Marine Battery Market Size, Share, Trends, Industry Analysis Report

By Ship (Commercial, Defense, Unmanned), By Type, By Function, By Capacity, By Propulsion, By Ship Power, By Design, By Energy Density, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM2277

- Base Year: 2024

- Historical Data: 2020-2023

Overview

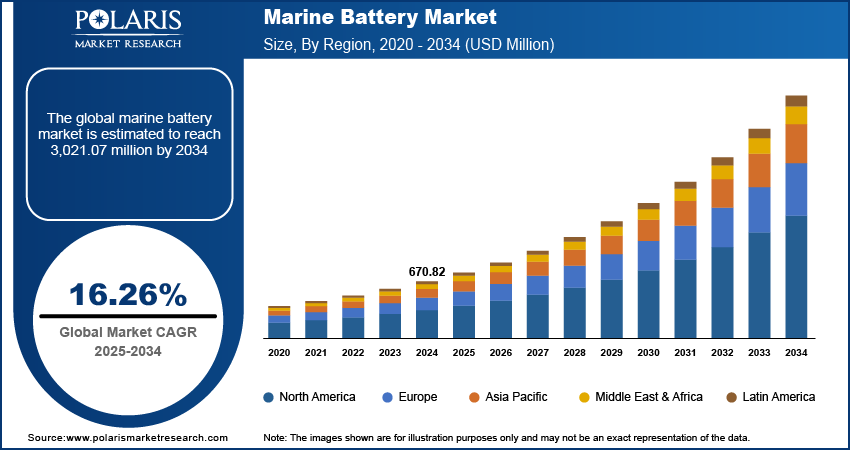

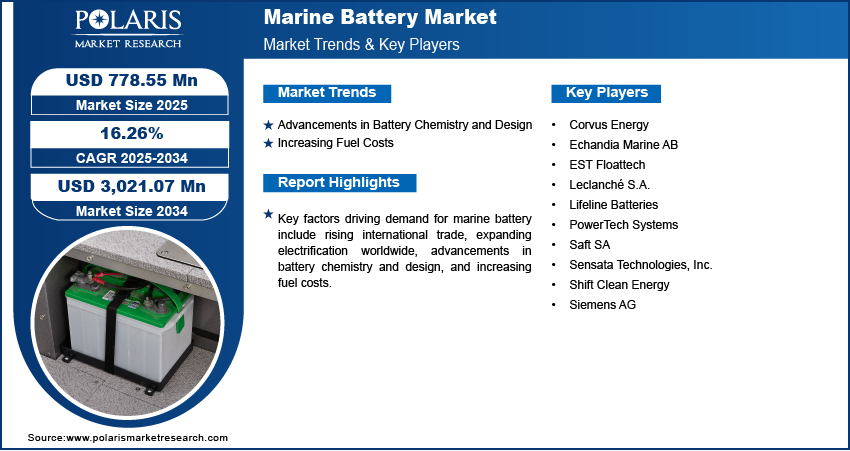

The global marine battery market size was valued at USD 670.82 million in 2024, growing at a CAGR of 16.26% from 2025 to 2034. Key factors driving demand for marine batteries include rising international trade, expanding electrification worldwide, advancements in battery chemistry and design, and increasing fuel costs.

Key Insight

- The commercial segment accounted for 81.08% of market revenue share in 2024.

- The deep-cycle batteries segment dominated the market share in 2024.

- The lithium segment held the largest market share in 2024 due to its superior energy density.

- Europe accounted for a 44.16% share of the global marine battery market in 2024.

- The UK held 17.79% of revenue share in the Europe marine battery landscape in 2024.

- The market in North America is projected to hold a substantial share in the coming years.

To Understand More About this Research: Request a Free Sample Report

Marine battery is a specialized power storage device made to meet the unique demands of marine environments, such as boats, yachts, and other watercraft. Unlike standard automotive batteries, marine batteries are built to withstand harsh aquatic conditions, including constant vibration, moisture, salinity, and the motion of waves. The robust construction of marine batteries ensures reliable performance and safety of ferries, making them essential for both recreational and commercial maritime activities.

The rising international trade is driving the market growth. World Trade Organization, in its report, stated that as of 2024, world trade volume and value have expanded by 4% and 5%, respectively, on average since 1995. This increase in international trade is driving shipping companies to invest in more cargo ships, ferries, and container vessels to meet the growing logistical needs. These vessels require reliable and sustainable power solutions, raising the demand for marine batteries. Additionally, shipping operators are now prioritizing battery-powered systems to enhance energy efficiency, lower operational costs, and comply with environmental mandates, thereby boosting the demand for marine batteries.

The marine battery market demand is driven by the expanding electrification worldwide. Governments and private sectors are investing heavily in electric infrastructure to support sustainable transportation, including in ports and coastal operations. This is fueling a shift among shipbuilders and operators toward battery-powered vessels, aiming to reduce reliance on fossil fuels and thereby driving the adoption of marine batteries. Moreover, the growing focus on electric mobility across various sectors is strengthening confidence in marine battery technology, accelerating its integration into commercial and recreational boats.

Industry Dynamics

- Advancements in battery chemistry and design are driving the market growth by reducing the risk of overheating and improving the overall efficiency of batteries.

- Increasing fuel costs are driving the adoption of marine batteries, fueling demand for battery-powered boats.

- Expansion of maritime tourism and recreational boating is projected to create a lucrative opportunity in the industry.

- The high investments required in marine batteries, especially advanced lithium-ion and solid-state types, hinder the growth.

Advancements in Battery Chemistry and Design: Manufacturers are developing next-generation batteries with faster charging capabilities, longer lifespans, and greater resistance to harsh marine environments, which is increasing their adoption. Innovations such as solid-state batteries and lithium iron phosphate (LFP) batteries are reducing the risk of overheating and improving overall efficiency, making them ideal for marine applications. These improvements are encouraging vessel operators to adopt these advanced marine batteries and integrate them into their vessels to support powerful onboard systems, leading to market growth.

Increasing Fuel Costs: The operational costs of diesel-powered vessels are rising significantly, driven by increasing fuel costs, which is promoting the adoption of battery-powered vessels and leading to market expansion. Marine batteries provide a cost-effective solution by reducing dependence on fuel and lowering long-term expenses through improved energy efficiency and reduced maintenance requirements. This financial incentive, combined with stricter environmental regulations, is encouraging the widespread adoption of battery-powered propulsion, accelerating the demand for marine batteries.

Segmental Insights

Ship Analysis

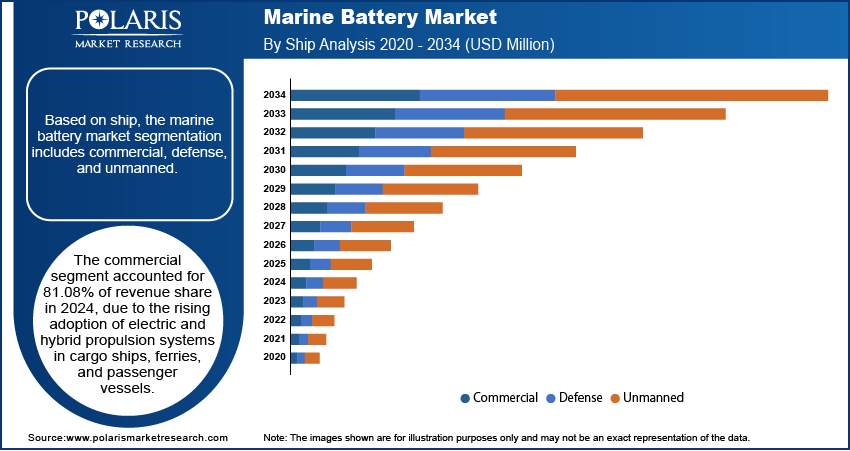

Based on ship, the segmentation includes commercial, defense, and unmanned. The commercial segment accounted for 81.08% of revenue share in 2024 due to the rising adoption of electric and hybrid propulsion systems in cargo ships, ferries, and passenger vessels. Shipbuilders and commercial operators increasingly shifted toward low-emission technologies to comply with international environmental regulations such as the International Maritime Organization’s (IMO) 2020 sulfur. Additionally, commercial vessels, especially short-distance ferries and offshore support ships, underwent rapid electrification due to their predictable routes and regular docking patterns, which facilitated easier battery recharging. The high energy demand in these ships created strong demand for high-capacity, long-cycle lithium-ion battery systems, contributing to their dominance.

The unmanned segment is projected to grow at a robust pace in the coming years. Naval forces and commercial shipping companies are deploying autonomous surface and underwater vessels for tasks such as surveillance, research, logistics, and offshore inspection. These ships rely heavily on electric propulsion to reduce noise, improve efficiency, and enable compact, low-maintenance designs. Furthermore, advances in remote battery management systems and modular energy storage have made integration into unmanned vessels more feasible, fueling their adoption in both military and commercial applications.

Type Analysis

In terms of type, the segmentation includes lithium, lead acid, nickel cadmium, sodium-ion, and fuel cells. The lithium segment held the largest share in 2024 due to its superior energy density, longer lifecycle, and lighter weight compared to other batteries. Vessel operators across both commercial and defense sectors increasingly adopted lithium-based battery systems to enhance performance, reduce maintenance costs, and meet stringent environmental regulations. The rapid shift toward electrification in ferries, patrol boats, and offshore service vessels created robust demand for lithium batteries. Manufacturers also favored lithium solutions due to their scalability and compatibility with modern battery management systems, enabling efficient energy monitoring and control.

Function Analysis

In terms of function, the segmentation includes starting batteries, deep-cycle batteries, and dual purpose batteries. The deep-cycle batteries segment dominated the market share in 2024 due to its ability to deliver consistent power over extended periods, making it ideal for propulsion and onboard energy systems in electric and hybrid vessels. Ship operators chose deep-cycle systems to support auxiliary functions such as lighting, navigation, refrigeration, and communication, particularly in commercial and recreational vessels that require sustained energy delivery rather than quick bursts. Unlike starting batteries, which provide short, high-current outputs, deep-cycle variants withstand frequent charge and discharge cycles, offering better reliability and longevity in marine environments. The rising adoption of electric propulsion systems further propelled demand for deep-cycle technologies, especially among short-distance ferries, offshore service vessels, and yachts.

Capacity Analysis

In terms of capacity, the segmentation includes < 100 AH, 100–250 AH, and > 250 AH. The 100–250 AH segment is projected to register the CAGR during the forecast period, owing to its widespread application in mid-sized vessels such as ferries, fishing boats, and recreational crafts. Ship operators are prioritizing this capacity range as it offers a balanced combination of power, endurance, and cost-efficiency, making it suitable for propulsion and auxiliary systems in electric and hybrid setups. Additionally, the availability of compact, modular battery systems within this capacity range allows for easier integration into existing onboard configurations without compromising performance or space efficiency, leading to their high adoption.

Regional Analysis

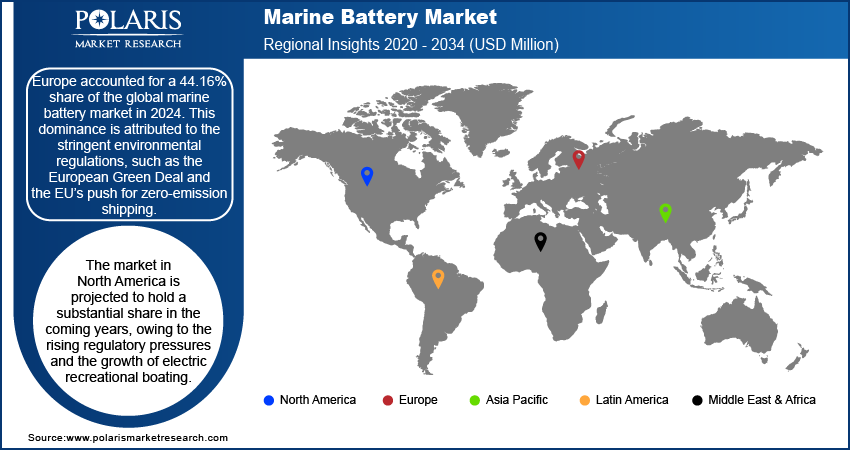

The Europe marine battery market accounted for a 44.16% share of the global market in 2024. This dominance is attributed to the stringent environmental regulations, such as the European Green Deal and the EU’s push for zero-emission shipping. The region's heavy investments in electrification, particularly for inland waterways, ferries, and short-sea shipping, contributed to the demand for marine batteries across the region. Countries such as Norway, Germany, and the Netherlands led the adoption of hybrid and fully electric vessels, supported by government subsidies and incentives. Additionally, the growing offshore wind industry, which requires battery-powered support vessels, further boosted demand.

UK Marine Battery Market Insight

The UK held 17.79% of revenue share in the Europe marine battery landscape in 2024, due to increasing decarbonization targets, including the Clean Maritime Plan, which aims for zero-emission shipping by 2050. The UK’s strong offshore energy sector further propelled marine battery demand as this sector needs battery-powered vessels for maintenance and crew transfers. Government grants and partnerships with battery manufacturers also fueled the shift toward sustainable maritime solutions.

North America Marine Battery Market Trends

The market in North America is projected to hold a substantial share in the coming years, owing to the rising regulatory pressures and the growth of electric recreational boating. The U.S. and Canada are implementing stricter emissions standards for commercial and passenger vessels, particularly in environmentally sensitive areas such as the Great Lakes and coastal zones, fueling marine battery demand. The rise of electric ferries in cities such as New York and Seattle, along with increasing interest in hybrid propulsion for workboats, is boosting industry growth. Additionally, the popularity of electric yachts and small leisure boats is contributing to demand.

U.S. Marine Battery Market Overview

In the U.S., the push for marine batteries is driven by federal and state-level initiatives aimed at reducing maritime emissions, including the EPA’s Clean Ports Program and California’s stringent air quality regulations. The U.S. Navy and commercial shipping operators are increasingly adopting hybrid and fully electric propulsion systems, leading to industry expansion. The recreational boating sector is also a major contributor to the industry, with companies such as Brunswick and startups investing in high-performance marine batteries.

Asia Pacific Marine Battery Market Analysis

The industry in Asia Pacific is projected to register the highest CAGR from 2025 to 2034 due to expanding ferry networks, government-led electrification projects, and increasing investments in green shipping. Countries such as China, Japan, and South Korea are leading in the region, with China dominating battery production and deployment in electric vessels. The region’s booming offshore wind and aquaculture industries are also driving market revenue. Additionally, Southeast Asian nations are adopting electric ferries to reduce urban waterway pollution, supported by international funding and local policy incentives, leading to industry expansion.

Key Players and Competitive Analysis

The marine battery landscape is highly competitive, with key players such as Corvus Energy, Echchandia Marine AB, EST Floattech, Leclanché SA, Lifeline Batteries, PowerTech Systems, Saft SA, Sensata Technologies, Shift Clean Energy, and Siemens AG driving innovation in energy storage for maritime applications. Corvus Energy leads the industry with its high-capacity lithium-ion batteries, widely adopted in hybrid and fully electric ferries, offshore vessels, and naval applications. Echandia Marine AB specializes in advanced battery systems optimized for short-sea shipping, leveraging its expertise in fast-charging and energy-dense solutions. EST Floattech focuses on modular and scalable battery systems, catering to inland waterways and workboats, while Leclanché SA provides marine-certified lithium-ion batteries with a strong emphasis on safety and lifecycle performance. The competitive dynamics are shaped by factors such as energy density, safety compliance, lifecycle costs, and compatibility with charging infrastructure.

Key Players

- Corvus Energy

- Echandia Marine AB

- EST Floattech

- Leclanché S.A.

- Lifeline Batteries

- PowerTech Systems

- Saft SA

- Sensata Technologies, Inc.

- Shift Clean Energy

- Siemens AG

Industry Developments

March 2025: Corvus Energy received approval from the UK-based classification society Lloyd’s Register (LR) for its Dolphin NxtGen Energy marine battery system,

February 2024: EST-Floattech, a developer of maritime battery systems, received an investment of €4 million from Energy Transition Fund Rotterdam and existing shareholders for the development of maritime battery systems.

June 2024: Leclanché SA announced the launch of a third-generation marine battery system to support the needs of ship builders in producing 100% electric and hybrid marine vessels.

Marine Battery Market Segmentation

By Ship Outlook (Revenue, USD Million, 2020–2034)

- Commercial

- Defense

- Unmanned

By Type Outlook (Revenue, USD Million, 2020–2034)

- Lithium

- Lead Acid

- Nickel Cadmium

- Sodium-Ion

- Fuel Cells

By Function Outlook (Revenue, USD Million, 2020–2034)

- Starting Batteries

- Deep-Cycle Batteries

- Dual Purpose Batteries

By Capacity Outlook (Revenue, USD Million, 2020–2034)

- < 100 AH

- 100–250 AH

- > 250 AH

By Propulsion Outlook (Revenue, USD Million, 2020–2034)

- Conventional

- Hybrid

- Fully Electric

By Ship Power Outlook (Revenue, USD Million, 2020–2034)

- < 75 KW

- 75–150 KW

- 150–745 KW

- 745 KW & Above

By Design Outlook (Revenue, USD Million, 2020–2034)

- Solid State

- Liquid/ Gel Based

By Energy Density Outlook (Revenue, USD Million, 2020–2034)

- <100 WH/Kg

- 100–500 WH/Kg

- >500 WH/Kg

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Marine Battery Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 670.82 Million |

|

Market Size in 2025 |

USD 778.55 Million |

|

Revenue Forecast by 2034 |

USD 3,021.07 Million |

|

CAGR |

16.26% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 670.82 million in 2024 and is projected to grow to USD 3,021.07 million by 2034.

The global market is projected to register a CAGR of 16.26% during the forecast period.

Europe dominated the market in 2024, holding 44.16% share.

A few of the key players in the market are Corvus Energy; Echandia Marine AB; EST Floattech; Leclanché S.A.; Lifeline Batteries; PowerTech Systems; Saft SA; Sensata Technologies, Inc.; Shift Clean Energy; and Siemens AG.

The deep-cycle batteries segment dominated the market in 2024.

The unmanned segment is expected to witness the fastest growth during the forecast period.