MENA & GCC Truck Market Size, Share, Trends, Industry Analysis Report

By Tonnage (Less than 10 ton, 10-30 ton), By Type, By Propulsion, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6375

- Base Year: 2024

- Historical Data: 2020-2023

Overview

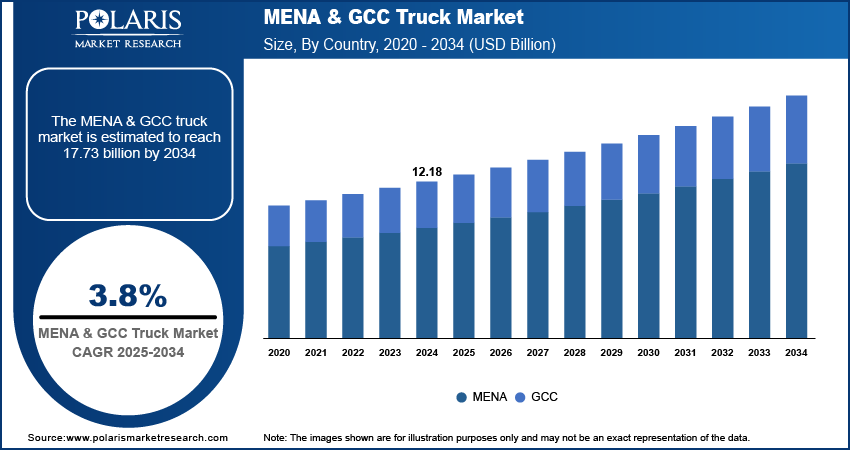

The MENA & GCC truck market size was valued at USD 12.18 billion in 2024, growing at a CAGR of 3.8% from 2025 to 2034. Key factors driving industry growth include rising demand for refrigerated & specialized trucks, infrastructure development & mega projects, rising e-commerce industry, and the rising adoption of electric vehicles.

Key Insights

- The 10-30-ton segment led in revenue share in 2024, as its versatility serves multiple sectors such as construction, logistics, and industrial operations effectively.

- The non-tractor trucks segment is expected to register the highest CAGR of 3.9% during the forecast period, favored for short-haul and urban deliveries due to their maneuverability and efficiency.

- Diesel trucks dominated in 2024, supported by heavy-duty use and widespread fuel infrastructure, making them the preferred choice for long-haul transport.

- The freight and logistics segment is expected to expand at a 3.9% CAGR during 2025–2034, driven by rising trade demand and the need for efficient domestic and cross-border goods movement.

- MENA held the major MENA & GCC truck market share in 2024, fueled by large-scale infrastructure projects, industrial growth, and increasing logistics needs across the region.

- Israel led in the MENA truck industry in 2024 due to its tech-driven logistics, strong manufacturing, and advanced transport infrastructure supporting efficient goods movement.

- The GCC truck market is expected to grow significantly in the coming years, supported by booming construction, mega-projects, and industrial expansion, driving demand for heavy and medium-duty vehicles.

- Saudi Arabia captured 42.44% of the GCC truck market in 2024, driven by Vision 2030 projects, industrial growth, and a rapidly expanding logistics sector.

Industry Dynamics

- Surging online shopping fuels demand for efficient logistics, increasing need for light/medium-duty trucks to enable faster last-mile deliveries and robust distribution networks.

- Growing electric truck use supports sustainability targets, offering cleaner, cost-effective transport solutions for urban and short-haul logistics operations.

- High upfront costs of electric trucks and limited charging infrastructure slow adoption, despite long-term savings, particularly in price-sensitive markets.

- GCC megaprojects will drive demand for heavy-duty and specialized trucks, creating significant revenue potential by 2030.

Market Statistics

- 2024 Market Size: USD 12.18 billion

- 2034 Projected Market Size: USD 17.73 billion

- CAGR (2025–2034): 3.8%

- MENA: Largest market in 2024

AI Impact on MENA & GCC Truck Market

- AI optimizes truck routes, fuel use, and maintenance through real-time data, cutting costs for fleet operators in logistics and construction sectors.

- GCC trials self-driving trucks for deserts/highways, reducing labor costs and improving long-haul safety with AI collision avoidance.

- AI analyzes trade, weather, and infrastructure projects to forecast regional truck demand, helping manufacturers align production with Saudi/UAE market needs.

- AI manages battery-swap networks and charging for e-trucks, supporting GCC’s net-zero goals by optimizing energy use in hot climates.

A truck, broadly defined as a motor vehicle designed for transporting goods and materials, plays a critical role in supporting diverse industries across the MENA and GCC. The market is driven by the rising demand for refrigerated and specialized trucks, which cater to sectors such as food and beverage, pharmaceuticals, and perishable goods. The need for reliable cold-chain logistics has increased, pushing fleet operators to invest in advanced refrigerated solutions as consumer preferences shift toward fresh and temperature-sensitive products. Moreover, specialized trucks designed for oil, gas, chemicals, and construction sectors are gaining traction, ensuring safe and efficient transport of sensitive or heavy-duty cargo. This trend highlights how the growing reliance on industry-specific logistics is reshaping fleet modernization and fueling demand for specialized truck categories.

The rapid pace of infrastructure development and large-scale mega projects contribute to the expansion opportunities. The demand for heavy-duty trucks to transport construction materials, machinery, and equipment has greatly strengthened with governments investing heavily in expanding road networks, industrial zones, smart cities, and energy projects. Trucks are becoming essential enablers of progress, supporting the seamless execution of projects that form the backbone of regional economic diversification strategies. In addition, sustained growth in cross-border trade and urban development initiatives highlights the critical role of trucks in maintaining supply chain efficiency and supporting regional connectivity. This alignment of infrastructure growth with logistics demand continues to drive the expansion across MENA and GCC.

Drivers & Opportunities

Rising E-Commerce Industry: The rising e-commerce industry is driving growth opportunities as it directly boosts the demand for efficient logistics and last-mile delivery solutions. According to a 2023 E-Commerce Report on the MENA, the UAE's e-commerce market was valued at USD 7.5 billion in 2023 and will exceed USD 13.3 billion by 2028. Businesses require a strong distribution network supported by light- and medium-duty trucks to ensure timely deliveries as consumers increasingly rely on online platforms for a wide range of products. This trend has accelerated the utilization of trucks for urban and intercity transport and has also driven fleet diversification to handle varying delivery volumes and schedules. As a result, the growth of e-commerce continues to reshape the logistics ecosystem, positioning trucks as an essential asset for meeting evolving customer expectations in terms of speed, reliability, and service efficiency.

Rising Adoption of Electric Vehicles: The rising adoption of electric vehicles (EVs) is transforming the growth opportunities, aligning with regional sustainability goals and the push toward reducing carbon emissions. Governments and fleet operators are increasingly considering electric trucks as a viable solution for cleaner and more cost-efficient transportation, particularly in urban and short-haul operations. In May 2024, Newrizon partnered with Al Yemni Group as its exclusive GCC dealer for electric trucks. The agreement supports regional sustainability goals in Saudi Arabia, the UAE, and Bahrain, offering EV solutions with battery-swap technology and lower operating costs. These vehicles help reduce dependency on fossil fuels and lower long-term operational costs through reduced maintenance and energy efficiency. Additionally, the integration of EVs into logistics fleets enhances corporate environmental responsibility, making them an attractive choice for businesses aiming to meet green targets. This growing shift toward electrification is steadily shaping the future trajectory of the regional truck market.

Segmental Insights

Tonnage Analysis

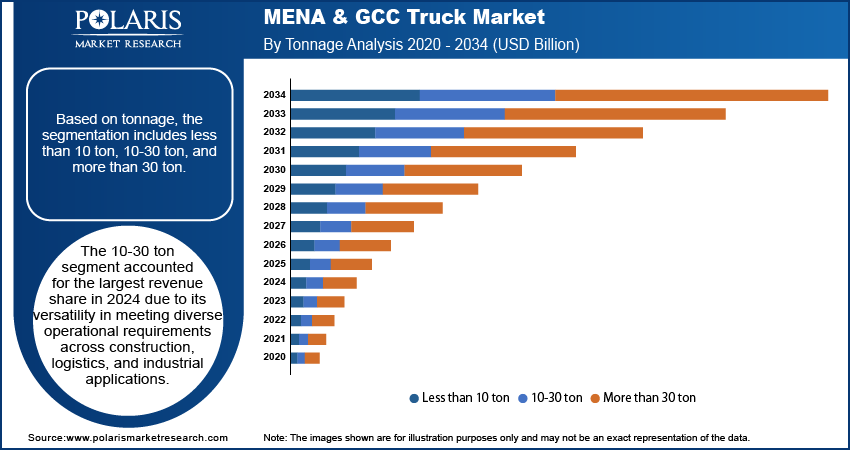

Based on tonnage, the segmentation includes less than 10 ton, 10-30 ton, and more than 30 ton. The 10-30 ton segment accounted for the largest revenue share in 2024 due to its versatility in meeting diverse operational requirements across construction, logistics, and industrial applications. Trucks in this category create a balance between payload capacity and maneuverability, making them suitable for both urban distribution and medium-haul transport. Their adaptability to multiple industries and ability to handle varied cargo volumes position them as a preferred choice for fleet operators. Moreover, the rising demand for reliable mid-range trucks to support infrastructure and commercial projects further reinforces their dominance in the market.

The more than 30 ton segment is expected to register a significant CAGR of 4.0% during the forecast period. The growth is supported by increasing investments in heavy construction, mining, and large-scale infrastructure development across the region. These trucks provide superior hauling capacity and durability, enabling them to handle bulk materials, oversized cargo, and demanding off-road conditions. Their adoption is also driven by the expansion of industrial zones, mega-projects, and cross-border trade, which require long-haul and heavy-duty transportation solutions. The growth trajectory of this segment reflects the rising importance of large-scale trucking fleets in supporting regional economic expansion and industrial activities.

Type Analysis

In terms of type, the segmentation includes non-tractor truck and tractor truck. The tractor truck segment dominated the revenue share in 2024 due to its efficiency in long-haul freight movement and ability to tow large loads across extended distances. Tractor trucks are integral to regional and international logistics, facilitating the bulk transportation of goods across borders and supporting trade networks. Their higher load-bearing capacity and adaptability to multiple trailer configurations make them the backbone of freight and logistics operations. This strong demand highlights their essential role in connecting supply chains and enabling efficient goods movement across the MENA and GCC.

The non-tractor truck segment is projected to witness the highest CAGR of 3.9% during the forecast period, driven by its suitability for short-haul operations and urban distribution. These trucks are widely utilized for delivering construction materials, industrial supplies, and perishable goods within city limits, where maneuverability and operational flexibility are critical. Their lower operational costs and adaptability to specialized applications, such as refrigerated or utility trucks, further enhance their market potential. Non-tractor trucks are increasingly being adopted by businesses to optimize their delivery networks as cities expand and last-mile logistics gain prominence.

Propulsion Analysis

The segmentation, based on propulsion, includes below diesel, gasoline, and other. The diesel segment accounted for the largest share in 2024, primarily due to its dominance in heavy-duty applications and widespread availability of fueling infrastructure. Diesel trucks are favored for their superior torque, fuel efficiency, and durability, making them well-suited for long-distance and demanding industrial operations. Their reliability in handling heavy payloads and ability to operate efficiently in varied terrains reinforce their continued preference among fleet operators. Additionally, the well-established supply chain for diesel fuel ensures uninterrupted operations, further consolidating the dominance of this segment.

The gasoline segment is expected to register the highest CAGR of 3.6% during the forecast period, driven by its increasing adoption in light- and medium-duty trucks used for urban and regional transport. Gasoline trucks are preferred for their lower upfront costs, quieter operations, and ease of maintenance compared to diesel counterparts. Their suitability for short-haul logistics, last-mile delivery, and urban distribution aligns with the rising demand from e-commerce and retail sectors. The expansion of urban transportation needs and preference for cost-effective solutions are likely to sustain the growth of this segment.

Application Analysis

Based on application, the segmentation includes construction and mining, freight and logistics, and others. The construction and mining segment accounted for the largest share in 2024 due to the extensive use of heavy-duty trucks in transporting raw materials, equipment, and aggregates for large-scale infrastructure projects. Trucks in this segment are critical for ensuring timely material supply and supporting the efficiency of construction and mining operations. Their durability and ability to withstand harsh operating conditions make them essential in these sectors, which remain major contributors to economic development across the region.

The freight and logistics segment is expected to witness significant growth at a CAGR of 3.9% during the forecast period, owing to the rising demand for efficient goods movement across domestic and international trade networks. Trucks are increasingly being used to facilitate distribution across industries such as retail, manufacturing, and food supply chains, reflecting the sector’s expanding logistics requirements. The growth of e-commerce, coupled with regional trade integration, further emphasizes the importance of trucks in ensuring timely deliveries and maintaining supply chain continuity.

Regional Analysis

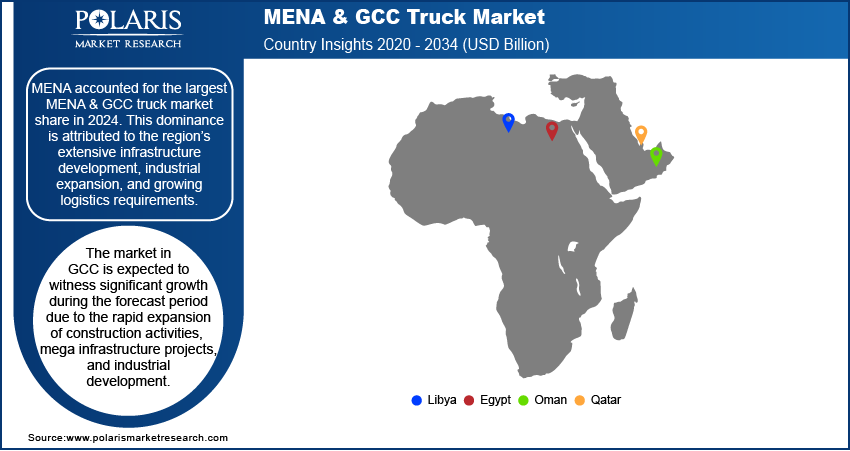

MENA Truck Market Insights

The MENA accounted for the largest market share in 2024. This dominance is attributed to the region’s extensive infrastructure development, industrial expansion, and growing logistics requirements. Rising demand from construction, mining, and large-scale energy projects has boosted the need for heavy-duty trucks. At the same time, the growth of retail and e-commerce sectors has increased the utilization of medium- and light-duty trucks for urban and regional deliveries. The combination of diverse applications and government-backed investments in transportation networks has positioned the MENA as a key hub for truck demand. This broad market base reflects the strategic role of trucks in supporting economic diversification and trade connectivity.

Israel Truck Market Trends

Israel held a significant market share in the MENA truck landscape in 2024 due to its advanced logistics infrastructure, strong manufacturing base, and growing focus on technology-driven transport solutions. The country’s well-developed road networks and cross-border trade links support consistent demand for both heavy- and medium-duty trucks. Furthermore, Israel’s increasing adoption of modern fleet management systems and preference for efficient, specialized trucks have boosted its market position. The focus on sustainability and gradual integration of alternative propulsion technologies also contributes to shaping the dynamics of the Israel truck market.

GCC Truck Market Analysis

The market in GCC is expected to witness significant growth during the forecast period due to the rapid expansion of construction activities, mega infrastructure projects, and industrial development. According to a November 2023 ITA report, the UAE's construction sector is projected to grow steadily at up to 4.7% annually over the next five years. Governments across the region are investing heavily in smart cities, energy projects, and transport corridors, creating robust demand for trucks across multiple applications. Additionally, the GCC’s role as a regional trade hub amplifies the importance of efficient freight and logistics networks, where trucks remain a backbone for goods transportation. The combination of large-scale development and rising trade flows continues to strengthen growth opportunities in the GCC truck market.

KSA Truck Market Overview

The market in KSA captured 42.44% share of the GCC landscape in 2024, driven by the country’s infrastructure projects, large-scale industrial expansion, and growing logistics sector. Saudi Arabia’s demand for trucks is reinforced by its energy projects, construction initiatives, and diversification efforts under its national development plans as the largest economy in the GCC. The country’s geographic position as a logistics hub connecting regional and global trade routes further boosts the importance of trucks in its transport ecosystem. This strong foundation of economic activities and logistics integration has made KSA the leading contributor to the growth opportunities.

Key Players & Competitive Analysis

The MENA & GCC truck industry is witnessing intense competition driven by strategic investments and emerging technologies, with global and regional players aiming for dominance. Revenue opportunities are expanding as governments prioritize infrastructure megaprojects and logistics modernization under initiatives such as Saudi Vision 2030. Competitive intelligence reveals Chinese brands gaining traction through affordable offerings, while established players such as Volvo and Mercedes-Benz focus on sustainable value chains via electric and hydrogen trucks. Economic and geopolitical shifts, including trade corridor developments, are reshaping growth projections. Disruptions and trends such as battery-swap technology and local assembly partnerships are altering vendor strategies. Small and medium-sized businesses are entering last-mile delivery segments, leveraging latent demand for light-duty EVs. Supply chain disruptions and localization policies are influencing regional footprints, while technological advancements in autonomous trucks present expansion opportunities. The sector’s future development strategies will hinge on balancing cost efficiency with decarbonization mandates.

A few major companies operating in the MENA & GCC truck industry include AB Volvo; Anhui Ankai Automobile Co., Ltd; Beiqi Foton Motor Co., Ltd.; BYD Company Limited; Daimler Truck Holding AG; EMENA & GCC Truckco; Golden Dragon (Xiamen Golden Dragon MENA & GCC Truck Co., Ltd.); Higer MENA & GCC Truck Company Limited; Iveco Group N.V.; MAN Truck & MENA & GCC Truck; Renault Group; Scania AB; Shanghai Sunwin MENA & GCC Truck Co., Ltd.; Solaris MENA & GCC Truck & Coach sp. z o.o.; Sunlong Automobile; TEMSA; Xiamen King Long United Automotive Industry Co., Ltd.; Yutong MENA & GCC Truck Co., Ltd.; and Zhongtong MENA & GCC Truck Holding Co., Ltd.

Key Players

- AB Volvo

- Fiat Professional (Stellantis NV)

- Ford Motor Co

- ISUZU MOTORS INTERNATIONAL FZE

- Iveco

- MAN

- Mercedes-Benz Group AG

- Toyota Motor Corporation

- UD Trucks Corporation

- Volkswagen AG

MENA & GCC Truck Industry Developments

- July 2025: UD Trucks launched the new light-duty Kuzer (7.5-8.5-ton GVW) truck in Malaysia, featuring improved payload, fuel efficiency, and emissions. Standard safety upgrades include ABS, airbags, and LED lights, while retaining the brand’s design for continuity.

- January 2025: Jameel Motors partnered with China's Farizon Auto to distribute its new energy commercial vehicles in the UAE, including the all-electric Farizon SV truck. The agreement supports the UAE's shift toward sustainable transport solutions.

MENA & GCC Truck Market Segmentation

By Tonnage Outlook (Volume, Units; Revenue, USD Billion, 2020–2034)

- Less than 10 ton

- 10-30 ton

- More than 30 ton

By Type Outlook (Volume, Units; Revenue, USD Billion, 2020–2034)

- Non-Tractor Truck

- Tractor Truck

By Propulsion Outlook (Volume, Units; Revenue, USD Billion, 2020–2034)

- Diesel

- Gasoline

- Other

By Application Outlook (Volume, Units; Revenue, USD Billion, 2020–2034)

- Construction and Mining

- Freight and Logistics

- Others

By Regional Outlook (Volume, Units; Revenue, USD Billion, 2020–2034)

- MENA

- Iran

- Israel

- Egypt

- Algeria

- Iraq

- Jordan

- Lebanon

- Libya

- Morocco

- Tunisia

- Syria

- Yemen

- Djibouti

- Malta

- GCC

- KSA

- UAE

- Qatar

- Kuwait

- Oman

- Bahrain

MENA & GCC Truck Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 12.18 Billion |

|

Market Size in 2025 |

USD 12.63 Billion |

|

Revenue Forecast by 2034 |

USD 17.73 Billion |

|

CAGR |

3.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Units; Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 12.18 billion in 2024 and is projected to grow to USD 17.73 billion by 2034.

The market is projected to register a CAGR of 3.8% during the forecast period.

MENA accounted for the largest share of the MENA & GCC truck market in 2024.

A few of the key players in the market are AB Volvo; Anhui Ankai Automobile Co., Ltd; Beiqi Foton Motor Co., Ltd.; BYD Company Limited; Daimler Truck Holding AG; EMENA & GCC Truckco; Golden Dragon (Xiamen Golden Dragon MENA & GCC Truck Co., Ltd.); Higer MENA & GCC Truck Company Limited; Iveco Group N.V.; MAN Truck & MENA & GCC Truck; Renault Group; Scania AB; Shanghai Sunwin MENA & GCC Truck Co., Ltd.; Solaris MENA & GCC Truck & Coach sp. z o.o.; Sunlong Automobile; TEMSA; Xiamen King Long United Automotive Industry Co., Ltd.; Yutong MENA & GCC Truck Co., Ltd.; and Zhongtong MENA & GCC Truck Holding Co., Ltd.

The 10-30 ton segment accounted for the largest revenue share in 2024.

The non-tractor truck segment is projected to witness the highest CAGR of 3.9% during the forecast period.