Metal Powder Market Size, Share, Trends, & Industry Analysis Report

By Production Method (Chemical, Mechanical, and Physical), By Type, By Application, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 122

- Format: PDF

- Report ID: PM1832

- Base Year: 2024

- Historical Data: 2020-2023

Overview

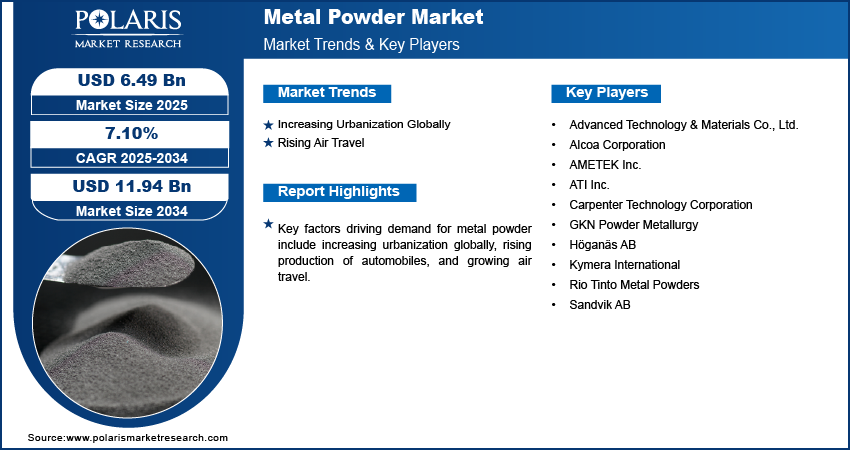

The global metal powder market size was valued at USD 6.10 billion in 2024, growing at a CAGR of 7.01% from 2025 to 2034. Key factors driving demand for metal powder include increasing urbanization globally, rising production of automobiles, and growing air travel.

Key Insights

- The chemical segment accounted for 61.41% of the revenue share in 2024 due to its ability to deliver powders with high purity.

- The automotive segment accounted for 69.00% of the revenue share in 2024 due to manufacturers' reliance on powder metallurgy to produce components.

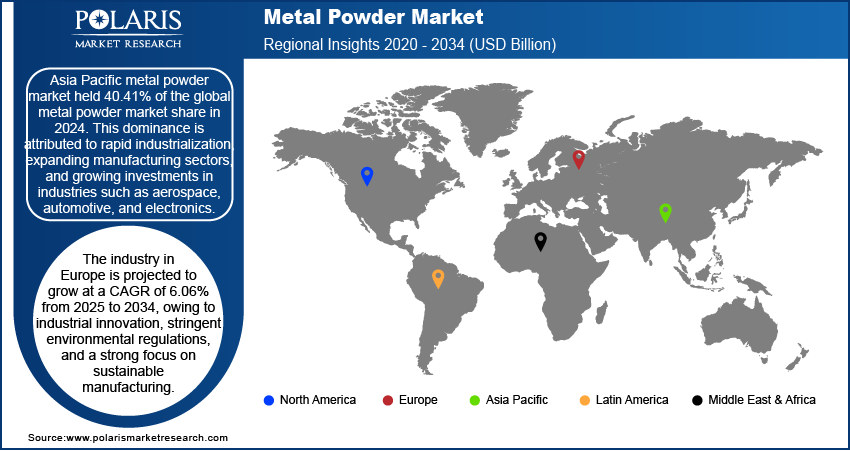

- Asia Pacific metal powder market held 40.41% of the global metal powder market share in 2024, owing to rapid industrialization.

- China held 40.36% of the revenue share in the Asia Pacific metal powder landscape in 2024, due to the rising production of EVs.

- The industry in Europe is projected to grow at a CAGR of 6.06% from 2025 to 2034, owing to industrial innovation and stringent environmental regulations.

Industry Dynamics

- Increasing urbanization globally is fueling the adoption of metal powders by increasing the construction of high-rise buildings, bridges, and transportation networks.

- Rising air travel is driving the demand for metal powders as modern aircraft manufacturers are using advanced metal powders in additive manufacturing (3D printing) and powder metallurgy to produce complex engine components.

- The increasing industrialization in emerging nations such as India and Vietnam is creating a lucrative market opportunity.

- The high production and handling costs of metal powder may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 6.10 Billion

- 2034 Projected Market Size: USD 11.94 Billion

- CAGR (2025-2034): 7.01%

- Asia Pacific: Largest Market Share

AI Impact on Metal Powder Market

- AI enhances production efficiency by optimizing metal powder manufacturing processes.

- Predictive maintenance via AI reduces downtime in powder production facilities.

- AI-driven quality control ensures consistent powder characteristics for additive manufacturing.

- Demand forecasting using AI improves supply chain management and inventory control.

Metal powder refers to finely divided solid particles of metallic elements or alloys that are produced through processes such as atomization, chemical reduction, electrolysis, or mechanical pulverization. These powders vary in size, shape, and purity depending on the production method. They serve as a crucial raw material across several industries due to their ability to be compacted, molded, and sintered into complex shapes that would otherwise be difficult or costly to manufacture using traditional methods.

What are the types of metal powder?

By elements, a few common types of metal powder are iron and steel, copper, and aluminum. Iron and steel powder is mostly used for brake pads and magnetic products. Copper powder are used in applications that require high corrosion resistance. There is an increasing use of aluminum powder in solar cells, due to the rising focus on renewable energy generation and use. It is also used in fireworks and paints. The expansion of various end-use industries such as automotive, consumer goods, and aerospace boosts the demand for metal powder. The following table provides information on metal powder shipments in North America in 2023 and 2024.

|

North American Metal Powder Shipments |

||

|

|

2023 |

2024 |

|

|

Short Tons |

Short Tons |

|

Iron & Steel |

320,234 |

301,126 |

|

Stainless Steel |

6,300 (E) |

5,607 (E) |

|

Copper & Copper Base/Tin* |

13,056 (E) |

9,497 (E) |

|

Aluminum |

23,650 (E) |

29,000 (E) |

|

Molybdenum |

843 (E) |

987 (E) |

|

Tungsten |

3,186 (E) |

2,750 (E) |

|

Tungsten Carbide |

4,759 (E) |

5,761 (E) |

|

Nickel |

4,400 (E) |

4,100 (E) |

|

|

376,428 |

358,828 (E) |

|

(E) estimate (R) revised |

||

(Source: Powder Metallurgy Fact Sheet, Metal Powder Industries Federation)

Based on alloy or function, metal powder types include alloy powders, stainless steel, refractory metals, and functional powders. Alloy powders are particles that are an alloy in themselves, such as bronze, steel, and brass powders. Stainless steel is mostly used in applications where corrosion resistance is paramount. Refractory metals include powders of high-melting-point metals, including molybdenum, tungsten, and tantalum. Functional powders include silver-based, nickel-based, zinc-based powders, cobalt-based, and copper-based. Each powder type contains different properties and uses.

In the automotive and aerospace industries, metal powders enable the production of lightweight yet durable components through additive manufacturing and powder metallurgy, enhancing fuel efficiency and performance. In construction and industrial machinery, they are widely used for producing high-strength parts, wear-resistant tools, and thermal spray coatings that extend equipment life. Additionally, metal powders play a key role in electronics for manufacturing conductive pastes, magnetic materials, and batteries.

The global demand for metal powder is driven by the rising production of automobiles. According to the European Automobile Manufacturers' Association, in 2022, 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021. This fueled the need for metal powder as automakers use these powders to produce lightweight engine parts, transmission gears, and structural components that enhance fuel efficiency and durability. The ability to mold powders into complex shapes reduces material wastage and lowers production costs, making them attractive for large-scale vehicle manufacturing. Electric vehicle makers are also depending on metal powders for producing battery components, magnetic materials, and lightweight parts that improve energy efficiency and driving range. Therefore, as global production of passenger and commercial vehicles continues to grow, the need for cost-effective, durable, and lightweight automotive parts fuels the need for metal powders.

Drivers & Opportunities/Trends

Increasing Urbanization Globally: Urbanization is driving the construction of high-rise buildings, bridges, and transportation networks, all of which require durable, lightweight, and high-performance materials. Metal powders play a crucial role in producing these advanced construction materials, such as reinforced concrete additives, corrosion-resistant coatings, and specialized alloys for structural use. Additionally, urbanization is fueling the adoption of smart technologies and sustainable solutions, such as electric vehicles and renewable energy systems, which rely on metal powders for batteries, sensors, and efficient manufacturing processes. Hence, as more people move to cities, the demand for metal powders increases in various urban development sectors. United Nations, in its report, stated that the global urban population is projected to increase to around two-thirds of the total population in 2050.

Rising Air Travel: Modern aircraft manufacturers are using advanced metal powders in additive manufacturing (3D printing) and powder metallurgy to produce complex engine components, turbine blades, and structural parts. These processes allow for intricate designs that reduce weight, enhance durability, and lower maintenance costs, critical factors as airlines expand their fleets and upgrade to next-generation planes. The push for more fuel-efficient and environmentally friendly aircraft is further driving innovation, increasing the reliance on high-performance metal powders like titanium, nickel, and aluminum alloys. Therefore, as global air travel grows, so does the need for these specialized materials to meet the industry’s evolving demands. According to the International Air Transport Association (IATA), European carriers had a 4.1% year-on-year increase in demand in May 2025 from May 2024.

Segmental Insights

Production Method Analysis

Based on production method, the segmentation includes chemical, mechanical, and physical. The chemical segment accounted for 61.41% of the revenue share in 2024 due to its ability to deliver powders with high purity, controlled particle size, and superior surface properties. Manufacturers favored this process as it supports critical applications in automotive, aerospace, and electronics, where precision and quality directly influence performance. The method also enabled the production of specialized alloys and fine powders that met the requirements of additive manufacturing and advanced coating technologies. Growing demand from industries that rely on lightweight materials and enhanced thermal or electrical conductivity further strengthened the adoption of chemical processing techniques.

The mechanical segment is projected to grow at a CAGR of 6.46% from 2025 to 2034, owing to its scalability and ability to cater to mass production needs across diverse industries. Companies are increasingly adopting atomization and milling techniques as they offer a cost-effective solution for producing large volumes of powder suitable for automotive components, construction materials, and general manufacturing applications. Rising investments in 3D printing and powder metallurgy are also driving the segment, since mechanical processes can consistently deliver powders with adequate flowability and density. Furthermore, the global shift toward sustainable and resource-efficient production methods strengthens the appeal of mechanical techniques, as they utilize recyclable scrap metal and reduce material wastage, making them an environmentally aligned choice.

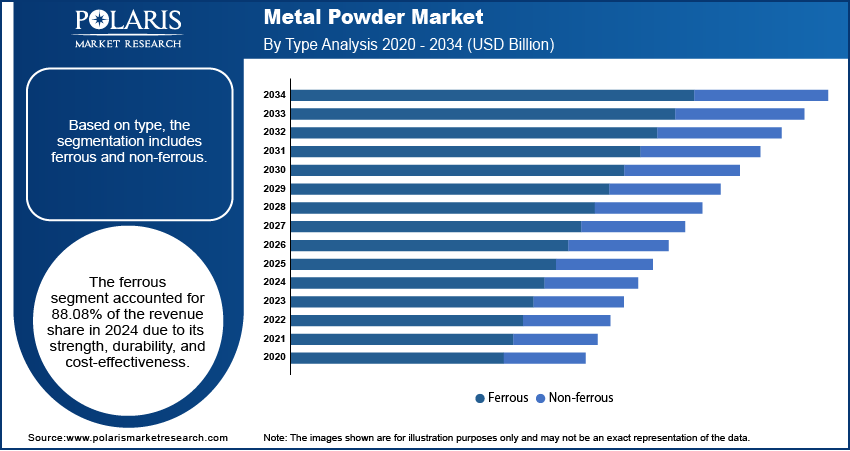

Type Analysis

Based on type, the segmentation includes ferrous and non-ferrous. The ferrous segment accounted for 88.08% of the revenue share in 2024 due to its strength, durability, and cost-effectiveness. Manufacturers used ferrous powders extensively in powder metallurgy to produce structural components, gears, bearings, and filters that demanded high mechanical strength and wear resistance. The increasing adoption of electric vehicles further boosted demand, as ferrous powders played a key role in producing components for motors and drivetrains. Additionally, the abundant availability of raw materials and established large-scale production facilities made ferrous powders more economical, which contributed to their dominance in industrial applications.

Application Analysis

In terms of application, the segmentation includes additive manufacturing, press & sinter, metal injection molding, and others. The press & sinter segment held 72.84% of revenue share in 2024 due to manufacturers across automotive, industrial machinery, and consumer goods relied on this cost-efficient and highly scalable process to produce complex parts with excellent dimensional accuracy. Companies preferred press & sinter technology as it enabled mass production of gears, bearings, and structural components at competitive costs, while also minimizing material wastage. The method’s ability to use a wide range of ferrous and non-ferrous powders provided versatility and allowed industries to meet diverse mechanical and structural requirements. The established infrastructure for powder metallurgy in mature markets such as North America and Europe further supported the strong adoption of this process.

The additive manufacturing segment is expected to grow at a CAGR of 18.4% from 2025 to 2034. Aerospace and medical device manufacturers are increasingly adopting 3D printing technologies to develop lightweight components and patient-specific implants that traditional methods cannot achieve. Automotive companies are also investing heavily in additive manufacturing to accelerate prototyping. The method’s ability to optimize material usage, reduce assembly steps, and support the production of complex geometries without tooling requirements strengthens its appeal. Continuous advancements in powder quality, printer technology, and large-scale production capabilities are estimated to accelerate the adoption of additive manufacturing in the coming years.

End Use Analysis

In terms of end use, the segmentation includes automotive, industrial, aerospace & defense, construction, healthcare, and others. The automotive segment accounted for around 69.00% of the revenue share in 2024 due to manufacturers' reliance on powder metallurgy to produce high-strength, lightweight, and cost-effective components. Automakers used powders in the press & sinter process to manufacture gears, bearings, bushings, and structural parts that required durability and dimensional accuracy. The rising production of electric vehicles further increased demand, as powders played a crucial role in producing components for batteries, motors, and drivetrains.

The aerospace & defense segment is expected to grow at a CAGR of 9.2% from 2025 to 2034. Aircraft manufacturers are increasingly adopting additive manufacturing technologies to produce complex engine parts, turbine blades, and structural components using titanium and aluminum powders. The sector benefits from stringent performance standards that require powders with superior mechanical and thermal properties, which drives continuous investment in advanced production methods. The global expansion of air travel, coupled with rising defense budgets in major economies, is further accelerating metal powder adoption. According to the International Air Transport Association (IATA), Asia Pacific airlines achieved a 13.3% year-on-year increase in demand in May 2025 from May 2024.

Regional Analysis

Asia Pacific metal powder market held 40.41% of the global metal powder market share in 2024. This dominance is attributed to rapid industrialization, expanding manufacturing sectors, and growing investments in industries such as aerospace, automotive, and electronics. Countries like India, Japan, and South Korea witnessed increased adoption of additive manufacturing (3D printing) and powder metallurgy technologies, which rely heavily on metal powders. Additionally, government initiatives to boost domestic manufacturing and infrastructure development contributed to higher demand. The region’s expanding electric vehicle (EV) production also fueled the need for precision metal components produced through powder-based processes. According to the International Energy Agency, China remains the world’s electric car manufacturing hub, accounting for more than 70% of global production in 2024.

China Metal Powder Market Insight

China held 40.36% of the revenue share in the Asia Pacific metal powder landscape in 2024, due to its aggressive push toward technological self-reliance. The country’s strong aerospace, defense, and automotive industries are major consumers of metal powders, particularly for use in 3D printing and advanced component manufacturing. Government support through initiatives like "Made in China 2025" has prioritized innovation in advanced materials and additive manufacturing, fueling domestic production and consumption of metal powders. Moreover, China’s expanding EV sector and investments in renewable energy infrastructure created sustained demand for high-performance metal components and powders.

North America Metal Powder Market

The North America market is projected to hold a significant revenue share in 2034, driven by advancements in additive manufacturing, especially within the aerospace, defense, and healthcare sectors. The United States leads the region in R&D investments and commercial adoption of 3D printing technologies, which require high-quality titanium, aluminum, and nickel-based powders. Increasing focus on lightweight, fuel-efficient vehicles and aircraft is driving the use of complex metal parts produced through powder metallurgy. Additionally, government and private-sector collaborations to strengthen supply chains and promote advanced manufacturing are further supporting market expansion across the region.

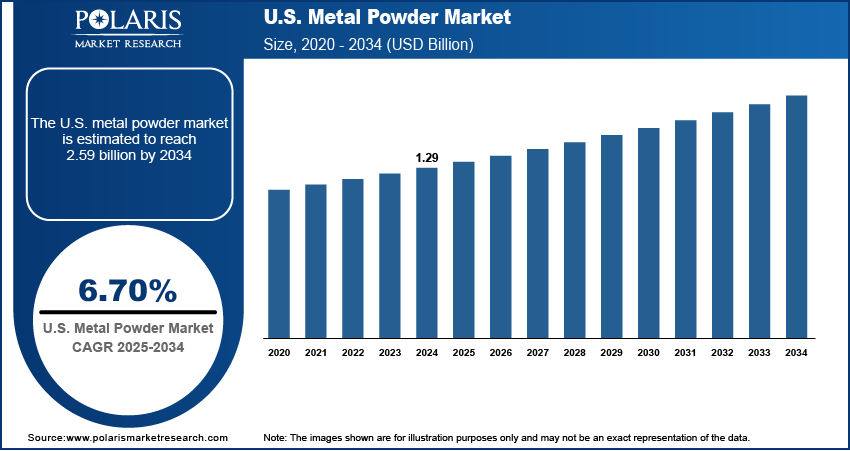

U.S. Metal Powder Market Overview

The demand for Metal Powder in the U.S. is being driven by advanced aerospace, defense, medical, and automotive industries. The widespread use of additive manufacturing in prototyping and production, particularly in military and space applications, has elevated the need for specialty metal powders such as titanium, Inconel, and tool steels. Federal funding for innovation in manufacturing technologies, along with private-sector investments in 3D printing, continues to drive industry growth. Furthermore, the U.S. emphasis on reshoring manufacturing and reducing dependency on foreign supply chains is encouraging domestic production of metal powders and related technologies.

Europe Metal Powder Market

The industry in Europe is projected to grow at a CAGR of 6.06% from 2025 to 2034, owing to industrial innovation, stringent environmental regulations, and a strong focus on sustainable manufacturing. Countries such as Germany, France, and the UK are driving the demand by adopting additive manufacturing in automotive, aerospace, and energy sectors. The European Union’s Green Deal and push for energy efficiency are promoting the use of lightweight metal components, which are often produced using powder metallurgy. Additionally, robust R&D infrastructure and collaboration between academia, industry, and government are accelerating the development and application of advanced metal powders.

Key Players & Competitive Analysis Report

The global metal powder market features a competitive landscape with key players such as Höganäs AB, GKN Powder Metallurgy, Sandvik AB, and Rio Tinto Metal Powders driving innovation and market expansion. These companies dominate in production capacity, technological expertise, and geographic reach, particularly in automotive, aerospace, and additive manufacturing sectors. Asian manufacturers like Advanced Technology & Materials Co., Ltd. are gaining attention due to rising industrialization and government support in high-tech materials. U.S.-based firms such as Carpenter Technology Corporation and ATI Inc. focus on specialty alloys for high-performance applications. Competition is intensifying as companies invest in R&D for advanced powders tailored for 3D printing. Strategic partnerships, vertical integration, and sustainability initiatives are key differentiators.

Major companies operating in the metal powder industry include 6K Additive; Advanced Technology & Materials Co., Ltd.; Alcoa Corporation; AMETEK Inc.; ATI Inc.; Carpenter Technology Corporation; GKN Powder Metallurgy; Höganäs AB; Kymera International; Rio Tinto Metal Powders; Sandvik AB.

Key Companies

- 6K Additive

- Advanced Technology & Materials Co., Ltd.

- Alcoa Corporation

- AMETEK Inc.

- ATI Inc.

- Carpenter Technology Corporation

- GKN Powder Metallurgy

- Höganäs AB

- Kymera International

- Rio Tinto Metal Powders

- Sandvik AB

Industry Developments

August 2025, Sandvik introduced Osprey MAR 55, a highly versatile tool steel powder that bridges the gap between maraging steels and tool steels.

June 2024, AMETEK announced the launch of its new high green strength stainless steel powders, ideal for use in powder metallurgy for a wide range of automotive pressed and sintered parts.

November 2023, 6K Additive entered into a strategic partnership with Metal Powder Works (MPW) to produce copper/nickel and bronze alloy powders for additive manufacturing.

Metal Powder Market Segmentation

By Production Method Outlook (Revenue, USD Billion, 2020–2034)

- Chemical

- Mechanical

- Physical

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Ferrous

- Non-ferrous

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Additive Manufacturing

- Press & Sinter

- Metal Injection Molding

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Industrial

- Aerospace & Defense

- Construction

- Healthcare

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Metal Powder Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.10 Billion |

|

Market Size in 2025 |

USD 6.49 Billion |

|

Revenue Forecast by 2034 |

USD 11.94 Billion |

|

CAGR |

7.10% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.10 billion in 2024 and is projected to grow to USD 11.94 billion by 2034.

The global market is projected to register a CAGR of 7.01% during the forecast period.

Asia Pacific dominated the market in 2024

A few of the key players in the market are 6K Additive; Advanced Technology & Materials Co., Ltd.; Alcoa Corporation; AMETEK Inc.; ATI Inc.; Carpenter Technology Corporation; GKN Powder Metallurgy; Höganäs AB; Kymera International; Rio Tinto Metal Powders; Sandvik AB.

The ferrous segment dominated the market revenue share in 2024.

The aerospace & defense segment is projected to witness the fastest growth during the forecast period.