Medical Aesthetics Market Share, Size, Trends, Industry Analysis Report

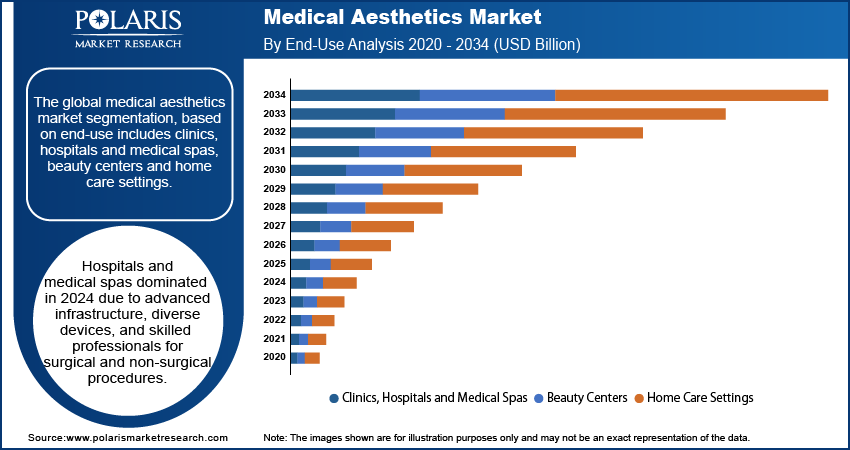

By Product; By End-Use (Clinics, Hospitals and Medical Spas, Beauty Centers, Home Care Settings); By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM2842

- Base Year: 2024

- Historical Data: 2020-2023

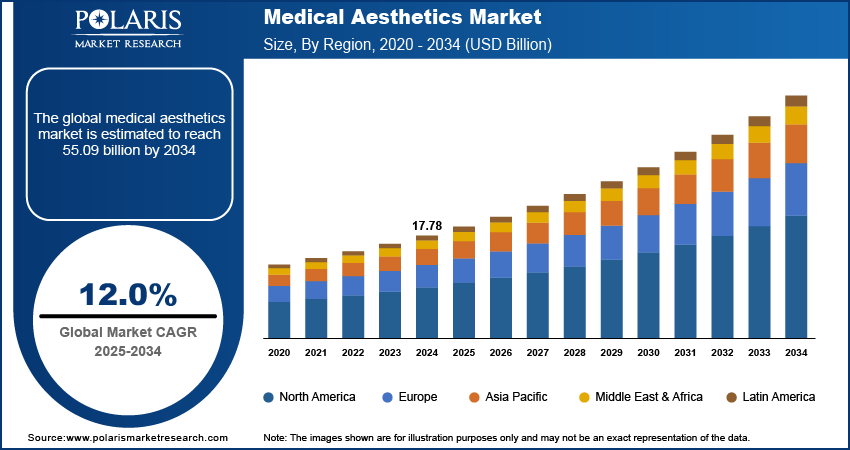

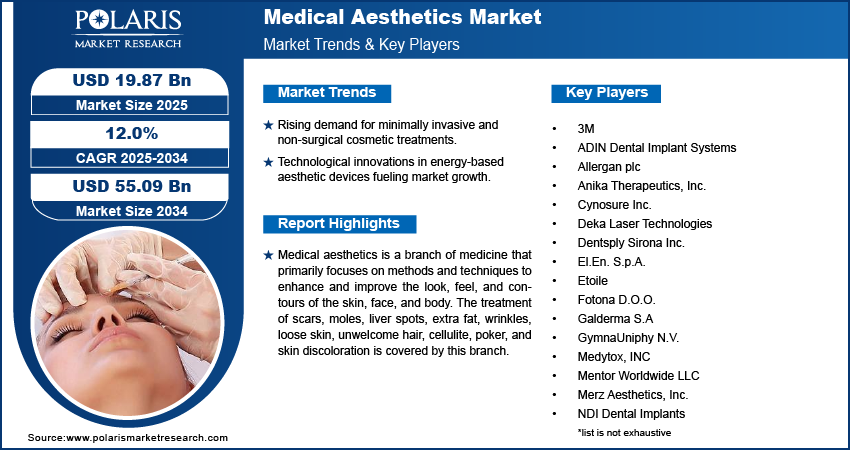

The medical aesthetics market was valued at USD 17.78 billion in 2024 and is expected to grow at a CAGR of 12.0% during the forecast period. The growing implementation of minimally invasive and non-invasive aesthetic procedures, growing public awareness about cosmetic products, and rising adoption of aesthetic procedures among the geriatric population to improve appearance are the factors propelling the market's growth.

Key Insights

- By product, the facial aesthetic products segment held the largest share in 2024. This is due to the growing desire for non-invasive and minimally invasive treatments.

- By end use, hospitals and medical spas held the largest share in 2024 because these places have a well-established infrastructure and a wide range of advanced devices and trained professionals to perform both surgical and non-surgical procedures.

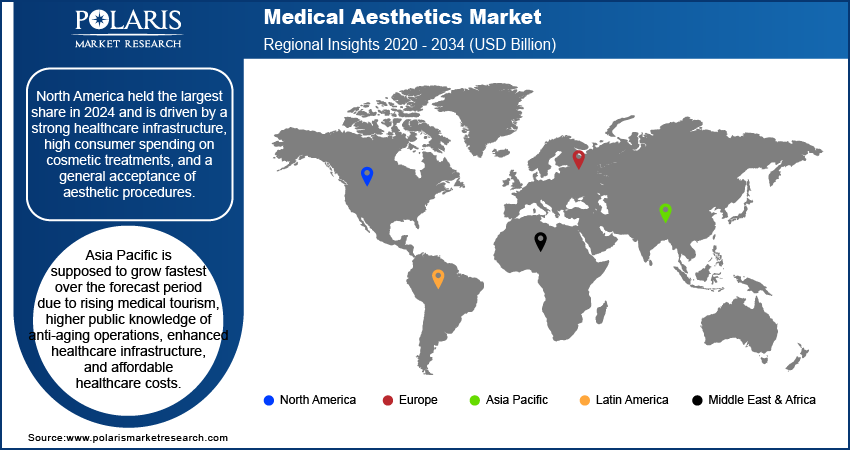

- By region, North America held the largest share in 2024 and is driven by a strong healthcare infrastructure, high consumer spending on cosmetic treatments, and a general acceptance of aesthetic procedures.

Industry Dynamics

- The increasing preference for minimally invasive and non-surgical cosmetic procedures is a major growth factor.

- Technological advancements in aesthetic devices, including energy-based tools like radiofrequency and lasers, continue to drive expansion.

- The growing influence of social media and virtual interactions significantly fuels the demand for aesthetic treatments by creating heightened visual awareness.

Market Statistics

- 2024 Market Size: USD 17.78 billion

- 2034 Projected Market Size: USD 55.09 billion

- CAGR (2025-2034): 12.0%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on the Market

- AI can analyze vast amounts of data, including customer preferences and historical outcomes, to offer services and products tailored to individual needs.

- AI is streamlining business processes and increasing the accuracy of procedures. In sectors like medical aesthetics, AI-powered devices can enhance the precision of treatments like laser therapies by adjusting parameters in real time.

- The use of AI is improving the ability to detect and diagnose issues earlier and more accurately. For instance, in dermatology, AI algorithms can analyze images to help identify skin conditions, including early signs of issues like melanoma.

Medical aesthetics is a branch of medicine that primarily focuses on methods and techniques to enhance and improve the look, feel, and contours of the skin, face, and body. The treatment of scars, moles, liver spots, extra fat, wrinkles, loose skin, unwelcome hair, cellulite, poker, and skin discoloration is covered by this branch.

The demand for the healthcare business has expanded globally due to improvements in technology and equipment. The company's primary goal is to generate demand for the product by raising awareness of it. Healthcare systems in both developed and underdeveloped countries are incorporating diverse medical aesthetics technologies.

The surge in medical tourism, a rising adult population, rising disposable incomes, and growing awareness of aesthetic specialties are creating opportunities for the players operating in the medical aesthetic market. The market for medical aesthetics is expanding in China, Brazil, and Mexico since many surgeons are present there.

The Covid-19 pandemic negatively hindered the medical aesthetics market. The manufacturing and supply chain for the luxury and beauty sectors have experienced problems such as irregular demand for goods and services and timely product delivery to customers.

Additionally, the market is presently recovering from negative impact of pandemic, which can be accounted several factors, including disrupted supply chains, decline in product demand from significant end users, limited operations in the majority of industries, the momentary shutting of significant end-user facilities, and challenges in providing post-essential services because of the lockdown.

Industry Dynamics

Growth Drivers

The demand for aesthetic medicine is expected to rise in many countries due to increasing consumer spending on cosmetic pharmaceuticals globally and rising surgical product demand, particularly among the working-age population. The demand for aesthetic treatments has increased dramatically. The number of doctors and surgeons who treat patients safely and effectively with the aid of new technology equipment is growing.

Additionally, easy availability of home-use aesthetic devices through various distribution channels such as spas, retail stores, and internet businesses, the usage of there has been an increase in demand and usage of home-use aesthetic devices. As laser and light-based therapies are increasingly accepted for household use, they are used to treat precancerous lesions, rosacea, and acne.

Moreover, technology advances, rising demand for non-invasive or minimally invasive reconstruction surgeries, an increase in trauma cases and traffic accidents, a high incidence of breast cancer, an increase in cosmetology surgeons, a high prevalence of congenital face and dental deformities, and an increase in awareness campaigns like the breast reconstructive awareness campaign, which was started in the United States, all influence the market for medical aesthetic devices.

Report Segmentation

The market is primarily segmented based on product, end-use, and region.

|

By Product |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

Facial aesthetic product segment accounted for the largest market share in 2024

The facial aesthetic product segment acquired significant market revenue in 2024 due to growing numbers of women entering the workforce, rising disposable income, and their desire to look young, attractive, and achieve the best treatment outcomes.

Additionally, increasing demand for derma filers is supposed to influence the segment's growth due to its beneficial uses, such as enhancing shallow contours, softening facial creases and wrinkles, improving the appearance of recessed scars, and plumping thin lips.

Moreover, the cosmetic implant segment is supposed to grow fastest during the forecast period as many implants are prostheses used to replace missing body parts. Other implants are used to maintain organs and tissues, provide medication, or monitor physiological processes. Certain implants are made from human skin, bone, and other tissues. Others are made from a range of materials, including metal, plastic, ceramic, and others.

Furthermore, the rising prevalence of target diseases, rising acceptance of bio-implants, and the availability of clear regulatory criteria in developed economies are key factors anticipated to fuel market expansion. For instance, the US Food and Drug Administration (FDA) gave Allergan permission to commercialize NATRELLE INSPIRA SoftTouch breast implants. This should accelerate the expansion of the cosmetic implant segment.

Clinics, hospitals and medical spaces segment accounted for the significant market share in 2024

The clinics, hospitals, and medical spaces segment acquired the most considerable market share in 2024 due to a number of variables, such as the greater accessibility of financial and physical resources at clinics and hospitals, including qualified surgeons and more. Additionally, medical aesthetic procedures exhibit easily accessible and deliverable advances in clinics and hospitals, promoting segment growth.

Home care settings are supposed to grow fastest over the forecast timeline due to a number of causes, such as the increased use of technological gadgets in home care settings and their integration with information technology.

North America dominated the regional market

North America dominated the medical aesthetic regional market due to the high number of cosmetic treatments performed, the rise in the elderly population, rising disposable income, increased awareness, and supportive government funding for healthcare infrastructure. The demand for medical aesthetics in this region is also rising due to the strong research pipeline, the creation of technologically sophisticated products, and FDA approvals for home-use aesthetic devices.

Moreover, Asia Pacific is supposed to grow fastest over the forecast period due to rising medical tourism, higher public knowledge of anti-aging operations, enhanced healthcare infrastructure, and affordable healthcare costs.

Competitive Insight

Some of the major players operating in the global market include 3M, ADIN Dental Implant Systems, Allergan plc, Anika Therapeutics, Inc., Cynosure Inc., Deka Laser Technologies, Dentsply Sirona Inc., El.En. S.p.A., Etoile, Fotona D.O.O., Galderma S.A, GymnaUniphy N.V., Medytox, INC, Mentor Worldwide LLC, Merz Aesthetics, Inc., NDI Dental Implants, PhotoMedex, Inc., Sientra, Inc., Sinclair Pharma PLC, Solta Medical, Solta Medical, Inc., Syneron Medical, Ltd., Tecno Gamma, TRI Dental Implants, YOLO Medical, ZELTIQ Aesthetics, Inc., and Zimmer Biomet Holdings, Inc.

Recent developments

- In October 2024, Allergan Aesthetics, a division of AbbVie Inc. (US), received FDA approval for BOTOX Cosmetic to treat mild to severe platysma bands, the vertical bands that extend from the jawline to the neck.

- In January 2024, Galderma got regulatory clearance for Restylane SHAYPE, a hyaluronic acid injection meant to augment the chin area and shape the lower face with a bone-like look. According to Galderma, the injection utilizes NASHA HD technology to provide natural-looking, long-lasting effects for up to 12 months.

- In June 2022, Cynosure Inc., launched PicoSure Pro, its latest upgrade to the PicoSure platform which delivers energy in a trillionth of a second, utilizing pressure instead of heat to provide safe and effective treatments for unwanted pigmentation and skin revitalization for all skin types.

- In November 2020, a US-based company called AbbVie acquired Allergan plc, to form a global segment ‘Allergan Aesthetics’ in order to improve its medical aesthetics product line.

Medical Aesthetics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 17.78 billion |

| Market size value in 2025 | USD 19.87 billion |

|

Revenue forecast in 2034 |

USD 55.09 billion |

|

CAGR |

12.0 % from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

3M, ADIN Dental Implant Systems, Allergan plc, Anika Therapeutics, Inc., Cynosure Inc., Deka Laser Technologies, Dentsply Sirona Inc., El.En. S.p.A., Etoile, Fotona D.O.O., Galderma S.A, GymnaUniphy N.V., Medytox, INC, Mentor Worldwide LLC, Merz Aesthetics, Inc., NDI Dental Implants, PhotoMedex, Inc., Sientra, Inc., Sinclair Pharma PLC, Solta Medical, Solta Medical, Inc., Syneron Medical, Ltd., Tecno Gamma, TRI Dental Implants, YOLO Medical, ZELTIQ Aesthetics, Inc., and Zimmer Biomet Holdings, Inc. |

FAQ's

? The global market size was valued at USD 17.78 billion in 2024 and is projected to grow to USD 55.09 billion by 2034.

? The global market is projected to register a CAGR of 12.0% during the forecast period.

? North America dominated the market share in 2024.

? The facial aesthetic products segment accounted for the largest share of the market in 2024.