Medical Alert Systems Market Share, Size, Trends, Industry Analysis Report

By Application; By Technology (Two-way Voice Systems, Unmonitored Medical Alert Systems), By System Type, By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 115

- Format: PDF

- Report ID: PM2195

- Base Year: 2024

- Historical Data: 2020 - 2023

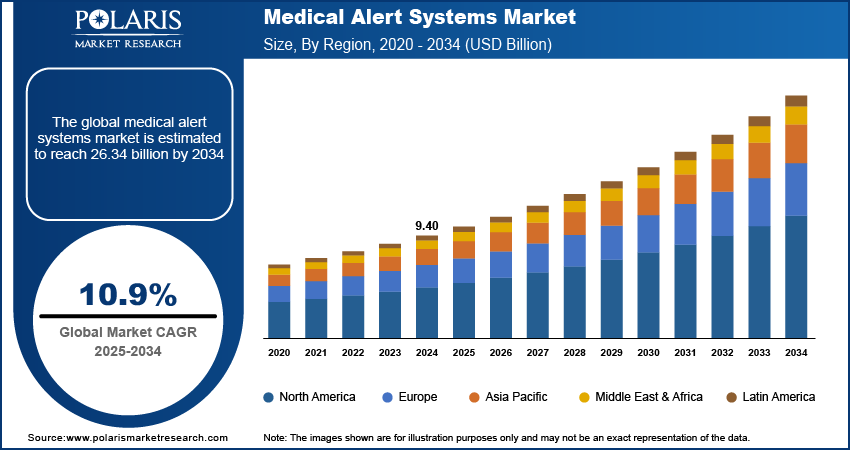

The global medical alert systems market was valued at USD 9.40 billion in 2024 and is expected to grow at a CAGR of 10.9% during the forecast period. Key factors driving the demand includes favorable healthcare policies and a strong focus on financial assistance, consumer inclination towards preventive healthcare, and advanced technologies such as the Internet of Things (IoT) and artificial intelligence (AI).

Key Insights

- In 2024, the two-way voice systems dominated the market due to the transformation of the user experience from a normal alarm to a communication channel.

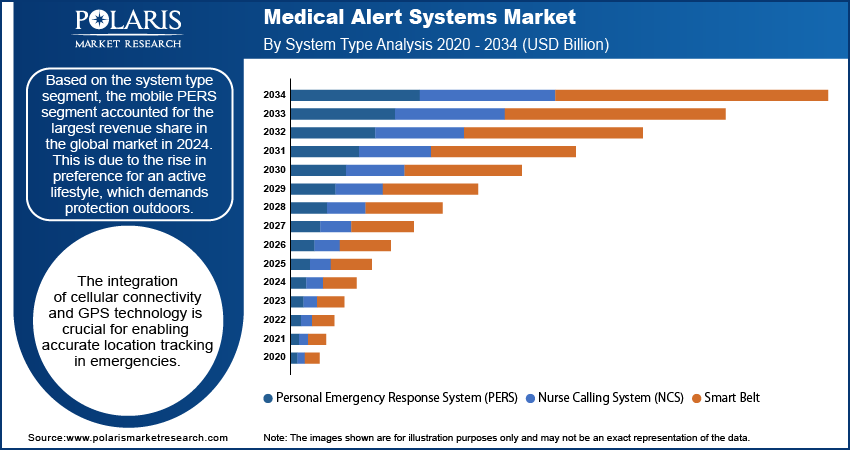

- The mobile PERS segment accounted for the largest revenue share in the global market in 2024, driven by the increasing preference for an active lifestyle, which demands protection outdoors.

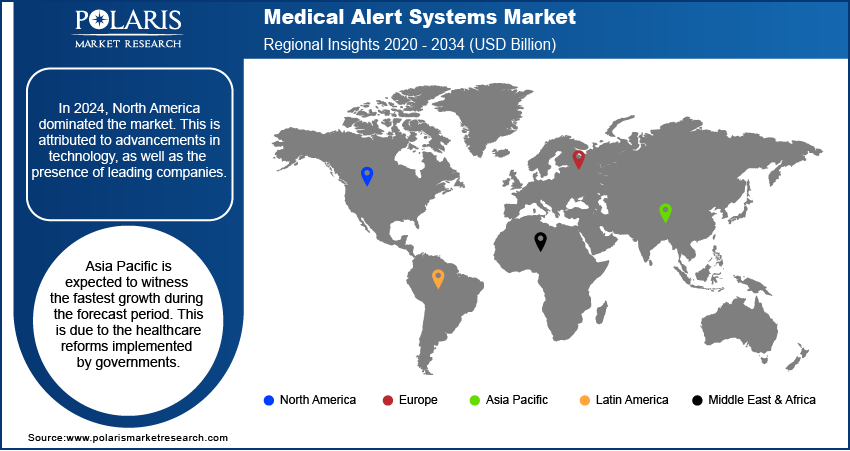

- In 2024, North America dominated the market. This is attributed to advancements in technology, as well as the presence of leading companies.

- Asia Pacific is expected to witness the fastest growth during the forecast period. This is due to the healthcare reforms implemented by governments.

Industry Dynamics

- Extensive developments supported by various factors such as the rising geriatric population and increasing awareness among people for a medical vigilant system are driving market demand.

- The prevalence of chronic pain is relatively high among the geriatric population and is considered an independent risk factor for mortality, which creates growth opportunities for these systems.

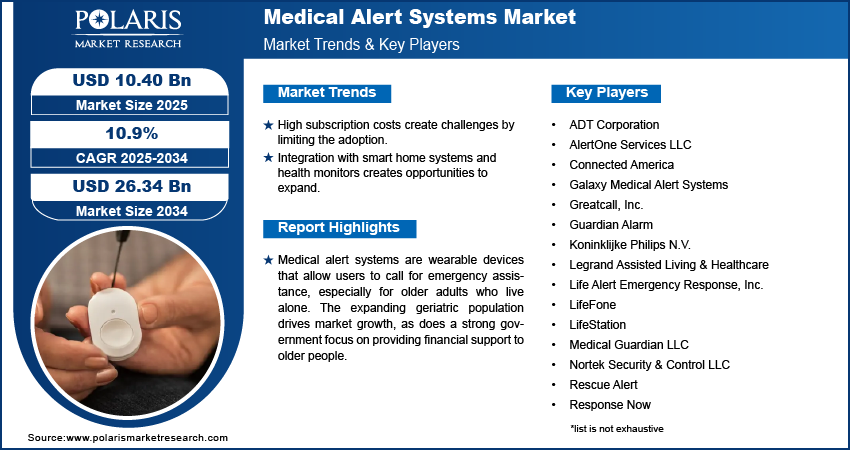

- High subscription costs create challenges by limiting the adoption.

- Integration with smart home systems and health monitors creates opportunities to expand.

Market Statistics

- 2024 Market Size: USD 9.40 billion

- 2034 Projected Market Size: USD 26.34 billion

- CAGR (2025-2034): 10.9%

- Largest market in 2024: North America

To Understand More About this Research: Request a Free Sample Report

AI Impact on Medical Alert Systems Market

- Enables proactive fall detection even if the user is unresponsive.

- Provides predictive analytics for health to identify unusual patterns, allowing for early intervention of health risks.

- Smart sensors and ML reduce false alarms to improve response.

- Personalizes user monitoring to customize alerts and sensitivity, enhancing accuracy and user experience.

Medical alert systems are wearable devices that allow users to call for emergency assistance, especially for older adults who live alone. The expanding geriatric population drives market growth, as does a strong government focus on providing financial support to older people. According to the United Nations (UN), by 2050, the geriatric population is expected to rise to 1.5 billion. Moreover, according to the Canadian Government (Nova Scotia), residents can receive reimbursement when purchasing a medical alert system. The Personal Alert Assistance Program helps qualifying low-income seniors over the age of 65 and Nova Scotians aged 19 and over who have suffered an acquired brain injury. The program reimburses up to USD 480 per year for the cost of a personal vigilance assistance service. Thus, the growth of the geriatric population has led to an increase in market demand for medical alert systems. Government funding for purchasing these medical systems is also boosting the growth opportunities.

Furthermore, advanced technologies such as the Internet of Things (IoT) and artificial intelligence (AI) are also driving market expansion, providing manufacturers with new opportunities. In combination with predictive analytics, AI-driven technologies facilitate automatic fall detection, visitor management, and provide caregivers with timely notice. AI-powered fall detectors for older people have been developed by companies such as Xsens, XanderKardian, Bay Alarm Medical, and Qventus. For instance, in September 2021, Bay Alarm Medical, a medical alert system supplier, and Kami Visual announced a partnership to integrate Bay Alarm Medical's safety service with Kami's AI platform. With this, both will deliver powerful AI technology and visual verification to elders in the U.S., allowing seniors and caregivers to reduce false alerts, improve emergency connection speeds, and eventually enable elders to age in place safely. The impact of such technologies has boosted the market demand for medical alert systems.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The market has witnessed extensive developments over the last few decades, supported by various factors such as the rising geriatric population and increasing awareness among people for a medical vigilant system. The medical alert system, which can be utilized by older citizens, individuals with disabilities, or those with brain diseases to receive quick help in an emergency, is in high demand due to the growing geriatric population and increasing public awareness of the medical system worldwide.

Furthermore, as the prevalence of chronic pain is relatively high among the geriatric population and is considered an independent risk factor for mortality, this injects huge growth in the global medical alert systems market. The current situation, on the other hand, is radically different. Falling birth rates and a significant increase in life expectancy are also driving this shift.

Report Segmentation

The market is primarily segmented based on application, system type, technology, and region.

|

By Application |

By System Type |

By Technology |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Segmental Insights

Technology Analysis

Two-way voice systems dominated the market in 2024. This is due to the transformation of the user experience from a normal alarm to a communication channel. This technology advancement addresses a crucial user need of being alone during an emergency. The immediate hearing of a live voice from a response provides comfort and confirmation that help is on the way. This urgent human contact reduces panic and enables a clear assessment of the situation. Thus, this shift from traditional systems makes this segment essential for consumers to adopt.

System Type Analysis

Based on the system type segment, the mobile PERS segment accounted for the largest revenue share in the global market in 2024. This is due to the rise in preference for an active lifestyle, which demands protection outdoors. The integration of cellular connectivity and GPS technology is crucial for enabling accurate location tracking in emergencies. Moreover, innovation in battery life and wearable devices has boosted convenience and adoption. Mobile-based PERS, or mPERS, is expected to lead the medical alert systems market in the coming years. This is due to the widespread usage of smartphones in recent years.

Smart wearables can be worn on the wrist or as a pendant, which are integrated with mPERS. These devices provide seniors with mobility by preserving their independence, allow users to use the device wherever they go. Furthermore, built-in sensors, usage of a mobile phone app, and faster response times has boosted demand for mobile-based PERS. Thus, the industry's evolution will continue to bring new and exciting trends in the years ahead.

Geographic Overview

The market in North America dominated the revenue share in 2024. This is attributed to the advancements in technology, as well as presence of leading companies with strategies, such as partnerships, acquisitions, mergers, and product launches for expansion. For example, in February 2021, Connected America, a connected health solution provider, collaborated with Urban Health Plan to provide Remote Patient Monitoring (RPM) services to underserved patients and communities. Companies are experiencing consumer interest with these types of strategies that enhance and innovate the features of their products. Additionally, developed healthcare infrastructure and better awareness are supporting the use of these advanced systems, which produces a market that supports technology advancement and consumer interest.

Asia Pacific is expected to witness the fastest growth during the forecast period. This is due to the healthcare reforms implemented by governments in China, India, and South Korea for their aging populations. Factors, such as increased healthcare awareness and rising per capita healthcare expenditure, is expected to boost the market demand in this region. According to the IBEF, the Indian government aims to increase healthcare spending to 3% of GDP by 2022 and investments in health-related infrastructure by 2.4 times.

Competitive Insight

Some of the major players operating in the global medical alert systems market include ADT Corporation, AlertOne Services LLC, Bay Alarm Medical, Connected America, Galaxy Medical Alert Systems, Greatcall, Inc., Guardian Alarm, Koninklijke Philips N.V., Legrand Assisted Living & Healthcare, Life Alert Emergency Response, Inc., LifeFone, LifeStation, Medical Guardian LLC, Nortek Security & Control LLC, Philips N. V., Rescue Alert, Response Now, Tunstall Healthcare Group Ltd., Valued Relationships, Inc., Vanguard Wireless, and VRI Inc.

Industry Developments

June 2025: SOS Technologies launched an emergency alert system to serve members of the Deaf and hard-of-hearing community with real-time alerts delivered via American Sign Language (ASL) video and animated GIFs.

November 2024: LogicMark, Inc. launched Freedom Alert Max. The Freedom Alert Max offers over-the-air updates providing new features and improvements regularly, such as medication reminders and the fall detection algorithm.

Medical Alert Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 9.40 billion |

| Market size value in 2025 | USD 10.40 billion |

|

Revenue forecast in 2034 |

USD 26.34 billion |

|

CAGR |

10.9% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2034 |

|

Segments covered |

By System Type, By Technology, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

ADT Corporation, AlertOne Services LLC, Connected America, Galaxy Medical Alert Systems, Greatcall, Inc., Guardian Alarm, Koninklijke Philips N.V., Legrand Assisted Living & Healthcare, Life Alert Emergency Response, Inc., LifeFone, LifeStation, Medical Guardian LLC, Nortek Security & Control LLC, Philips N. V., Rescue Alert, Response Now, Tunstall Healthcare Group Ltd., Valued Relationships, Inc., Vanguard Wireless, and VRI Inc. |

FAQ's

• The global market size was valued at USD 9.40 billion in 2024 and is projected to grow to USD 26.34 billion by 2034.

• The global market is projected to register a CAGR of 10.9% during the forecast period.

• North America dominated the global market share in 2024.

• A few key players in the market are ADT Corporation, AlertOne Services LLC, Connected America, Galaxy Medical Alert Systems, Greatcall, Inc., Guardian Alarm, Koninklijke Philips N.V., Legrand Assisted Living & Healthcare, Life Alert Emergency Response, Inc., LifeFone, LifeStation, Medical Guardian LLC, Nortek Security & Control LLC, Philips N. V., Rescue Alert, Response Now, Tunstall Healthcare Group Ltd., Valued Relationships, Inc., Vanguard Wireless, and VRI Inc.

• In 2024, the two-way voice systems dominated the market.

• The mobile PERS segment accounted for the largest revenue share in 2024.