Liquid Ring Vacuum Pumps Market Share, Size, Trends, Industry Analysis Report

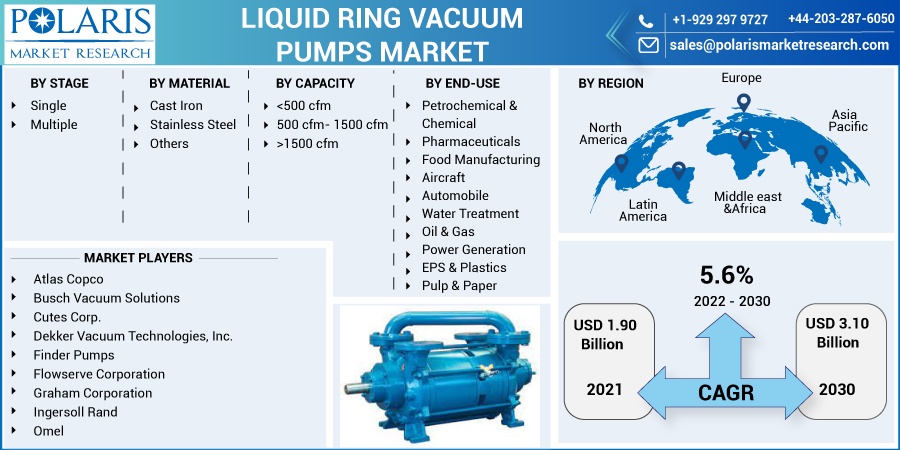

By Stage (Single, Multiple); By Material (Cast Iron, Stainless Steel, Others); By Capacity; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 113

- Format: PDF

- Report ID: PM2265

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

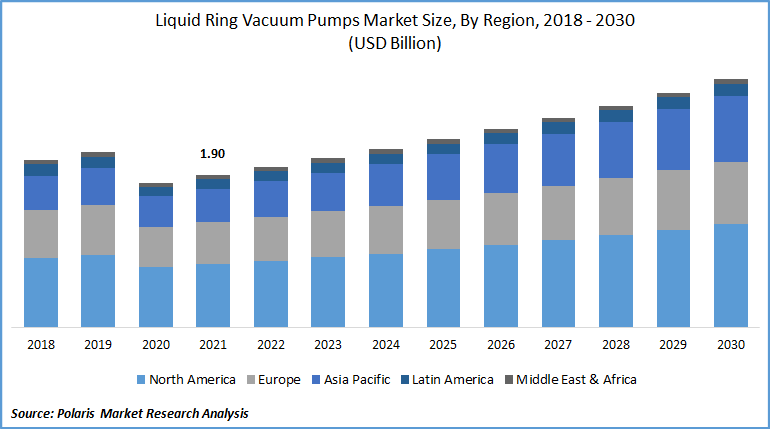

The global liquid ring vacuum pumps market was valued at USD 1.90 billion in 2021 and is expected to grow at a CAGR of 5.6% during the forecast period. The key factors such as the growing application in the chemical industry, rising demand for the market from various industries, and low maintenance and operation cost, boost market growth over the forecast period.

Know more about this report: request for sample pages

They are used to remove gas and air molecules from a process in various sectors and applications, including food and beverage, semiconductor and electronics, pulp and paper, medical, plastics, and woodworking, are some examples. Pick and place machines, component drying, bottle filling, bottle holding, and lifting are all examples of liquid ring vacuum pump applications. Moreover, most chemical process industries use these pumps compressors, especially those that require solvent recovery and vapor recovery. Furthermore, these pumps are required for specialized applications such as hydrogen compression, ViCl2 monomer recovery, and so on.

It is being predicted to develop due to the improving worldwide outlook for the chemical sector, primarily ascribed to solid growth from end-user clients, particularly from Asian countries. Another essential element fueling revenue for the liquid ring vacuum pumps market is worldwide bioethanol and biodiesel. To its high-intensity content and ability to minimize greenhouse emissions, governments in various countries are shifting toward ethanol production.

However, adherence to strict law is the factor that challenges the industry growth over the forecast period. The global liquid ring vacuum pumps market is likely to be restrained due to the high initial cost and the shift towards hybrid technologies. Depending on the capacity, power, kind of material, and safety measures required in the sector, the initial installation cost of a liquid ring vacuum pump is quite high. A liquid ring machine or compressor can cost anywhere from USD 1,000 to 50,000, with the more expensive pumps and compressors being utilized for specialized applications. As a result, rather than using a single high-power, high-capacity liquid ring machine, most organizations employ a combination of devices.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

In the last few decades, the market has witnessed extensive developments supported by various factors such as increased energy consumption and rising demand from general process industries. For instance, according to the International Energy Agency (IEA), the share of energy consumption by various sectors in 2019 includes coal sector contributes 9.5%, oil sector contributes 40.4%, natural gas (16.4%), biofuels, and waste (10.4%), electricity (19.7%), and others sector contributes 3.6% to the energy consumption. Thus, the increase in energy consumption has led to an increase in the demand for liquid ring machines, which is driving the industry's growth.

Further, process businesses, especially textiles, pulp & paper, sugar processing, pharmaceuticals, and food & beverage, have increased demand for liquid ring machines and compressors, resulting in increased output. Increasing demand for energy-efficient industrial operations in developed countries is predicted to drive up spending on pumping equipment, resulting in increased demand for liquid ring vacuum pumps market.

A major element driving sales of liquid ring machines is growing demand from SMEs, particularly in developing economies such as India and China. However, the sugar, paper & pulp, chemical process sectors, and pumps with capacities less than 1000 cm are expected to account for a major portion of this demand.

Report Segmentation

The market is primarily segmented based on stage, material, capacity, end-use, and region.

|

By Stage |

By Material |

By Capacity |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Material

Based on the material type segment, the stainless-steel segment is expected to be the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance in the foreseen period. Stainless steel liquid ring machines are utilized in various industries, including pharmaceuticals, food production, oil and gas, and power generation. This market is expanding owing to stainless steel's superior cavitation resistance, which extends the life of liquid ring vacuum pumps.

Geographic Overview

In terms of geography, North America had the highest share in 2021. Due to continuous expansion in oil-producing countries such as the Middle East and North America, this rise can be attributed to the oil and gas sectors. Water and wastewater treatment plants in the region are growing their need for liquid ring vacuum pumps.

In April 2021, Aguas de Manizales, a Colombian water provider that serves the capital of the Caldas department, has announced a 137-billion-peso (US$38 million) tender to develop and operate a new wastewater treatment plant in the city's Los Cámbulos area. The project comprises the construction of a plant capable of treating an average of 320l/s when it begins operations in 2022, increasing to 520l/s by 2034. Food and beverage, chemical processing, and pharmaceutical industries also boost demand for the market in the region.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market in 2021. The simple availability of raw materials and manpower at low rates tempt investors to build up production facilities in the region. Due to low production costs and local government backing, industrial activity increases in this region. In addition, the market for liquid ring vacuum pumps in the Asia Pacific is being driven by increased investments in research & development activities.

Competitive Insight

Some of the major players operating in the global market include Atlas Copco, Busch Vacuum Solutions, Cutes Corp., Dekker Vacuum Technologies, Inc., Finder Pumps, Flowserve Corporation, Graham Corporation, Ingersoll Rand, Omel, PPI Pumps Samson Pumps, Speck, Tsurumi Manufacturing Co., Ltd., Vooner, and Zibo Zhaohan Vacuum Pump Co., Ltd.

Liquid Ring Vacuum Pumps Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.90 billion |

|

Revenue forecast in 2030 |

USD 3.10 billion |

|

CAGR |

5.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Stage, By Material, By Capacity, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Atlas Copco, Busch Vacuum Solutions, Cutes Corp., Dekker Vacuum Technologies, Inc., Finder Pumps, Flowserve Corporation, Graham Corporation, Ingersoll Rand, Omel, PPI Pumps Samson Pumps, Speck, Tsurumi Manufacturing Co., Ltd., Vooner, and Zibo Zhaohan Vacuum Pump Co., Ltd. |