Middle East HVAC Systems Market Size, Share, Trends, Industry Analysis Report

By Equipment (Heating, Ventilation, Cooling), By Application, By Distribution Channel, By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 124

- Format: PDF

- Report ID: PM6391

- Base Year: 2024

- Historical Data: 2020-2023

Overview

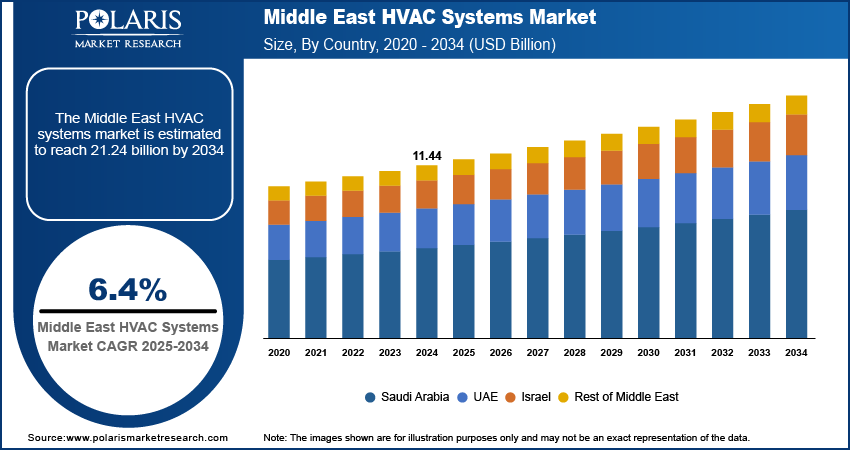

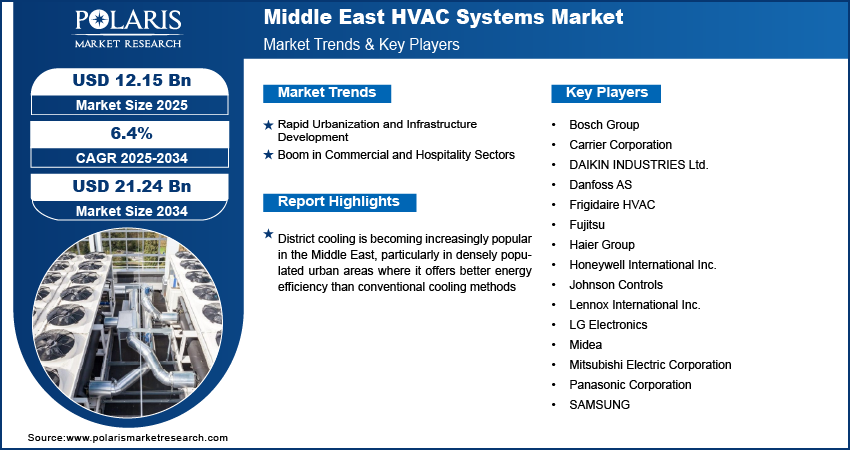

The Middle East HVAC systems market size was valued at USD 11.44 billion in 2024, growing at a CAGR of 6.4% from 2025 to 2034. The market growth is driven by rapid urbanization and infrastructure development, and a boom in the commercial and hospitality sectors.

Key Insights

- In 2024, the cooling segment led the market with the largest share, driven by the Middle East’s extremely hot and arid climate, which creates a consistent demand for cooling solutions.

- The commercial application segment is projected to grow significantly, supported by the ongoing development of office buildings, hospitals, shopping malls, and hospitality projects across the region.

- Saudi Arabia held the largest market share in 2024, fueled by harsh climatic conditions, large-scale urban development, and major investments aligned with the Vision 2030 initiative.

- The UAE market is expected to grow substantially over the forecast period due to rapid urban growth, an expanding construction industry, and increasing focus on sustainable, energy-efficient HVAC systems.

Industry Dynamics

- Rapid urbanization and construction boom drive the demand for HVAC systems across the Middle East.

- Growth in the commercial and hospitality sectors is fueling the industry growth.

- The rise of smart home technology has also impacted the HVAC industry by improving HAVC system’s appeal.

- High initial installation costs and maintenance expenses restrain the growth.

Market Statistics

- 2024 Market Size: USD 11.44 billion

- 2034 Projected Market Size: USD 21.24 billion

- CAGR (2025–2034): 6.4%

- Saudi Arabia: Largest market in 2024

AI Impact on Middle East HVAC Systems Market

- AI improves HVAC system efficiency by analyzing real-time data to optimize energy consumption and reduce operational costs.

- AI-enabled predictive maintenance detects potential HVAC system failures early, minimizing downtime and extending equipment lifespan.

- Integration of AI allows smart HVAC systems to adapt to user preferences and environmental changes, enhancing comfort and indoor air quality.

- AI-driven analytics help manufacturers forecast demand and optimize production schedules, improving supply chain management and reducing inventory costs.

HVAC systems refer to heating, ventilation, and air conditioning systems that regulate indoor temperature, air quality, and comfort in residential, commercial, and industrial spaces. They include components such as air conditioners, heat pumps, furnaces, ductwork, and ventilation units. These systems help maintain a healthy and energy-efficient indoor environment by controlling temperature, humidity, and airflow.

The Middle East experiences some of the highest temperatures globally. During summer, temperatures can exceed 50°C in countries such as Saudi Arabia, the UAE, and Kuwait. This extreme heat drives continuous demand for effective and energy-efficient air conditioning systems in residential, commercial, and industrial spaces. The need to maintain comfortable indoor environments throughout the year fuels the growth of the HVAC. Cooling solutions become essential infrastructure rather than optional as urban populations rise, further fueling HVAC systems demand as a necessity across the region and driving the growth in the region.

District cooling is becoming increasingly popular in the Middle East, particularly in densely populated urban areas where it offers better energy efficiency than conventional cooling methods. Cities such as Dubai and Abu Dhabi are expanding their district cooling networks to serve new developments. These centralized systems provide chilled water to multiple buildings through insulated pipelines, reducing peak electricity demand and lowering emissions. The growing preference for district cooling among developers and municipalities is expected to significantly fuel the demand for HVAC systems in the Middle East.

Drivers & Opportunities

Rapid Urbanization and Infrastructure Development: Major Middle Eastern cities such as Riyadh, Dubai, and Doha are undergoing rapid urban expansion, with significant investments in infrastructure, smart cities, and mega construction projects. According to the World Bank Group, as of 2024, 85% of the population in Saudi Arabia lives in Urban settings. Developments such as NEOM in Saudi Arabia and Expo City in Dubai demand modern, integrated HVAC systems for efficient climate control. The demand for advanced HVAC technologies grows as more commercial and residential buildings are constructed. Additionally, the region’s focus on building sustainable and climate-resilient urban spaces further fuels investment in heating, cooling, and ventilation technologies, thereby driving the growth.

Boom in Commercial and Hospitality Sectors: The Middle East continues to witness substantial growth in commercial sectors such as tourism, hospitality, healthcare, and retail. According to the UAE Ministry of Economy & Tourism, in 2023, the hotel industry recorded revenue of AED 43.5 million (i.e., USD 11.8 million). Large-scale development of hotels, airports, shopping malls, and healthcare facilities requires robust HVAC systems for temperature control, air quality, and energy optimization. Additionally, events such as Expo 2020 and Vision 2030 initiatives have accelerated commercial expansion, making HVAC solutions critical to infrastructure development. Demand is particularly high for centralized and VRF systems that serve large spaces efficiently, which further drives the market forward.

Segmental Insights

Equipment Analysis

The segmentation, based on equipment, includes heating, ventilation, and cooling. In 2024, the cooling segment dominated with the largest share due to the region’s extremely hot and arid climate. Temperatures often soar above 45°C, especially in countries such as Saudi Arabia, the UAE, and Qatar. This constant demand for air conditioning, especially during long summer months, drives the need for efficient cooling systems in residential, commercial, and industrial spaces. Government initiatives to replace older units with energy-efficient models and rising urbanization further increase the adoption of advanced cooling technologies such as VRF, chillers, and inverter-based split systems across the region, thereby fueling the growth of the segment.

The ventilation segment accounted for significant growth as buildings become more airtight and energy-efficient. The demand for advanced ventilation systems has surged with growing awareness of indoor air quality (IAQ). The increasing number of malls, hotels, hospitals, and high-rise offices requires reliable air circulation systems to meet safety and comfort standards. Regulatory frameworks in countries like the UAE and Qatar now include IAQ mandates in building codes, pushing the adoption of energy recovery ventilators and smart ventilation systems, especially in densely populated urban areas, thereby driving the segment growth.

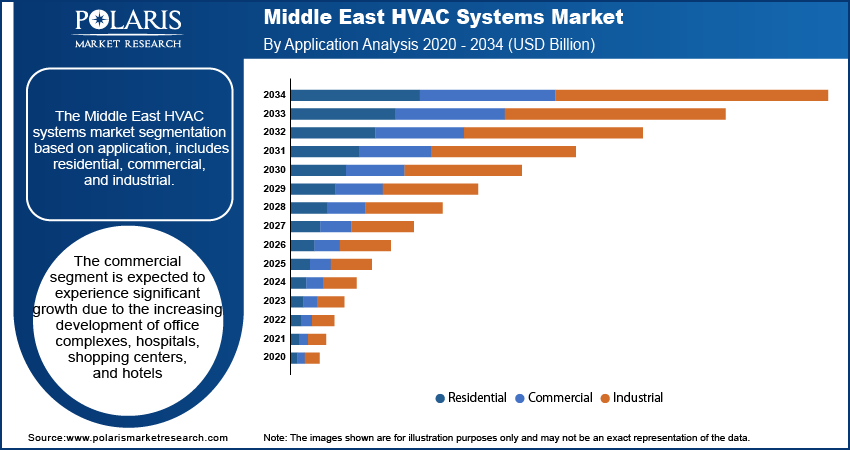

Application Analysis

The segmentation, based on application, includes residential, commercial, and industrial. The commercial segment is expected to experience significant growth due to the rapid expansion of office complexes, hospitals, retail malls, and hospitality infrastructure. Projects aligned with Saudi Vision 2030 and UAE’s smart city initiatives are accelerating commercial real estate development, all of which require scalable and energy-efficient HVAC solutions. Growing tourism and events such as Expo 2020 and FIFA World Cup 2022 have spurred hotel construction, demanding advanced HVAC systems that ensure energy savings and optimal comfort. Additionally, the push for green buildings in the Gulf Cooperation Council (GCC) boosts demand for high-performance commercial HVAC units.

Distribution Channel Analysis

The segmentation, based on distribution channel, includes online, retail stores, wholesale stores, and others. The retail stores segment dominated with the largest share as major electronics and home appliance chains in cities such as Dubai, Riyadh, and Doha offer wide product ranges and installation services, making them a preferred choice for residential and small business consumers. The demand for branded, energy-efficient cooling units surged across retail outlets with increasing disposable incomes and high temperatures. Frequent promotional campaigns, warranty options, and after-sales support further strengthen this channel. Additionally, retail store presence in both urban centers and growing suburban areas further drives the growth in the segment.

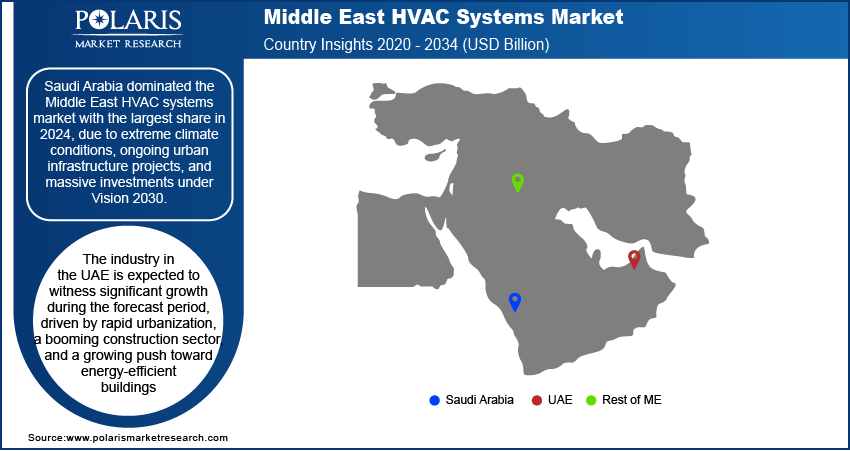

Country Analysis

Saudi Arabia HVAC Systems Market Trends

Saudi Arabia dominated the market with the largest share in 2024, due to extreme climate conditions, ongoing urban infrastructure projects, and massive investments under Vision 2030. There is a consistent demand for air conditioning across residential, commercial, and industrial spaces with year-round high temperatures. Mega-projects such as NEOM, The Line, and Red Sea Development are driving demand for modern, energy-efficient HVAC systems. Additionally, the government’s focus on sustainability and green buildings is encouraging the adoption of smart HVAC technologies. The commercial sector, especially in hospitality and retail, is further expanding, fueling the demand for scalable and efficient HVAC solutions, thereby driving the growth.

UAE HVAC Systems Market Insights

The industry in the UAE is expected to witness significant growth during the forecast period, driven by rapid urbanization, a booming construction sector, and a growing push toward energy-efficient buildings. HVAC systems play a central role in meeting comfort and sustainability standards, with Dubai and Abu Dhabi, continuing to lead in high-rise developments, malls, hotels, and smart cities. Government policies such as Estidama and the Dubai Green Building Regulations are boosting demand for eco-friendly HVAC technologies. Additionally, the country’s focus on sustainable tourism, smart building and infrastructure, and energy conservation is accelerating the shift toward inverter-based systems, district cooling, and smart HVAC integration in buildings, thereby driving the growth.

Israel HVAC Systems Market Analysis

The Israel industry is projected to witness substantial growth during the forecast period, driven by the country’s technological advancements, climate diversity, and growing interest in smart energy management systems. While coastal regions require efficient cooling, colder inland areas need reliable heating, pushing demand for versatile HVAC systems. Israel’s strong focus on innovation and clean tech supports the development and adoption of smart HVAC solutions integrated with IoT technology and AI. Rising environmental awareness and strict building energy codes are encouraging the use of energy-efficient and low-emission systems in both residential and commercial buildings, thereby boosting the growth.

Rest of Middle East HVAC Systems Market Overview

The Rest of Middle East includes countries such as Qatar, Kuwait, Bahrain, and Oman. The regional market is projected to witness substantial growth in the coming years, fueled by infrastructure modernization, climate challenges, and increased commercial development. High temperatures and humidity levels drive strong demand for efficient cooling systems. Countries such as Qatar are investing in large-scale infrastructure for tourism and events, while Kuwait and Oman focus on residential expansion and public sector buildings. Additionally, energy diversification goals and initiatives to reduce carbon footprints are pushing governments to implement energy-efficiency standards for HVAC equipment, thereby fueling the growth in the countries.

Key Players and Competitive Analysis

The competitive landscape of the Middle East industry is characterized by the presence of major global players and regional suppliers, all striving to meet the region’s growing demand for energy-efficient and climate-adaptive HVAC solutions. Key international manufacturers such as DAIKIN INDUSTRIES Ltd., Carrier Corporation, LG Electronics, Mitsubishi Electric Corporation, and Johnson Controls maintain a strong foothold through extensive product portfolios and advanced technologies tailored to harsh Middle Eastern climates. Companies like Samsung, Panasonic, Fujitsu, and Midea focus on smart, inverter-based systems to cater to the region’s rising preference for sustainable cooling. Meanwhile, Honeywell, Danfoss, and Bosch Group lead in HVAC controls, automation, and energy efficiency. Rising infrastructure development in countries, including Saudi Arabia and the UAE, has led to intense competition in the commercial and industrial segments. Market players are also investing in local partnerships, service networks, and innovation centers to strengthen their presence and meet evolving regulatory and consumer demands.

Key Players

- Bosch Group

- Carrier Corporation

- DAIKIN INDUSTRIES Ltd.

- Danfoss AS

- Frigidaire HVAC

- Fujitsu

- Haier Group

- Honeywell International Inc.

- Johnson Controls

- Lennox International Inc.

- LG Electronics

- Midea

- Mitsubishi Electric Corporation

- Panasonic Corporation

- SAMSUNG

Middle East HVAC Systems Industry Developments

In July 2025, LFB Group launched the Redge brand for its commercial HVAC operations across EMEA, replacing the Lennox brand, to strengthen its sustainability focus and continue delivering high-performance climate control solutions under a refreshed identity.

In April 2025, Foster International launched its own HVAC brand, FOSTER, offering energy-efficient systems and smart technologies designed for residential, commercial, and industrial applications, reinforcing its commitment to innovation and sustainability.

Middle East HVAC Systems Market Segmentation

By Equipment Type Outlook (Revenue, USD Billion, 2020–2034)

- Heating

- Heat Pump

- Furnace

- Unitary Heaters

- Boilers

- Electric Baseboards

- Heating Cables

- Others

- Ventilation

- Air Purifier

- Dehumidifier

- Air Handling Units

- Ventilation Fans

- Others

- Cooling

- Air Conditioning

- Chillers

- Cooling Towers

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Online

- Retail Stores

- Wholesale Stores

- Others

By Country Outlook (Revenue, USD Billion, 2020–2034)

- Saudi Arabia

- UAE

- Israel

- Rest of Middle East

Middle East HVAC Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 11.44 Billion |

|

Market Size in 2025 |

USD 12.15 Billion |

|

Revenue Forecast by 2034 |

USD 21.24 Billion |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 11.44 billion in 2024 and is projected to grow to USD 21.24 billion by 2034.

The market is projected to register a CAGR of 6.2% during the forecast period.

Saudi Arabia dominated the market share in 2024.

A few of the key players in the market are Bosch Group, Carrier Corporation, DAIKIN INDUSTRIES Ltd., Danfoss AS, Frigidaire HVAC, Fujitsu, Haier Group, Honeywell International Inc., Johnson Controls, Lennox International Inc., LG Electronics, Midea, Mitsubishi Electric Corporation, Panasonic Corporation, and SAMSUNG.

The cooling segment dominated the market share in 2024.

The commercial segment is expected to witness the significant growth during the forecast period.