Natural Surfactants Market Size, Share, Trends, Industry Analysis Report

By Product Type (Anionic Natural Surfactants, Non-Ionic Natural Surfactants), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 122

- Format: PDF

- Report ID: PM2492

- Base Year: 2024

- Historical Data: 2020-2023

Overview

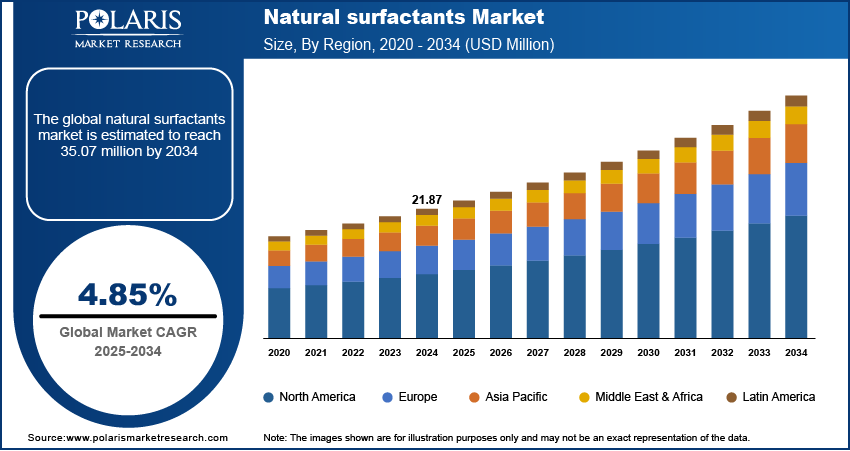

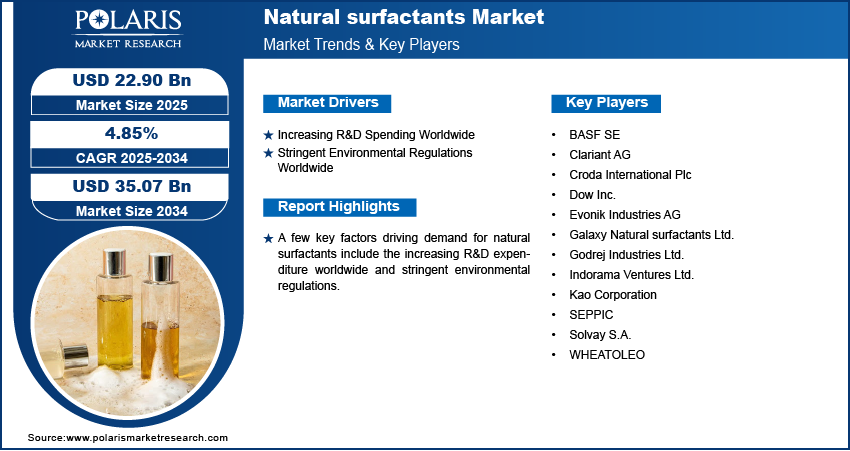

The global natural surfactants market size was valued at USD 21.87 billion in 2024, growing at a CAGR of 4.85% from 2025 to 2034. Key factors driving demand for natural surfactants include growing R&D spending worldwide and increasing stringent environmental regulation.

Key Insights

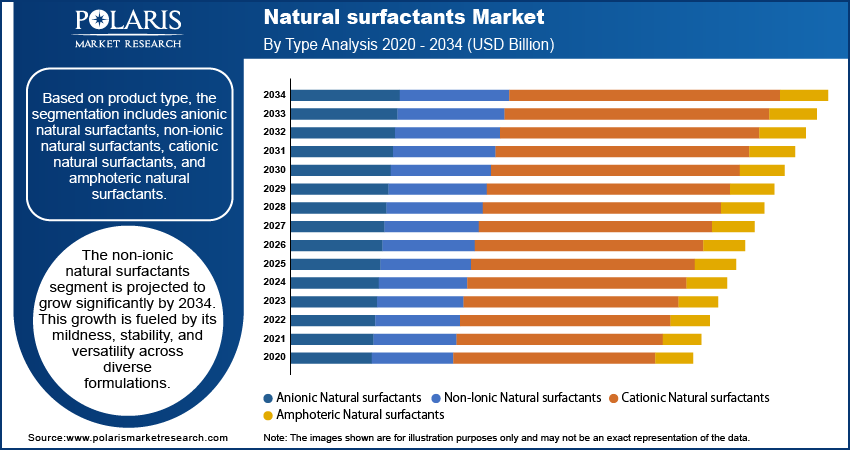

- The anionic natural surfactants segment dominated the market share in 2024.

- The non-ionic natural surfactants are projected to grow at a rapid pace in the coming years, driven by its wide application in detergents, personal care products, agrochemicals, and industrial cleaning agents.

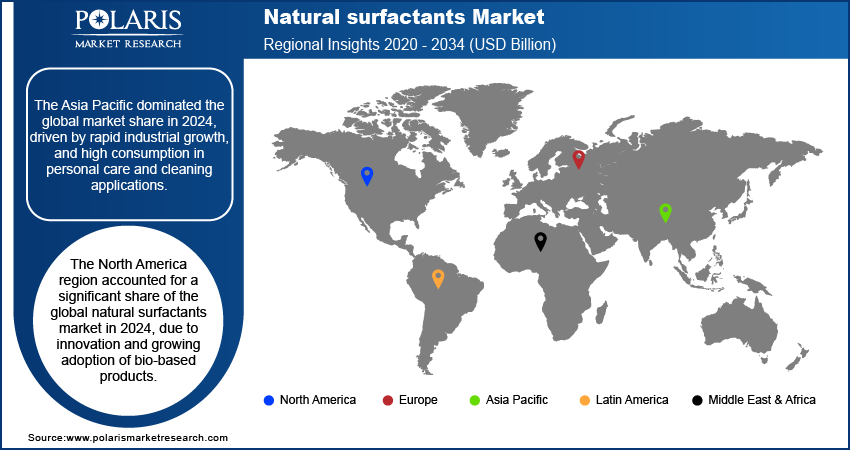

- The Asia Pacific natural surfactant market dominated the global market share in 2024.

- The India natural surfactant market is growing due to rising demand for eco-friendly cleaning and personal care products, coupled with expansion of food & biotech industry.

- The market in North America is projected to grow at a fast pace from 2025-2034, propelled by advancements in specialty bio-based formulations, strong R&D infrastructure, and increasing adoption of premium sustainable products across multiple industries.

- Countries such as China and Japan are playing a key role in regional growth, due to robust industrial output, rapid innovation in plant-derived formulations and supportive regulatory frameworks boosting renewable raw material usage.

Industry Dynamics

- Rising R&D spending worldwide is fueling the market growth due to accelerated innovation in bio-based surfactants, enabling improved performance, diversified applications, and compliance with stringent environmental standards.

- Stringent environmental regulations drive the demand for natural surfactants due to their biodegradability, low toxicity, and ability to replace petrochemical-based alternatives in industrial and consumer applications.

- Innovations in enzymatic synthesis, microbial fermentation, and green chemistry is expected to create lucrative opportunities during the forecast period.

- The supply chain vulnerability of raw materials are anticipated to restrain market growth.

Market Statistics

- 2024 Market Size: USD 21.87 Billion

- 2034 Projected Market Size: USD 35.07 Billion

- CAGR (2025–2034): 4.85%

- Asia Pacific: Largest Market Share

Natural surfactants are surface-active agents derived from renewable sources such as plants, microorganisms and animals used to reduce surface and interfacial tension between liquids or between a liquid and a solid. They are adopted across personal care, household cleaning, agriculture, food processing, and industrial applications due to their biodegradability, low toxicity, and environmental safety. Growing consumer preference for sustainable and eco-friendly products, coupled with stricter regulations on synthetic surfactants, is accelerating the shift toward bio-based alternatives. Continuous advancements in fermentation technology and feedstock optimization are expanding production capabilities, driving broader market adoption across multiple industries.

The rising pace of urbanization and infrastructure development is propelling growth in the natural surfactants market due to increased demand for eco-friendly cleaning agents, detergents, and industrial formulations used in construction, maintenance, and urban utilities. Expanding urban populations generate higher consumption of household and industrial cleaning products, creating strong demand for biodegradable and non-toxic surfactants. According to the United Nations, the urban population represented 57% of the global population and is projected to reach 68% by 2050. This demographic shift is accelerating the adoption of sustainable cleaning and processing chemicals across residential, commercial, and industrial sectors.

The global growth of the food and biotechnology industries is driving the natural surfactant market due to their rising application in food processing, fermentation, and biopharmaceutical production. Natural surfactants are utilized for emulsification, foaming, and stabilization in food products, as well as in bio-based formulations for drug delivery and cell culture. Rising consumer demand for sustainable and plant-derived ingredients, coupled with advancements in biotechnology-based production methods, is amplifying their adoption.

Drivers & Opportunities

Increasing R&D Spending Worldwide: The rise in gross domestic spending on research and development (R&D) is propelling the natural surfactants market due to accelerated innovation in bio-based formulations, green chemistry processes, and sustainable production methods. Increased R&D investment enables manufacturers to enhance product performance, expand application scope, and comply with stringent environmental regulations. According to Organisation for Economic Co-operation and Development (OECD), Israel’s R&D expenditure reached 6.3% of GDP in 2023, while Korea and Sweden recorded 5% and 3.6%, respectively. This substantial spending growth is fostering the development of advanced natural surfactant technologies, backing up industries such as personal care, household cleaning, pharmaceuticals, and food processing.

Stringent Environmental Regulations Worldwide: The stringent environmental regulations on synthetic surfactants are driving the natural surfactants market as governments worldwide impose restrictions on the use of petrochemical-based and non-biodegradable surfactants due to their ecological impact. Regulatory frameworks such as the European Union’s REACH regulation and the U.S. Environmental Protection Agency (EPA) guidelines are propelling industries to adopt biodegradable, plant-based alternatives to reduce water pollution and ecological harm. This policy-driven shift is pushing manufacturers to develop and integrate natural surfactants across applications in detergents, personal care, food, and agriculture, thereby accelerating market expansion.

Segmental Insights

Product Type Analysis

In term of type, the segmentation is divided into anionic natural surfactants, non-ionic natural surfactants, cationic natural surfactants, and amphoteric natural surfactants. The anionic natural surfactants segment held the dominant share of the market in 2024, due to its high efficiency in removing dirt and oils across a range of cleaning and personal care applications. Derived from natural sources such as fatty acids, these surfactants exhibit strong foaming properties and cost-effective production, making them widely used in household detergents and industrial cleaning formulations. The segment’s prominence is shaped by strong demand from developed and emerging markets where consumers favor biodegradable and eco-certified products.

The non-ionic Natural surfactants segment is anticipated to witness the most rapid growth during the forecast period, due to their mild nature, low toxicity, and excellent performance in hard water conditions. These surfactants are incorporated into personal care products, agricultural formulations, and specialty industrial cleaners. Additionally, advancements in plant-based feedstock processing and demand for products with low environmental impact are accelerating adoption across multiple end-use industries. For instance, in March 2025, biosurfactant producers Dispersa and AGAE Technologies scaled up operations, collectively adding over 1,000 metric tons of new annual capacity for biobased natural surfactants, which is expected to enhance supply availability and market penetration over the next few years.

Application Analysis

In terms of application, the segmentation includes detergents, personal care, agricultural chemicals, industrial & institutional (I&I) cleaning, and others. The detergents segment dominated the surfactant market in 2024, driven by large-scale consumption in household laundry products, dishwashing liquids, and fabric care solutions. Growing consumer preference for sustainable cleaning agents and regulations limiting the use of synthetic surfactants, boost the demand for natural formulations. Manufacturers are investing in R&D to enhance cleaning efficiency while maintaining biodegradability, solidifying the position of natural surfactants in detergent applications.

The personal care segment is expected to grow at a rapid pace in the coming years, fueled by rising demand for eco-friendly shampoos, body washes, and skincare products. Natural surfactants are favored for their gentle cleansing properties, compatibility with sensitive skin, and sustainable sourcing. The growth of organic and herbal personal care brands, coupled with increasing consumer awareness of product ingredient transparency, is expected to sustain strong market expansion in this segment.

Regional Analysis

Asia Pacific held the dominant share of the global natural surfactants market in 2024, driven by rapid industrial expansion, urban growth, and advancements in food processing and biotechnology across major economies such as China, India, and Southeast Asian nations. Strong demand from personal care, household cleaning, and industrial manufacturing is fueling higher consumption of bio-based surfactant formulations. The region benefits from abundant cost-effective raw materials, an extensive manufacturing base, and rising investments in plant-derived surfactants as industries work toward achieving sustainability targets.

India Natural Surfactants Market Insights

India is witnessing robust growth in natural surfactants driven by the expanding food and beverage industry. Natural surfactants are widely utilized for emulsification, dispersion, and texture enhancement in processed foods, beverages, and dairy products. Rising demand for packaged and convenience foods, coupled with the transition toward plant-based emulsifiers, is propelling manufacturers to develop innovative, clean-label surfactant solutions. According to the Department of Biotechnology (DBT) – Biotechnology Industry Research Assistance Council (BIRAC), India’s food processing sector was valued at USD 44 billion in 2017 and is projected to reach USD 300 billion by 2030, highlighting significant potential for surfactant applications in value-added food categories.

Europe Natural Surfactants Market Assessments

The market in Europe is projected to hold a substantial revenue share in 2034 due to its strong chemical manufacturing base, rigorous environmental regulations, and rising consumer preference for sustainable products. Countries such as Germany, France, and the U.K. are leading the adoption of plant-derived ingredients in detergents, cosmetics, and industrial applications. This trend is further boosted by the region’s commitment to green chemistry and circular economy practices, fueling investments in eco-friendly production methods and renewable raw material sourcing.

North America Natural Surfactants Market Trends

North America is anticipated to record the fastest growth during the forecast period, driven by advancements in specialty natural surfactant development and swift commercialization of innovative formulations across diverse end-use sectors. Growing demand for eco-friendly cleaning solutions, premium personal care products, and bio-based industrial additives is boosting market expansion. The region’s strong R&D capabilities and targeted investments in high-performance, low-toxicity surfactants are helping manufacturers address evolving regulatory standards and consumer preferences. Moreover, widening applications in pharmaceuticals and food processing are enhancing market penetration, solidifying North America’s role as a major growth hub in the years ahead.

The U.S. Natural Surfactants Market Overview

The growing shift toward eco-friendly and renewable raw materials is propelling the natural surfactants market, as manufacturers focus on minimizing environmental impact and adhering to strict sustainability standards. Companies are investing in bio-based surfactant innovations to meet the needs of environmentally conscious consumers and industrial sectors. For instance, in May 2025, Pilot Chemical Company partnered with Novvi LLC to launch CalCare AOS, a fully biobased alpha olefin sulfonate surfactant line in North America, highlighting the market’s strong momentum toward sustainable product offerings.

Key Players & Competitive Analysis

The natural surfactants market is moderately competitive, with key players such as BASF SE, Evonik Industries AG, Croda International Plc, Clariant AG, Dow Inc., Solvay S.A., and Kao Corporation. These companies focus on producing plant-based, biodegradable surfactants derived from renewable feedstocks to cater to industries such as personal care, home care, food processing, pharmaceuticals, and agrochemicals. The competitive dynamics are further shaped by strategic collaborations, and acquisitions aimed at enhancing manufacturing capabilities and expanding into emerging markets. Growing investment in R&D for high-performance, sulfate-free, and low-toxicity surfactants coupled with tightening environmental regulations and rising consumer preference for green products is influencing market positioning.

A few major companies operating in the Natural surfactants industry include BASF SE, Evonik Industries AG, Dow Inc., Solvay S.A., Clariant AG, Croda International Plc, Kao Corporation, Galaxy Natural surfactants Ltd., Godrej Industries Ltd., WHEATOLEO, SEPPIC, and Indorama Ventures Ltd.

Key Players

- BASF SE

- Clariant AG

- Croda International Plc

- Dow Inc.

- Evonik Industries AG

- Galaxy Natural surfactants Ltd.

- Godrej Industries Ltd.

- Indorama Ventures Ltd.

- Kao Corporation

- SEPPIC

- Solvay S.A.

- WHEATOLEO

Natural surfactants Industry Developments

March 2025: Galaxy Natural surfactants Limited partnered with a major global client to deliver EPC services including process design, procurement, engineering, construction, and commissioning for an overseas performance surfactants and specialty ingredients facility. This initiative boost Galaxy’s strategy to expand its geographic presence in high-potential target markets.

November 2024: Godrej Industries Limited acquired the natural surfactants business of Savannah Natural Surfactants Pvt. Ltd. to fortify its production capacity, widen its market reach, and accelerate growth in domestic and international markets.

Natural Surfactants Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Anionic Natural surfactants

- Non-Ionic Natural surfactants

- Cationic Natural surfactants

- Amphoteric Natural surfactants

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Detergents

- Personal Care

- Agricultural Chemicals

- Industrial & Institutional (I&I) Cleaning

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Natural surfactants Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 21.87 Billion |

|

Market Size in 2025 |

USD 22.90 Billion |

|

Revenue Forecast by 2034 |

USD 35.07 Billion |

|

CAGR |

4.85% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 21.87 billion in 2024 and is projected to grow to USD 35.07 billion by 2034.

The global market is projected to register a CAGR of 4.85% during the forecast period.

Asia Pacific dominated the market in 2024 driven by robust industrial expansion and strong demand from personal care, household cleaning, and industrial sectors.

A few of the key players in the market are BASF SE, Evonik Industries AG, Dow Inc., Solvay S.A., Clariant AG, Croda International Plc, Kao Corporation, Galaxy Natural surfactants Ltd., Godrej Industries Ltd., WHEATOLEO, SEPPIC, and Indorama Ventures Ltd.

The anionic natural surfactants segment dominated the market revenue share in 2024 due to its extensive use in detergents, shampoos, and cleaning agents, offering strong cleaning efficiency, cost-effectiveness, and formulation compatibility.

The personal care segment is projected to witness the fastest growth during the forecast period due to rising demand for skincare, haircare, and cosmetic products.