Liquid Biopsy for Early Cancer Detection and Monitoring Market Size, Share, Trends, Industry Analysis Report

By Biomarker [Circulating Tumor DNA (ctDNA), Circulating Tumor Cells (CTCs)], By Cancer, By Technology, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6201

- Base Year: 2024

- Historical Data: 2020-2023

Overview

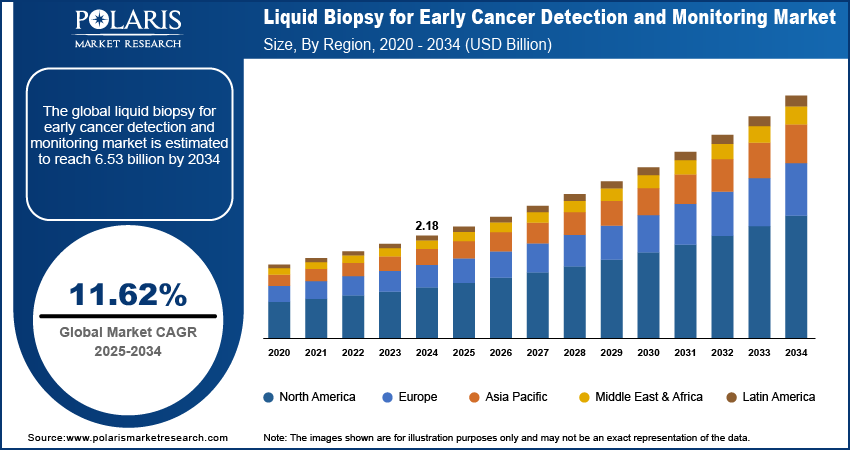

The global liquid biopsy for early cancer detection and monitoring market size was valued at USD 2.18 billion in 2024, growing at a CAGR of 11.62% from 2025 to 2034. Key factors driving demand for liquid biopsy for early cancer detection and monitoring include the rising prevalence of cancer globally, expanding healthcare spending, and ongoing clinical trial.

Key Insights

- The circulating tumor DNA (ctDNA) segment held 32.31% of the revenue share in 2024 due to its broad applicability across cancer types such as lung cancer, breast cancer, and others.

- The lung cancer segment accounted for a major revenue share in 2024 due to the need for early detection.

- North America accounted for 37.15% of global revenue share in 2024, owing to the high prevalence of cancer.

- The U.S. held the largest revenue share in the North America liquid biopsy for early cancer detection and monitoring landscape in 2024, due to advancements in genomic technologies.

- The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to expanding healthcare infrastructure.

Industry Dynamics

- The expanding healthcare spending is driving the demand for liquid biopsy by making it more affordable and widely available.

- The ongoing clinical trials are boosting the demand for liquid biopsy by demonstrating its accuracy in detecting early-stage cancers.

- The limited sensitivity in detecting low levels of tumor-derived material is projected to hinder market growth.

- The rising focus on precision oncology is creating a lucrative market opportunity.

Market Statistics

- 2024 Market Size: USD 2.18 Billion

- 2034 Projected Market Size: USD 6.53 Billion

- CAGR (2025–2034): 11.62%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Liquid Biopsy for Early Cancer Detection and Monitoring Market

- AI tools are used to interpret high-dimensional sequencing data to identify subtle ctDNA signals, mutation patterns, cfDNA fragmentation profiles, and tumor-specific signatures that traditional methods can miss.

- Integration of AI systems helps in early detection, therapeutic monitoring, and precision oncology.

- AI-powered algorithms help analyze circulating tumor DNA (ctDNA), cell-free DNA (cfDNA), and RNA fragments to detect cancer-related genetic and epigenetic alterations.

- AI tools automate analysis, expedite result reporting, and reduce manual labor.

Liquid biopsy is a noninvasive diagnostic tool that detects cancer-related biomarkers in bodily fluids for early cancer detection and monitoring. Liquid biopsy offers a safer, faster, and less painful alternative, enabling repeated testing to monitor disease progression, treatment response, and recurrence. Liquid biopsies are particularly valuable for identifying cancers at early stages when they are most treatable. Liquid biopsy leverages advanced genomic sequencing and bioinformatics to analyze cancer-specific alterations, such as mutations, copy number variations, or DNA methylation patterns. The minimally invasive nature of liquid biopsy makes it ideal for patients who are ineligible for surgical biopsies or require frequent monitoring, such as those undergoing immunotherapy or chemotherapy.

Liquid biopsies are revolutionizing oncology by enabling personalized medicine, where treatments are tailored based on real-time molecular profiles of tumors. They also help overcome tumor heterogeneity, as they capture genetic material from multiple metastatic sites, providing a comprehensive picture of the disease. Challenges remain in the market, including limited sensitivity to detect low levels of ctDNA in early-stage cancers and standardizing protocols across laboratories. Liquid biopsies represent a transformative shift in cancer care by offering hope for earlier diagnoses, better outcomes, and reduced treatment costs.

The global liquid biopsy for early cancer detection and monitoring market demand is driven by the rising prevalence of cancer globally. The World Health Organization (WHO), in its report, predicted that over 35 million new cancer cases may occur by 2050. This is driving healthcare systems to adopt the liquid biopsy technique to diagnose tumors early, as it offers a less painful and quicker alternative to traditional tissue biopsies. Moreover, the ability of liquid biopsy to detect cancer biomarkers in blood with minimal risk and discomfort is encouraging patients and clinicians to adopt the liquid biopsy test to treat growing cases of cancer. Therefore, the increasing prevalence of cancer globally is propelling the demand for liquid biopsy for early cancer detection.

Drivers & Opportunities

Expanding Healthcare Spending: Governments and private insurers are allocating more funds to early cancer detection programs, making liquid biopsies more affordable and widely available. Hospitals and clinics are also adopting these tests as rising budgets enable them to invest in precision medicine and noninvasive diagnostic solutions. Growing healthcare spending is further supporting research and development, leading to more accurate and cost-effective liquid biopsy tests. The American Medical Association, in its report, stated that health spending in the U.S. increased by 7.5% to reach $4.9 trillion, or $14,570 per capita, in 2023 from 2022. Additionally, increasing funding for oncology initiatives is boosting reimbursement policies, further encouraging the use of liquid biopsies for early detection and ongoing monitoring.

Ongoing Clinical Trial: Ongoing clinical trials are fueling the demand for liquid biopsy by demonstrating its accuracy and clinical utility in detecting early-stage cancers and monitoring treatment response. Researchers are continuously validating new biomarkers and refining testing methods, increasing confidence among oncologists and patients in liquid biopsy as a reliable diagnostic tool. Positive trial results are further encouraging regulatory approvals, expanding the use of liquid biopsies in standard care protocols. Pharmaceutical companies and biotech firms are investing more in liquid biopsy development as trials are proving its potential for personalized therapy selection and minimal residual disease detection. Additionally, patient participation in trials is raising awareness, leading to greater acceptance and demand for noninvasive cancer screening options.

Segmental Insights

Biomarker Analysis

Based on biomarker, the segmentation includes circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), exosomes/microvesicles, and circulating proteins. The circulating tumor DNA (ctDNA) segment held 32.31% of the revenue share in 2024 due to its high sensitivity, broad applicability across cancer types, and ability to detect minimal residual disease and tumor heterogeneity. Clinicians increasingly adopted ctDNA-based assays as they provide real-time insights into tumor dynamics without requiring invasive tissue biopsies. The growing integration of next-generation sequencing (NGS) technologies further strengthened ctDNA's dominance by enabling comprehensive genomic profiling, which supports personalized treatment strategies. Additionally, pharmaceutical companies actively utilized ctDNA in clinical trials for patient stratification and therapy response monitoring, which expanded its use in research and clinical laboratories.

The exosomes/microvesicles segment is projected to grow at a robust pace in the coming years, owing to its potential to deliver multi-analyte information, including nucleic acids, proteins, and lipids, from viable tumor cells. Exosomes reflect active tumor communication and are increasingly recognized for their role in early-stage cancer detection. Advances in exosome isolation and characterization techniques have made these biomarkers more clinically relevant. Moreover, researchers value exosomes for their stability in bodily fluids and their ability to carry diverse molecular signatures, which enhances their utility in monitoring and noninvasive cancer diagnostics.

Cancer Analysis

In terms of cancer, the segmentation includes lung cancer, breast cancer, colorectal cancer, prostate cancer, and others. The lung cancer segment accounted for a major revenue share in 2024 due to the high incidence of the disease, the need for early detection, and the limitations of traditional diagnostic methods such as tissue biopsy and imaging. Physicians increasingly relied on liquid biopsy for lung cancer as it enables noninvasive, repeatable monitoring of tumor mutations, particularly in non-small cell lung cancer (NSCLC), which represents the majority of lung cancer cases. Additionally, regulatory approvals for companion diagnostics, such as those for EGFR mutation detection, have further validated the clinical utility of liquid biopsy in lung cancer management.

The breast cancer segment is expected to grow at a rapid pace during the forecast period owing to the growing awareness, rising screening rates, and the need for minimally invasive tools to detect recurrence and monitor treatment response. Researchers and oncologists are increasingly recognizing the value of liquid biopsy in capturing tumor heterogeneity and monitoring dynamic changes, especially in hormone receptor-positive and HER2-positive subtypes. Furthermore, strong investments in clinical trials and biomarker discovery for breast cancer continue to expand the use of liquid biopsies in both early detection and therapeutic decision-making.

Technology Analysis

In terms of technology, the segmentation includes next-generation sequencing (NGS), PCR-based assays, microarray, epigenomics/methylation assays, and others. The next-generation sequencing (NGS) segment dominated the revenue share in 2024 due to its capability to analyze multiple genetic alterations simultaneously with high sensitivity and specificity. Oncologists and researchers favored NGS-based liquid biopsy platforms for their ability to detect a broad spectrum of mutations, including single nucleotide variants, insertions/deletions, gene fusions, and copy number alterations across various cancer types. The rapid decline in sequencing costs, along with advancements in bioinformatics tools, made NGS more accessible for clinical applications. Additionally, major companies developed NGS panels tailored for early cancer detection, enabling comprehensive tumor profiling from a simple blood sample, which further accelerated adoption.

The epigenomics/methylation assays segment is estimated to grow at a robust pace during the assessment period owing to its growing potential in detecting early-stage cancers that lack identifiable genetic mutations. These assays also offer superior sensitivity for detecting tumor-derived DNA fragments by analyzing cancer-associated epigenetic changes. Companies are investing heavily in developing blood-based methylation assays capable of identifying multiple cancer types from a single test, fueling commercial interest and clinical integration, leading to segment growth.

End Use Analysis

In terms of end use, the segmentation includes hospitals, diagnostic laboratories, and others. The diagnostic laboratories segment is projected to grow at a robust pace in the coming years. These laboratories offer specialized expertise, cost-effective testing solutions, and shorter turnaround times, making them attractive for both physicians and patients. Independent labs and reference laboratories continue to expand their liquid biopsy test menus and collaborate with biotech firms to deliver multi-cancer early detection solutions. Furthermore, the rise of decentralized testing models, including direct-to-consumer and telehealth-integrated services, is projected to support the growing role of diagnostic labs in enabling early cancer detection at scale.

Regional Analysis

The North America liquid biopsy for early cancer detection and monitoring market accounted for 37.15% of revenue share in 2024. This dominance is attributed to the high prevalence of cancer, increasing adoption of noninvasive diagnostic techniques, and strong healthcare infrastructure. The region also benefited from high investments in precision medicine and oncology research, along with supportive regulatory frameworks from agencies such as the FDA. Additionally, rising awareness about early cancer detection, the growing burden of late-stage cancer diagnoses, and the presence of key players accelerated innovation in the market, which contributed to North America dominance.

U.S. Liquid Biopsy for Early Cancer Detection and Monitoring Market Insights

The U.S. held the largest revenue share in the North America liquid biopsy for early cancer detection and monitoring landscape in 2024, due to the increasing prevalence of cancer, advancements in genomic technologies, and a shift toward personalized medicine. The FDA’s approvals of liquid biopsy tests, such as those for detecting circulating tumor DNA (ctDNA), have propelled adoption. The presence of major biotech and pharmaceutical companies, along with significant funding for cancer research, supported market expansion. Additionally, the emphasis on value-based care and early intervention to reduce treatment costs drove the demand for liquid biopsies in oncology.

Europe Liquid Biopsy for Early Cancer Detection and Monitoring Market Trends

The market in Europe is projected to hold a substantial revenue share in 2034 due to rising cancer cases, government initiatives supporting early detection, and increasing research collaborations. The European Medicines Agency (EMA) and national health systems are promoting the integration of liquid biopsies into clinical practice. Countries such as the UK, France, and Spain are investing in precision oncology programs, while the EU’s Horizon Europe funding supports innovation in cancer diagnostics, leading to market growth. The demand for liquid biopsy in Europe is also driven by the need for less invasive, real-time monitoring solutions for cancer patients undergoing treatment.

Germany Liquid Biopsy for Early Cancer Detection and Monitoring Market Overview

The demand for liquid biopsy for early cancer detection and monitoring in Germany is being driven by its strong healthcare system, strong oncology research landscape, and high cancer incidence rates. The country’s focus on innovative diagnostic technologies and early cancer detection programs is supporting the adoption of liquid biopsy. German research institutions and biotech firms are actively developing and commercializing liquid biopsy tests, with increasing collaborations between academia and industry. Additionally, favorable reimbursement policies and government support for precision medicine are contributing to market growth.

Asia Pacific Liquid Biopsy for Early Cancer Detection and Monitoring Market Assessment

The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to increasing cancer prevalence, improving healthcare infrastructure, and rising awareness about early detection. Countries such as China, Japan, and India are investing heavily in genomic research and precision oncology, driving market growth. The large patient pool, growing medical tourism, and government initiatives in the region to enhance cancer care are driving liquid biopsy adoption. Additionally, the expansion of biotech companies and partnerships with global players is fueling the availability and affordability of liquid biopsy tests in the region.

Key Players & Competitive Analysis

The liquid biopsy market for early cancer detection and monitoring is highly competitive, with key players leveraging advanced genomic and proteomic technologies to improve sensitivity and specificity. Companies such as Illumina lead the way with multi-cancer early detection (MCED) tests, including Galleri, which simultaneously screens for multiple cancers using next-generation sequencing (NGS). Similarly, Guardant Health focuses on Guardant Reveal and LUNAR assays, combining circulating tumor DNA (ctDNA) and methylation profiling for early detection and recurrence monitoring. Exact Sciences, known for Cologuard, is expanding into liquid biopsies with its cancerguard test, which integrates methylation and protein biomarkers.

The competition is intensifying as companies strive for FDA approvals, partnerships with healthcare systems, and cost-effective solutions. Challenges include achieving high specificity to minimize false positives and demonstrating clinical utility for reimbursement purposes. The market is poised for rapid growth, with leaders differentiating through proprietary algorithms, large clinical validation studies, and global commercialization strategies.

A few major companies operating in the liquid biopsy for early cancer detection and monitoring industry include AnchorDx; Burning Rock Biotech Limited; Elypta AB; Exact Sciences Corporation; Freenome Holdings, Inc.; GENECAST; Illumina, Inc.; Guardant Health; Lucence Health Inc.; Myriad Genetics, Inc.; and Oncimmune.

Key Players

- AnchorDx

- Burning Rock Biotech Limited

- Elypta AB

- Exact Sciences Corporation

- Freenome Holdings, Inc.

- GENECAST

- Guardant Health

- Illumina, Inc.

- Lucence Health Inc.

- Myriad Genetics, Inc.

- M42

- Oncimmune

Liquid Biopsy for Early Cancer Detection and Monitoring Industry Developments

In June 2025, M42 announced a strategic collaboration with AstraZeneca and SOPHiA GENETICS to launch liquid biopsy testing in the UAE, aiming to advance cancer diagnosis and inform treatment decisions.

In January 2025, Guardant Health received Medicare coverage for its liquid biopsy test to monitor cancer disease recurrence in colorectal cancer patients.

Liquid Biopsy for Early Cancer Detection and Monitoring Market Segmentation

By Biomarker Outlook (Revenue, USD Billion, 2020–2034)

- Circulating Tumor DNA (ctDNA)

- Circulating Tumor Cells (CTCs)

- Exosomes/Microvesicles

- Circulating Proteins

By Cancer Outlook (Revenue, USD Billion, 2020–2034)

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Prostate Cancer

- Others

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Next-Generation Sequencing (NGS)

- PCR-Based assays

- Microarray

- Epigenomics/Methylation assays

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Diagnostic Laboratories

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Liquid Biopsy for Early Cancer Detection and Monitoring Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.18 Billion |

|

Market Size in 2025 |

USD 2.43 Billion |

|

Revenue Forecast by 2034 |

USD 6.53 Billion |

|

CAGR |

11.62% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.18 billion in 2024 and is projected to grow to USD 6.53 billion by 2034.

The global market is projected to register a CAGR of 11.62% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are AnchorDx; Burning Rock Biotech Limited; Elypta AB; Exact Sciences Corporation; Freenome Holdings, Inc.; GENECAST; Illumina, Inc.; Guardant Health; Lucence Health Inc.; Myriad Genetics, Inc.; and Oncimmune.

The circulating tumor DNA (ctDNA) segment dominated the market revenue share in 2024.

The diagnostic laboratories segment is projected to witness the fastest growth during the forecast period.