Net-Zero Energy Buildings Market Size, Share, Trends, & Industry Analysis Report

By Equipment (HVAC Systems, Lighting, Walls and Roofs, and Others), By Type, By Region; Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 132

- Format: PDF

- Report ID: PM1078

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

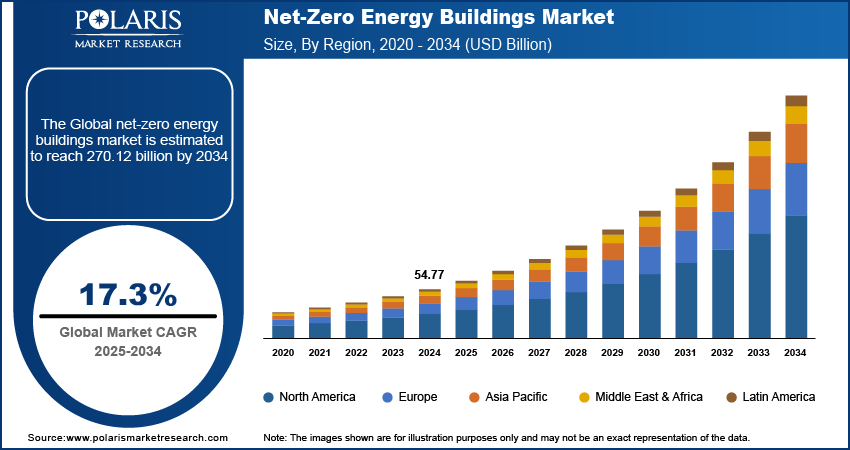

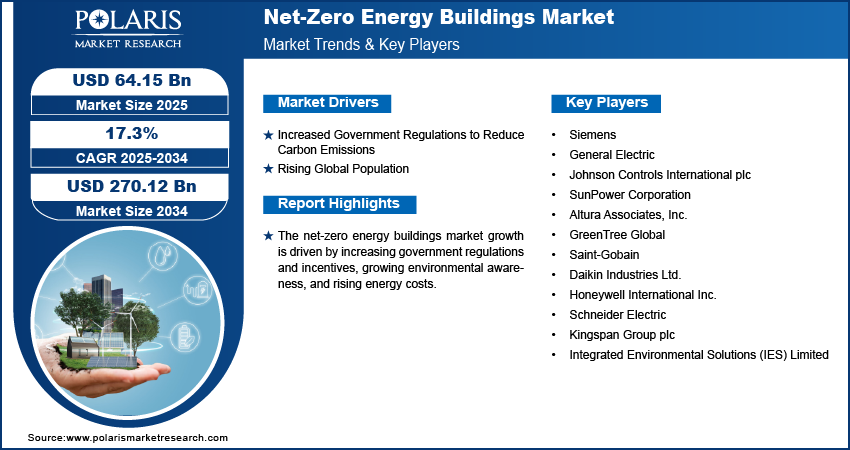

The global net-zero energy buildings market size was valued at USD 54.77 billion in 2024 and is expected to reach USD 270.12 billion by 2034, exhibiting a CAGR of 17.3% from 2025 to 2034. The market is growing as governments and developers prioritize sustainability. Increased use of solar panels, energy-efficient systems, and green construction materials is driving demand. Supportive policies and environmental awareness are accelerating adoption across commercial and residential sectors.

Net-zero energy buildings (ZNEBs), also known as zero-energy buildings, are buildings that produce as much energy as they consume. They balance their energy needs with energy generated from renewable, zero-emission sources, such as solar panels, wind turbines, and geothermal systems. These buildings aim to reduce their carbon footprint and minimize their environmental impact. ZNEBs often incorporate energy management systems to monitor and control energy usage. Also, they make use of sustainable materials and passive design strategies to reduce energy demand and improve indoor environmental quality.

To Understand More About this Research: Request a Free Sample Report

The net-zero energy buildings market growth is driven by increasing government regulations and incentives, growing environmental awareness, and rising energy costs. Technological advancements in insulating materials and smart building automation systems, along with growing awareness about the environmental and economic advantages of ZNEBs, are expected to become key trends. The market presents opportunities for stakeholders, including policymakers, developers, and technology providers, to innovate and collaborate on developing scalable solutions that address challenges related to the widespread adoption of ZNEBs.

Market Drivers

Increased Government Regulations to Reduce Carbon Emissions

The earth’s climate is experiencing drastic changes due to the unprecedented emissions of greenhouse gases (GHGs) since the start of the industrial revolution. This has resulted in the rise in the global average temperature, leading to several issues such as extreme weather events, rising sea levels, ecosystem disruptions, ocean acidification, and food security threats. This concerning fact has prompted several nations to take action to stop the unchecked emission of greenhouse gases across various industries, including the building and construction sectors. Governments worldwide are implementing several strategies, including building codes and emission standards, to reduce emissions from buildings and construction activities. For instance, in 2022, the Indian government amended the Energy Conservation Act, making Energy Conservation Building Code (ECBC) mandatory for residential buildings. The act makes it necessary to incorporate energy-efficient measures such as lighting systems, building envelope design, and HVAV systems. Thus, increasing government regulations mandating energy efficiency standards to lower GHG emissions drive the net-zero energy buildings market demand.

Rising Global Population Drives Market Growth

The global population is increasing at a significant pace. The world population is estimated to reach 8.6 billion by 2030 and 9.8 billion by 2050, according to a United Nations Report. The rapid population growth drives the growth of the building and construction sector, which accounts for a staggering 37% of global emissions. To address the challenge of embodied carbon emissions in this sector, stakeholders from across the entire lifecycle are increasingly collaborating. This cooperation involves several groups, including builders, researchers, policymakers, and community members, and it focuses on collaborative design processes, public-private partnerships, cross-sector collaborations, policy advocacy, and education and training programs to reduce emissions. For instance, in February 2023, the United Nations Development Programme (UNDP) established the Carbon Payments for Development (CP4D) Facility to support public-private partnerships (PPPs) that decrease carbon emissions and help achieve sustainable development goals (SDGs). Thus, the rising population across the world, which propels the demand for residential and commercial buildings, drives the net-zero energy buildings market growth.

Segmental Insights

Insights by Type

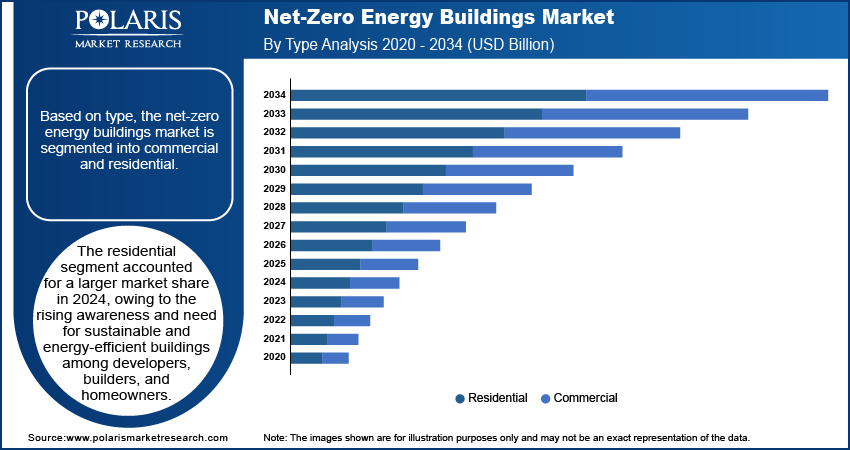

Based on type, the net-zero energy buildings market is bifurcated into commercial and residential. The residential segment accounted for the largest share in 2024, owing to the rising awareness and need for sustainable and energy-efficient buildings among developers, builders, and homeowners. Increasing climate change concerns and a growing focus on environmental sustainability have encouraged residential building industry players to adopt the net-zero energy building concept to decrease energy consumption and lower their carbon footprint. Residential buildings are increasingly utilizing energy-efficient lighting appliances and incorporating renewable energy sources to get zero or near-zero energy performance.

Insights by Equipment

Based on equipment, the net-zero energy buildings market is segmented into HVAC systems, lighting, walls and roofs, and others. The HVAC systems segment held the largest market share in 2024. Heating, ventilation, and air conditioning (HVAC) systems help control the temperature, humidity, and air quality of a space. Net-zero energy buildings use HVAC systems to maintain comfortable indoor air quality through adequate ventilation. Governments and regulatory authorities worldwide are implementing high energy efficiency criteria, including HVAC systems, to reduce greenhouse gas emissions. This promotes the adoption of advanced HVAC systems that meet these criteria and contribute to achieving zero energy targets.

Regional Insights

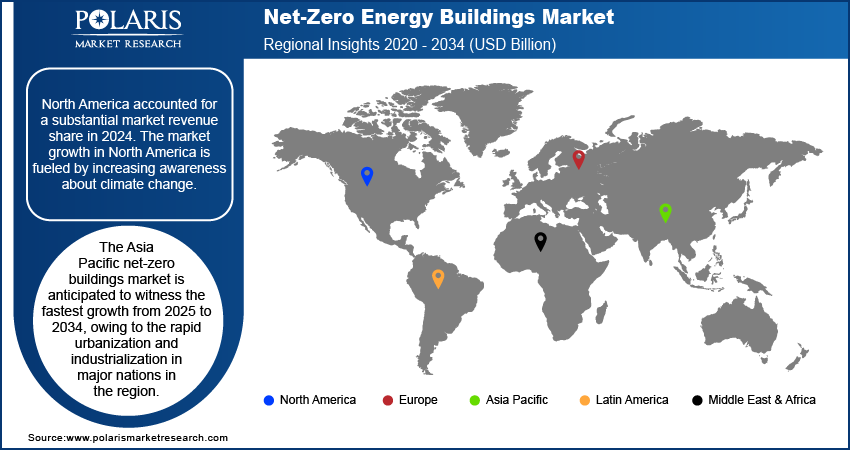

By region, the study provides net-zero buildings market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for a substantial market revenue share in 2024. The market growth in North America is fueled by increasing awareness about climate change, which drives the adoption of the net-zero energy concept to reduce carbon emissions. Besides, extreme weather conditions associated with climate change have prompted local governments to redesign urban planning strategies with a strong emphasis on sustainability.

The US dominated the North America net-zero energy buildings market in 2024. The presence of stringent energy efficiency standards and the introduction of building codes drive the adoption of net-zero energy building plans in the US. In April 2023, the American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE) announced the release of ANSI/ASHRAE Standard 228-2023. The new standard provides a method to evaluate a building’s performance for zero net energy and zero net carbon.

The Asia Pacific net-zero energy buildings market is anticipated to witness the fastest growth from 2025 to 2034. The rapid urbanization and industrialization in major nations such as India, China, and Japan have led to increased energy demand and heightened awareness of environmental sustainability. The need to address rising climate concerns and promote sustainable urban development is driving the adoption of net-zero energy buildings in the region. Besides, several regional governments in the Asia Pacific have adopted stringent building codes and energy efficiency requirements, financial incentives, and grants to encourage net-zero building technologies. For instance, the Green Building Council of Australia (GBCA) has established energy efficiency requirements for commercial buildings through its Green Star rating system.

Key Players and Competitive Insights

The leading industry players are making significant investments in research and development activities to improve their products and services offerings and drive market demand. Besides, they are adopting various strategic initiatives, including collaborations, mergers and acquisitions, increased investment, and new product launches, to expand their global footprint. To expand and survive in a more competitive and rising market environment, the industry players must offer cost-effective items.

In recent years, the net-zero energy buildings market has witnessed several technological and innovation breakthroughs, with key players seeking to provide advanced solutions that help meet sustainability goals. A few leading players in the industry include Siemens; General Electric; Johnson Controls International plc; SunPower Corporation; Altura Associates, Inc.; GreenTree Global; Saint-Gobain; Daikin Industries Ltd.; Honeywell International Inc.; Schneider Electric; Kingspan Group plc; and Integrated Environmental Solutions (IES) Limited.

List of Key Players

- Siemens

- General Electric

- Johnson Controls International plc

- SunPower Corporation

- Altura Associates, Inc.

- GreenTree Global

- Saint-Gobain

- Daikin Industries Ltd.

- Honeywell International Inc.

- Schneider Electric

- Kingspan Group plc

- Integrated Environmental Solutions (IES) Limited

Industry Developments

In June 2022, Siemens announced the launch of Building X, an open AI-enabled suite for net zero buildings. Built on the design principles of Siemens Xcelerator, Building X enables stakeholders, including real estate companies, property investors, and building users, to digitize their building data from several disciplines, systems, and sources into a single platform.

In July 2021, Honeywell and Nexii Building Solutions Inc. announced a strategic partnership for developing buildings with a lower environmental impact. With the new alliance, Honeywell will provide building technologies and energy-efficiency products for buildings constructed by Nexii.

Net-Zero Energy Buildings Market Segmentation

By Type Outlook

- Residential

- Commercial

By Equipment Outlook

- HVAC Systems

- Lighting

- Walls and Roofs

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Net-Zero Energy Buildings Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 54.77 billion |

|

Market Size Value in 2025 |

USD 64.15 billion |

|

Revenue Forecast by 2034 |

USD 270.12 billion |

|

CAGR |

17.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The net-zero energy buildings market value reached USD 54.77 billion in 2024 and is projected to grow to USD 270.12 billion by 2034.

The market is projected to register a CAGR of 17.3% from 2025 to 2034.

North America accounted for a substantial net-zero energy buildings market share in 2024.

Siemens; General Electric; Johnson Controls International plc; SunPower Corporation; Altura Associates, Inc.; GreenTree Global; Saint-Gobain; Daikin Industries Ltd.; Honeywell International Inc.; Schneider Electric; Kingspan Group plc; and Integrated Environmental Solutions (IES) Limited are among the key players in the market.

The residential segment dominated the market for net zero-energy buildings in 2024.

The HVAC systems segment held the largest market share in 2024.