within the U.S.

|

Stakeholders |

Role |

Key Players in U.S. |

|

Investors |

Provide funds for technological developments, R&D, and business expansion. |

Venture Capital Firms: Andreessen Horowitz, Sequoia Capital Private Equity: Insight Partners |

|

Governments & Regulatory Bodies |

Establish regulations, policies, and funding mechanisms to support the life sciences sector. |

U.S. Food and Drug Administration (FDA), Centers for Disease Control and Prevention (CDC), National Institutes of Health (NIH) |

|

Academic Researchers & Organizations |

Conduct primary research and collaborate with industry players to translate findings into practical applications. |

Harvard Medical School, Johns Hopkins University, Stanford University |

|

Technology Providers |

Develop and supply data analytics platforms, software, and infrastructure |

Oracle Corporation (Oracle Analytics Intelligence for life sciences), SAS Institute Inc. (SAS Viya for life sciences), IBM Corporation (Watson Health) |

|

Service Providers |

Provide consultation, implementation, and support services to install life science analytics solutions. |

Accenture Plc, Cognizant Technology Solutions Corporation, Wipro Limited |

|

Contract Research Organizations (CROs) |

Offer clinical trials, data analysis, and other outsourced research services. |

IQVIA Holding Inc., Labcorp Drug Development, Parexel International |

|

End Users |

Use analytics solutions to boost research & development (R&D) and various commercialization processes. |

Pharmaceutical Firms: Pfizer, Merck Biotechnology Companies: Amgen, Genentech Medical Device Manufacturers: Medtronic, Abbott Laboratories |

|

Cloud & Infrastructure Providers |

Supply the computing power and storage solutions required for large-scale data analytics. |

Amazon Web Services (AWS), Google Cloud Platform, Microsoft Azure |

|

Data Providers |

Offer access to genomic, clinical, and real-world data required for analytics. |

IQVIA, Tempus, Flatiron Health |

|

Professional Associations & Standards Bodies |

Develop standards and practices to ensure high-quality and interoperability in analytics solutions. |

HL7 International, Clinical Data Interchange Standards Consortium (CDISC), Pharmaceutical Research and Manufacturers of America (PhRMA) |

Asia Pacific is expected to be the fastest-growing region for the global market for life science analytics due to increased investments and digitization in healthcare. Growing healthcare spending, adopting advanced technologies, developing healthcare facilities and infrastructure will further drive life science analytics industry growth. In addition, the presence of many CROs and pharmaceutical companies in countries like India and China will further boost the development of the market for life science analytics in the region.

Competitive Insight

Players in the life science analytics industry are investing heavily in research and development to develop new analytical tools to cater to various fields of life sciences. Companies are also entering into partnerships, collaborations, and acquisitions to gain a nascent market foothold. Major players operating in the market include Cognizant, Accenture, IBM, SAS Institute, Inc., Oracle, Wipro Limited, Take Solutions Limited, and IQVIA.

Recent Development

- June 2024: IQVIA announced the launch of the clinical trial technology platform One Home in order to conduct smooth clinical trial management by merging multiple systems into one dashboard. According to IQVIA, the new platform aims to reduce the administrative load on research websites.

- July 2024: Indegene publicly announced its partnership with Microsoft in order to amplify the adoption of generative AI in life sciences to scale up efficiency and innovation throughout the industry.

Life Science Analytics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 10.61 billion |

| Market size value in 2025 | USD 11.40 billion |

|

Revenue forecast in 2034 |

USD 22.04 billion |

|

CAGR |

7.6% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Type, By Component, By Application, By Delivery, By End-Use, By Region |

|

Regional scope |

North America Europe Asia Pacific Latin America; Middle East & Africa |

|

Key Companies |

IBM, Accenture plc, Amazon Web Services, Inc., Allscripts Healthcare Solutions, Inc., Alteryx, Cerner Corporation, Cognizant, Cotiviti Holdings, Inc., IQVIA, MaxisIT Inc, Microsoft Corporation, Optum, Inc., Oracle Corporation, Pyramid Analytics, SAS Institute, SCIO Health Analytics (part of EXL Health), Sisense, Take Solutions Ltd., ThoughtSpot, Inc., Wipro Limited |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

FAQ's

• The market size was valued at USD 10.61 Billion in 2024 and is projected to grow to USD 22.04 Billion by 2034.

• The market is projected to register a CAGR of 7.6% during the forecast period.

• A few of the key players in the market are IBM, Accenture plc, Amazon Web Services, Inc., Allscripts Healthcare Solutions, Inc., Alteryx, Cerner Corporation, Cognizant, Cotiviti Holdings, Inc., IQVIA, MaxisIT Inc, Microsoft Corporation, Optum, Inc., Oracle Corporation, Pyramid Analytics, SAS Institute, SCIO Health Analytics (part of EXL Health), Sisense, Take Solutions Ltd., ThoughtSpot, Inc., Wipro Limited.

• The sales & marketing support accounted for the largest market share in 2024.

• The predictive segment is expected to record significant growth.