Lignans Market Size, Share, Trends, Industry Analysis Report

: By Source (Plant Resins, Cereals & Grains, and Oilseeds), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM1877

- Base Year: 2024

- Historical Data: 120

Lignans Market Overview

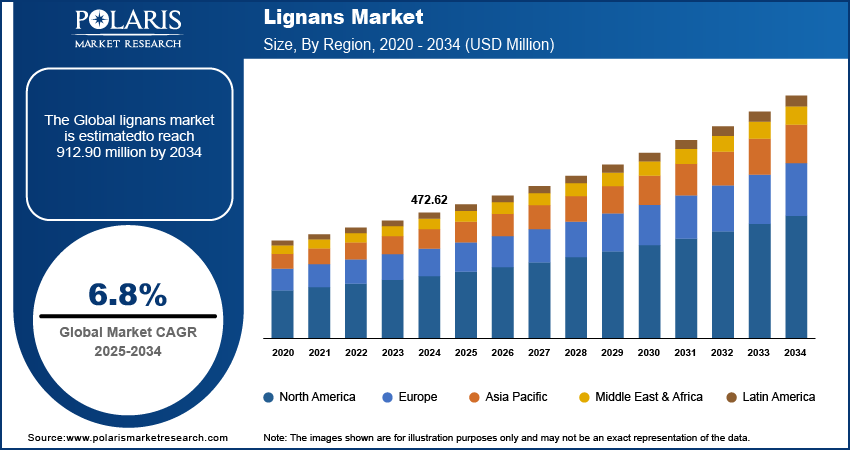

The lignans market size was valued at USD 472.62 million in 2024. The market is projected to grow from USD 503.72 million in 2025 to USD 912.90 million by 2034, exhibiting a CAGR of 6.8% from 2025 to 2034.

Lignans are a type of polyphenolic compound widely distributed across various plant families and are commonly found in staple foods such as grains, nuts, seeds, and vegetables.

They are also present in popular beverages like tea, coffee, and wine and are known for their association with dietary fiber. Furthermore, lignan-based food products have been identified for their potential anticancer effects and their ability to reduce the risk of heart disease. The increasing demand for food products rich in lignans, driven by their beneficial health effects, is a significant factor contributing to the growth of the lignan market.

To Understand More About this Research: Request a Free Sample Report

Lignan is widely used in animal feed due to its high immunity properties. The prebiotic effects of lignan-based animal feed products also help reduce pathogenic bacteria presence, support intestinal immunity, and maintain a healthy balance of intestinal microflora in animals, which increases its adoption in animal feed products.

Lignans Market Trends and Drivers Analysis

Shift Towards Herbal and Organic Products

Market CAGR for the lignans is driven by increasing demand for organic products that have a reduced amount of side effects on human health. Consumers are increasingly shifting towards organic and natural items, including organic cosmetic products such as shampoos, soaps, face masks, and others. In addition, various fruits, flowers, and others with anti-aging properties are enhancing the skincare routine. The rise of herbal and natural skin care remedies is increasing the demand for lignan in the market.

Lignan used in cosmetics is generally extracted from flaxseeds, which offer moisturizing, skin brightening, and acne-prevention properties. Growing awareness about chemical-based products and their side effects is fueling the demand for more herbal and organic products. Consequently, the organic medicines and treatments provided by pharmaceutical companies are contributing to the market growth.

Technological Advancements in Extraction Processes

Rapid technological developments have led to advancements in lignan extraction and are significantly driving market growth. The development of innovative and eco-friendly extraction machinery has resulted in increased lignan production. In addition, various techniques, such as green extraction techniques and microwave-assisted extraction, enhance the efficiency and sustainability of lignan extraction products.

Extraction techniques like nanoencapsulation involve enclosing lignan molecules in nano-sized carriers such as nanoparticles or liposomes to improve their bioavailability, stability, and targeted delivery. The automation in extraction techniques minimizes waste, maximizes yield, and reduces overall production costs, boosting the lignan market revenue.

Lignans Market Segment Analysis

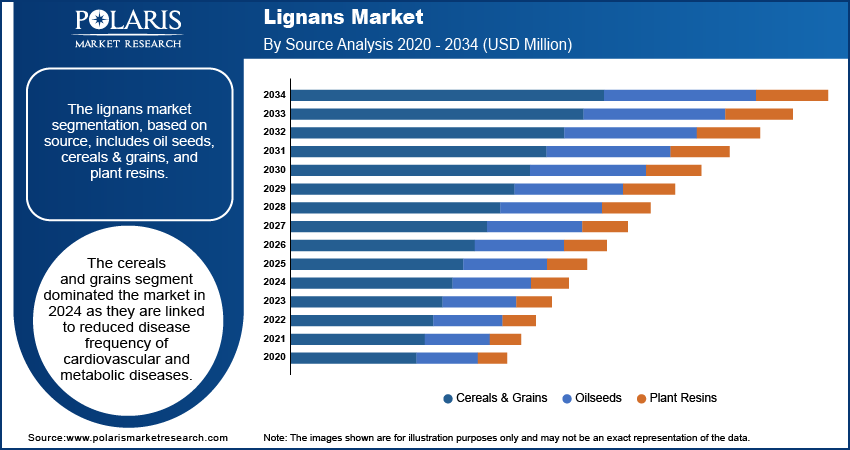

Lignans Market Assessment by Source

The lignans market segmentation, based on source, includes oil seeds, cereals & grains, and plant resins. The cereals and grains segment dominated the market in 2024 as they are linked to reduced disease frequency of cardiovascular and metabolic diseases. Cereals have excellent antioxidant, anti-inflammatory, and hormone-inducing effects on humans. In addition, cereal-based lignans possess various properties, such as estrogenic, anticarcinogenic, and antiestrogenic, that are beneficial for health. This contributes the the dominant position of the segment.

Increased exports of cereals are becoming a major source of lignans in the market and are driving market expansion. For instance, in 2023, 17% of total global cereal production was traded internationally, with variations across different cereals. Consequently, the significant rise in lignans is driven by higher production and consumption rates of the cereals across different regions.

Lignans Market Breakdown by Application Insights

The lignans market segmentation, based on application, includes cosmetics & toiletries, food & beverages, animal nutrition, pharmaceuticals, and others. The food & beverage market segment is expected to dominate the market due to the advent of functional foods and growing consumer awareness regarding the nutritional benefits associated with these food products. Functional foods help reduce the risk of disease onset by strengthening the immune system, thereby playing a crucial impact in preventing any disease or disorder. In addition, rising income levels and consumer’s inclination towards preventive healthcare drive the market segment forward.

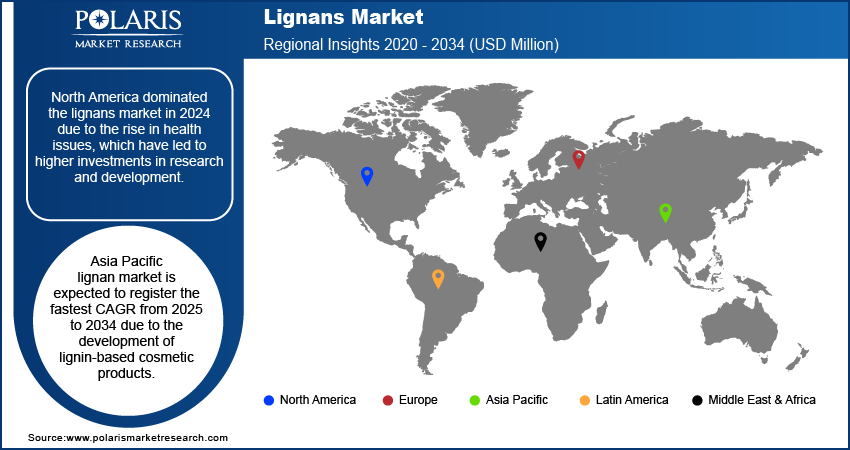

Lignans Market Breakdown by Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the lignans market in 2024 due to the rise in health issues, which have led to higher investments in research and development. In addition, the presence of major companies such as SPI Pharma, Prairie Tide Diversified Inc., and others offering their services further strengthens the market landscape in North America.

The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the market during the forecast period.

The US accounts for the largest market share in North America’s lignan market, owing to the rising number of breast cancer patients across the region. Lignans have anticancer properties that reduce the risk of breast cancer. For instance, as per the American Cancer Society report, about 297,790 women and 2,800 men were estimated to be diagnosed with breast cancer in 2023, increasing the demand for lignans and lignan-based products. Furthermore, the rising obesity rate is driving the demand for healthy diets, which is also contributing to the market growth.

Asia Pacific lignan market is expected to register the fastest CAGR from 2025 to 2034 due to the development of lignin-based cosmetic products. Additionally, the rising number of lignin manufacturers and companies is boosting market revenue. Cosmetics manufacturers are increasingly incorporating lignans in their products, including shampoos, anti-aging products, and moisturizers to prevent dryness and soften the skin of people having dull complexions. For instance, Ktein, a cosmetic manufacturer in India, developed lignin-based flaxseed gel for hair moisturization and nourishment. Therefore, increasing innovations in various sectors are driving market growth.

Lignans Market – Key Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their product lines, which will help the lignans market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the lignans market must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the lignans market to benefit clients and increase the market sector. In recent years, the market has offered some technological advancement. Major players in the lignans market include BioGin Biochemicals; Biosynth; FarmaSino Pharmaceuticals; Hebei Xinqidian Biotechnology; Kingherbs Ltd.; Naturalin Bio-Resources Co.; Plamed Green Science Group.; Prairie Tide Diversified Inc.; Shaanxi Zebrago Industrial; SPI Pharma; TSKG Products LLC.; and Xi'an Sinuotebio Tech.

Prairie Tide Diversified Inc., headquartered in Canada, is a leading producer of flax seed. The company's product line includes thickeners and egg replacement products, nutritional supplements such as dietary fiber, Omega-3-rich flaxseed oils, concentrated lignan, and others. Moreover, they provide specialized bioactive cyclic peptides for health and cosmetic markets.

Shaanxi Zebrago Industrial Co., Ltd., headquartered in China, manufactures plant extract products and services. The company extends its services across various sectors, such as biomedicine, functional food, beverages, and other businesses and services. Their product range includes health food powder, cosmetic raw materials, pharmaceutical intermediates, food additives, herbal extracts, and others. The company also provides flax lignan as health food powder.

List of Key Companies in Lignans Market

- Bio – Botanica Inc.

- BioGin Biochemicals

- Biosynth

- FarmaSino Pharmaceuticals

- Hebei Xinqidian Biotechnology

- Kingherbs, Ltd.

- Naturalin Bio-Resources Co.

- Plamed Green Science Group.

- Prairie Tide Diversified Inc.

- Shaanxi Zebrago Industrial

- SPI Pharma

- TSKG Products LLC.

- Xi'an Sinuotebio Tech

Lignans Market Developments

May 2024: SPI Pharma appointed IMCD to expand their distributions across the Middle East region, which will help SPI Pharma to expand its products offering across the Middle East region.

June 2024: Biosynth introduced an automated peptide quotation tool for customers with a web account that enables rapid generation of a personalized peptide quote. The tool is designed to facilitate order tracking and provide quality control documentation.

November 2023: Bio-botanica introduced serums containing pure sterol (Pueraria Mirifica), which are specifically formulated to target and diminish facial wrinkles.

Lignans Market Segmentation

By Source Outlook (Revenue – USD Million, 2020–2034)

- Oilseeds

- Cereals & Grains

- Plant Resins

By Application Outlook (Revenue – USD Million, 2020–2034)

- Cosmetics & Toiletries

- Toiletries

- Haircare

- Skincare

- Others

- Food & Beverages

- Dietary Supplements

- Functional Beverages

- Functional Food

- Others

- Animal Nutrition

- Pharmaceuticals

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Lignans Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 472.62 million |

|

Market Size Value in 2025 |

USD 503.72 million |

|

Revenue Forecast in 2034 |

USD 912.90 million |

|

CAGR |

6.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The lignans market size was valued at USD 472.62 million in 2024

The market is projected to grow at a CAGR of 6.8% from 2025 to 2034

North America had the largest share of the market.

The key players in the market are Bio-Botanica Inc.; BioGin Biochemicals; Biosynth; FarmaSino Pharmaceuticals; Hebei Xinqidian Biotechnology; Kingherbs Ltd.; Naturalin Bio-Resources Co.; Plamed Green Science Group.; Prairie Tide Diversified Inc.; Shaanxi Zebrago Industrial; SPI Pharma; TSKG Products LLC.; and Xi'an Sinuotebio Tech.

The cereals & grains segment dominated the market in 2024.

The food & beverage segment is projected to dominate the market.