Manufacturing Execution Systems Market Share, Size, Trends, Industry Analysis Report

By Deployment (On-premises, On-demand, and Hybrid); By Offering; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 119

- Format: PDF

- Report ID: PM2783

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

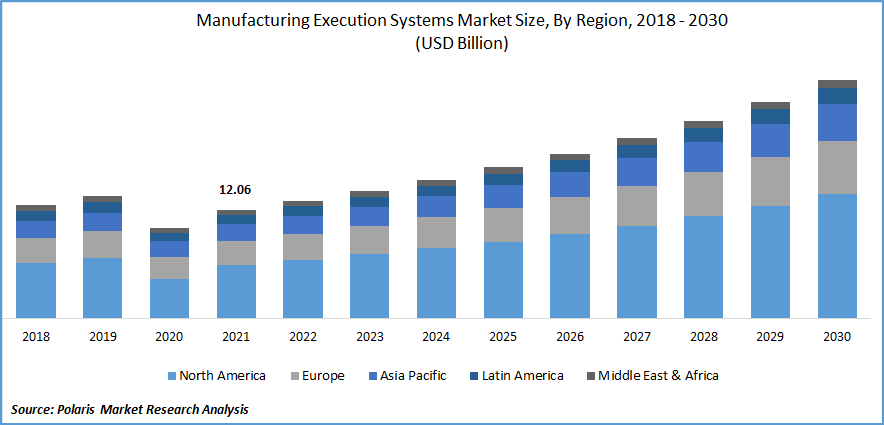

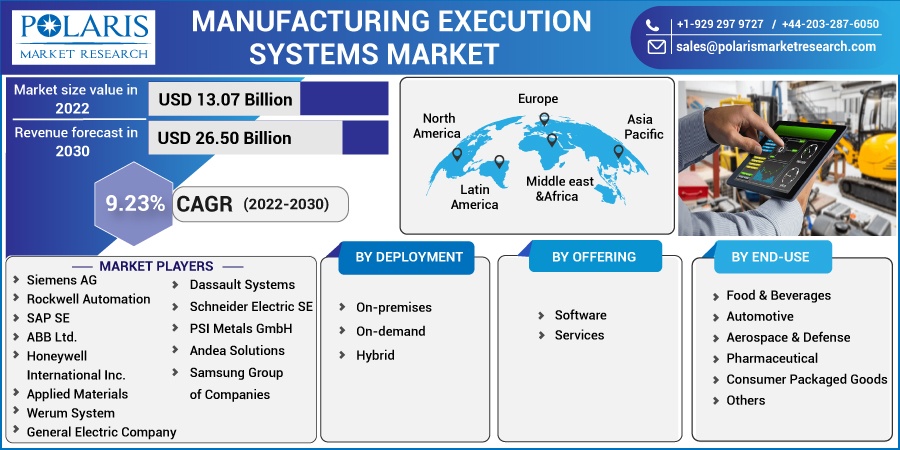

The global manufacturing execution systems market was valued at USD 12.06 billion in 2021 and is expected to grow at a CAGR of 9.23% during the forecast period.

The high development in the utilization of modern mechanization in various process ventures coupled with low sending and operational costs are major factors favoring growth. Moreover, extensive growth in the research and development sector through several key market players, including Honeywell International and Rockwell Automation, for providing better solutions/services to their consumers across the globe is likely to fuel the growth and demand of the global market in the near future.

Know more about this report: Request for sample pages

In addition, the high implementation of manufacturing execution systems by several large businesses and SMEs for enhancing manufacturing processes and improving quality are fueling the market growth at a strong growth rate over the forecast period. Various features of these types of systems, including increased production capacity, reduced overall cost, and real-time data collection for enhancing efficiency, are also expected to impact the global market positively over the coming years. This rising implementation also results in less energy consumption and reduced wastage during manufacturing.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the market. The pandemic caused many major halts in different sections of various industries, including no operation in manufacturing plants, low production in manufacturing facilities, and disrupted supply-chain across the globe. Additionally, periodic maintenance and again and again discontinuation of operation among various manufacturing plants have largely hampered the demand for manufacturing execution solutions across the world.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising need for connected supply chains in various manufacturing industries across the globe is a key factor projected to drive growth. The growing popularity of manufacturing execution systems among global manufacturers for efficient and enhanced productivity with the help of real-time information helps in lowering production costs as well as fostering market growth globally.

Furthermore, increased investment in development activities by large market players to eliminate non-value factors, systematic and standard processing among all plants, analysis of the problems and immediate resolutions, constant product and service enhancement, and reduction in cost by effective resource utilization are also expected to boost the demand and adoption of MES with a significant growth rate in the coming years.

Report Segmentation

The market is primarily segmented based on deployment, offering, end-use, and region.

|

By Deployment |

By Offering |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Hybrid segment is projected to witness fastest growth in 2021

The hybrid segment is likely to grow at the fastest growth rate over the forecast period due to the rising deployment of manufacturing execution systems in oil & gas sector owing to increased importance regarding real-time information tracking about the various operations in oil & gas field across the globe. Moreover, the ability of hybrid deployment to provide extra storage capacity and highly ensure the safety of the data is also attracting manufacturers to adopt these solutions around the globe.

Furthermore, the on-premises segment accounted for the highest market share in 2021 with a significant market share. Increased focus on greater integration and better control over the system for delivering highly personalized user experience, which meets the requirements of manufacturing firms.

Services segment accounted for the largest market share in 2021

The rising importance of the post-implementation process of several industrial execution systems around the globe is the key factor driving the growth of the segment market. Increased efficiency and lowering waste and output time in the manufacturing process of various applications including food & beverages, pharmaceuticals, and consumer packaged goods, are other factors projected to propel the growth and demand for services segment over the forecast period.

Furthermore, the software segment is expected to witness fastest CAGR during the forecast period due to the continuously rising investments in research & development activities and increasing introduction to various new software, and analytical tools by many large market players across the globe are major factors anticipated to fuel the demand and growth of the segment growth in the near future.

For instance, in November 2021, AVEVA announced the launching of its latest Vision AI Assistant 2021, an advanced image classification-based analytics tool. The new AI solution is integrated into AVEVA insight and system platform and their operation management interface. Expanding the company’s product offerings is projected to strengthen its position ahead of its competitors.

Pharmaceuticals segment held the largest revenue share in 2021

The pharmaceuticals segment held the largest market share in 2021 and is set to retain its position throughout the forecast period. The increasing prevalence of continuously changing industry dynamics and rising demand to adjust their manufacturing processes to satisfy growing consumer needs are key factors projected to foster segment growth at a healthy growth rate over the coming years.

In addition, rising manufacturers’ attempts to ensure compliance with the EU Falsified Medicine Directive and various other universal laws through adding innovative and advanced technology and growing resources for managing administrative load are further likely to contribute significantly to the segment growth.

Additionally, the automotive segment is expected to hold a significant market share in 2021, owing to the increasing popularity of automobiles and rising consumer purchasing power, which attracts them to spend higher on comfortable vehicles across the world. The number of automobiles running on the roads worldwide is growing rapidly, which has resulted in higher adoption of ME systems among manufacturers of automobiles.

North America dominated the market with the highest revenue share in 2021

North America accounted for the largest market revenue share in 2021 and is projected to continue its dominance throughout the forecast period. Large presence of manufacturing execution systems vendors such as Honeywell International Inc., Oracle Corporation, Emerson, and Rockwell Automation, coupled with the strong financial position, which enables them to invest a higher amount in advanced solutions and technologies, are key factors expected to drive the growth of the market in the region. In addition, rising consumer awareness regarding new innovations and easy availability of these systems in developed countries like the United States and Canada are also anticipated to contribute significantly to the regional market growth over the coming years.

Furthermore, Asia Pacific region is witnessing the fastest growth rate over the forecast period owing to the high adoption of developed technologies, increasing demand from various end-use industries, and fast industrialization. In Asia Pacific, China and India are the quickest developing countries due to their increasing investment in research & development activities. Additionally, rising awareness regarding executions systems for manufacturing processes among various industries is propelling market growth significantly over the coming years.

Competitive Insight

Some of the key major players operating in the global market are Siemens AG, Rockwell Automation, SAP SE, ABB Ltd., Honeywell International Inc., Applied Materials, Werum Software & Systems, General Electric Company, Emerson Electric, Epicore Software Corporation, Oracle Group, Dassault System, Schneider Electric SE, PSI Metals GmbH, Andea Solutions, and Samsung Group of Companies.

Recent Developments

In May 2021, Siemens AG, launched its new Opcenter Execution Discrete 4.1, which comes with powerful MES capabilities, synchronized production processes for the management of optimal supply chain, and complete integrations of regulatory and various quality requirements. The new product enables the company to reduce operation and maintenance costs as well.

In November 2021, Rockwell Automation, a leading global service provider, launched its new remote access solutions with robust security capabilities and multi-factor authentication with encrypted protocols. It will help to fulfill current and future remote access requirements around the globe.

Manufacturing Execution Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 13.07 billion |

|

Revenue forecast in 2030 |

USD 26.50 billion |

|

CAGR |

9.23% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Deployment, By Offering, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Siemens AG, Rockwell Automation, SAP SE, ABB Ltd., Honeywell International Inc., Applied Materials, Werum System, General Electric Company, Emerson Electric, Epicore Software Corporation, Oracle Group, Dassault Systems, Schneider Electric SE, PSI Metals GmbH, Andea Solutions, and Samsung Group of Companies. |