Network as a Service Market Share, Size, Trends, Industry Analysis Report

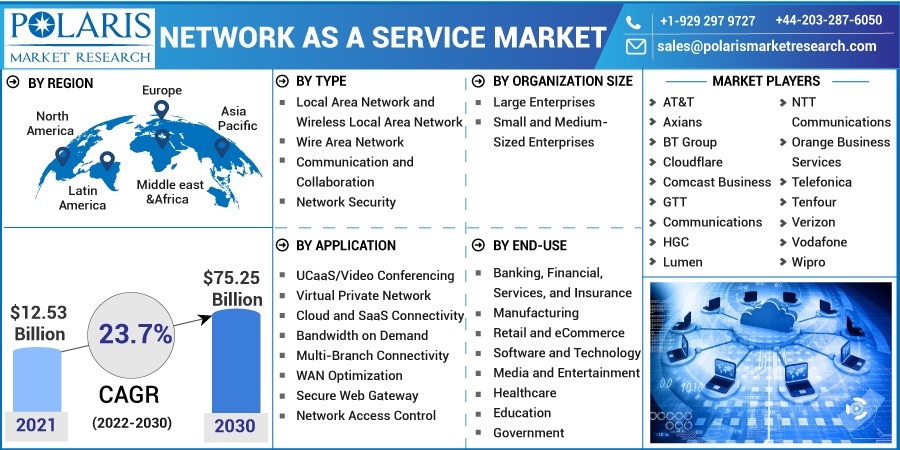

By Organization Size (Large Enterprises, Small and Medium-Sized Enterprises); By Type; By Application; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jul-2022

- Pages: 118

- Format: PDF

- Report ID: PM2525

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

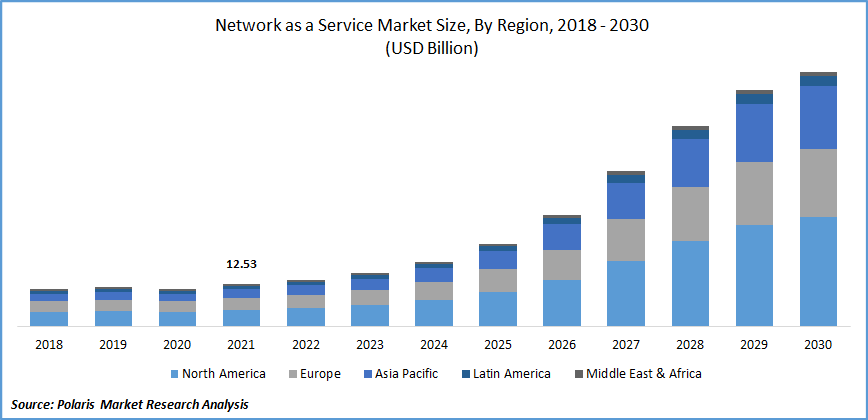

The global network as a service market was valued at USD 12.53 billion in 2021 and is expected to grow at a CAGR of 23.7% during the forecast period. The increasing demand for the network as a service across several industries including manufacturing, healthcare, media & entertainment, education, BFSI, retail & eCommerce, software and technology, and others, are expected to boost the growth of the industry.

Know more about this report: Request for sample pages

The rising need for wireless communication for industrial as well as commercial operations is likely to provide novel opportunities for the network as a service market in the near future. NaaS is a cloud delivery approach that makes net management easier for companies. It allows for significant elasticity and flexibility, as well as the option to switch from CapEx to OpEx. Since this makes it possible for companies to achieve desired results without having to own, create, or keep up infrastructure, the demand for the market is expected to grow in the global market.

Furthermore, the demand for the industry is driven by the benefits that are captivating in terms of value and speed offered by network as a service. People may increase or decrease capacity in response to market conditions owing to NaaS, which offers on-demand networking usage that promises higher scalability and greater elasticity. For instance, managing workloads, enhancing application experiences, and securely connecting users to their apps in a world of hybrids.

The outbreak of the Covid-19 pandemic has significantly impacted the network as a service market. The demand for networking infrastructure and connectivity increased as the trend toward remote work commenced during the period. Restricted movement of people, as well as more time spent online browsing, accelerated the growth of the market.

However, as a result of supply chain disruptions caused by global lockdowns, net services were severely impacted. The demand for the market was affected due to a severe economic crisis and declining consumer confidence. The main obstacles to the implementation of networks during the outbreak were the delay in investment and supply chain disruptions across industries.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Some of the more popular use cases for NaaS installation today include multibranch networking, multi-cloud access, and safeguarding the remote workforce. The ability to quickly deploy new sites, provide customers and employees with a more secure and uniform application experience, achieve better agility, and offload some of your network management chores are some advantages contributing to the increased demand for the market.

There has been a significant increase in data traffic recently due to the widespread use of smart devices and high bandwidth applications, which has sparked the creation of novel network architectures that permit greater flexibility while limiting the increased capital and operational expenditure (CAPEX/OPEX). As a result, the market is expected to grow.

Modern warehouse-sized data centers (DCs) are playing a bigger role nowadays, and virtualization technology has advanced in terms of security, isolation, and performance. These factors support the sustainability of NaaS.

Report Segmentation

The market is primarily segmented on the basis of type, organization size, application, end-use, and region.

|

By Type |

By Organization Size |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

WAN as a services is expected to account for the largest market share

Every sector is seeing an increase in demand for WAN solutions to manage intricate and varied network infrastructure at a reasonable price. The WAN solutions satisfy the cloud application's requirements for increased bandwidth, reduced latency, and bandwidth optimization.

In addition, they make difficult network issues such as configuration, maintenance, and optimization for WAN networks simpler. They effectively increase network capacity while lowering overall Capex to enable reliable branch connectivity over conventional WAN architecture.

Small and medium enterprises segment is expected to grow at highest CAGR

The majority of businesses in operation today are SMEs present across the globe. Small and mid-size firms are responsible for many technological advancements and processes. Large businesses are less adaptable than SMEs since they frequently concentrate on enhancing existing items in order to produce larger quantities and gain general benefits from the dimensional economy. Therefore, the demand for the network as a service market in these organizations is projected to grow over the forecast period.

Geographic Overview

North America is expected to account for the largest market size during the forecast period. North America's network as service market size is primarily driven by the U.S. Additionally, cloud-based applications are becoming more prevalent within organizations, and therefore, cloud-based services are rising in popularity. Cloud computing is still developing in the sector as a crucial platform for sharing resources such as infrastructure, software, operational processes, and applications.

Asia Pacific is expected to grow at a faster CAGR rate during the forecast period. The potential benefits of NaaS, such as optimized bandwidth consumption, less network traffic, transparent network visibility, faster deployment, and fewer network maintenance and management difficulties, are anticipated to have a positive impact on the expansion of the global network as a service industry.

Competitive Landscape

Some of the major players operating in the Network as a Service includes AT&T, Axians, BT Group, Cloudflare, Comcast Business, GTT Communications, HGC, Lumen, NTT Communications, Orange Business Services, Tata Communications, Telefonica, Tenfour, Verizon, Vodafone, and Wipro.

Recent Developments

In March 2022, Acuative Corporation, a leading provider of managed network lifecycle solutions announced its acquisition with Network as a Service (NaaS) provider, TenFour. The acquisition is made with a strategy to help clients leverage technology in order to meet their business needs and goals in the near future.

In April 2022, Bharti Airtel India’s communications solutions provider has acquired a strategic stake in cloud-based networking solutions provider Cnergee Technologies under the Airtel Startup Accelerator Program. This will enable Airtel to improve its NaaS proposition for Small and Medium Businesses (SMBs) who are looking to stimulate their shift to cloud-based applications.

Network as a Service Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 12.53 billion |

|

Revenue forecast in 2029 |

USD 75.25 billion |

|

CAGR |

23.7% from 2022 - 2029 |

|

Base year |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2029 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2029 |

|

Segments covered |

By Component, By Frequency, By Spectrum, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

AT&T, Axians, BT Group, Cloudflare, Comcast Business, GTT Communications, HGC, Lumen, NTT Communications, Orange Business Services, Tata Communications, Telefonica, Tenfour, Verizon, Vodafone, and Wipro |