Molecular Diagnostics Market Size, Share, Trend, Industry Analysis Report

By Product (Instruments, Reagents, Others), By Test Location, By Technology, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 127

- Format: PDF

- Report ID: PM6073

- Base Year: 2024

- Historical Data: 2020-2023

Overview

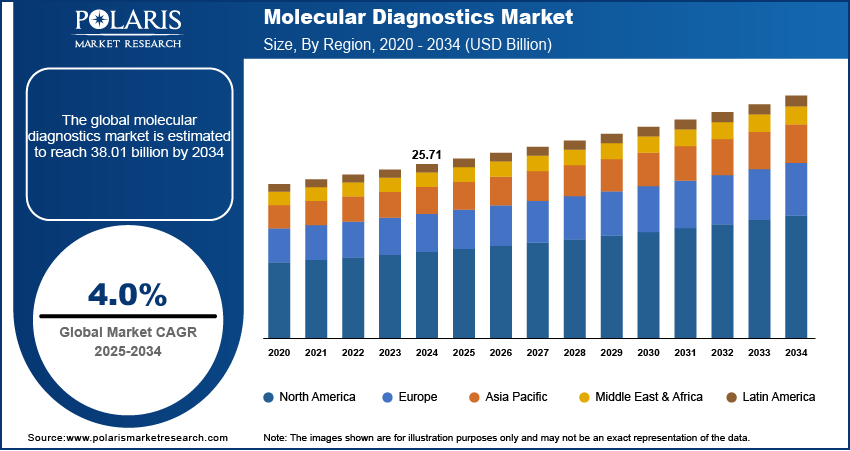

The global molecular diagnostics market size was valued at USD 25.71 billion in 2024, growing at a CAGR of 4.0% from 2025 to 2034. Increasing global incidence of infectious diseases, including emerging pathogens, is driving demand for rapid, accurate molecular diagnostic tests to ensure timely detection, containment, and treatment, thereby strengthening public health responses and clinical decision-making.

Key Insights

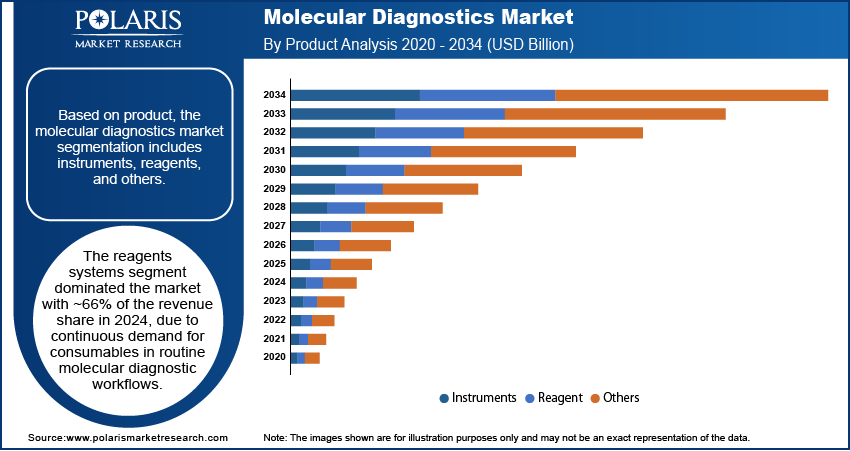

- The reagents segment held ~66% of the market share in 2024, driven by steady demand for consumables in routine molecular testing.

- The central laboratories segment captured ~80% of the revenue share in 2024, due to high-throughput capabilities and advanced diagnostic infrastructure.

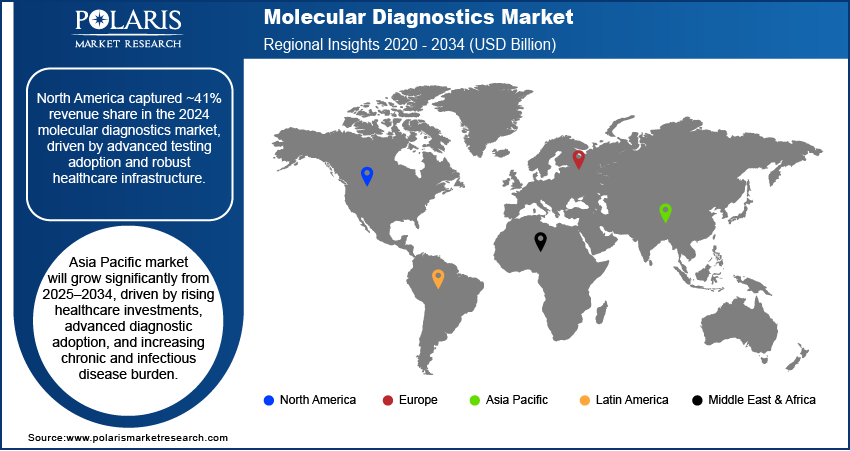

- North America accounted for ~41% of the market in 2024, supported by widespread adoption of advanced molecular diagnostics and strong healthcare systems.

- The U.S. led the regional market in 2024, fueled by the growth of personalized medicine and targeted therapies reliant on molecular testing.

- The market in Asia Pacific is expected to grow rapidly from 2025 to 2034, driven by rising healthcare investments and the adoption of advanced diagnostic technologies.

- The market in China is expanding quickly due to national precision medicine initiatives and government-funded genomic research integrating molecular diagnostics into healthcare.

Industry Dynamics

- The rising prevalence of chronic and infectious diseases is driving demand for early and accurate molecular diagnostic testing globally.

- Advancements in genomics and automation are enabling faster, high-throughput molecular testing in clinical and research laboratories.

- Integration of AI and data analytics enhances diagnostic accuracy and enables predictive insights from molecular testing data.

- High cost of instruments and reagents limits adoption, especially in low-resource and developing healthcare settings.

Market Statistics

- 2024 Market Size: USD 25.71 billion

- 2034 Projected Market Size: USD 38.01 billion

- CAGR (2025–2034): 4.0%

- North America: Largest market in 2024

AI Impact on Molecular Diagnostics Market

- AI accelerates molecular diagnostic processes by analyzing complex genomic and proteomic data swiftly, reducing test turnaround times and improving early disease detection accuracy.

- Machine learning enhances detection of rare genetic disorders by pinpointing disease-causing variants, enabling precision diagnostics in personalized medicine.

- AI-driven automation optimizes laboratory workflows, reducing human error, controlling sample quality, and cutting operational costs in molecular testing.

- Predictive AI models analyze patient data to forecast disease progression and treatment responses, aiding clinicians in making tailored therapeutic decisions.

The molecular diagnostics market involves advanced testing methods that detect and measure specific genetic RNA or DNA sequences to diagnose, monitor, and guide treatment for diseases. These tests enable early, precise detection of infections, cancers, genetic disorders, and other medical conditions. Continuous improvements in sequencing, PCR, and multiplex assay technologies are enhancing sensitivity, speed, and cost-efficiency of molecular diagnostics, enabling broader clinical adoption and expanding their use in both routine healthcare and specialized applications.

Rising global cancer rates are increasing demand for molecular diagnostics that detect specific genetic mutations, guide personalized therapy selection, and monitor disease progression, supporting precision oncology and improving patient survival outcomes. Moreover, healthcare is moving toward individualized treatment approaches, where molecular diagnostics play a key role in tailoring therapies based on genetic profiles, optimizing efficacy, minimizing side effects, and improving long-term treatment success.

Drivers & Opportunities

Rising Prevalence of Infectious Diseases: Rising prevalence of infectious diseases is fueling the demand for advanced molecular diagnostics, as healthcare systems face growing challenges from both known and emerging pathogens. According to the National Institute of Health, every year, ~23 million Americans visit a doctor’s clinic to find treatment for infections. Rapid urbanization, global travel, and changing environmental conditions have increased the spread of infectious agents, making timely detection critical. Molecular diagnostic tests provide high accuracy and speed, enabling early identification of infections, which is vital for effective treatment and outbreak control. This capability improves patient outcomes and strengthens public health surveillance. The need for quick and reliable testing solutions is therefore pushing continuous innovation and adoption in molecular diagnostic technologies worldwide.

Supportive Regulatory and Funding Initiatives: Supportive regulatory and funding initiatives are playing a key role in expanding the molecular diagnostics market. According to the National Institutes of Health (NIH), the RADx initiative has supported over 900 institutions and awarded more than $2.8 billion in funding since its launch, with continued project extensions and follow-on funding into 2023 for innovative diagnostic technologies. Governments and health agencies are providing substantial investments and grants to encourage research, development, and commercialization of advanced diagnostic tools. Streamlined regulatory pathways are reducing the time required for product approvals, allowing new tests to reach healthcare providers faster. These measures are particularly important in addressing urgent health threats where rapid deployment of testing solutions is critical. Increased financial and policy support also promotes collaboration between public and private sectors, fostering innovation and ensuring that advanced diagnostic technologies are accessible across diverse healthcare settings.

Segmental Insights

Product Analysis

Based on product, the segmentation includes instruments, reagents, and others. The reagents systems segment dominated the market in 2024 with ~66% of the revenue share due to continuous demand for consumables in routine molecular diagnostic workflows. High testing volumes in infectious disease screening, oncology, and genetic analysis require consistent reagent supply, driving recurring revenue streams for suppliers. Advances in assay sensitivity, multiplexing capabilities, and rapid turnaround reagents have expanded application scope in both clinical and research settings. The growing adoption of automated platforms has further increased consumption rates, while manufacturers benefit from strong customer retention through proprietary reagent systems. This repeat-purchase model, combined with the rising frequency of diagnostic testing, sustains market leadership.

The instruments segment is expected to register a significant CAGR during 2025–2034 driven by rising adoption of high-throughput molecular diagnostic systems in hospitals, reference laboratories, and decentralized testing sites. Demand for integrated platforms capable of automating sample preparation, amplification, and detection is increasing, reducing turnaround times and labor costs. Technological improvements in compact, portable, and user-friendly devices are enabling broader deployment in point-of-care and near-patient settings. Investments in upgrading laboratory infrastructure and replacing outdated systems are also contributing to growth. Continuous innovation in digital PCR, microfluidics, and sequencing instruments will further enhance testing accuracy and scalability, driving sustained adoption across diverse healthcare environments.

Test Location Analysis

In terms of test location, the segmentation includes point of care, self-test or OTC, and central laboratories. The central laboratories segment held ~80% of the revenue share in 2024 due to its capability to process high testing volumes with advanced instrumentation and specialized expertise. Complex diagnostic procedures, such as next-generation sequencing and multiplex PCR, are more efficiently performed in centralized facilities where quality control and data accuracy are prioritized. These laboratories often serve as reference centers for hospitals and clinics, handling specialized tests that cannot be performed on-site. Established logistics networks for sample collection and transport ensure timely results. The concentration of skilled professionals and advanced infrastructure has reinforced their dominant position in delivering molecular diagnostic services at scale.

The self-test or OTC segment is expected to register the highest CAGR from 2025 to 2034 due to rising consumer preference for convenient, private, and rapid diagnostic solutions. The COVID-19 pandemic accelerated awareness and acceptance infectious diseases diagnostic, paving the way for broader adoption in areas such as sexual health, genetic screening, and wellness monitoring. Advances in assay miniaturization and smartphone-integrated readouts are improving usability and accuracy. Increasing retail availability and regulatory approvals for over-the-counter kits are expanding market reach. Growing emphasis on preventive healthcare and early detection will continue to fuel demand for self-administered molecular diagnostic products in the coming years.

Technology Analysis

In terms of technology, the segmentation includes polymerase chain reaction (PCR), in situ hybridization (ISH), isothermal nucleic acid amplification technology (INAAT), chips and microarrays, mass spectrometry, transcription mediated amplification (TMA), and others. The polymerase chain reaction (PCR) segment held ~80% of the revenue share in 2024 due to its unmatched sensitivity, specificity, and versatility across diverse diagnostic applications. PCR remains the gold standard for detecting pathogens, genetic mutations, and cancer biomarkers due to its rapid turnaround and adaptability to new targets. Continuous advancements, including multiplexing and real-time quantification, have expanded its clinical utility. Widespread laboratory familiarity, established protocols, and availability of high-quality reagents reinforce its market dominance. The scalability of PCR platforms, from high-throughput laboratory systems to portable point-of-care devices, ensures its continued relevance in both centralized and decentralized molecular testing environments.

The In Situ Hybridization (ISH) segment in the molecular diagnostics market is projected to witness the fastest CAGR from 2025 to 2034 due to its increasing adoption in precision medicine and cancer diagnostics. ISH enables the detection of specific nucleic acid sequences within preserved tissue samples, allowing pathologists to visualize spatial gene expression patterns with high accuracy. The growing demand for early and accurate cancer detection, particularly for identifying genetic alterations such as HER2 amplification in breast cancer, is driving usage. Technological improvements, including multiplexing and automation, are reducing turnaround times and improving reproducibility, making ISH more accessible for routine clinical workflows. Rising integration of ISH with digital pathology platforms is further enhancing its diagnostic value and boosting adoption in both clinical and research settings.

Application Analysis

In terms of application, the segmentation includes oncology, pharmacogenomics, infectious disease, genetic testing, neurological disease, cardiovascular disease, microbiology, and others. The infectious diseases segment held the largest revenue share of ~62% in 2024 due to the high global burden of viral, bacterial, and emerging pathogens requiring rapid and accurate detection. Molecular diagnostics enable early intervention and containment, critical for conditions such as COVID-19, tuberculosis, HIV, and hepatitis. Advances in multiplex testing allow simultaneous detection of multiple pathogens from a single sample, improving efficiency. Public health surveillance programs and outbreak preparedness initiatives have further driven testing volumes. Continuous emergence of drug-resistant strains and novel infectious agents keeps demand high, with healthcare providers prioritizing molecular assays for their precision, speed, and adaptability to evolving disease threats.

The oncology segment is expected to register a significant CAGR from 2025 to 2034, fueled by the expanding use of molecular diagnostics in early cancer detection, prognosis, and treatment selection. Precision oncology relies on identifying genetic mutations and biomarkers to guide targeted therapies, making advanced molecular testing essential. Liquid biopsy technologies, enabling non-invasive tumor profiling, are gaining clinical adoption. Increased investment in cancer research and personalized treatment approaches is accelerating assay development. Rising cancer incidence globally is driving demand for more sensitive and comprehensive molecular diagnostic solutions. Integration of AI-driven analytics will further enhance diagnostic accuracy and therapeutic decision-making in oncology care.

Regional Analysis

The North America molecular diagnostics market accounted for the largest revenue share of ~41% due to strong adoption of advanced molecular testing technologies, supported by a well-established healthcare infrastructure and high diagnostic accuracy standards. Extensive investment in precision medicine programs and integration of genomics into routine clinical workflows have driven test adoption across hospitals and specialized laboratories. The presence of leading diagnostic companies, coupled with rapid availability of newly developed assays, enables faster clinical uptake. Favorable reimbursement frameworks and government-funded screening initiatives for infectious and genetic diseases further strengthen market demand, creating a competitive yet innovation-driven environment across the region.

U.S. Molecular Diagnostics Market Insights

The U.S. held the largest revenue share in 2024 due to high penetration of personalized medicine and targeted therapy programs that rely heavily on molecular diagnostics. A strong focus on early detection of cancers, infectious diseases, and rare disorders has increased demand for advanced PCR, NGS, and multiplex testing solutions. Widespread collaborations between research institutions, biotech companies and hospitals accelerate innovation and clinical validation. A robust regulatory framework ensures faster approvals for breakthrough diagnostic technologies, while rising consumer awareness encourages adoption of home-based and point-of-care molecular tests.

Asia Pacific Molecular Diagnostics Market Trends

Asia Pacific is growing significantly from 2025-2034 due to increasing healthcare investments, rapid adoption of advanced diagnostic platforms, and the rising burden of chronic and infectious diseases. For instance, the World Health Organization reports that noncommunicable diseases (NCDs), primarily cardiovascular diseases, chronic respiratory conditions, diabetes, and cancer, are the leading causes of mortality in the South-East Asia Region, resulting in around 8.5 million deaths each year. Governments are expanding molecular testing capabilities through public health programs, particularly for cancer and pathogen surveillance. Growing affordability of NGS and PCR technologies, supported by localized manufacturing and technology transfer, is reducing cost barriers. The shift toward preventive healthcare is creating demand for early disease detection tools. Strong growth in medical tourism and adoption of international diagnostic standards are attracting global players to establish regional partnerships, enhancing the availability and accessibility of molecular tests.

China Molecular Diagnostics Market Overview

China is growing due to rapid expansion of precision medicine initiatives and government-backed genomic research projects that integrate molecular diagnostics into national healthcare strategies. Strong domestic manufacturing capabilities for PCR and sequencing equipment reduce dependency on imports, lowering costs and improving accessibility. Increasing cancer incidence and demand for infectious disease monitoring are driving adoption of high-throughput molecular testing. Collaboration between academic institutions, hospitals, and biotech firms accelerates assay development tailored to local healthcare needs. Favorable regulatory reforms and fast-track approvals for innovative diagnostic technologies are enabling quicker market entry, strengthening China’s role as both a major consumer and producer in this sector.

Europe Molecular Diagnostics Market Analysis

Europe is increasing significantly due to a strong focus on early disease detection through national screening programs, particularly for cancer and genetic disorders. Advancements in molecular diagnostics are being rapidly integrated into public healthcare systems, supported by reimbursement policies that encourage adoption. Growing emphasis on personalized treatment approaches, coupled with rising investments in molecular research, is driving clinical use of advanced NGS and PCR-based tests. Cross-border collaborations between research institutes and diagnostic companies enhance innovation and regulatory harmonization. Rising incidence of infectious diseases and antimicrobial resistance further accelerate demand for rapid and accurate molecular diagnostic solutions across European healthcare facilities.

Key Players & Competitive Analysis

The competitive landscape of the molecular diagnostics market is shaped by dynamic industry. Companies are engaging in joint ventures, strategic alliances, and mergers and acquisitions to strengthen technology portfolios and penetrate emerging markets. Post-merger integration focuses on streamlining product lines, aligning regulatory pathways, and optimizing supply chains for improved efficiency. Advancements in technology, particularly in automation and high-throughput platforms, are influencing competitive positioning by enabling faster and more accurate results. Strategic collaborations with research institutes and healthcare providers are supporting innovation pipelines, while partnerships for co-development are enabling the rapid commercialization of advanced molecular testing solutions.

Key Players

- Abbott

- Agilent Technologies, Inc.

- BD

- 8BIOMÉRIEUX

- Bio-Rad Laboratories, Inc.

- Danaher

- F. Hoffmann-La Roche, Ltd.

- Grifols

- Hologic Inc. (Gen Probe)

- Illumina, Inc.

- QIAGEN

- Siemens Healthineers AG

- Sysmex Corporation

Molecular Diagnostics Industry Developments

August 2024: Sysmex Corporation and QIAGEN expanded their strategic partnership to strengthen genetic testing through joint efforts in R&D, manufacturing, clinical trials, and global commercialization.

January 2023: QIAGEN launched the EZ2 Connect MDx platform, a new automated sample processing system compatible with dPCR, PCR, and other molecular diagnostic applications.

Molecular Diagnostics Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Instruments

- Reagents

- Others

By Test Location Outlook (Revenue, USD Billion, 2020–2034)

- Point of Care

- Self-test or OTC

- Central Laboratories

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Polymerase Chain Reaction (PCR)

- PCR, by Procedure

- Nucleic Acid Extraction

- Others

- PCR, by Type

- Multiplex PCR

- Other PCR

- PCR, by Product

- Instruments

- Reagents

- Others

- In Situ Hybridization (ISH)

- PCR, by Procedure

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- Chips and Microarrays

- Mass Spectrometry

- Transcription Mediated Amplification (TMA)

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Oncology

- Pharmacogenomics

- Infectious Disease

- MRSA

- Clostridium Difficile

- Tuberculosis and Drug-Resistant TB

- Meningitis

- Gonorrhea

- HIV

- Hepatitis C

- Hepatitis B

- Others

- Genetic Testing

- Neurological Disease

- Cardiovascular Disease

- Microbiology

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Vietnam

- Australia

- Rest of Asia Pacific

- Latin America

- Argentina

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

- Rest of Middle East & Africa

Molecular Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 25.71 billion |

|

Market Size in 2025 |

USD 26.71 billion |

|

Revenue Forecast by 2034 |

USD 38.01 billion |

|

CAGR |

4.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 25.71 billion in 2024 and is projected to grow to USD 38.01 billion by 2034.

The global market is projected to register a CAGR of 4.0% during the forecast period.

North America accounted for the largest global revenue share of ~41% due to strong adoption of advanced molecular testing technologies.

A few of the key players in the market are Abbott; Agilent Technologies, Inc.; BD; BIOMÉRIEUX; Bio-Rad Laboratories, Inc.; Danaher; F. Hoffmann-La Roche, Ltd.; Grifols; Hologic Inc. (Gen Probe); Illumina, Inc.; QIAGEN; Siemens Healthineers AG; Sysmex Corporation.

The reagents systems segment dominated the market with ~66% of the revenue share in 2024 due to continuous demand for consumables in routine molecular diagnostic workflows.

The infectious diseases segment held the largest revenue share of ~62% in 2024 due to the high global burden of viral, bacterial, and emerging pathogens requiring rapid and accurate detection.