Lighting Fixture Market Share, Size, Trends, Industry Analysis Report

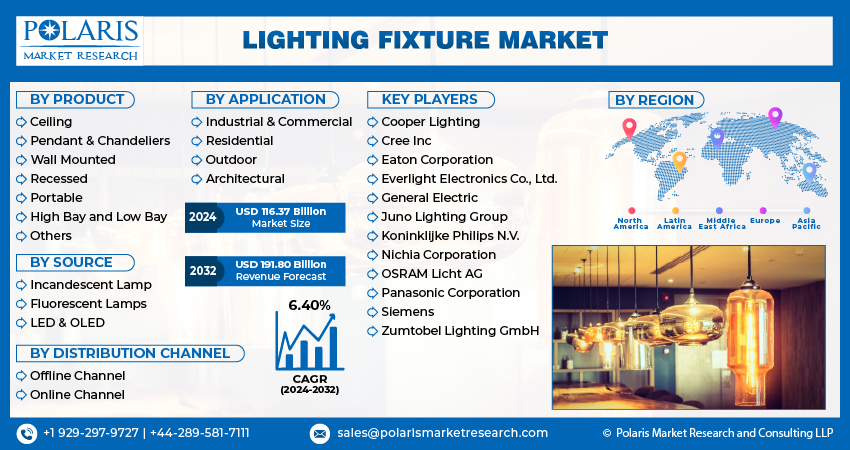

By Product (Ceiling, Pendant & Chandeliers, Wall Mounted, Recessed, Portable, High Bay and Low Bay, Others); By Source; By Application; By Distribution Channel; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM3657

- Base Year: 2023

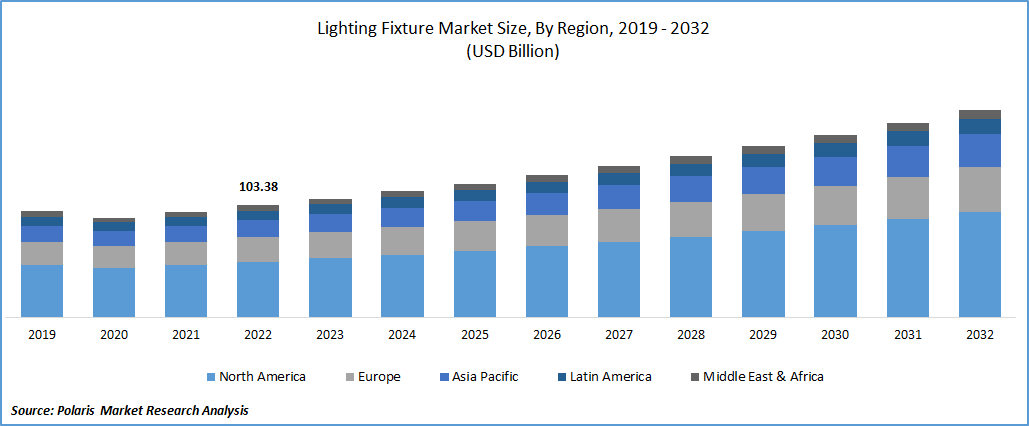

- Historical Data: 2019-2022

Report Outlook

The global lighting fixture market was valued at USD 109.65 billion in 2023 and is expected to grow at a CAGR of 6.40% during the forecast period.

The lighting fixture market refers to the industry involved in the manufacturing, distributing, and selling of lighting fixtures, which are devices used to distribute, control, and deliver light. Lighting fixtures are essential components in residential, commercial, and industrial settings, serving the purpose of illuminating spaces efficiently and effectively.

To Understand More About this Research: Request a Free Sample Report

The scope of the lighting fixture is broad and encompasses various segments, including residential, commercial, and industrial applications. Residential lighting fixtures, including indoor and outdoor lighting solutions, are designed for use in homes and apartments. Commercial lighting fixtures cater to lighting needs in offices, retail stores, hotels, hospitals, and other public spaces. Industrial lighting fixtures are specifically designed for industrial facilities, warehouses, factories, and outdoor industrial areas.

The lighting fixture also includes a wide range of product types, such as ceiling-mounted fixtures, wall-mounted fixtures, pendant fixtures, recessed fixtures, chandeliers, track lighting, and specialty lighting. Additionally, the market incorporates various light sources, including incandescent bulbs, fluorescent tubes, LEDs (Light Emitting Diodes), and HID (High-Intensity Discharge) lamps.

Factors influencing the market's growth include the increasing adoption of LED lighting fixtures, new product development, and innovations like smart lighting that can link to IoT devices.

- For instance, in 2019, Philips introduced a smart Wi-Fi LED using the WiZ platform and a smartphone or tablet in India. With this intelligent LED bulb, changing the hue of the light is simple and allows for the creation of personalized light appearances.

The world economy has suffered significant destruction due to the COVID-19 pandemic. All businesses around the world had to either down or operate with fewer employees as a result of lockdowns put in place to stop the coronavirus from spreading, which hurt global trade. It affected people's jobs and salaries, causing some to lose their jobs and reduce their pay, which lowered living standards.

Furthermore, after the pandemic, the growth of urban areas and infrastructure development projects, such as commercial buildings, residential complexes, and public spaces, propelled the demand for lighting fixtures. Urbanization due to increased construction activities creates a need for lighting solutions in various settings.

Industry Dynamics

Growth Drivers

Energy Efficiency and Environmental Concerns

The growing emphasis on energy efficiency and sustainability drives the adoption of energy-efficient lighting fixtures. LED lighting fixtures, in particular, have gained popularity due to their long lifespan, low energy consumption, and reduced environmental impact. Government regulations and initiatives promoting energy-efficient lighting also influence market growth.

Also, the advancements in lighting technologies, such as LED lighting, have revolutionized the lighting fixture market. LED lighting fixtures offer significant advantages, including energy efficiency, cost savings, and enhanced lighting control options. Integrating smart lighting systems, incorporating IoT (Internet of Things) and wireless connectivity, is another driver fueling the market growth.

Report Segmentation

The market is primarily segmented based on product, source, application, distribution channel, and region.

|

By Product |

By Source |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Source

The Fluorescent lamps segment held the largest revenue share in 2022

In 2022, the fluorescent lamps segment held the largest revenue share due to their superior characteristics. Unlike incandescent bulbs that utilize a metallic filament, fluorescent lamps use gas to produce light, reducing power consumption. It, coupled with its longer lifespan, energy efficiency, and cost-effectiveness, has contributed to the substantial market share of fluorescent lamps.

Moreover, these lamps are designed to be compatible with existing lighting fixtures intended for incandescent bulbs. They are available in various sizes and shapes for recessed fixtures such as table lamps, ceiling lights, and wall-mounted lighting. Additionally, manufacturers are actively developed compact fluorescent lamps (CFLs) that can be used with three-way lamps featuring dimmer switches. The compatibility, brightness, and improved light quality of fluorescent light fixtures have consequently fueled the growing demand in recent years.

By Distribution Channel

The online channel segment is expected to accounted for the fastest market share during the forecast period

The online channel segment is expected to accounted for the fastest market share during the forecast period. It indicates that the online retail platform for lighting fixtures is expected to capture a significant market share compared to other distribution channels.

E-commerce has revolutionized the retail industry, including the lighting fixture. Online platforms provide convenience, easy accessibility, and a wide range of products to customers. With the increasing penetration of Internet services and the growing trend of online shopping, consumers are increasingly turning to online channels to purchase lighting fixtures.

Online channels offer various lighting fixtures from multiple brands, styles, and price ranges. This extensive product range gives consumers more options, allowing them to find the perfect lighting fixture that meets their requirements.

Online retailers often offer competitive pricing for lighting fixtures compared to traditional brick-and-mortar stores. The online marketplace fosters price transparency and lets consumers compare prices from different sellers easily. Additionally, frequent discounts, promotional offers, and deals on online platforms attract customers and drive sales.

Regional Insights

Asia Pacific dominated the largest market share in 2022

In 2022, the Asia Pacific dominated the largest market share, primarily due to the growing government support for the widespread adoption of energy-efficient lighting solutions in emerging economies. Notably, the government of India implemented the Domestic Efficient Lighting Programs (DELP) project, which aimed to replace CFL bulbs and traditional incandescent with more energy-efficient LED lights. This initiative has significantly contributed to the market share of the region.

Furthermore, commercial enterprises in the Asia Pacific region have invested heavily in enhancing their facilities, including hospitals, retail shops, educational institutes, salons, malls, and warehouses. Such investments are aimed at attracting customers by providing well-lit and visually appealing spaces. It has further fueled the demand for energy-efficient lighting fixtures.

North America is expected to witness the fastest growth in the lighting fixtures market, driven by the rising need for wireless lighting fixtures. Significant companies in North America are actively developing wireless lighting fixtures to capitalize on their numerous advantages, including long-distance control, programmability, energy efficiency, and extended lifespan. As a result, the increasing demand for wireless lighting fixtures is anticipated to propel the market growth.

Key Market Players & Competitive Insights

The numerous players in the lighting industry have strategically shifted their focus away from the traditional lighting business. As a result, these market players are actively investing in research and development (R&D) for medical devices and exploring opportunities in the automotive industry and other sectors. This strategic realignment reflects the growing recognition of new market potentials and the need to adapt to evolving industry trends.

Some of the major players operating in the global market include:

- Cooper Lighting

- Cree Inc

- Eaton Corporation

- Everlight Electronics Co., Ltd.

- General Electric

- Juno Lighting Group

- Koninklijke Philips N.V.

- Nichia Corporation

- OSRAM Licht AG

- Panasonic Corporation

- Siemens

- Zumtobel Lighting GmbH

Recent Developments

- On June 9, 2022, Helvar, an energy-saving lighting solutions provider, launched its latest offering, the ActiveAhead Generation 2. This intelligent and scalable wireless solution incorporates advanced AI algorithms to learn and adapt to space usage patterns. Additionally, the ActiveAhead Generation 2 can be seamlessly connected to cloud services, enhancing its functionality and allowing for centralized control and monitoring.

- In 2019, Windfall, a Germany-based company, introduced LED chandeliers and wall lamps in India. These lighting fixtures provide warm, discreet, and efficient illumination. The chandeliers offer minor variations, such as options for direct switches or dimmers, chain hanging, and diverse finishes with various materials. These features have captured customers' attention, making chandelier lighting fixtures increasingly popular in the market.

Lighting Fixture Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 116.37 billion |

|

Revenue forecast in 2032 |

USD 191.80 billion |

|

CAGR |

6.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Source, By Application, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Cooper Lighting, Cree Inc, Eaton Corporation, Everlight Electronics Co., Ltd., General Electric, Juno Lighting Group, Koninklijke Philips N.V., Nichia Corporation, OSRAM Licht AG, Panasonic Corporation, Siemens, Zumtobel Lighting GmbH |

FAQ's

The lighting fixture market report covering key segments are product, source, application, distribution channel, and region.

Lighting fixture Market Size Worth $191.80 Billion By 2032.

The global lighting fixture market is expected to grow at a CAGR of 6.4% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in lighting fixture market are Growing Demand for Aesthetic and Functional Lighting.