Metabolic Testing Market Share, Size, Trends, Industry Analysis Report

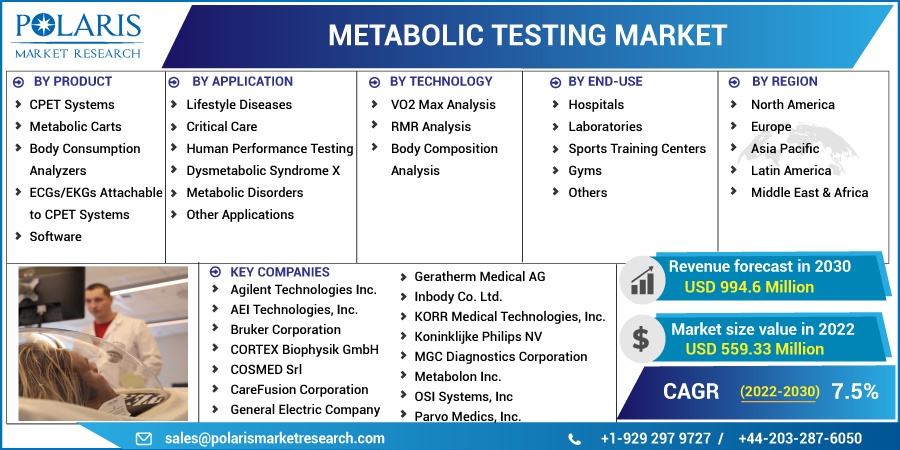

By Product; By Application; By Technology (VO2 Max Analysis, RMR Analysis, Body Composition Analysis); By End-Use; By Region; Segment Forecast, 2022-2030

- Published Date:Dec-2022

- Pages: 117

- Format: PDF

- Report ID: PM2878

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

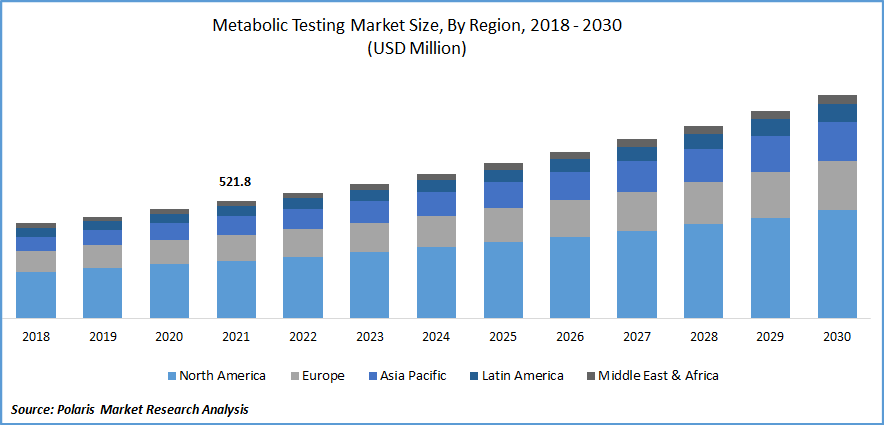

The global metabolic testing market was valued at USD 521.8 million in 2021 and is expected to grow at a CAGR of 7.5% during the forecast period.

An organism's metabolic activity is a chemical reaction and physical process that keeps it in a living state by maintaining functions like breathing, blood flow, muscle contraction, absorption of nutrients and vitamins, elimination of wastes including urine, temperature regulation, and nerve and brain feature. It is a pathway that starts with a particular molecule and a series of chemical processes, and it leads to a product with the aid of a particular enzyme. The health and welfare of an individual are assessed using metabolic testing equipment.

Know more about this report: Request for sample pages

The global market for metabolic testing is anticipated to develop over the coming years as a result of rising healthcare spending, and growing public awareness of health issues. People from developing nations are currently putting more money into healthcare services. The rise in the worldwide population's demand for high-quality healthcare improved healthcare infrastructure, and rising disposable income are driving the market.

The market is anticipated to increase as new technologies are increasingly used by metabolic testing equipment. In May 2022, the Mayo Clinic created a new app that securely and seamlessly communicates electrocardiogram (ECG) signals from Apple Watches taken outside of clinical settings to the medical facility so that artificial intelligence (AI) analysis can be used to find the life-threatening, undiagnosed heart condition known as left ventricular dysfunction.

Furthermore, the market is growing as more industry participants develop new metabolic testing devices. For instance, in January 2022, Royal Philips announced the release of a 12-lead, full-service, at-home ECG solution that will be used in decentralized clinical studies. Combining data readings that are significant compared to clinical, site-based ECGs with Philips, introduced clinical-grade ECG offerings within the cardiac monitoring, which then in turn supports the innovation across the healthcare ecosystem.

The COVID-19 pandemic is anticipated to boost market expansion. The COVID-19 epidemic has led to an increase in sedentary behaviors and unhealthy eating patterns. This resulted from the necessary social isolation promoted to stop the spread of SARS-CoV-2, which put a heavy social, economic, and psychological burden on the affected individuals. The market for metabolic medications is anticipated to grow since obese patients continue to have a greater risk of COVID-19 contraction.

Additionally, due to lockdowns and orders to stay at home, people's lifestyles have grown even more sedentary. Due to changes in lifestyle and the growing convenience of home delivery, many people consume unhealthy fats and carbohydrate-based beverages. More people are selecting home workout routines and fitness seminars as a result of rising health consciousness. It is anticipated that these developments would affect the demand for metabolic testing for monitoring systems.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising prevalence of lifestyle diseases such as obesity and diabetes which increase the demand for metabolic testing is the major factor driving the growth of the market. The number of patients with various ailments or diseases has noticeably increased recently. For instance, as per the World Obesity Organization, 1 in 5 women and 1 in 7 men would be obese by the year 2030. In 2019, there were more than 160 million deaths worldwide attributed to having a high BMI, and the number is projected to rise even further. This represents more than 20% of all life wasted as a result of avoidable chronic illness.

Furthermore, as per the CDC, one in ten Americans, or even more than 37 million people, have diabetes, and around 90–95% of them, have type 2 diabetes. The majority of persons with type 2 diabetes are over the age of 45, but it is also more common in kids, teenagers, and young adults. Obesity and Type-2 diabetes are two major lifestyle disorders that are projected to raise demand for metabolic testing and open up new market growth opportunities.

Report Segmentation

The market is primarily segmented based on product, application, technology, end-use, and region.

|

By Product |

By Application |

By Technology |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Body Consumption Analyzers segment is expected to witness the fastest growth

Body composition analyzers are instruments that measure different body parts and provide their corresponding values at the examination site. In particular, causality observational studies in anthropology, nutrition, epidemiology, and other fields, as well as sports and medical research, make extensive use of body composition analyzers. The category is fueled by the leading market players launching new products and the increased prevalence of lifestyle disorders.

Furthermore, the market for body composition analyzers and other fat monitoring technology is projected to expand in emerging nations since they have a higher burden of obesity-related illnesses. Sales of body composition analyzers have surged, supporting the category growth, due to the obese population's vulnerability to lifestyle issues.

The lifestyle disease segment industry accounted for the highest market share in 2021

The market for metabolic testing is anticipated to expand significantly over the coming years as a result of the rising incidence of lifestyle disorders such as type 2 diabetes, overweight, and cardiovascular conditions. For instance, the American Diabetes Association (ADA) estimates that 37.3 million Americans had diabetes in 2019. In contrast, around 1.9 million Americans, including 244,000 children and teenagers, had type 1 diabetes. Therefore, it is anticipated that the high prevalence of diabetes will fuel the expansion of the global market for metabolic testing over the forecast period.

Additionally, as per the WHO, 1.2 Bn individuals worldwide suffer from hypertension, with 2/3 of them living in low & middle-income nations. The need for metabolic testing is therefore anticipated to rise as a result of the growing trend of monitoring health parameters and the increasing occurrence of such lifestyle disorders.

The demand in North America is expected to witness significant growth

North America leads the global market for metabolic testing due to the rising frequency of metabolic disorders, heart diseases, and cardiovascular diseases, as well as the development of equipment and technologies for metabolic testing. As per CDC, in July 2022, coronary heart disease (CHD) is the most prevalent condition, affecting over 20.1 million persons in the country who are 20 years of age and older.

Moreover, Asia Pacific is predicted to experience the fastest growth during the projection period due to the rising need for high-quality medical solutions and rising living standards. Increased spending on research and development in the healthcare sector, supported by both public and private initiatives, is also anticipated to spur market expansion. Additionally, the region's demand for metabolic testing is being driven by an increase in the elderly population and public awareness.

Competitive Insight

Key players include Agilent Technologies, AEI Technologies, Bruker Corporation, CORTEX Biophysik, COSMED, CareFusion Corporation, General Electric, Geratherm Medical, Inbody, Human Metabolome, KORR Medical, Koninklijke Philips NV, MGC Diagnostics, Metabolon, Microlife Medical, OSI Systems, Parvo Medics, and Thermo Fisher Scientific.

Recent Developments

In February 2022, KardiaMobile Card, the most practical personal ECG gadget, was introduced by AliveCor. The KardiaMobile Card is a regular credit card size and meets any wallet with ease. It provides a single-lead ECG of healthcare quality in 30 seconds.

Metabolic Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 559.33 million |

|

Revenue forecast in 2030 |

USD 994.6 million |

|

CAGR |

7.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments Covered |

By Product, By Application, By Technology, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Agilent Technologies Inc., AEI Technologies, Inc., Bruker Corporation, CORTEX Biophysik GmbH, COSMED Srl, CareFusion Corporation, General Electric Company, Geratherm Medical AG, Inbody Co. Ltd., Human Metabolome Technologies Inc., KORR Medical Technologies, Inc., Koninklijke Philips NV, MGC Diagnostics Corporation, Metabolon Inc., Microlife Medical Home Solutions, Inc., OSI Systems, Inc., Parvo Medics, Inc., and Thermo Fisher Scientific, Inc. |