Maritime Surveillance and Intervention Market Share, Size, Trends, Industry Analysis Report

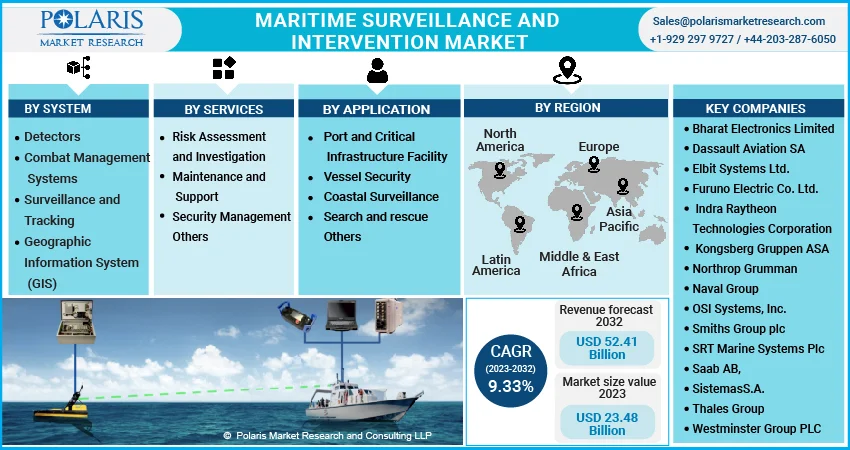

By System (Detectors, Combat Management Systems, Surveillance and Tracking, Geographic Information System (GIS), and Others); By Services; By Application; By Region; Segment Forecast, 2023-2032

- Published Date:Apr-2023

- Pages: 119

- Format: PDF

- Report ID: PM3138

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

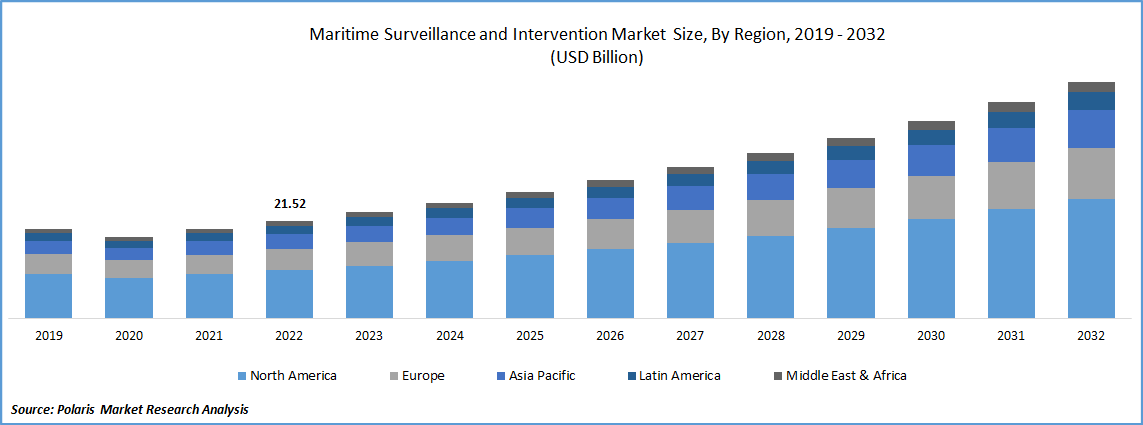

The global maritime surveillance and intervention market was valued at USD 21.52 billion in 2022 and is expected to grow at a CAGR of 9.33% during the forecast period. Maritime surveillance and intervention systems are employed to improve maritime security. The MSI comprises numerous systems such as battle management systems, sensors, surveillance, tracking systems, geographic information systems (GIS), and many others. They are employed for surveillance. According to United Nations Conference on Trade and Development, maritime transportation trade would decrease to 1.4% growth in 2022. It is predicted to expand at a 2.1% annual rate from 2023 to 2027, less than the 3.3% average observed during the previous three decades. Rising maritime traffic due to an increase in payload vessels for transportation is causing an increase in marine crime.

Know more about this report: Request for sample pages

Additionally, the MSI can protect against seaway crimes such as smuggling, piercing, drug trafficking, uncontrolled immigration, human trafficking, unlawful fishing, and others. Advanced surveillance and intervention systems are utilized to assist in securing merchant vessels, coastal lines, terminals, and vital infrastructure sites. For instance,

in September 2022, Equinor and Vissim finished developing a new ocean space surveillance system for electricity operators on the Norwegian and UK coastlines.

The massive ocean space surveillance system integrates subsea infrastructure monitoring and maritime planning using weather forecasts, real-time tracking, and 3D tactical awareness. The modern, advanced design also incorporates improving sailing plans and route prediction; effective communication among offshore personnel, vessels, and control panels; a performance management asset and vessel data; and environmental surveillance. As a result, the increasing deployment of modern monitoring systems and supportive regulatory action would strengthen the country's ocean security.

The coronavirus epidemic has had a significant impact on the maritime industry. The lockdown has temporarily halted several marine operations, including transportation, fishing, and oil and gas production, to prevent coronavirus transmission. Thus, coastguards are deploying unmanned aerial vehicles (UAVs) to execute maritime surveillance operations remotely to observe the coastline. If any lockdown offenders are found, the coastline law enforcement squad will take drastic action against them for violating the regulations. As a result, the need for maritime surveillance UAVs is increasing to improve coast guard safety and protection.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The increased emphasis on strengthening marine safety and security drives demand for MSI solutions. With increasing ocean trade worldwide, maritime traffic is on the rise. Maritime trade is the most established and widely used cargo import and export method because it can transport heavyweight items. Rising seaway transit has increased the number of trading vessels in the sea, raising the rate of maritime crime globally. This has resulted in implementing of surveillance and intervention measures to combat ocean criminal activities such as piracy, illegal immigration, smuggling, and others. Furthermore, growing foreign pressure and terrorist actions have bolstered the choice of MSI to strengthen the country's maritime well-being and security. These are the major elements likely to fuel the growth of the maritime surveillance and intervention market.

Furthermore, Satellite radar, thermal imaging, automated identification system, undersea robotic system, and lengthy identification and tracking device are used to improve the capabilities of maritime surveillance and security activity. For instance, in September 2022, Kraken Technology Group (KTG) announced an agreement with MSI-Defence Technologies (MSI-DS) to develop essential systems for its "K50 KRAKEN" marine gunship. This new agreement highlights numerous areas of cooperation & development between these organizations, particularly the integration of the "Seahawk Compact Weapon Station" & LMM launcher in the "K50 KRAKEN" combat vehicle. This will suit the needs of navies, border troops, and law enforcement organizations for rapid detection and intervention. As a result, interest in advanced MSI aircraft is growing, which has increased the market growth.

Report Segmentation

The market is primarily segmented based on systems, services, applications, and regions.

|

By System |

By Services |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The risk assessment and investigation segment is expected to witness the fastest growth in 2022

The risk assessment and investigation segment is expected to grow rapidly due to advances in enhanced intervention technologies. The International Safety Management Code (ISM Code) requires risk management and incident investigation. This training provides marine professionals with the theoretical and practical skills needed to participate effectively in the full safety management process, from detecting risks to risk factors and mitigation via appropriate risk control methods. Recurring incident report approaches are developed, such as effective root cause analysis and corrective measures planning.

The surveillance and tracking segment industry accounted for the largest market share in 2022

The surveillance and tracking segment held the largest market share. This high proportion can be ascribed to the increasing use of radars, sensor systems, and remotely operated vehicles (ROV) for undersea surveillance applications. A remotely operated vehicle (ROV) is an unmanned underwater robot linked to the ship through connected cables. Cables transfer command and control signals between the operator and the ROV, enabling the vehicle to be navigated remotely. In March 2020, the Indian Navy intended to opt for unmanned systems, especially undersea vehicles. The Indian Navy maintains a well-trained diving team constantly deployed onboard vessels. Therefore, the segmental demand is rising as the ROV installation is growing.

The vessel security segment industry accounted for the largest market share in 2022

During the forecast period, the vessel security segment would expand with the largest share. This increase is related to a rise in cargo vessels for maritime commerce activities. As a result, surveillance solutions are employed to protect ships from collisions and control criminal activities such as piracy, uncontrolled immigration, drug smuggling, and illegal hunting.

The demand in North America is expected to witness significant growth during the forecast period

In the base year, North America dominated the market with the largest share. This expansion can be ascribed to the increased deployment of advanced maritime surveillance systems to provide greater protection for coastal operations. Furthermore, Canada possesses the world's longest coastline. As a result, MSI solutions would be in high demand in the Canadian marine industry. Furthermore, favorable regulatory compliance criteria are boosting the expansion of the North American maritime market. In the base year, Europe accounted for a sizable market share. The region's established marine industry and substantial trade activity in the United Kingdom boost European demand for MSI solutions.

Asia Pacific Marine is expected to grow fastest during the forecast period. This expansion is primarily owing to increased maritime activity in developing countries like China, India, and Japan. The seaway handles the majority of China's trade. As a result, China would demonstrate widespread deployment of monitoring solutions. Furthermore, the growing number of disputes and criminal behavior in the Indian Ocean would necessitate an increase in the procurement of sophisticated military warships equipped with integrated monitoring systems to bolster India's maritime security.

Competitive Insight

Some of the major players operating in the global market include Bharat Electronics, Dassault Aviation, Elbit Systems, Furuno Electric, Raytheon Technologies, Kongsberg Gruppen, Northrop Grumman, Naval Group, OSI Systems, Smiths Group, SRT Marine Systems, Saab, Sistemas, Thales Group, Westminster Group, & Yaltes SA.

Recent Developments

- In December 2022, Unseenlabs, a supplier of space-based RF monitoring for Maritime Domain Awareness, announced the launch of BRO-8, the eighth satellite in its constellation. BRO-8 was launched as a component of the Transporter-6 Mission in January 2023 by SpaceX's Falcon 9 rocket from Cape Canaveral, Florida.

- In May 2022, the Naval Group and its associates completed a major operational deployment of the EFFECTOR project. This protest was held at the "Regional Operational Centre for Surveillance and Rescue in the Mediterranean (CROSS MED)" & included the Naval Group-developed SeaMIS maritime monitoring and rescue control scheme and maritime remote monitoring from other European countries as part of cross-border collaborative operations.

Maritime Surveillance and Intervention Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 23.48 billion |

|

Revenue forecast in 2032 |

USD 52.41 billion |

|

CAGR |

9.33% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By System, By Services, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Bharat Electronics Limited, Dassault Aviation SA, Elbit Systems Ltd., Furuno Electric Co. Ltd., Indra Raytheon Technologies Corporation, Kongsberg Gruppen ASA, Northrop Grumman, Naval Group, OSI Systems, Inc., Smiths Group plc, SRT Marine Systems Plc, Saab AB, Sistemas, S.A., Thales Group, Westminster Group PLC, and Yaltes SA |

FAQ's

Key companies in maritime surveillance and intervention market are Bharat Electronics, Dassault Aviation, Elbit Systems, Furuno Electric, Raytheon Technologies, Kongsberg Gruppen, Northrop Grumman, Naval Group, OSI Systems.

The global maritime surveillance and intervention market expected to grow at a CAGR of 9.3% during the forecast period.

The maritime surveillance and intervention market report covering key segments are systems, services, applications, and regions.

Key driving factors in maritime surveillance and intervention market are supportive growth through regulatory compliance/policies.

The global maritime surveillance and intervention market expected to grow at a CAGR of 9.3% during the forecast period.