Medical Imaging Equipment Market Share, Size, Trends, Industry Analysis Report

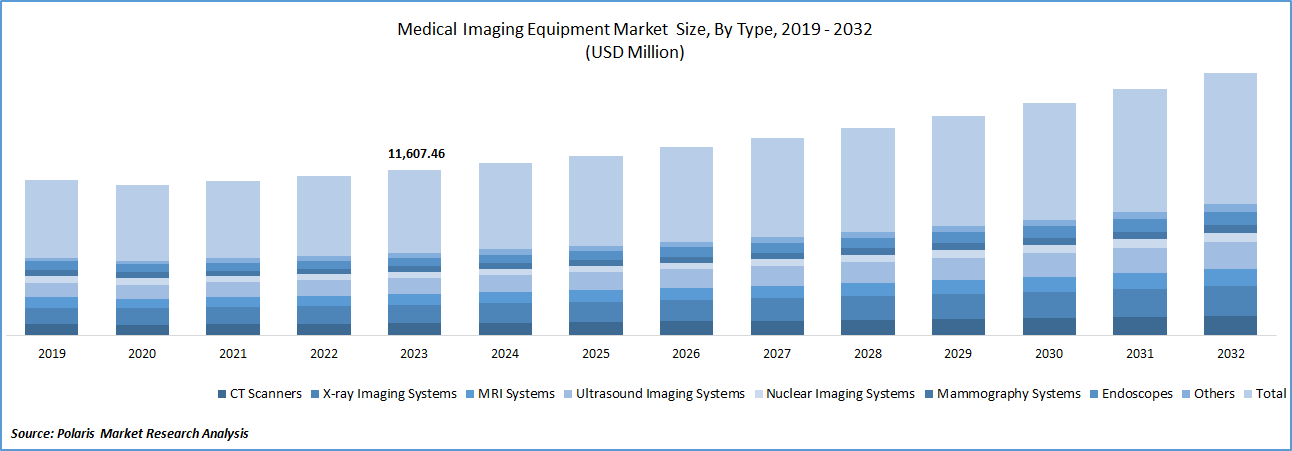

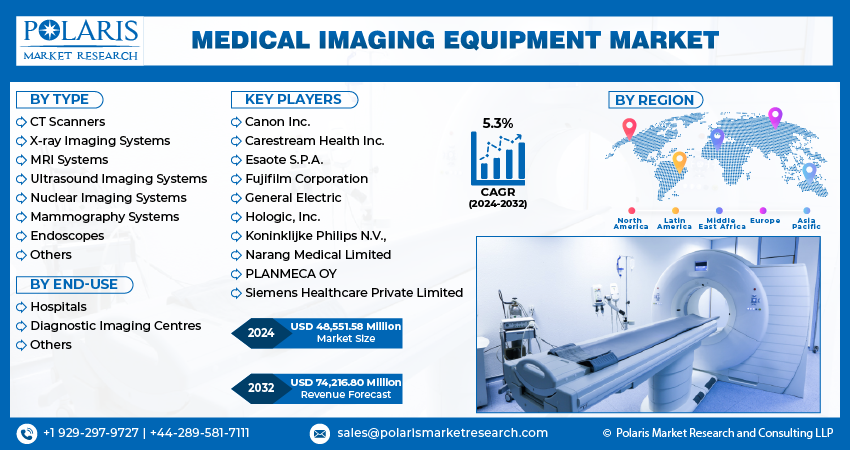

By Type (CT Scanners, X-Ray Imaging Systems, MRI Systems, Ultrasound Imaging Systems, Nuclear Imaging Systems, Mammography Systems, Endoscopes, Others); End-Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Jun-2024

- Pages: 116

- Format: PDF

- Report ID: PM4949

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

The medical imaging equipment market size was valued at USD 46,639.36 million in 2023. The market is anticipated to grow from USD 48,551.58 million in 2024 to USD 74,216.80 million by 2032, exhibiting a CAGR of 5.3% during the forecast period.

Industry Trend

The demand for medical imaging equipment in the healthcare sector has experienced significant growth, primarily driven by the rising prevalence of diseases, including chronic and neurological conditions and cancers worldwide. The increasing burden of these illnesses has necessitated advanced diagnostic tools for early detection and effective treatment planning. Medical imaging equipment encompasses a range of technologies, such as X-ray machines, magnetic resonance imaging (MRI) scanners, computed tomography (CT) scanners, ultrasound devices, and positron emission tomography (PET) scanners, among others.

To Understand More About this Research:Request a Free Sample Report

One major factor contributing to the escalating demand is the continuous technological advancements in imaging equipment. Manufacturers are investing in research and development to stay ahead of the competition by introducing innovative features, improving image quality, and enhancing diagnostic capabilities. The implementation of digital technology and automation has streamlined imaging processes, leading to increased efficiency and accuracy in diagnostics.

The surge in demand for 3D medical imaging devices further propels the global market for medical imaging equipment. The three-dimensional imaging technology provides a more comprehensive and detailed view of anatomical structures, facilitating better diagnosis and treatment planning. This increased demand underscores the importance of technological evolution in the healthcare sector as clinicians seek more sophisticated tools to improve patient outcomes.

Governments are urged to increase investments in highly advanced imaging equipment to ensure safety, reliability, and cost-effectiveness in healthcare delivery. For instance, in June 2021, the government of India launched X-Ray Setu, an AI-based platform aimed at aiding doctors in the early intervention of COVID-19 cases. Additionally, Siemens Healthineers' introduction of a new CT scanner production unit in India in 2022 reflects the industry's response to the growing demand for imaging equipment and the importance of meeting the healthcare needs with cutting-edge technology.

The changing lifestyle patterns and the prevalence of lifestyle-related diseases have further fueled the demand for medical imaging equipment. The rise in chronic conditions necessitates more frequent and advanced diagnostic procedures for early detection and intervention. Moreover, technological advancements aimed at improving turnaround time in imaging procedures have become crucial in addressing the growing healthcare challenges. Governments are increasingly undertaking reimbursement initiatives and investing in new facilities, further fostering the growth of the medical imaging equipment market.

The adoption of artificial intelligence (AI) has emerged as a significant catalyst in boosting the growth of medical imaging equipment. AI is increasingly being integrated into imaging processes to automate image quantification and identification, leading to faster and more accurate diagnoses. For instance, Google's DeepMind and Moorfields Eye Hospital collaborated to use AI for the early detection of age-related macular degeneration by reading eye scans. Furthermore, the introduction of 3D MRI and CT scans, coupled with computer vision applications, allows radiologists to quickly analyze scans, reducing analysis time and improving overall efficacy in patient care.

Key Takeaway

- North America dominated the largest market and contributed to more than 38% of the share in 2023.

- The Asia Pacific market is expected to be the fastest-growing CAGR during the forecast period.

- By end-use category, the diagnostic imaging centres segment accounted for the largest market share in 2023.

- By type category, the ultrasound imaging systems segment is projected to grow at a high CAGR during the projected period.

What are the Market Drivers Driving the Demand for the Medical Imaging Equipment Market?

Technological Advancements in Medical Imaging Equipment

Technological advancements play a pivotal role in driving the demand for medical imaging equipment, fostering innovation, and enhancing diagnostic capabilities. The introduction of advanced imaging equipment has been a major catalyst in the growth of the global medical imaging market. These technologies enable more accurate and rapid diagnosis, contributing to better patient outcomes.

The integration of artificial intelligence (AI) in imaging equipment has emerged as a key driver for market growth. AI-enabled diagnostic tools facilitate not only swift diagnosis but also predictive analysis, revolutionizing healthcare practices. For instance, Koninklijke Philips N.V. launched an AI-enabled Magnetic Resonance (MR) portfolio, showcasing the integration of smart diagnostic systems and workflow solutions. This emphasizes the trend of automating complex clinical tasks for consistent quality and sustainability. Additionally, Google Cloud introduced the Medical Imaging Suite in October 2022, demonstrating the industry's commitment to improving the accessibility and interoperability of imaging data through innovative technology.

The increased adoption of AI-enabled medical imaging equipment has not only improved diagnostic capabilities but has also streamlined workflow and reduced the burden on healthcare professionals. With automated image analysis and interpretation, clinicians can focus more on patient care and treatment decisions rather than spending extensive time on manual image review. This efficiency gain is a significant factor driving the demand for AI-enabled medical imaging devices. The market has responded to this trend with a proliferation of AI-integrated imaging solutions, ranging from image acquisition to diagnosis, catering to the growing preference for intelligent and time-saving technologies in the healthcare sector.

In addition to AI, the growing need for early and cost-effective diagnosis of chronic diseases, coupled with the global aging population, contributes to the increasing demand for medical imaging equipment. For instance, Fujifilm Corporation's AI-based technology for lung nodule detection demonstrates the industry's commitment to addressing critical healthcare challenges. The launch of products like the SCENARIA View Focus Edition system with advanced features like cardiac motion correction further exemplifies how technological progress is driving innovation in medical imaging and fostering market growth.

Which Factor is Restraining the Demand for Medical Imaging Equipment?

Presence of Alternative Materials are Expected to Hinder the Growth of the Market

The high cost of medical imaging equipment poses a significant challenge to the growth of the global medical imaging equipment market. One major aspect contributing to this challenge is the substantial expense associated with acquiring advanced imaging technologies such as Magnetic Resonance Imaging (MRI) machines. In many underdeveloped nations, the financial burden of procuring these sophisticated devices is a deterrent, limiting their widespread adoption. The initial capital investment required for purchasing and installing medical imaging equipment can strain healthcare budgets, particularly in resource-constrained settings. This financial barrier not only hampers the ability of healthcare facilities in these regions to acquire the latest imaging technologies but also restricts patient access to these critical diagnostic tools.

Furthermore, the high prices of medical imaging equipment are exacerbated by additional factors that contribute to the overall cost of these technologies. One significant factor is the need for specialized infrastructure to support and operate these devices effectively. The installation and maintenance of medical imaging equipment require dedicated facilities with appropriate environmental conditions and safety measures. The cost of constructing and maintaining such infrastructure adds to the overall financial burden, making it challenging for healthcare providers in underdeveloped countries to establish and sustain fully functional imaging centers. This lack of infrastructure further limits the accessibility of advanced medical imaging services, exacerbating disparities in healthcare. Moreover, the need for more skilled professionals proficient in MRI physics and clinical applications contributes to the challenges faced by underdeveloped nations in utilizing medical imaging equipment. The need for more trained personnel capable of operating and maintaining these complex devices not only increases operational costs but also poses a significant barrier to effective and widespread implementation. The need for more expertise in these regions further hinders the development of a robust healthcare system, perpetuating the cycle of limited access to advanced medical imaging and hindering progress in diagnostics and patient care. In addressing these challenges, concerted efforts are needed to make medical imaging equipment more affordable, enhance training programs for healthcare professionals, and invest in the development of infrastructure conducive to the effective deployment of these critical technologies.

Report Segmentation

The market is primarily segmented based on type, end-use, and region.

|

By Type |

By End-Use |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By End-Use Insights

Based on end-use analysis, the market is segmented on the hospitals, diagnostic imaging centers, others. Diagnostic imaging centers held the largest market share in 2023. Diagnostic imaging centers play a pivotal role in the dynamic landscape of medical imaging, contributing significantly to the global market for medical imaging equipment. These centers serve as essential hubs for various diagnostic procedures, leveraging advanced technologies to visualize and assess internal structures within the human body. The medical imaging equipment market encompasses a diverse range of technologies, including X-ray, ultrasound, computed tomography (CT), magnetic resonance imaging (MRI), and nuclear medicine. These modalities facilitate the detection, diagnosis, and monitoring of a wide array of medical conditions. Diagnostic imaging centers utilize state-of-the-art equipment to conduct procedures such as X-ray examinations for bone and tissue visualization, ultrasound for real-time imaging with no ionizing radiation, CT scans for detailed cross-sectional images, and MRI for comprehensive soft tissue assessments.

In terms of end-use, diagnostic imaging centers cater to a broad spectrum of medical specialties and patient needs. From routine screenings to complex diagnostic investigations, these centers provide crucial support to healthcare practitioners in making informed decisions regarding patient care. Abdominal ultrasounds, bone sonometry for assessing bone fragility, breast ultrasounds, echocardiograms to visualize the heart, and fetal ultrasounds during pregnancy are among the many services offered by these centers.

By Type Insights

Based on type analysis, the market has been segmented on the basis of CT scanners, X-ray imaging systems, MRI systems, ultrasound imaging systems, nuclear imaging systems, mammography systems, endoscopes, others. The Ultrasound Imaging Systems segment expected to be the fastest growing CAGR during the forecast period. Ultrasound imaging, or sonography, utilizes high-frequency sound waves to provide real-time views inside the body without ionizing radiation exposure. During the procedure, a transducer is placed on the skin, and gel facilitates wave transmission. The image is created based on wave reflections off body structures, with signal strength and travel time guiding image production. Common uses include abdominal, bone, breast, fetal, and ophthalmic imaging, as well as ultrasound-guided procedures. Ultrasound has a proven safety record, relying on non-ionizing radiation. While generally safe, biological effects, such as tissue heating or cavitation, exist. Prudent use is emphasized, particularly during pregnancy. Non-medical use for 'keepsake' images is discouraged.

Ultrasound imaging systems play a pivotal role in the ever-evolving landscape of medical imaging equipment. The market for these systems is significantly influenced by several driving factors, contributing to their widespread adoption and continuous technological advancements. One key factor is the safety profile of ultrasound imaging, as it operates on high-frequency sound waves, eliminating the need for ionizing radiation. This inherent safety makes ultrasound a preferred choice in various medical applications. Additionally, the real-time imaging capability of ultrasound, showcasing the movement of internal organs and blood flow, further enhances its diagnostic value.

The versatility of ultrasound imaging systems is another driving force. Extensive use of ultrasound imaging systems ranges from medical procedures, including abdominal examinations for visualizing tissues and organs, bone sonometry to assess bone fragility, breast imaging, fetal monitoring through Doppler fetal heart rate monitors, echocardiograms for detailed heart visualization, and guidance for biopsies and needle placements in blood vessels or tissues. The adaptability of ultrasound across diverse medical specialties contributes to its widespread adoption and market growth.

Regional Insights

North America

North America region accounted to be the largest market share in 2023. significant driver is the rising prevalence of chronic diseases, including cancer and cardiovascular diseases. Technological advancements, particularly in machine learning and artificial intelligence, have further enhanced the capabilities of medical imaging software, leading to more precise and accurate diagnoses. Medical imaging equipment, such as X-rays, CT scanners, MRI machines, and ultrasound machines, generate substantial amounts of digital image data. Advanced medical imaging software plays a crucial role in processing, analysing, and managing this data, enabling healthcare professionals to formulate accurate diagnoses and effective treatment plans. The market experiences growth due to increased investments in advancing healthcare infrastructure. Additionally, the growing adoption of medical image management solutions, often facilitated through contractual agreements, contributes to market expansion.

Asia Pacific

Asia Pacific is expected for the growth of fastest CAGR during the forecast period. The Asia-Pacific medical imaging equipment market is propelled by several factors, including the prevalence of cancer and cardiovascular diseases, technological advancements, developments in medical imaging reagents, and a high demand for medical and diagnostic imaging procedures. Cardiovascular disorders, a leading global cause of death, contribute significantly to the market, and the growth of the geriatric population is expected to further drive demand for medical imaging reagents, particularly as elderly individuals are more prone to chronic diseases. The convergence of technological advancements with government investments is anticipated to foster market expansion, especially in developing countries like India and China. For example, in January 2020, Allengers introduced India's first locally built 32-slice CT scanner, with assistance from Canon Medical Systems in its development.

Competitive Landscape

In the competitive landscape of the medical imaging equipment market, The companies leverage advanced technologies and extensive distribution networks to maintain their market positions. Emerging players, particularly from regions like Asia-Pacific, are gaining momentum by offering innovative and cost-effective solutions tailored to specific market segments. Strategic partnerships, mergers, and acquisitions are common strategies employed to enhance product portfolios and expand market reach.

Some of the major players operating in the global market include:

- Canon Inc.

- Carestream Health Inc.

- Esaote S.P.A.

- Fujifilm Corporation

- General Electric

- Hologic, Inc.

- Koninklijke Philips N.V.,

- Narang Medical Limited

- PLANMECA OY

- Siemens Healthcare Private Limited

Recent Developments

In November 2023, Fujifilm introduced cutting-edge medical imaging solutions, including a compact 128-slice CT system with vision modeling iterative reconstruction for significant dose reduction, unveiled at the 2023 RSNA annual meeting.

- In October 2023, Esaote introduced S-scan Open, a groundbreaking MRI system incorporating the latest technology for musculoskeletal exams, advanced performance, image optimization algorithms, and enhanced operator and patient experience, aligning with regulatory standards.

- In March 2023, Planmeca has introduced cutting-edge AI-based tools designed for integration with Planmeca Romexis. As the premier software platform in dentistry, Planmeca Romexis provides a comprehensive suite of tools catering to dental imaging, diagnosis, and treatment planning across various indications and dental specialties.

- In October 2023, Carestream Health and EXAMION join forces to introduced forward-thinking healthcare imaging solutions in Germany, reinforcing Carestream's commitment to improving user and patient experiences, enhancing clinical outcomes, and streamlining radiography workflows.

- In September 2023, Hologic and Bayer have unveiled a global partnership to provide breast imaging facilities with a comprehensive package for contrast-enhanced mammography.

- In September 2023, Hologic and Bayer have unveiled a global partnership to provide breast imaging facilities with a comprehensive package for contrast-enhanced mammography.

- In August 2023, SSM Health and Siemens have revealed a new ten-year strategic partnership agreement with a focus on broadening access to top-tier care and educating the future healthcare workforce. The collaborators aim to elevate quality, efficiency, and accessibility to diagnostic and imaging services in communities spanning SSM Health's four-state service area, encompassing Illinois, Missouri, Oklahoma, and Wisconsin.

Report Coverage

The medical imaging equipment market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, end-use, and their futuristic growth opportunities.

Medical Imaging Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 48,551.58 million |

|

Revenue forecast in 2032 |

USD 74,216.80 million |

|

CAGR |

5.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By End-Use, And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Medical Imaging Equipment Market Size Worth $ 74,216.80 Million by 2032

The top market players in Medical Imaging Equipment Market are Canon Inc., Carestream Health Inc., Esaote S.P.A., Fujifilm Corporation, General Electric,

North America is the region contribute notably towards the Medical Imaging Equipment Market.

The medical imaging equipment market exhibiting a CAGR of 5.3% % during the forecast period

Medical Imaging Equipment Market report covering key segments are type, end-use and region.