Limestone Market Share, Size, Trends, Industry Analysis Report

By Application (Chemical Lime, Industry Lime, Construction Lime, Refractory Lime); By End-User; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM4056

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

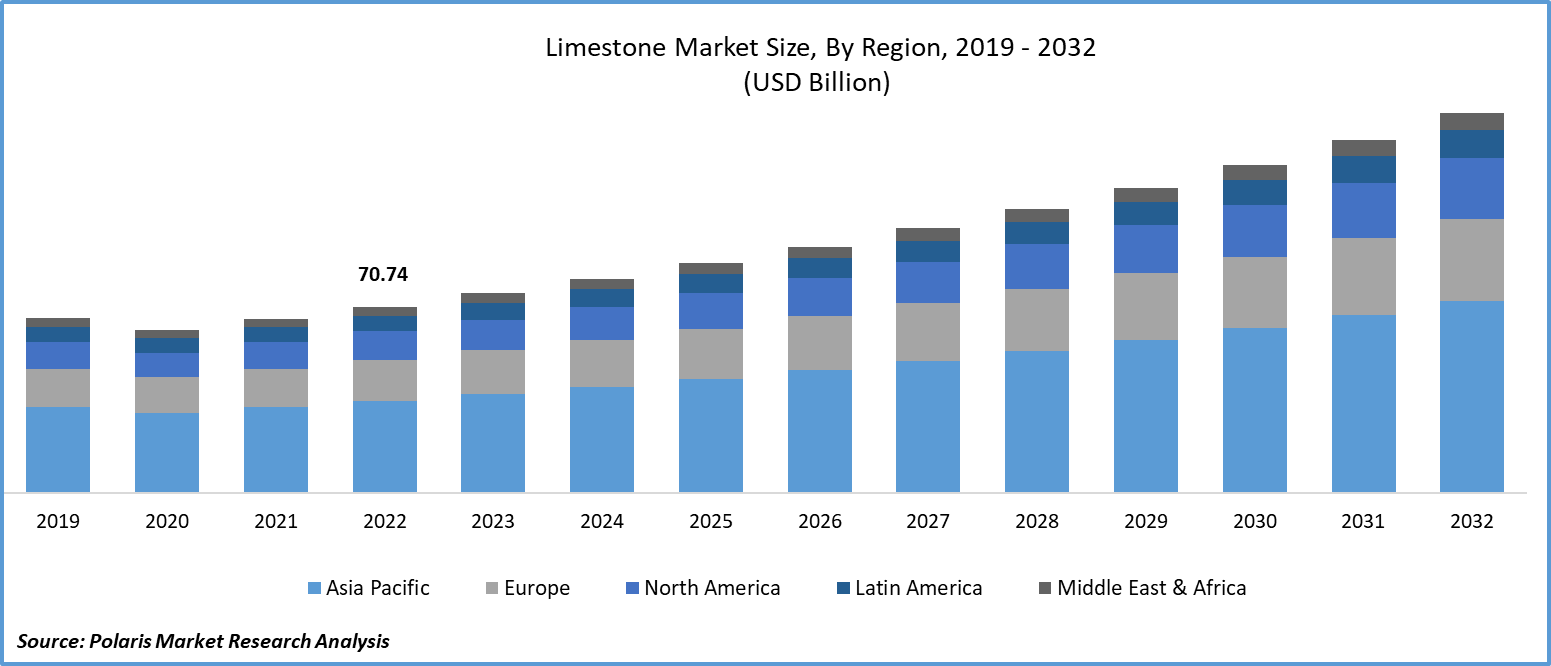

The global limestone market was valued at USD 75.79 billion in 2023 and is expected to grow at a CAGR of 7.4% during the forecast period.

Limestone, a versatile sedimentary rock, has become an integral component in various industries worldwide. Its wide range of applications, from construction to agriculture, paints a vibrant picture of its market growth.

The limestone market is poised for sustained growth, driven by the expansion of industries such as construction, agriculture, and chemicals. While environmental concerns and market price volatility pose challenges, innovation and sustainable practices hold the key to overcoming these restraints. By leveraging emerging opportunities and embracing responsible practices, stakeholders in the limestone market can continue to thrive in a dynamic global economy.

To Understand More About this Research: Request a Free Sample Report

The construction sector significantly relies on limestone, primarily for its essential role in cement and concrete production. Limestone plays a pivotal role in enhancing the strength, durability, and workability of these construction materials. With the global construction industry's continuous expansion, the demand for limestone is anticipated to grow in tandem.

Limestone is also used in agriculture to adjust soil pH levels. It neutralizes acidic soils, making them more suitable for crop cultivation. This practice is essential for optimizing crop yields, which is crucial in feeding the growing global population. Moreover, limestone serves as a crucial raw material in a range of chemical processes, giving rise to essential compounds like calcium oxide (commonly known as quicklime) and calcium hydroxide. These compounds play pivotal roles in industries spanning metallurgy, water treatment, and pharmaceuticals.

For instance, in February 2023, Heirloom, a company specializing in direct air capture technology, entered a partnership with Leilac, a developer focused on decarbonization technology. This collaboration entails the integration of Leilac's innovative kiln technology into Heirloom's DAC solution.

However, quarrying and mining operations for limestone can have adverse environmental impacts, including habitat destruction and water pollution. Sustainable quarrying practices and stricter environmental regulations are crucial in mitigating these concerns. Furthermore, the cost of limestone is susceptible to variations influenced by factors like transportation expenses, energy price shifts, and geopolitical occurrences. Such fluctuations can present challenges for both producers and consumers when it comes to strategic planning and budgeting.

Growth Drivers

Increasing Population Growth and Food Security is Projected to Spur the Product Demand

The increasing global population necessitates higher agricultural productivity. As a result, the demand for limestone in agriculture is expected to rise, especially in regions aiming to enhance food security. Moreover, rapid urbanization and the need for modern infrastructure are primary drivers of the limestone market.

Rapid urban expansion is fueling heightened demand for construction materials like cement and concrete, particularly in emerging economies. Simultaneously, the growth of diverse industries, including manufacturing, steel production, and chemicals, hinges significantly on the abundant supply of limestone. As these sectors continue to expand, so does the need for this indispensable raw material.

Report Segmentation

The market is primarily segmented based on application, end-user, and region.

|

By Application |

By End-User |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Application Analysis

Industry Lime Segment is Expected to Witness Highest Growth During Forecast Period

The industry lime segment is projected to grow at a CAGR during the projected period. The lime segment within the limestone market has experienced robust growth in recent years. This surge can be attributed to the versatile applications of lime across various industries. Lime, derived from limestone, undergoes a calcination process, resulting in quicklime and hydrated lime, both of which find extensive use in different sectors.

In the construction industry, lime is a vital component in mortar and plaster formulations, contributing to enhanced workability, durability, and resilience of structures. Its effectiveness in soil stabilization and asphalt modification further solidifies its position in the construction sector. Moreover, lime's pivotal role in water treatment and purification processes is driving demand within the environmental sector. Its alkaline properties neutralize acidity and aid in the removal of contaminants, ensuring cleaner water supplies.

In agriculture, lime is indispensable for adjusting soil pH levels, optimizing conditions for plant growth and maximizing crop yields. This crucial role in enhancing agricultural productivity has propelled the lime segment's growth. As industries increasingly recognize the value of lime in diverse applications, including metallurgy, chemical manufacturing, and waste management, the lime segment within the limestone market is expected to continue its upward trajectory, presenting significant opportunities for stakeholders in the lime production and supply chain..

By End-User Analysis

Construction Segment Accounted for the Largest Market Share in 2022

The construction segment in the limestone market has witnessed substantial growth in recent years, reflecting the indispensable role of limestone in the building and infrastructure sectors. Limestone, a fundamental ingredient in cement and concrete production, plays a crucial role in ensuring the strength, longevity, and ease of use of construction materials. With urbanization gaining momentum on a global scale, there is a surging need for fresh residential properties, commercial establishments, and infrastructure ventures. The versatility of limestone extends beyond traditional applications, with its use in architectural elements, such as cladding, flooring, and decorative features, gaining prominence.

Furthermore, the sustainable qualities of limestone contribute to its popularity in modern construction practices. Its abundance, recyclability, and energy-efficient production processes align with the industry's growing emphasis on eco-friendly building materials. Additionally, limestone's role in sustainable construction practices, particularly in green building certifications, positions it as a favored material choice. Its use in LEED (Leadership in Energy and Environmental Design) certified projects, for instance, underscores its significance in the construction segment's growth.

Overall, with the construction industry poised for continual expansion, driven by urbanization and infrastructure development, the demand for limestone is set to remain robust, affirming its pivotal role in shaping the built environment.

Regional Insights

Asia Pacific Region Dominated the Global Market in 2022

The Asia Pacific region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. The growth of the segment market can be largely attributed due to rapid urbanization, infrastructure development, and increasing industrialization. Countries within this region have shown substantial demand for limestone across various sectors.

China, as the world's largest consumer and producer of cement, stands at the forefront of this growth. The country's colossal construction activities, driven by ambitious urbanization projects and massive infrastructure investments, have fueled a significant surge in limestone consumption. India follows closely, with its burgeoning construction industry and expanding manufacturing sector, both of which heavily rely on limestone.

Countries in Southeast Asia, including Indonesia, Vietnam, and Thailand, have witnessed substantial expansion in their construction and manufacturing industries. The surge in limestone demand within these nations can be chiefly attributed to the ongoing infrastructure development, housing initiatives, and the continuous growth of industrial activities.

Moreover, Japan and South Korea exhibit a consistent demand for limestone in steel production and manufacturing processes. These advanced economies continue to drive the market through their sophisticated industrial bases. Thus, the Asia-Pacific region, encompassing these dynamic economies, stands as a critical player in the global limestone market. The growth trajectory in this region is poised to continue, as urbanization and industrialization efforts persist, creating sustained demand for limestone across its diverse applications.

North America has witnessed steady growth in its limestone market due to various factors. The U.S. as a major player, has a robust demand for limestone driven by its flourishing construction, manufacturing, and agriculture sectors. Canada also contributes significantly to the market, with a burgeoning construction industry and a growing emphasis on sustainable building materials. Mexico's construction and industrial sectors continue to drive limestone demand in the region. Additionally, the adoption of limestone in environmental applications, such as water treatment, further fuels market growth across North American countries.

Key Market Players & Competitive Insights

The limestone market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Adelaide Brighton Ltd.

- Buechel Stone Corp.

- Carmeuse Group S.A.

- CRH plc

- Graymont Limited

- HeidelbergCement AG

- Independent Limestone Company, LLC

- Lhoist Group

- Mississippi Lime Company

- Mitsubishi Materials Corporation

- NALC LLC

- Nittetsu Mining Co., Ltd.

- Sumitomo Osaka Cement Co., Ltd.

- United States Lime & Minerals, Inc.

- Vulcan Materials Company

Recent Developments

- In June 2023, Ecocem, headquartered in Ireland, joined forces with CB Green to establish a collaborative venture aimed at ramping up the production of cement with a remarkable 70% reduction in CO2 emissions. This groundbreaking achievement is made possible through the utilization of Ecocem's advanced ACT technology.

Limestone Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 81.24 billion |

|

Revenue forecast in 2032 |

USD 143.97 billion |

|

CAGR |

7.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Application, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |