Nanocatalysts Market Size, Share, Trends, Industry Analysis Report

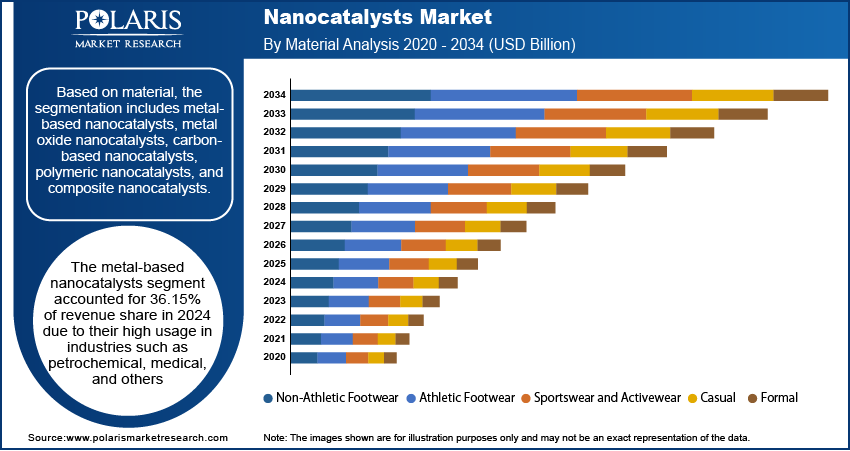

By Material (Metal-Based Nanocatalysts, Metal Oxide Nanocatalysts, Carbon-Based Nanocatalysts, Polymeric Nanocatalysts, Composite Nanocatalysts), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 124

- Format: PDF

- Report ID: PM6383

- Base Year: 2024

- Historical Data: 2020-2023

Overview

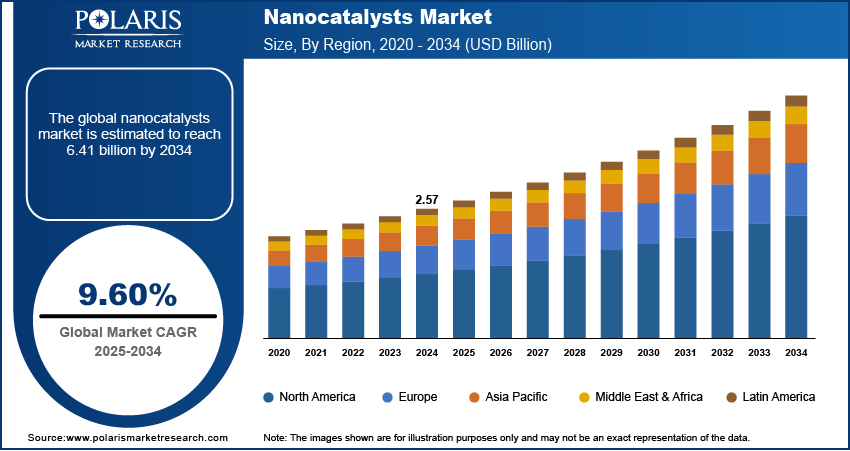

The global nanocatalysts market size was valued at USD 2.57 billion in 2024, growing at a CAGR of 9.60% from 2025 to 2034. Key factors driving demand for nanocatalysts include advancements in nanotechnology and material science, expanding urbanization, and rising industrialization.

Key Insights

- The metal-based nanocatalysts segment accounted for 36.15% of revenue share in 2024 due to the expanding petrochemical and pharmaceutical industries.

- The petroleum refining segment held 30.87% of revenue share in 2024 due to nanocatalysts' ability to improve fuel yield and reduce harmful emissions.

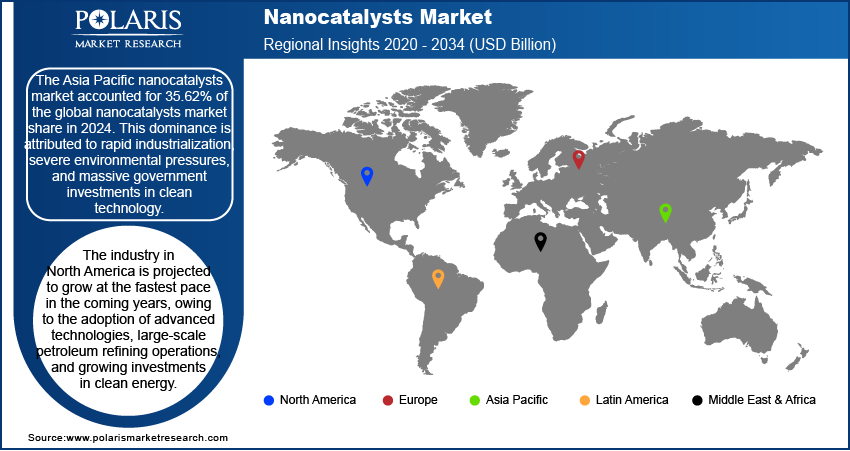

- The Asia Pacific nanocatalysts market accounted for 35.62% of the global nanocatalysts market share in 2024, owing to government investments in clean technology.

- China held the largest revenue share in the Asia Pacific nanocatalysts landscape in 2024, due to its strong role in global chemical production.

- The market in Europe is projected to hold a substantial revenue share by 2034 due to strong adoption of sustainable technologies.

Industry Dynamics

- Expanding urbanization is fueling the demand for nanocatalysts by driving the need for cleaner fuels, advanced waste management, and improved air quality.

- Advancements in nanotechnology and material science are fueling the demand for nanocatalysts by enabling scientists and engineers to design catalysts with precision and efficiency.

- Increasing production of electric vehicles (EVs) is expected to create a lucrative market opportunity during the forecast period.

- High cost and complexity of production hinder the nanocatalysts market growth.

Artificial Intelligence (AI) Impact on Nanocatalysts Market

- AI rapidly screens millions of material combinations, identifying high-performance nanocatalysts faster than traditional methods.

- AI-driven simulations optimize synthesis and industrial processes, reducing costs and waste.

- Machine learning models also simulate reaction mechanisms, enabling precise tuning of nanocatalyst structure for maximum efficiency and selectivity.

- AI sensors and analytics enhance quality control and catalyst performance during production.

Market Statistics

- 2024 Market Size: USD 2.57 Billion

- 2034 Projected Market Size: USD 6.41 Billion

- CAGR (2025–2034): 9.60%

- Asia Pacific: Largest Market Share

Nanocatalysts are advanced catalytic materials, offering high surface area, enhanced reactivity, and unique electronic properties that improve chemical reaction efficiency. They are broadly classified into three main types: metal-based nanocatalysts, oxide nanocatalysts, and carbon-based nanocatalysts. Metal-based nanocatalysts are used in hydrogenation, fuel cells, and automotive exhaust treatment. Oxide nanocatalysts are applied in photocatalysis, air purification, and wastewater treatment. Carbon-based nanocatalysts are utilized in organic synthesis and energy storage.

Nanocatalysts are widely used in various industries such as petrochemicals, pharmaceuticals, and renewable energy due to their exceptional catalytic activity and selectivity. They enable greener chemical processes by reducing energy consumption and waste production. Additionally, their tunable properties allow for precise control in reactions, making them essential in sustainable technologies such as CO₂ conversion, hydrogen production, and pollutant degradation. The versatility and efficiency of nanocatalysts make them crucial in modern chemistry and environmental science.

The global demand for nanocatalysts is driven by the rising industrialization. Economic Survey 2023-24 highlighted that India witnessed robust industrial growth of 9.5% in 2023–24. This drove demand for nanocatalysts in industries such as petrochemicals, pharmaceuticals, and energy, as these industries rely on nanocatalysts to accelerate chemical reactions, reduce energy consumption, and minimize harmful byproducts. Moreover, industries are adopting green technologies, which favor nanocatalysts for their ability to optimize production while lowering environmental impact. Therefore, as industries scale up operations, they require advanced materials such as nanocatalysts to maintain competitiveness and meet stricter environmental regulations.

Drivers & Opportunities

Expanding Urbanization: Urbanization is driving the need for cleaner fuels, advanced waste management, and improved air quality, prompting industries to adopt nanocatalysts in catalytic converters, fuel cells, and wastewater purification systems. United Nations, in its report, stated that the global urban population is projected to increase to around two-thirds of the total population by 2050. The construction of smart cities and green buildings is further accelerating nanocatalyst usage, as they enhance energy-efficient processes and reduce harmful emissions. Additionally, rising urbanization is boosting manufacturing activity, where nanocatalysts optimize chemical production, pharmaceuticals, and consumer goods. Therefore, the growing urbanization is fueling the demand for nanocatalysts.

Advancements in Nanotechnology and Material Science: Advancements in nanotechnology and material science fuel the demand for nanocatalysts by enabling scientists and engineers to design catalysts with precision and efficiency. Nanotechnology allows researchers to manipulate materials at the atomic and molecular levels, creating catalysts with much higher surface areas and unique electronic properties. These nanocatalysts significantly enhance reaction rates and selectivity, making industrial processes faster, more energy-efficient, and environmentally friendly. Material science contributes by developing novel nanomaterials such as graphene, metal-organic frameworks, and quantum dots that exhibit exceptional catalytic activity. Numerous industries such as petrochemicals, pharmaceuticals, and renewable energy increasingly adopt these advanced nanocatalysts to reduce costs, minimize waste, and meet stringent environmental regulations.

Segmental Insights

Material Analysis

Based on material, the segmentation includes metal-based nanocatalysts, metal oxide nanocatalysts, carbon-based nanocatalysts, polymeric nanocatalysts, and composite nanocatalysts. The metal-based nanocatalysts segment accounted for 36.15% of revenue share in 2024 due to their high usage in industries such as petrochemical, medical, and others. Chemical manufacturing, petroleum refining, and pharmaceutical sectors increasingly adopted these materials due to their efficiency in accelerating reactions and reducing energy consumption. Companies also invested in platinum, palladium, gold, and silver-based catalysts to improve yields in fuel cells and emission control systems, which significantly strengthened demand. Rising concerns over sustainability further encouraged industries to use these catalysts to lower carbon emissions and optimize resource utilization, which contributed to their dominance in the market.

Application Analysis

In terms of application, the segmentation includes petroleum refining, chemicals, environmental, energy & fuel cells, automotive, electronics & semiconductor, food & beverage, and pharmaceuticals & biotechnology. The petroleum refining segment held 30.87% of revenue share in 2024 due to nanocatalysts' ability to improve fuel yield and reduce harmful emissions. Petroleum companies used nanoscale catalysts to enhance the efficiency of cracking and hydroprocessing, which allowed them to produce cleaner fuels that met strict regulatory standards. The segment also benefited from the rising global demand for gasoline, diesel, and jet fuel, along with continuous upgrades in refinery operations to maximize output and minimize energy consumption. The ability of these catalysts to offer high surface area, improved selectivity, and longer operational life further strengthened their adoption in refining applications.

The energy & fuel cells segment is projected to grow at a robust pace in the coming years, owing to the global shift toward clean and sustainable energy solutions. Growing investments in hydrogen-based energy systems, coupled with the need for efficient catalysts in fuel cells, continue to drive demand. Industries prefer nanostructured catalysts for fuel cells as they deliver superior electrochemical activity, faster reaction rates, and reduced reliance on expensive metals such as platinum. Government policies promoting renewable energy adoption and corporate initiatives to decarbonize operations are driving the segment growth.

Regional Analysis

Asia Pacific nanocatalysts market accounted for 35.62% of the global nanocatalysts market share in 2024. This dominance is attributed to rapid industrialization, severe environmental pressures, and massive government investments in clean technology. Countries such as India, South Korea, and Southeast Asian nations faced significant challenges with air and water pollution from their manufacturing and energy sectors. This created a powerful regulatory push for cleaner industrial processes, where nanocatalysts are essential for advanced emissions control systems and wastewater treatment. Furthermore, the region's booming chemical and petrochemical industry utilized nanocatalysts in 2024 to enhance process efficiency, reduce energy consumption, and improve yields in refining and polymer production.

China Nanocatalysts Market Insights

China held the largest revenue share in the Asia Pacific nanocatalysts landscape in 2024, due to its aggressive push for cleaner industrial processes and its role in global chemical production. The country’s government policies emphasized reducing air pollution and carbon emissions, which increased the use of nanocatalysts in petroleum refining and environmental applications. China’s dominance in battery manufacturing and electric vehicle production further fueled demand for nanocatalysts in energy storage and fuel cell technologies. The nation’s strong investments in nanotechnology research and material science also accelerated innovation and commercialization of nanocatalyst applications across industries.

Europe Nanocatalysts Market Trends

The market in Europe is projected to hold a substantial revenue share in 2034 due to strict environmental regulations, strong adoption of sustainable technologies, and a strong chemical and pharmaceutical industry. The European Union’s stringent emission control policies are pushing refineries and automakers to integrate nanocatalysts for cleaner fuel production and catalytic converters. The region also leads in renewable energy transitions, particularly hydrogen-based solutions, which require advanced nanocatalysts for electrolysis and fuel cells. Furthermore, Europe’s pharmaceutical and biotechnology sectors are using nanocatalysts in drug development and fine chemical synthesis.

Germany Nanocatalysts Market Overview

The demand for nanocatalysts in Germany is being driven by rising automotive innovation, chemical manufacturing, and renewable energy technologies. German automakers are increasingly adopting nanocatalysts in catalytic converters and fuel-efficient engines to meet strict EU emission norms. The country’s focus on green hydrogen and sustainable fuel solutions also drives nanocatalyst utilization in energy and fuel cell applications. Germany’s strong R&D ecosystem and collaboration between universities, research institutes, and industry players are also accelerating advancements in nanotechnology.

North America Nanocatalysts Market Assessment

The industry in North America is projected to grow at the fastest pace in the coming years, owing to the adoption of advanced technologies, large-scale petroleum refining operations, and growing investments in clean energy. The U.S., in particular, drives demand with its extensive oil and gas industry seeking efficient nanocatalysts to optimize refining processes and comply with emission standards. The rapid growth of electric vehicles and hydrogen fuel cell projects in the region further supports the use of nanocatalysts. Additionally, the region’s strong pharmaceutical, biotechnology, and food processing industries leverage nanocatalysts for precision applications, ensuring steady market growth.

Key Players & Competitive Analysis

The nanocatalyst market is highly competitive, with key players such as BASF SE, Bayer AG, and Evonik Industries AG leading through advanced R&D and extensive industrial applications. These multinational giants leverage their strong chemical manufacturing expertise to develop high-performance nanocatalysts for petrochemicals, energy, and environmental sectors. Meanwhile, specialized firms such as Hyperion Catalysis International and Nanostellar, Inc. focus on niche innovations, such as carbon nanotube-based catalysts and emission control solutions. Emerging players, including Headwaters NanoKinetix and Nanophase Technologies Corporation, drive competition with cost-effective and scalable nanocatalytic solutions. The market is further diversified by Dow, Inc. and NanoScale Corporation, which emphasize sustainability and green chemistry. Intense R&D investments, patent strategies, and partnerships define the competitive dynamics, with North America and Europe dominating due to stringent environmental regulations, while Asia Pacific shows rapid growth fueled by industrialization and clean energy demand.

A few major companies operating in the nanocatalysts market include BASF SE; Beijing DK nano technology Co., Ltd.; Clean Diesel Technologies, Inc.; Dow, Inc.; Evonik Industries AG; Hyperion Catalysis International; Mach I, Inc.; Nanophase Technologies Corporation; Nanostellar, Inc.; QuantumSphere, Inc.; and Sakai Chemical.

Key Companies

- BASF SE

- Beijing DK nano technology Co. LTD

- Clean Diesel Technologies, Inc.

- Dow, Inc.

- Evonik Industries AG

- Hyperion Catalysis International

- Mach I, Inc.

- Nanophase Technologies Corporation

- Nanostellar, Inc.

- QuantumSphere, Inc.

- Sakai Chemical

Nanocatalysts Industry Developments

In January 2025, Scientists from the Institute of Nano Science and Technology (INST), an autonomous institution of the Department of Science and Technology (DST), developed a new copper-based catalyst with a star-like nanostructure.

Nanocatalysts Market Segmentation

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Metal-Based Nanocatalysts

- Metal Oxide Nanocatalysts

- Carbon-Based Nanocatalysts

- Polymeric Nanocatalysts

- Composite Nanocatalysts

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Petroleum Refining

- Chemicals

- Environmental

- Energy & Fuel Cells

- Automotive

- Electronics & Semiconductor

- Food & Beverage

- Pharmaceuticals & Biotechnology

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Nanocatalysts Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.57 Billion |

|

Market Size in 2025 |

USD 2.81 Billion |

|

Revenue Forecast by 2034 |

USD 6.41 Billion |

|

CAGR |

9.60% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.57 billion in 2024 and is projected to grow to USD 6.41 billion by 2034.

The global market is projected to register a CAGR of 9.60% during the forecast period.

Asia Pacific dominated the market in 2024

A few of the key players in the market are BASF SE; Beijing DK nano technology Co., Ltd.; Clean Diesel Technologies, Inc.; Dow, Inc.; Evonik Industries AG; Hyperion Catalysis International; Mach I, Inc.; Nanophase Technologies Corporation; Nanostellar, Inc.; QuantumSphere, Inc.; and Sakai Chemical.

The metal-based nanocatalysts segment dominated the market revenue share in 2024.

The energy & fuel cells segment is projected to witness the fastest growth during the forecast period.

The global market size was valued at USD 2.57 billion in 2024 and is projected to grow to USD 6.41 billion by 2034.

The global market is projected to register a CAGR of 9.60% during the forecast period.

Asia Pacific dominated the market in 2024

A few of the key players in the market are BASF SE; Beijing DK nano technology Co., Ltd.; Clean Diesel Technologies, Inc.; Dow, Inc.; Evonik Industries AG; Hyperion Catalysis International; Mach I, Inc.; Nanophase Technologies Corporation; Nanostellar, Inc.; QuantumSphere, Inc.; and Sakai Chemical.

The metal-based nanocatalysts segment dominated the market revenue share in 2024.

The energy & fuel cells segment is projected to witness the fastest growth during the forecast period.