MENA & GCC Bus Market Size, Share, Trends, & Industry Analysis Report

By Length (6m, 6-8m, 8-10m, 10-12m, above 12m), By Fuel Type, By Seating Capacity, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6378

- Base Year: 2024

- Historical Data: 2020-2023

Overview

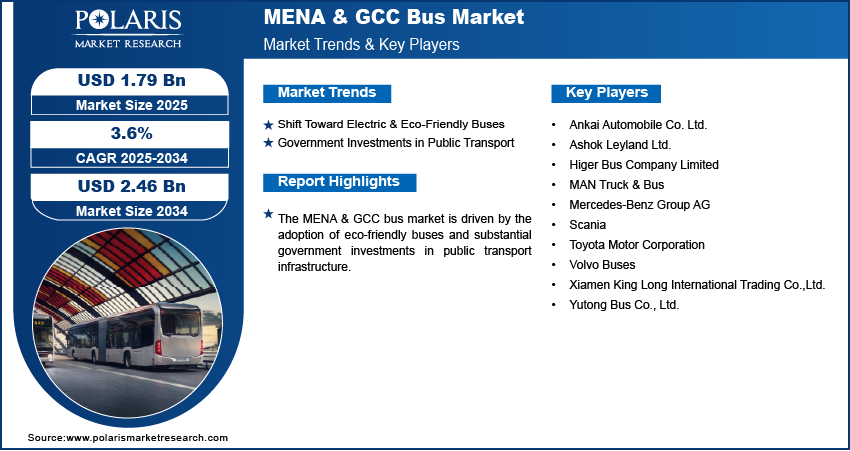

The MENA & GCC bus market size was valued at USD 1.73 billion in 2024, growing at a CAGR of 3.6% from 2025–2034. Key factors driving demand include urbanization & population growth, tourism and mega-events, shift toward electric and eco-friendly buses, and government investments in public transport.

Key Insights

- The below 6m bus segment held a 30.03% revenue share in 2024, favored for last-mile connectivity due to its compact size and urban maneuverability.

- The electric bus segment will grow fastest at 10.09% CAGR during the forecast period, fueled by green mobility investments, eco-conscious policies, and fleet electrification incentives.

- Buses in the 31-50 segment captured 33.22% share in 2024, ideal for urban and intercity routes with optimal passenger capacity and efficiency.

- Intercity/motor coaches will expand at 3.6% CAGR during the forecast period, driven by rising demand for comfortable, reliable long-distance travel and improved regional connectivity.

- MENA dominated the bus market in 2024, led by urbanization, population growth, and expanding public transport networks in key cities.

- The GCC market will grow significantly, supported by government efforts to diversify transport systems and reduce private vehicle reliance.

Industry Dynamics

- The move to electric and eco-friendly buses is accelerating, as MENA/GCC prioritizes sustainable transport to cut emissions and improve air quality, pushing operators to adopt cleaner alternatives over diesel fleets.

- Government funding is a major contributor, with investments in bus fleet expansion, modernized infrastructure, and smart transit tech boosting public transport efficiency and accessibility across the region.

- High upfront costs of electric buses and charging infrastructure hinder adoption, especially for budget-constrained operators, despite long-term savings.

- Rising government incentives and green financing options create a favorable landscape for fleet electrification, opening new revenue streams for manufacturers and operators.

Market Statistics

- 2024 Market Size: USD 1.73 billion

- 2034 Projected Market Size: USD 2.46 billion

- CAGR (2025-2034): 3.6%

- MENA: Largest market in 2024

AI Impact on MENA & GCC Bus Market

- AI-powered analytics improve bus scheduling and routing, reducing fuel costs and delays while enhancing passenger convenience in congested urban areas.

- AI monitors bus health in real-time, cutting downtime and repair costs by flagging issues before breakdowns occur.

- Pilot projects in UAE and Saudi Arabia use AI for self-driving buses, boosting efficiency and safety in smart city projects.

- AI analyzes travel patterns to optimize fleet size and routes, reducing empty runs and aligning supply with passenger demand.

A bus, defined as a large motor vehicle designed to carry passengers along predetermined routes, plays a major role in shaping the urban mobility landscape across the MENA and GCC regions. The rapid pace of urbanization, with population growth, has placed immense pressure on existing transportation infrastructure, leading to increased reliance on buses as a cost-effective and efficient public transit solution. According to World Bank data, Saudi Arabia's population reached 35.3 million in 2024. Demand for organized and sustainable mobility systems is on the rise, positioning buses as a critical mode of transport to address congestion and environmental concerns as cities expand and urban populations rise. The growing number of urban dwellers has thus boosted the need for accessible, reliable, and large-capacity transit solutions, creating favorable conditions for the expansion of the bus market.

Tourism and mega-events further contribute to the market by creating increasing demand for efficient and large-capacity transportation solutions. Major international events, exhibitions, and festivals attract substantial visitor inflows, requiring reliable transit systems to manage passenger movement smoothly across cities and event venues. Buses, particularly those designed for intercity travel, tourist transport, and shuttle services, play a critical role in ensuring seamless connectivity and enhancing the overall travel experience. This demand encourages fleet expansion, modernization, and deployment of specialized buses equipped for comfort and convenience. Additionally, governments and private operators invest in organized transport services to cater to tourists and event attendees, thereby boosting bus utilization and strengthening the overall growth in the region.

Drivers & Opportunities

Shift Toward Electric & Eco-Friendly Buses: The shift toward electric and eco-friendly buses is driving the expansion opportunities as the region places increasing focus on sustainable transportation solutions to reduce environmental impact. Governments and operators are focusing on cleaner alternatives to conventional diesel-powered fleets with rising concerns over carbon emissions and air quality. According to World Air Quality Index (AQI) data, Doha, Qatar, recorded an unhealthy PM2.5 level of 111 in August 2025, indicating substantial air pollution. Electric and hybrid buses support climate goals and also offer long-term cost efficiencies through reduced fuel dependency and maintenance requirements. This transition aligns with broader sustainability agendas and urban development plans, making eco-friendly buses central to the modernization of public transport systems across the region.

Government Investments in Public Transport: Government investments in public transport stand as another crucial driver, shaping the growth opportunities. Strategic funding directed toward expanding bus fleets, upgrading infrastructure, and integrating advanced technologies has greatly enhanced the quality and accessibility of public transit. For instance, in 2021, Saudi Arabia granted USD 147 billion for transport/logistics by 2030, with USD 9.06 billion allocated in its 2023 budget for infrastructure and transportation, as part of Vision 2030’s push to enhance connectivity and economic diversification. These initiatives aim to reduce road congestion, improve urban mobility, and encourage a modal shift from private vehicles to public transportation. Governments are creating a supportive environment for market growth by prioritizing bus systems as part of broader urban planning strategies, while ensuring long-term sustainability and efficiency of regional transport networks.

Segmental Insights

Length Analysis

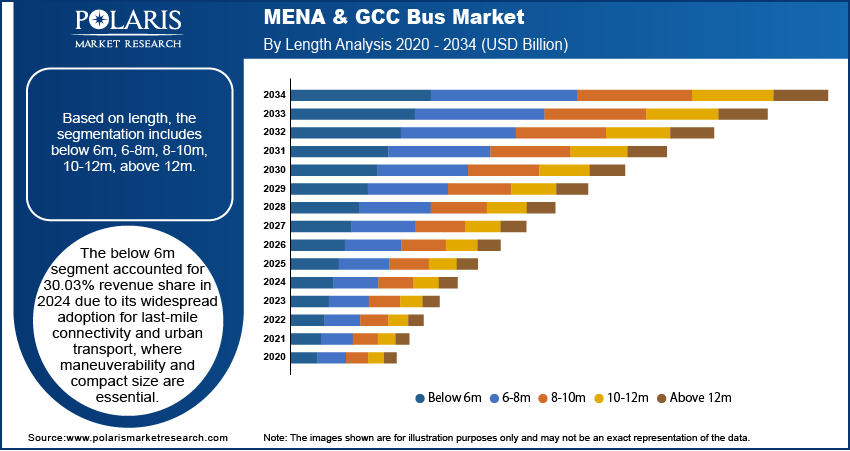

Based on length, the segmentation includes below 6m, 6-8m, 8-10m, 10-12m, above 12m. The below 6m segment accounted for 30.03% revenue share in 2024 due to its widespread adoption for last-mile connectivity and urban transport, where maneuverability and compact size are essential. These smaller buses are increasingly utilized in densely populated urban areas and narrow city routes, offering flexibility and efficiency for short-distance travel.

The 6-8m segment is expected to grow at a significant pace with a CAGR of 3.1% supported by rising demand from medium-sized cities and suburban areas, where these buses strike a balance between passenger capacity and operational efficiency. Their ability to serve both short and mid-range routes positions this category as a strong contributor to the future growth of the bus market.

Fuel Type Analysis

In terms of fuel type, the segmentation includes diesel, electric, hybrid, and alternative fuel. The diesel segment dominated the revenue share with 87.85% in 2024 due to the long-established infrastructure supporting diesel fuel and the cost-effectiveness of diesel-powered fleets across the region. Diesel buses remain a reliable option for high-capacity and long-distance routes, ensuring widespread adoption.

The electric segment is projected to witness fastest growth at a CAGR of 10.09% during the forecast period driven by increasing investments in green mobility, EV charging stations, growing environmental concerns, and supportive policies encouraging fleet electrification. The adoption of electric buses is also propelled by advancements in battery technologies, improved charging infrastructure, and the alignment of regional governments with sustainability goals.

Seating Capacity Analysis

The segmentation, based on seating capacity, includes below 15, 15 to 30, 31 to 50, above 50. The 31 to 50 segment accounted for 33.22% share in 2024 primarily due to its suitability for urban and intercity routes, offering an optimal balance of passenger accommodation and operational efficiency. This segment is widely preferred for transit systems as it can manage high ridership volumes while maintaining cost-effective operations.

The 15 to 30 segment is expected to grow at a significant pace with a CAGR of 3.4% during the forecast period driven by its rising adoption for shorter routes, school transportation, and shuttle services. Its versatility and adaptability to changing operational needs make it an attractive choice for both private operators and public transport networks.

Application Analysis

Based on application, the segmentation includes, transit bus, intercity/motor coaches, school bus, tourist bus, staff pickup/hotel shuttle, others. The transit bus segment accounted for 34.73% share in 2024 due to its central role in urban mobility, catering to large populations, and offering a sustainable alternative to private vehicles. These buses form the backbone of public transportation systems in metropolitan areas, providing frequent and affordable services.

The intercity/motor coaches segment is expected to witness robust growth at a CAGR of 3.6% during the forecast period owing to increasing regional connectivity demands and rising passenger preference for comfortable and reliable long-distance travel. Additionally, enhanced road networks and expanding tourism further support the growing adoption of intercity buses in the region.

Regional Analysis

MENA Bus Market Insight

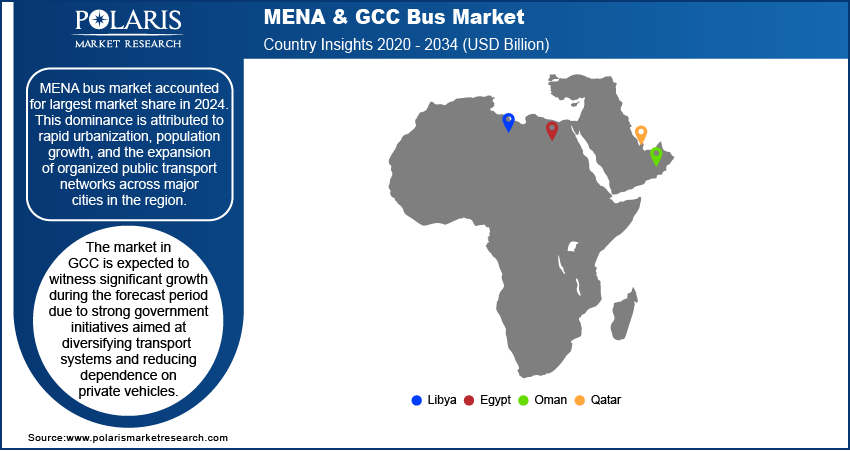

MENA bus market accounted for largest market share in 2024. This dominance is attributed to rapid urbanization, population growth, and the expansion of organized public transport networks across major cities in the region. Investments in infrastructure and increasing reliance on buses as a primary mode of mobility have further strengthened market growth. The region’s focus on modernizing fleets, integrating advanced technologies, and transitioning toward eco-friendly alternatives has also supported its leading position in the overall bus market landscape.

Israel Bus Market Insight

Israel held significant market share in MENA truck landscape in 2024 due to due to its well-developed transportation infrastructure and strategic focus on modernizing commercial vehicle fleets. The country’s focus on efficient logistics networks and urban connectivity has driven demand for versatile trucks capable of handling both urban deliveries and long-haul operations. Additionally, advanced technological integration in fleet management and maintenance has enhanced operational efficiency, further strengthening Israel’s position in the regional truck market.

GCC Bus Market

The market in GCC is expected to witness significant growth during the forecast period due to strong government initiatives aimed at diversifying transport systems and reducing dependence on private vehicles. Large-scale urban development projects, expanding road networks, and a rising focus on sustainable mobility are further driving demand for modern bus fleets in the region. Additionally, the integration of smart technologies and increasing adoption of electric buses are anticipated to enhance the efficiency and attractiveness of bus transportation in GCC, contributing to consistent market expansion.

KSA Bus Market Overview

The market in KSA captured 42.44% share of the GCC landscape in 2024 driven by rapid economic development, expansive infrastructure projects, and strong industrial activity. The growing need for freight transportation across urban and industrial hubs has boosted demand for high-capacity and reliable trucks. Government initiatives to support logistics, trade, and transport efficiency, coupled with investments in road networks, have further reinforced KSA’s dominance within the industry.

Key Players & Competitive Analysis Report

The MENA & GCC bus industry is witnessing dynamic competition as players like Yutong, Mercedes-Benz, and Volvo pursue strategic investments in emerging market segments and technological advancements. These companies are leveraging sustainable value chains and future development strategies to capitalize on latent demand and opportunities, particularly in electric and smart mobility solutions.

Revenue growth is being fueled by rapid urbanization and ambitious government initiatives such as Saudi Arabia's Vision 2030, while economic and geopolitical shifts continue to influence expansion opportunities across the region. Competitive intelligence reveals an industry focus on major disruptions and trends, including autonomous buses and last-mile connectivity solutions, with Chinese manufacturers gaining significant traction through their cost-efficient offerings.

Expert insights highlight high-growth markets like the UAE and Qatar, where favorable macroeconomic trends and mega-events are driving substantial demand for advanced transportation solutions. Vendors must strategically align with industry trends, optimize their product offerings, and effectively navigate ongoing supply chain disruptions to maintain competitive positioning in this evolving landscape.

Major companies operating in the MENA & GCC bus industry include Ankai Automobile Co. Ltd.; Ashok Leyland Ltd.; Higer Bus Company Limited; MAN Truck & Bus; Mercedes-Benz Group AG; Scania; Toyota Motor Corporation; Volvo Buses; Xiamen King Long International Trading Co., Ltd.; and Yutong Bus Co., Ltd.

Key Players

- Ankai Automobile Co. Ltd.

- Ashok Leyland Ltd.

- Higer Bus Company Limited

- MAN Truck & Bus

- Mercedes-Benz Group AG

- Scania

- Toyota Motor Corporation

- Volvo Buses

- Xiamen King Long International Trading Co.,Ltd.

- Yutong Bus Co., Ltd.

Industry Developments

- June 2025: Tata Motors and Al Hamad Automobiles launched the Euro VI-compliant LPO 1622 bus in Qatar for staff transport. Featuring a 220hp Cummins engine, advanced safety systems, and flexible 61/65-seat configurations, it prioritizes operational efficiency and passenger comfort.

MENA & GCC Bus Market Segmentation

By Length Outlook (Volume, Units; Revenue, USD Billion, 2020–2034)

- Below 6m

- 6-8m

- 8-10m

- 10-12m

- Above 12m

By Fuel Type Outlook (Volume, Units; Revenue, USD Billion, 2020–2034)

- Diesel

- Electric

- Hybrid

- Alternative Fuel

By Seating Capacity Outlook (Volume, Units; Revenue, USD Billion, 2020–2034)

- Below 15

- 15 to 30

- 31 to 50

- Above 50

By Application Outlook (Volume, Units; Revenue, USD Billion, 2020–2034)

- Transit Bus

- Intercity/Motor coaches

- School Bus

- Tourist Bus

- Staff Pickup/Hotel Shuttle

- Others

By Region Outlook (Volume, Units; Revenue, USD Billion, 2020–2034)

- MENA

- Iran

- Israel

- Egypt

- Algeria

- Iraq

- Jordan

- Lebanon

- Libya

- Morocco

- Tunisia

- Syria

- Yemen

- Djibouti

- Malta

- GCC

- KSA

- UAE

- Qatar

- Kuwait

- Oman

- Bahrain

MENA & GCC Bus Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.73 Billion |

|

Market Size in 2025 |

USD 1.79 Billion |

|

Revenue Forecast by 2034 |

USD 2.46 Billion |

|

CAGR |

3.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Units; Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.73 billion in 2024 and is projected to grow to USD 2.46 billion by 2034.

The market is projected to register a CAGR of 3.6% during the forecast period.

MENA bus market accounted for largest market share in 2024.

A few of the key players in the market are Ankai Automobile Co. Ltd.; Ashok Leyland Ltd.; Higer Bus Company Limited; MAN Truck & Bus; Mercedes-Benz Group AG; Scania; Toyota Motor Corporation; Volvo Buses; Xiamen King Long International Trading Co., Ltd.; and Yutong Bus Co., Ltd.

The below 6m segment accounted for 30.03% revenue share in 2024.

The electric segment is projected to witness fastest growth at a CAGR of 10.09% during the forecast period.