M-Commerce Market Share, Size, Trends, Industry Analysis Report

By Payment Modes (Near-field Communication (NFC), Premium SMS, Wireless Application Protocol (WAP)); By Transactions; By End Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 111

- Format: PDF

- Report ID: PM2305

- Base Year: 2024

- Historical Data: 2020 - 2023

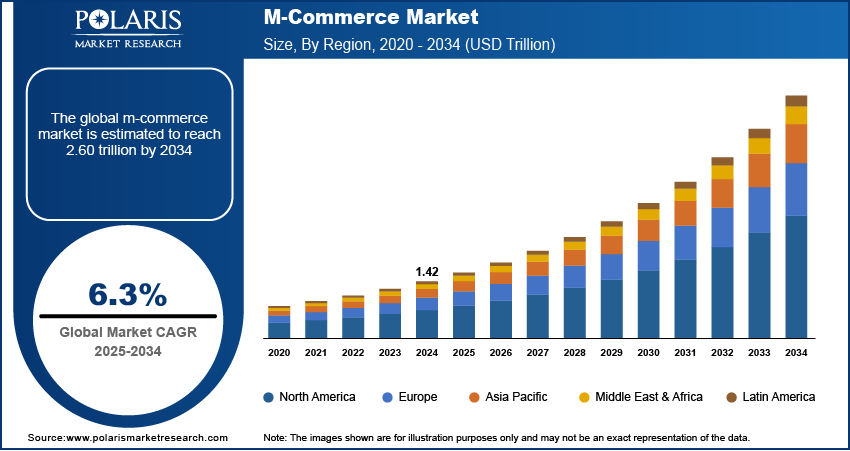

The global m-commerce market was valued at USD 1.42 trillion in 2024 and is expected to grow at a CAGR of 6.3% during the forecast period. The advancements in mobile technology for banking payments and the benefits of cellphones, which have led to an increase in mobile usage, are driving the m-commerce market growth during the forecast period.

Key Insights

- The m-retailing segment dominated the market in 2024 due to its alignment with mobile device use and user offering patterns.

- The near-field communication (NFC) segment held the largest global market share in 2024. This is driven by NFC chips embedded in credit cards for contactless payments.

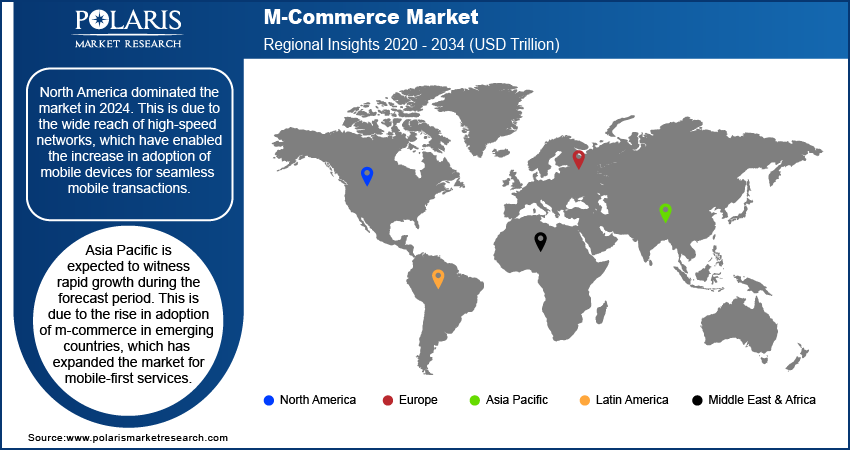

- North America dominated the market in 2024. This is due to the wide reach of high-speed networks, which have enabled the increase in adoption of mobile devices for seamless mobile transactions.

- Asia Pacific is expected to witness rapid growth during the forecast period. This is due to the rise in adoption of m-commerce in emerging countries, which has expanded the market for mobile-first services.

Industry Dynamics

- The rise in smartphone penetration and internet adoption is attributed to the increasing use of smartphones for online shopping, which has driven the growth of the m-commerce market.

- The advantage of online shopping with competitive prices and time saving drives the growth among consumers and B2B e-commerce markets.

- AI integration for personalized shopping experience creates opportunity to boost customer engagement, loyalty, and order value.

- The development of m-commerce market faces challenges due to the issue of location management in rural areas.

Market Statistics

- 2024 Market Size: USD 1.42 trillion

- 2034 Projected Market Size: USD 2.60 trillion

- CAGR (2025-2034): 6.3%

- Largest market in 2024: North America

To Understand More About this Research: Request a Free Sample Report

AI Impact on M-Commerce Market

- It creates a unique and engaging shopping experience for each customer by analyzing their behavior to offer relevant product recommendations.

- Product discovery becomes faster with the use of image searching and voice commands, as these tools analyze how users interact with their devices.

- Chatbots offer 24/7 support for queries, improve response times, and reduce pressure on agents for complex issues.

- Identification and prevention of fradulent activities are managed by analyzing transaction patterns in real-time.

M-commerce refers to transactions completed via mobile devices. This market has witnessed a considerable increase due to the widespread adoption of these devices. Mobile devices are now at the center of technologies and applications developed for customers and organizations worldwide. The number of mobile device users has increased over the years due to advancements in mobile technology. According to World Bank Data, mobile cellular subscriptions reached 9.14 billion in 2024.

Mobile Commerce is considered a cost-effective method of delivering e-commerce to customers regardless of time or location. The basic properties of mobile, such as personalization, mobility, and prevalence, demonstrate the enormous potential, tremendous fruitfulness, and high profitability of the m-commerce market. Furthermore, the rise of media-rich mobile communication devices such as smartphones and tablets, the growing number of internet users, higher broadband speeds, and an increase in internet consumption are all contributing to the expansion of the m-commerce market, driven by the rise in the number of mobile devices.

There are numerous mobile commerce software options available in the market that offer various benefits. End customers frequently use applications for mobile retailing, location mapping, news, mobile purchasing, and ticketing. As a result, most online retailers now have mobile websites or apps, which has led to a significant increase in both company revenue and consumer base.

However, some individuals remain hesitant to engage in mobile commerce because mobile phone networks are generally more vulnerable to criminal activity compared to traditional internet connections on PCs. Additionally, starting an m-commerce business is quite costly, requiring a substantial initial investment due to the necessity of mobile apps and the requirement for customers to use cellular data.

Industry Dynamics

Growth Drivers

The rise in smartphone penetration and internet adoption, as well as the increasing use of smartphones for online shopping, has boosted the m-commerce market. This adoption has encouraged the users to place a greater focus on mobile-based payments and transactions using mobile wallets, which are expected to have a positive impact on m-commerce market growth. Customers are increasingly using mobile devices, such as smartphones or tablets, for online financial transactions due to the shift toward mobile devices.

Online shopping is more convenient than visiting a physical store. People are increasingly involved in online shopping due to comparative pricing, website availability, low prices and discount offers, time-saving convenience, no crowds, and secure payment options. Buying products online is not an exception. According to International Trade Administration data, the global B2B e-commerce market is expected to reach USD 36 trillion by 2026. Therefore, offline companies should shift their focus to online products. The global crisis has driven shoppers to shift their shopping habits online, and today, online shopping is growing rapidly for essentials.

Moreover, internet penetration is growing rapidly worldwide due to the increasing availability of smartphones at affordable prices and the shift towards new technology development, including 4G and 5G networks. According to the Ministry of Electronics and Information Technology's report, the number of internet users is expected to reach 900 million by 2025.

Report Segmentation

The market is primarily segmented based on transactions, payment modes, end-use, and region.

|

By Transactions |

By Payment Modes |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Segmental Insights

Transactions Analysis

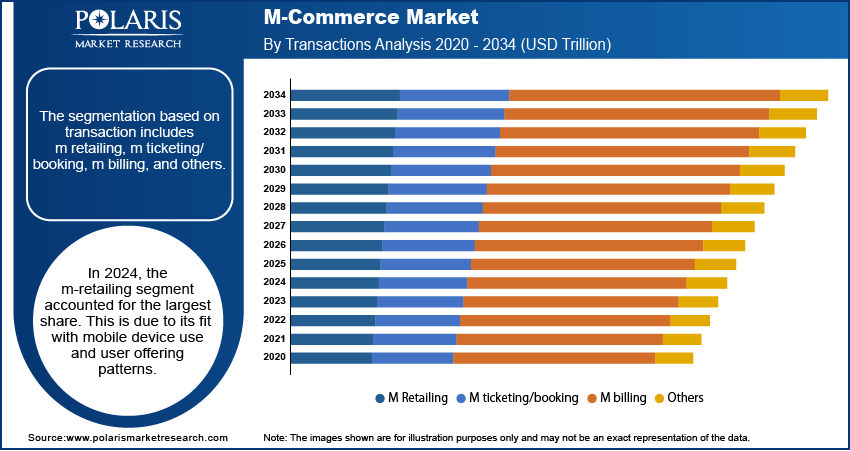

The segmentation based on transaction includes m retailing, m ticketing/booking, m billing, and others. In 2024, the m-retailing segment accounted for the largest share. This is due to its fit with mobile device use and user offering patterns. Consumers are satisfied with the convenience of browsing and purchasing consumer goods directly from their mobile phones. Improved mobile platforms, with better checkout processes and personalized offers has increased demand and improved frictionless transactions. Furthermore, the introduction of digital payment options increased consumer confidence in transactions on their mobile devices. Overall, the accessibility and quantity of products, along with a seamless UX led to the m-retailing segment dominant position.

Payment Modes Analysis

Based on the payment modes, the segmentation includes near-field communication (NFC), premium SMS, wireless application protocol (WAP), direct carrier billing, and others. The near-field communication (NFC) segment dominated the global m-commerce market in 2024. This is due to NFC chips embedded in credit cards for contactless payments. The customer’s smartphone digitizes their entire wallet, a more current and admittedly more appealing use case for NFC. Almost every mobile OS manufacturer offers its app with unique NFC features. Android users have the broadest range of options. Moreover, NFC chips are expected to replace all individual cards in their wallets. This means that the unique information on their frequent shopper loyalty cards, business cards, and other similar items can be stored and communicated using NFC technology.

Regional Analysis

North America M-Commerce Market Assessment

North America held the largest revenue share in 2024 due to the developed ecosystem of consumer behavior and adoption of technologies. This region has a wide reach of high-speed networks with an increase in the adoption of mobile devices, which enables seamless mobile transactions. The purchase process is streamlined due to customer trust in digital payments and early adoption of mobile wallet solutions. Moreover, the developed retail sector with refined mobile platforms from both retailers and digital brands has encouraged high-value and frequent transactions. Thus, advances in infrastructure, high consumer confidence, and a developed digital market boost the growth opportunities for this region.

Asia Pacific M-Commerce Market Insights

Asia Pacific is expected to witness the fastest growth during the forecast period due to demographic and technological advancements. The rise in international adoption in emerging countries has expanded the market for mobile-first services. The expansion of budget-friendly smartphones and affordable mobile data plans boosts their usage among new users, many of whom access the internet through mobile devices. This growth is further supported by the rapid innovation and adoption of applications integrated with social platforms, which facilitate effortless social media interaction and purchasing. Thus, this ongoing shift in the development and integration of fintech solutions into digital commerce is expected to boost the region's expansion opportunities.

Competitive Insight

Some of the major players operating in the global market include Boku Inc., Ericsson, Gemalto, Google Inc., IBM Corp., Mastercard Inc., Oxygen8 Solutions, Inc., Paypal, SAP AG, and Visa Inc., among others.

Industry Developmen

- January 2024: PayPal Holdings, Inc. introduced six innovations to revolutionize commerce through AI-driven personalization for both merchants and consumers. It features a new PayPal experience that speeds up the checkout process for consumers and helps merchants increase transaction conversions.

- October 2023: Visa invested USD 100 million to develop generative AI technologies and applications that will impact the future of commerce and payments.

M-Commerce Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.42 trillion |

|

Market size value in 2025 |

USD 1.50 trillion |

| Revenue forecast in 2034 | USD 2.60 trillion |

|

CAGR |

6.3% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion/trillion and CAGR from 2025 to 2034 |

|

Segments covered |

By Transactions, By Payment Modes, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Boku Inc., Ericsson, Gemalto, Google Inc., IBM Corp., Mastercard Inc., Oxygen8 Solutions, Inc., Paypal, SAP AG, and Visa Inc. |

FAQ's

• The global market size was valued at USD 1.42 trillion in 2024 and is projected to grow to USD 2.60 trillion by 2034.

• The global market is projected to register a CAGR of 6.3% during the forecast period.

• North America dominated the global market share in 2024.

• A few key players are Boku Inc., Ericsson, Gemalto, Google Inc., IBM Corp., Mastercard Inc., Oxygen8 Solutions, Inc., Paypal, SAP AG, and Visa Inc.

• The m-retailing segment dominated the market share in 2024.

• The near-field communication (NFC) segment held the largest global market share in 2024.