Middle East Building Envelope Market Size, Share, Trends, Industry Analysis Report

By Product (Walls & Cladding Systems, Roofs, windows & Doors, Others), By End Use, By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6404

- Base Year: 2024

- Historical Data: 2020-2023

Overview

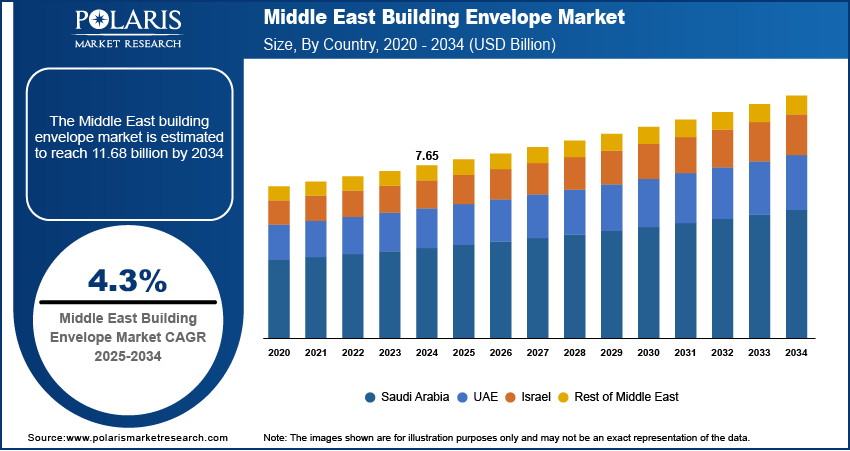

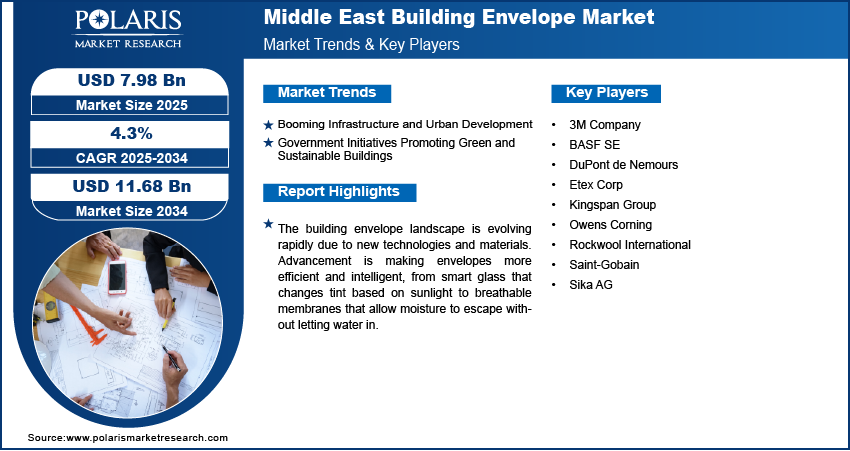

The Middle East building envelope market size was valued at USD 7.65 billion in 2024, growing at a CAGR of 4.3% from 2025 to 2034. The market growth is driven by booming infrastructure and urban development and government initiatives promoting green and sustainable buildings.

Key Insights

- In 2024, the walls and cladding systems segment held the largest market share, driven by their essential function in shielding buildings from extreme heat, sandstorms, and humidity.

- The commercial segment is projected to grow significantly during the forecast period, supported by developments in tourism, healthcare, education, and business industries.

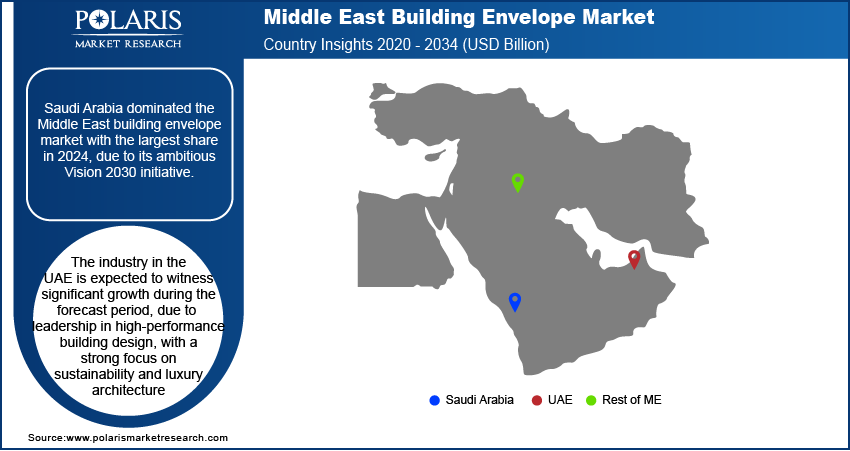

- Saudi Arabia led the market in 2024, propelled by its ambitious Vision 2030 plan aimed at economic diversification and infrastructure growth.

- The UAE market is expected to witness notable growth during the forecast period, due to its leadership in high-performance building design with a strong emphasis on sustainability and luxury architecture.

Industry Dynamics

- Booming infrastructure and urban development drive the demand for building envelopes.

- Government initiatives promoting green and sustainable buildings fuels the industry growth.

- The Middle East experiences strong growth in the commercial real estate and hospitality sectors, driven by tourism, business expansion, and international events.

- High initial costs of advanced building envelope systems restrain the adoption of building envelopes.

Market Statistics

- 2024 Market Size: USD 7.65 billion

- 2034 Projected Market Size: USD 11.68 billion

- CAGR (2025–2034): 4.3%

- Saudi Arabia: Largest market in 2024

AI Impact on Middle East Building Envelope Market

- AI improves energy efficiency by optimizing building envelope design through advanced simulations that reduce thermal loss and improve insulation performance.

- AI-powered sensors enable real-time monitoring, detecting air leaks and moisture intrusion early, which helps prevent costly damage and improves building durability.

- The technology supports predictive maintenance, allowing building owners to proactively manage repairs and extend the lifespan of envelope materials, reducing long-term costs.

- High implementation costs and the lack of AI integration expertise in the construction sector hinder the widespread adoption of AI in building envelope systems.

The building envelope is the outer shell of a building that separates the interior from the external environment. It includes elements such as walls, roofs, windows, doors, and insulation that control air, moisture, heat, and light flow. Its main role is to provide structural support, energy efficiency, and protection from the weather.

The rise of smart cities and mega-projects such as NEOM in Saudi Arabia and Lusail City in Qatar is reshaping the construction landscape in the Middle East. These futuristic developments demand advanced technologies, including intelligent building envelopes that offer digital integration, real-time performance monitoring, and adaptive insulation systems. Construction companies are focusing on innovative, high-performance building envelopes as governments invest in technology-driven infrastructure. These projects are fueling rapid adoption and creating a sustained demand for premium envelope solutions with advanced functionality, thereby fueling the growth.

The Middle East experiences strong growth in the commercial real estate and hospitality sectors, driven by tourism, business expansion, and international events. Luxury hotels, office towers, and shopping malls require high-quality façades, cladding systems, and glazing that improve visual appeal and enhance thermal performance. The demand for premium building envelope solutions continues to rise in urban and high-profile commercial projects as developers seek materials that meet modern design standards while maintaining energy efficiency and durability, thereby fueling the growth.

Drivers & Opportunities

Booming Infrastructure and Urban Development: The Middle East is witnessing a surge in large-scale infrastructure projects, including airports, smart cities, high-rise buildings, and stadiums in countries such as the UAE, Saudi Arabia, and Qatar. According to the Public Investment Fund, Saudi Arabia launched 3 to 4 giga projects aligned with the Vision 2030. This rapid urban expansion is driving the building envelope demand as modern structures require advanced insulation, weather protection, and façade systems. Governments are heavily investing in construction to diversify their economies and attract tourism and business. These high-profile projects demand superior building envelope materials that offer durability, energy efficiency, and aesthetic appeal, thereby driving demand across both residential and commercial sectors.

Government Initiatives Promoting Green and Sustainable Buildings: Middle Eastern governments are actively promoting sustainable construction through green building codes and environmental regulations. Initiatives such as Saudi Arabia’s Vision 2030 and the UAE’s Estidama program encourage developers to incorporate energy-saving and eco-friendly technologies. Building envelope systems play a major role in achieving sustainability certifications such as LEED and Estidama Pearl Ratings. Developers meet these requirements while reducing operational costs by investing in energy-efficient façades, insulation, and window systems. The demand for environmentally responsible building envelope solutions grows significantly across the region as sustainability becomes a national priority, thereby fueling the growth.

Segmental Insights

Product Analysis

The Middle East building envelope market segmentation, based on product, includes walls & cladding systems, roofs, windows & doors, and others. In 2024, the walls & cladding systems segment dominated with the largest share due to their critical role in protecting buildings from extreme heat, sand, and humidity. Developers across the region are prioritizing durable, energy-efficient wall systems to meet rising insulation demands and improve building aesthetics. Cladding materials like aluminum composites and stone façades are widely used in high-rise buildings, malls, and airports. The push for sustainable architecture and compliance with regional energy codes has further boosted the demand for high-performance walls and cladding systems, especially in cities like Dubai, Riyadh, and Doha.

The roofs segment accounted for significant growth due to increasing awareness of energy savings and the role of reflective and insulated roofing systems in heat reduction. Modern roofing technologies that lower indoor cooling loads are in high demand, with temperatures often exceeding 45°C. The rise in green buildings, along with government programs promoting energy-efficient housing, has encouraged the adoption of insulated and solar-reflective roofs. Additionally, large commercial and industrial structures require roofing solutions that offer weather resistance and durability, further supporting the expansion of this segment across the region.

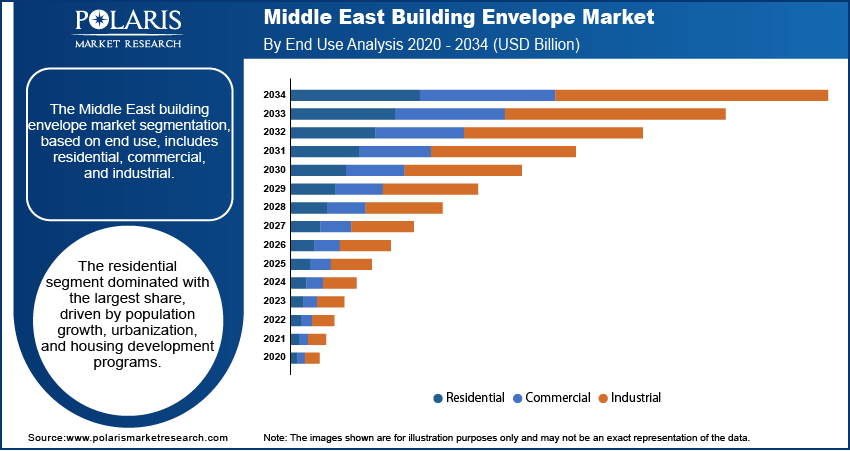

End Use Analysis

The segmentation, based on end use, includes residential, commercial, and industrial. The residential segment dominated with the largest share driven by population growth, urbanization, and housing development programs. Countries such as Saudi Arabia and the UAE have launched large-scale housing initiatives aimed at increasing homeownership and improving living standards. Building envelopes that reduce energy bills and improve comfort have become essential as homeowners and developers seek thermally efficient and cost-saving construction. Moreover, rising environmental awareness among residents has led to greater interest in eco-friendly materials and design, fueling sustained demand for advanced envelope systems in the residential sector.

The commercial segment is expected to experience significant growth fueled by expansion in sectors such as tourism, healthcare, education, and business. High-end office towers, hotels, retail malls, and cultural centers require building envelope solutions that offer energy efficiency, design flexibility, and compliance with green building standards. The demand for iconic, sustainable commercial architecture is rising with the region preparing for global events and promoting itself as a business and tourism hub. Advanced façades, curtain walls, and high-performance glazing systems are increasingly specified in commercial projects, pushing envelope innovation in form, function, and sustainability.

Regional Analysis

Saudi Arabia Building Envelope Market Trends

Saudi Arabia dominated with the largest share in 2024, due to its ambitious Vision 2030 initiative. The country is investing heavily in mega-projects such as NEOM, The Line, and Qiddiya, all of which demand advanced, sustainable building envelope solutions. The harsh desert climate and rising energy consumption have led to a strong push for thermally efficient materials that reduce cooling needs. Additionally, government-backed residential housing programs are accelerating demand for durable and cost-efficient envelope systems, while new construction codes are mandating higher energy performance, driving further adoption of modern building envelope technologies.

UAE Building Envelope Market Insights

The industry in the UAE is expected to witness significant growth during the forecast period, due to leadership in high-performance building design, with a strong focus on sustainability and luxury architecture. Cities such as Dubai and Abu Dhabi are seeing rising demand for building envelopes that combine aesthetics, energy efficiency, and climate resilience. The country's green building regulations, such as Estidama and Dubai Green Building Regulations, are pushing developers to adopt high-quality façades, insulation, and glazing systems. Large-scale developments, including business districts, hospitality projects, and urban housing, further fuel the need for innovative building envelope solutions.

Israel Building Envelope Market Analysis

The Israel industry is projected to witness substantial growth during the forecast period driven by its focus on innovation, energy conservation, and sustainable urban development. The country has implemented strict energy efficiency standards for buildings with limited natural resources and rising energy costs. This has increased demand for envelope systems that reduce energy loss, such as insulated walls, double-glazed windows, and solar-reflective roofs. Urban densification and tech-driven architecture further support the adoption of smart building materials. Israel’s commitment to environmental goals and high-tech construction practices ensures a growing need for high-performance, eco-friendly building envelope solutions across both residential and commercial sectors.

Rest of Middle East Building Envelope Market Overview

The Rest of Middle East includes Qatar, Kuwait, Oman, and Bahrain. The regional market is projected to witness substantial growth during the forecast period, driven by infrastructure expansion, particularly in hospitality, transport, and public sector buildings. Governments in these countries are further promoting green building certifications and urban development aligned with climate resilience. Consequently, demand is growing for materials that improve insulation, resist extreme heat, and support sustainable design goals, thereby driving the growth.

Key Players and Competitive Analysis

The Middle East building envelope market features a competitive landscape dominated by players such as 3M Company, BASF SE, DuPont de Nemours, Etex Corp, Kingspan Group, Owens Corning, Rockwool International, Saint-Gobain, and Sika AG. These companies are actively expanding their regional presence through partnerships, distribution networks, and localized manufacturing to cater to rising demand for high-performance envelope solutions. Product innovation remains a key focus, especially in energy-efficient insulation, fire-resistant cladding, and reflective roofing systems suited for the region’s extreme climate. As governments enforce stricter energy codes and promote sustainable construction, these players are positioning themselves as key providers of compliant and advanced solutions. Many are also aligning their offerings with green building standards such as Estidama and LEED, strengthening their value proposition. With growing competition, differentiation through technology, durability, and environmental performance is crucial, and companies are investing in R&D and digital integration to maintain a competitive edge.

Key Players

- 3M Company

- BASF SE

- DuPont de Nemours

- Etex Corp

- Kingspan Group

- Owens Corning

- Rockwool International

- Saint-Gobain

- Sika AG

Middle East Building Envelope Industry Developments

In February 2025, Typar launched several innovative building envelope products at the 2025 International Builders’ Show, including the industry’s first transparent acrylic flashing, new liquid flashing, a commercial peel-and-stick wrap, and a cold-weather spray adhesive, enhancing performance and installation efficiency.

Middle East Building Envelope Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Walls & Cladding Systems

- Roofs

- Windows & Doors

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Country Outlook (Revenue, USD Billion, 2020–2034)

- Saudi Arabia

- UAE

- Israel

- Rest of Middle East

Middle East Building Envelope Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.65 Billion |

|

Market Size in 2025 |

USD 7.98 Billion |

|

Revenue Forecast by 2034 |

USD 11.68 Billion |

|

CAGR |

4.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 7.65 billion in 2024 and is projected to grow to USD 11.68 billion by 2034.

The market is projected to register a CAGR of 4.3% during the forecast period.

Saudi Arabia dominated the market share in 2024.

A few of the key players in the market are 3M Company, BASF SE, DuPont de Nemours, Etex Corp, Kingspan Group, Owens Corning, Rockwool International, Saint-Gobain, and Sika AG.

The walls & cladding system segment dominated the market share in 2024

The commercial segment is expected to witness the significant growth during the forecast period.