Location-Based Services Market Size, Share, Trends, Industry Analysis Report

By Component (Hardware, Software, Services), By Location Type, By Technology, By Application, By Vertical, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6186

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

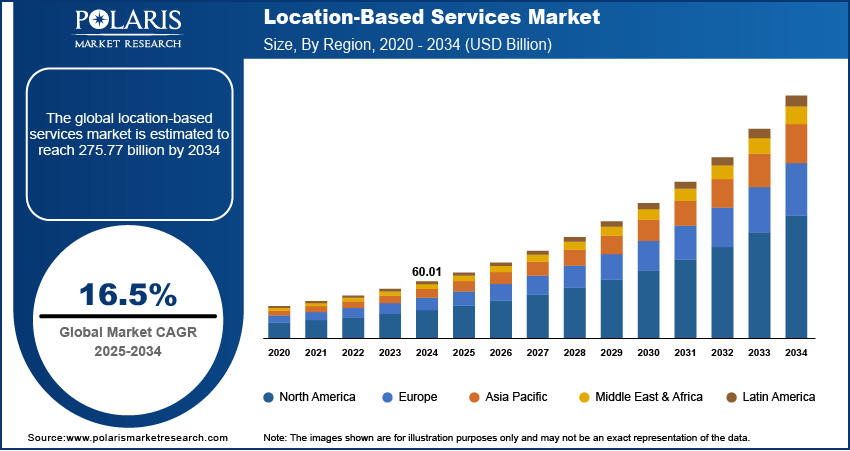

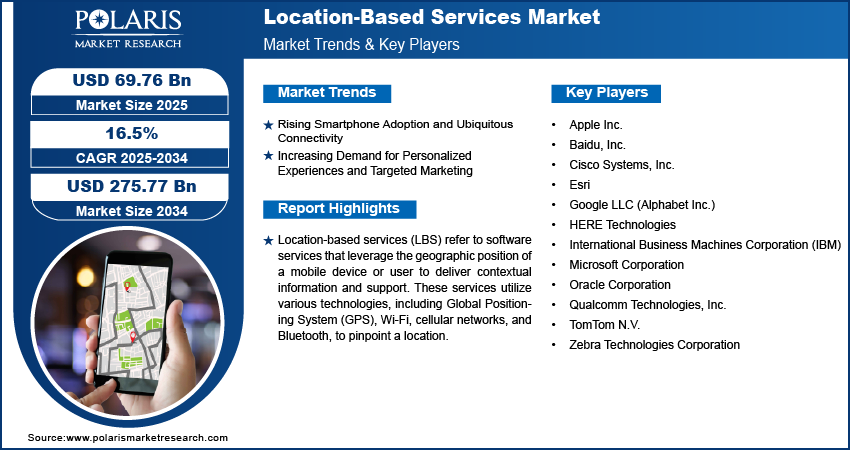

The global location-based services (LBS) market size was valued at USD 60.01 billion in 2024 and is anticipated to register a CAGR of 16.5% from 2025 to 2034. The industry is driven by the widespread adoption of smartphones and other mobile devices with built-in GPS capabilities. The increasing demand for personalized consumer experiences and targeted marketing fuels its growth.

Key Insights

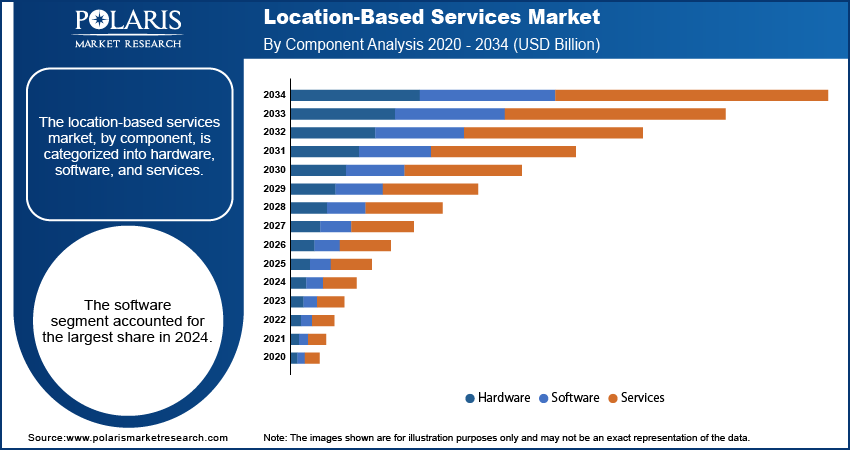

- By component, the software segment held the largest share in 2024 due to its critical role in enabling and delivering a wide range of LBS functionalities, including mapping, navigation, and location-aware analytics, with value shifting from hardware to intelligent processing.

- Based on location type, the outdoor segment held the largest share in 2024, primarily driven by the mature and widespread adoption of GPS technology. This includes essential applications such as personal navigation, ride-sharing, and logistics.

- In terms of technology, the Global Positioning System (GPS) technology segment held the largest share in 2024, as it serves as the foundational technology for the majority of outdoor location-based services worldwide.

- By application, the mapping and navigation segment held the largest share in 2024 as it addresses a fundamental consumer and business need for efficient travel and directional guidance.

- By vertical, the transportation and logistics segment held the largest share in 2024. This is attributed to the extensive reliance on LBS for critical operations such as real-time fleet tracking, route optimization, supply chain management, and asset monitoring.

Industry Dynamics

- The widespread use of smartphones and other mobile devices with GPS capabilities is a major factor. These devices provide the foundation for many location-aware applications, including location-based entertainment, enabling features like navigation, real-time tracking, and proximity-based services. This broad access to technology expands the user base for these services.

- The increasing demand for personalized consumer experiences and targeted marketing significantly drives the industry growth. Businesses are leveraging location data to deliver relevant offers and information to customers based on their current location, leading to more effective advertising campaigns and improved customer engagement.

- The growing integration of these services across various industries, such as transportation, logistics, and retail, is also a key driver. Companies use location intelligence to optimize routes, manage fleets, track assets, and enhance supply chain efficiency, which improves operations and decision-making.

Market Statistics

- 2024 Market Size: USD 60.01 billion

- 2034 Projected Market Size: USD 275.77 billion

- CAGR (2025–2034): 16.5%

- North America: Largest market in 2024

Location-based services (LBS) are software services that determine the geographic position of a mobile device to provide users with location-relevant information and support. These services leverage various technologies such as GPS, cellular networks, and Wi-Fi to offer features such as navigation, local search, and tracking capabilities. They enhance user experience by delivering personalized and context-aware content.

The growth of indoor positioning systems and the rise in mobile data usage contribute significantly to the evolution and expansion of location-based services. The increasing mobile data usage plays a notable role in the development. As mobile networks become faster and more accessible, users can more easily and consistently access location-enabled applications without interruption. The widespread rollout of 5G networks allows for real-time location systems for tracking with minimal delays, which is crucial for applications such as ride-sharing services and instant delivery platforms. This improved connectivity directly supports the functionality and reliability of location-based services, making them more appealing and useful for a broader range of applications.

Drivers and Trends

Rising Smartphone Adoption and Ubiquitous Connectivity: The widespread global adoption of smartphones and other mobile devices equipped with GPS capabilities has fundamentally driven the demand for location-based services. These devices act as the primary platform for a vast array of LBS applications, from simple navigation to complex real-time tracking and personalized advertising. The increasing penetration of these smart devices means that a larger portion of the population has access to and is accustomed to using location-aware features in their daily lives.

Supporting this, a 2022 study titled "Youth Perspectives on the Recommended Age of Mobile Phone Adoption: Survey Study" published in the National Center for Biotechnology Information (NCBI) highlighted that over 95% of teens aged 13 to 17 years had access to a cell phone, indicating a high level of mobile device penetration. This widespread availability of GPS-enabled devices directly fuels the demand for and utilization of location-based services, as it creates a large user base ready to engage with location-centric applications. This continuous increase in smartphone penetration and mobile connectivity globally significantly drives the expansion.

Increasing Demand for Personalized Experiences and Targeted Marketing: Consumers and businesses are increasingly seeking services that cater to their immediate needs and preferences, often based on their current location. Businesses, in turn, are leveraging location data to deliver highly relevant promotions, information, and services, which leads to improved customer engagement and more effective outreach.

The integration of geographic data with public health records has shown significant potential in delivering personalized health interventions and tracking disease outbreaks. A 2025 article titled "Location Intelligence in Healthcare: Driving Innovation & Transformation" noted that during the COVID-19 pandemic, integrating geographic data with health records enabled public health officials to swiftly identify hotspots and allocate resources effectively, and that such integration could potentially reduce the spread of infectious diseases by 20% through timely interventions, as suggested by studies featured on PubMed. This illustrates how the ability to tailor services based on location, whether for commercial or public benefit, acts as a powerful growth factor. Thus, the growing consumer and business demand for personalized experiences and targeted marketing strategies boost the location-based services market expansion.

Segmental Insights

Component Analysis

Based on component, the segmentation includes hardware, software, and services. The software segment held the largest share in 2024. This dominance stems from the crucial role software plays in enabling and delivering LBS functionalities. It includes a wide range of applications such as mapping and navigation tools, proximity marketing platforms, asset tracking solutions, and location-aware analytics. The value in LBS is increasingly shifting from the underlying hardware to the intelligent software that processes location data, interprets it, and presents it in a usable format for end-users and businesses. Software development also involves constant updates, feature enhancements, and customization to meet diverse industry needs, which contributes to its significant revenue generation. Furthermore, the scalability and versatility of software solutions allow them to be deployed across various devices and platforms, making them central to the entire LBS ecosystem.

The services segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is driven by the increasing demand for specialized expertise in implementing, managing, and optimizing LBS solutions for businesses across diverse industries. Many organizations, especially small and medium-sized enterprises, may lack the in-house capabilities to fully leverage complex location technologies. Consequently, they rely on third-party service providers for everything from system integration and custom application development to data analytics, consulting, and maintenance. The growing trend of outsourcing non-core activities and the need for tailored LBS strategies contribute significantly to the demand for these services. As the adoption of LBS continues to expand into new areas such as smart cities, healthcare, and retail analytics, the need for specialized services to unlock the full potential of these technologies will drive substantial growth in this segment.

Location Type Analysis

Based on location type, the segmentation includes indoor and outdoor. The outdoor segment held the largest share in 2024. This dominance is primarily attributed to the widespread and mature adoption of Global Positioning System (GPS) technology, which is highly effective in outdoor environments. Outdoor LBS encompasses a vast range of applications that are integral to daily life for many people and businesses. This includes navigation and mapping services for vehicles and pedestrians, location-aware advertising when people are out and about, ride-sharing applications, and fleet management for logistics and transportation. The established infrastructure for GPS and cellular networks, which are fundamental for outdoor positioning, has facilitated broad penetration and user familiarity. Furthermore, the extensive use of outdoor LBS in diverse sectors such as automotive, travel, and consumer applications contributes significantly to its leading position in terms of overall revenue and usage.

The indoor segment is anticipated to register the highest growth rate during the forecast period. This rapid growth is driven by the increasing need for precise location information within enclosed spaces where traditional GPS signals are often weak or unavailable. As more activities shift indoors, from shopping in large retail malls to navigating complex hospital buildings or tracking assets in warehouses, the demand for accurate indoor positioning solutions is surging. Technologies such as Wi-Fi, Bluetooth beacons, ultra-wideband (UWB), and magnetic positioning are advancing rapidly to address these indoor challenges. The potential applications for indoor LBS are vast and include personalized in-store navigation, asset tracking in industrial settings, enhanced safety and security in public venues, and more efficient space utilization in offices.

Technology Analysis

Based on technology, the segmentation includes GPS, wi-fi, RFID & NFC, Bluetooth Low Energy (BLE), and others. The GPS segment held the largest share in 2024, as GPS is the foundational technology for most outdoor location services worldwide. Its widespread integration into smartphones, vehicles, and various standalone navigation devices has made it ubiquitous. It offers reliable and accurate positioning in open environments, supporting a vast array of applications from personal navigation and ride-sharing services to logistics, fleet management, and emergency services. The maturity of GPS infrastructure, its global coverage, and its relatively low cost of implementation for basic tracking have cemented its position as the leading technology in the overall LBS ecosystem. Most outdoor location-aware applications depend on GPS data, making it the most significant contributor to revenue and usage.

The Bluetooth Low Energy, or BLE, segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is driven by the increasing demand for precise indoor positioning and proximity-based services. Unlike GPS, BLE thrives in enclosed environments, making it ideal for applications within retail stores, airports, museums, and healthcare facilities. Its low power consumption allows for long battery life in beacons and other devices, making it a cost-effective solution for indoor navigation, asset tracking, and localized marketing. The rising adoption of BLE in smartphones and its ability to integrate with the Internet of Things (IoT) devices fuels its growth. As businesses increasingly seek to enhance customer experiences, optimize operations indoors, and gather granular data on indoor movement, the versatility and efficiency of BLE are driving its accelerated adoption and expansion.

Application Analysis

Based on application, the segmentation includes mapping & navigation, location-based advertising, asset & fleet tracking, social networking & entertainment, and others. The mapping & navigation segment held the largest share in 2024. This dominance is due to the widespread adoption of GPS-enabled devices and the fundamental human need for efficient travel and directional guidance. Mapping and navigation tools are deeply integrated into smartphones, vehicles, and wearable devices, making them indispensable for daily commutes, travel, and logistics operations. Services ranging from turn-by-turn directions to real-time traffic updates and public transit information are used by millions globally. The continuous need for precise geographical information for personal and commercial purposes, coupled with ongoing advancements in mapping data and user interfaces, ensures its leading position. This segment forms the backbone of many other location-dependent applications, reinforcing its substantial contribution.

The asset and fleet tracking application segment is anticipated to register the highest growth rate during the forecast period. The rapid expansion is driven by the increasing need for operational efficiency, security, and cost reduction across a multitude of industries. Businesses are increasingly leveraging LBS to monitor the real-time location of their valuable assets, vehicles, and even personnel. This includes tracking delivery fleets for optimized routing and fuel efficiency, monitoring high-value equipment to prevent loss or theft, and managing field service teams for improved productivity. The growing complexity of global supply chains, the rise of e-commerce necessitating efficient last-mile delivery, and the push for greater accountability in asset management are all contributing factors.

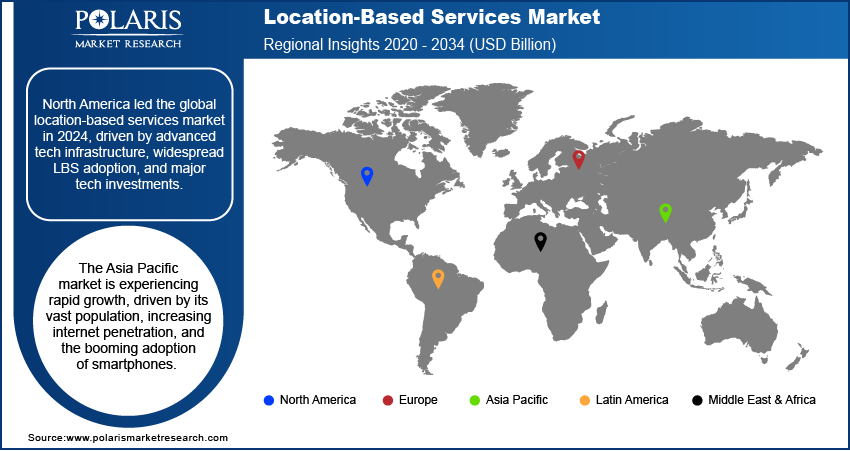

Regional Analysis

The North America Location-Based Services Market accounted for the largest share in 2024, largely driven by its robust technological infrastructure, high consumer adoption of smartphones, and the early integration of LBS across various industries. The region benefits from significant investments in research and development by leading technology companies and a strong ecosystem for innovation in areas such as geospatial technology, IoT, and artificial intelligence. The widespread use of LBS in sectors such as transportation, retail, healthcare, and public safety contributes to its strong position, with a high degree of digital literacy and acceptance of location-aware applications among the population.

U.S. Location-Based Services Market Insights

The U.S. is a primary contributor to North America's dominance in the market. This is driven by its large consumer base, early and rapid adoption of advanced mobile technologies, and a thriving innovation ecosystem. The country sees extensive application of LBS in navigation, ride-sharing, personalized advertising, and various enterprise solutions for logistics and asset tracking. Strong government initiatives and private sector investments in smart city projects and connected infrastructure further bolster the development and deployment of sophisticated LBS technologies across the nation.

Europe Location-Based Services Market Trends

Europe represents a significant and growing region in the market for location-based services, characterized by its advanced technological landscape and increasing adoption across diverse sectors. The region's focus on data privacy and regulations, such as the General Data Protection Regulation (GDPR), shapes the development and deployment of LBS, often leading to more privacy-centric solutions. The mature telecommunications infrastructure and a high level of smartphone penetration provide a strong foundation for the expansion of location-aware applications in both consumer and enterprise segments. Growth is also fueled by smart city initiatives and the demand for efficient transportation and logistics solutions across the region.

In Europe, the Germany Location-Based Services Market stands out as a major contributor. Its strong industrial base and emphasis on Industry 4.0 initiatives drive the adoption of LBS for asset tracking, inventory management, and intelligent manufacturing processes. The country also exhibits a high degree of technological readiness and a significant for automotive and logistics applications, where precise location intelligence is crucial. German companies are actively involved in developing advanced LBS solutions, including indoor positioning systems and real-time location analytics, further solidifying its prominent role in the European landscape.

Asia Pacific Location-Based Services Market Overview

The Asia Pacific market is experiencing rapid growth, driven by its vast population, increasing internet penetration, and the booming adoption of smartphones. Emerging economies in the region are rapidly urbanizing, leading to a surge in demand for navigation, public transport tracking, and location-based social networking. Government initiatives promoting digitalization, smart cities, and e-commerce also play a crucial role in expanding the reach and application of LBS. The region is becoming a hotbed for innovation, with local companies developing tailored solutions to meet specific regional needs and preferences.

China Location-Based Services Market Overview

China is a key player driving the growth of the location based services in Asia Pacific. The country's massive user base, rapid technological advancements, and extensive mobile payment adoption create a fertile ground for LBS. China has seen significant deployment of LBS in various sectors, including ride-hailing, food delivery, mobile advertising, and smart logistics. Government support for digital infrastructure and the emergence of domestic technology giants investing heavily in mapping and positioning technologies further accelerate the expansion and innovation within the country.

Key Players and Competitive Insights

The Location-Based Services Market features a competitive landscape with several major players striving for share and technological advancement. Key entities in this space include technology giants such as Google, Apple, and Microsoft, alongside specialized geospatial and mapping companies such as HERE Technologies and Esri. These players compete on factors such as the accuracy and coverage of their location data, the breadth of their LBS offerings across various applications, the robustness of their developer platforms, and their ability to integrate LBS with other emerging technologies such as artificial intelligence and the Internet of Things (IoT). The competition often revolves around developing more sophisticated indoor positioning capabilities, enhancing real-time location intelligence, and ensuring stringent data privacy and security measures to build user trust.

A few prominent companies in the industry include Google LLC (Alphabet Inc.); Apple Inc.; Microsoft Corporation; HERE Technologies; International Business Machines Corporation (IBM); Cisco Systems, Inc.; Oracle Corporation; Qualcomm Technologies, Inc.; TomTom N.V.; Esri; Zebra Technologies Corporation; and Baidu, Inc.

Key Players

- Apple Inc.

- Baidu, Inc.

- Cisco Systems, Inc.

- Esri

- Google LLC (Alphabet Inc.)

- HERE Technologies

- International Business Machines Corporation (IBM)

- Microsoft Corporation

- Oracle Corporation

- Qualcomm Technologies, Inc.

- TomTom N.V.

- Zebra Technologies Corporation

Location Based Services Industry Developments

July 2025: Google announced significant AI initiatives in India, including localizing Gemini 2.5 Flash for faster, low-latency AI performance, particularly for regulated sectors such as healthcare and finance.

April 2025: ECARX Holdings Inc. announced a strategic partnership with HERE Technologies to co-develop an AI-powered in-vehicle navigation system for global automakers.

Location-Based Services Market Segmentation

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Location Type Outlook (Revenue – USD Billion, 2020–2034)

- Indoor

- Outdoor

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- GPS

- Wi-Fi

- RFID & NFC

- Bluetooth Low Energy (BLE)

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Mapping & Navigation

- Location-Based Advertising

- Asset & Fleet Tracking

- Social Networking & Entertainment

- Others

By Vertical Outlook (Revenue – USD Billion, 2020–2034)

- Aerospace & Defense

- BFSI

- IT and Telecommunications

- Energy & Power

- Government

- Healthcare

- Retail

- Transportation & Logistics

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Location-Based Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 60.01 billion |

|

Market Size in 2025 |

USD 69.76 billion |

|

Revenue Forecast by 2034 |

USD 275.77 billion |

|

CAGR |

16.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 60.01 billion in 2024 and is projected to grow to USD 275.77 billion by 2034.

The global market is projected to register a CAGR of 16.5% during the forecast period.

North America dominated the share in 2024.

A few key players include Google LLC (Alphabet Inc.); Apple Inc.; Microsoft Corporation; HERE Technologies; International Business Machines Corporation (IBM); Cisco Systems, Inc.; Oracle Corporation; Qualcomm Technologies, Inc.; TomTom N.V.; Esri; Zebra Technologies Corporation; and Baidu, Inc.

The software segment accounted for the largest share in 2024.

The indoor segment is expected to witness the fastest growth during the forecast period.