Metalworking Fluids Market Size, Share, Trends, & Industry Analysis Report

By Product (Mineral, Synthetic), By End-use, By Industrial End-use, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 115

- Format: PDF

- Report ID: PM3725

- Base Year: 2024

- Historical Data: 2020-2023

What is the Metalworking Fluids Market Size?

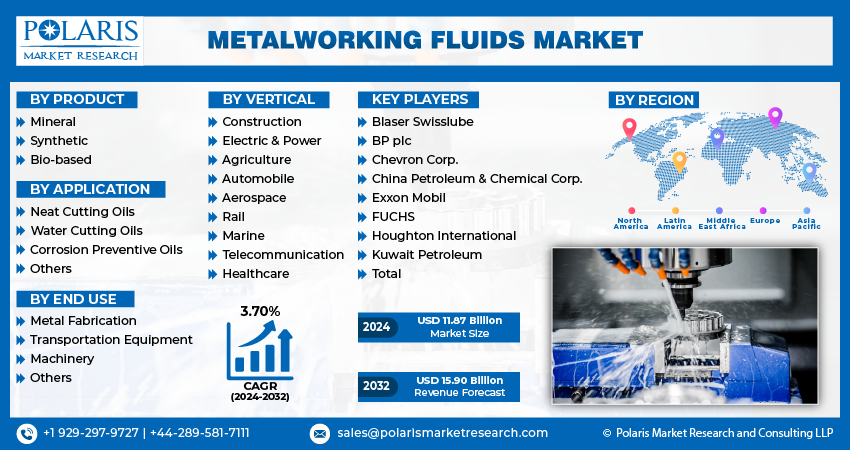

The global metalworking fluids market was valued at USD 14.92 billion in 2024 and is expected to grow at a CAGR of 17.5% during the forecast period. Market is fueled by a rising demand for automotive & heavy industry machinery.

Key Insights

- The transportation equipment segment is expected to witness significant growth during the forecast period due to the strong demand for MWFs in transportation equipment.

- The mineral dominated with largest share in 2024 due to the widespread usage of mineral-based oils.

- Asia Pacific dominated with largest share in 2024 due to rising number of industries in the region.

- North America is projected to accounted for a significant share in the global market due to region’s strong manufacturing base.

Industry Dynamics

- The expansion of automotive industry is fueling the market growth.

- The growth in fabrication, & transportation equipment sector is driving the growth.

- The technological advancement is boosting the industry growth.

- Stringent environmental regulations and disposal challenges related to metalworking fluids restrains the growth.

Market Statistics

- 2024 Market Size: USD 14.92 Billion

- 2034 Projected Market Size: USD 74.55 Billion

- CAGR (2025-2034): 17.5%

- Largest Market: Asia Pacific

To Understand More About this Research : Request a Free Sample Report

Key sectors like machinery, metal fabrication, & transportation equipment are playing a significant role in driving the expansion of this market. Crude oil serves as the fundamental source material for producing Metal Working Fluids (MWFs). Through processes of refining, treatment, & blending, crude oil is transformed into neat cutting oils, & corrosion-preventive oils, which are in high demand. Base oil, a major component derived from the crude oil, represents nearly, 40 percent of the total cost of the MWFs. Metalworking fluids contribute to enhancing machining processes, thereby increasing machine production volumes. Consequently, the demand for metalworking fluids is anticipated to remain steady throughout the projected period. The expansion of the heavy machinery industry in the emerging nations of Asia Pacific & South America is projected to drive the market forward. The increasing exploration and production activities in the oil and gas sector, particularly by the Chinese petro firms have played a crucial role in influencing the demand for the MWFs in oil & gas industry.

Industry Dynamics

Growth Drivers

What are the Factors Driving the Metalworking Fluids Market Growth?

Metalworking fluids find extensive application in the automotive sector owing to their ability to reduce friction between the workpiece and the tool, enhance surface quality, remove metal chips, and extend the lifespan of tools. By improving the efficiency of machining operations, metalworking fluids contribute to higher machine output. The production of passenger vehicles in India has experienced a notable surge in recent years. Data from the Society of Indian Automobile Manufacturers (SIAM) reveals that the production of passenger vehicles reached 3,650,698 units during the period of 2021-2022. This indicates a substantial growth of 19% compared to the previous year (2020-2021). Such a significant increase in production has played a pivotal role in supporting the overall metalworking fluids market growth in the automotive sector. China's 14th Five-Year Plan presents a significant opportunity for the country to advance its agricultural and rural transformation. This, in turn, leads to an increased utilization of heavy machinery in agricultural and construction activities.

Report Segmentation

The market is primarily segmented based on product, application, end use, vertical and region.

|

By Product |

By Application |

By End Use |

By Vertical |

By Region |

|

|

|

|

|

To Understand the Scope of this Report : Speak to Analyst

Why Mineral Segment held the Largest Share in 2024

Mineral segment held the largest share in 2024 due to the widespread usage of mineral-based oils, which are preferred due to their lower cost. Price-conscious consumers, particularly small- and medium-scale manufacturers, tend to opt for mineral oil-based Metalworking Fluids (MWFs). This consumer behavior is expected to impact the segment growth throughout the forecast period. Furthermore, mineral-based fluids find application in various machining processes, including turning, grinding, broaching, drilling, and milling, thereby driving the growth.

Which Segment by End Use is Expected to Witness Significant Growth?

Transportation equipment segment is expected to experience significant growth during the forecast period due to the strong demand for MWFs in transportation equipment, fueled by infrastructure development and increased product demand in the sector. MWFs play a crucial role in operations where efficient heat dissipation is essential for effective machining and the production of high-quality products. They find application in various forms of transportation equipment, including high-performance railway engines, ships, and aircraft. The primary areas where these fluids are utilized to enhance engine performance are Maintenance, Repair, and Overhauling (MRO) activities, thereby driving the segment growth.

Regional Insights

How Asia Pacific Dominated with Largest Share in 2024?

Asia Pacific dominated with largest share in 2024. The strong market performance in the region can be attributed to the growing number of manufacturing units in the area. Specifically, China and India are expected to play a significant role in driving the demand for both mineral and synthetic MWFs. The market for synthetic MWFs is anticipated to witness substantial growth in this region.

What are the Reasons for North America’s Significant Growth?

The North America is expected to witness significant growth during the forecast period due to its strong manufacturing base. The region is home to the largest manufacturers in automotive, aerospace, and industrial equipment sector. Major American players such as Boeing, Honeywell, and Ford and many others have domestic manufacturing bases which drives the demand for the fluids such as metalworking fluids for machining, cutting, grinding, and forming processes. Moreover, the government incentives for local manufacturers such as CHIPS Acts and Infrastructure Bill are increasing the production output of these sectors, which is further driving the demand for these fluids, thereby driving the growth of the industry in the region

Key Market Players & Competitive Insight

Key players in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- Blaser Swisslube

- BP plc

- Chevron Corp.

- China Petroleum & Chemical Corp.

- Exxon Mobil

- FUCHS

- Houghton International

- Kuwait Petroleum

- Total

Recent Developments

- August 2025, TotalEnergies launched innovative biocompatible metalworking fluids tailored for the medical manufacturing industry, addressing precision, safety, and sustainability needs by introducing water-based, non-hazardous lubricants designed to improve machining performance and meet stringent regulatory and environmental standards.

- June 2025, Master Fluid Solutions launched the TRIM SC417 semisynthetic coolant in Düsseldorf. The product offered strong rust protection for ferrous metals, low foam levels in soft water, and broad applicability across grinding, milling, turning, drilling, and tapping operations.

Metalworking Fluids Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14.92 billion |

| Market size value in 2025 | USD 17.47 billion |

|

Revenue forecast in 2034 |

USD 74.55 billion |

|

CAGR |

17.5% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By Application, By End Use, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global metalworking fluids market size is expected to reach USD 74.55 billion by 2034

Key players in the metalworking fluids market Blaser Swisslube,BP plc,Chevron Corp,China Petroleum & Chemical Corp.

North America region contribute notably towards the global metalworking fluids market

The global metalworking fluids market is expected to grow at a CAGR of 17.5% during the forecast period

Key segments in the metalworking fluids market product, application, end use, vertical and region.