Network Probe Market Share, Size, Trends, Industry Analysis Report

By Component (Software, Services); By Deployment; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3790

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

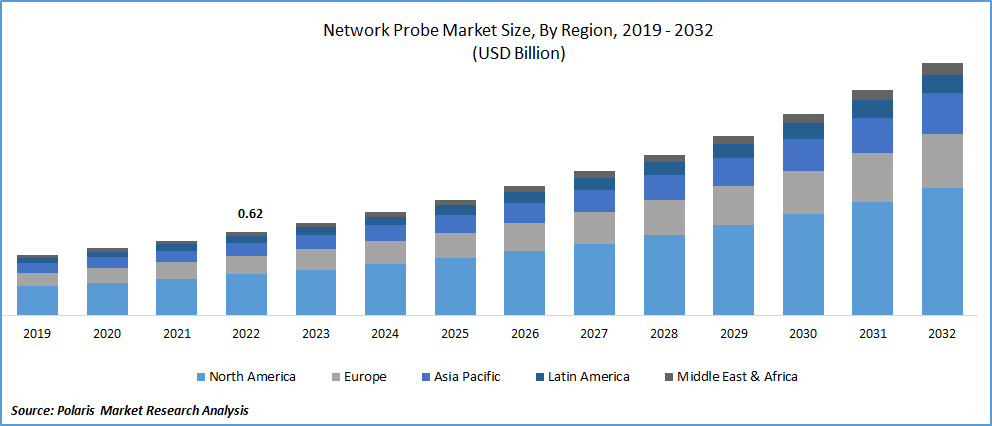

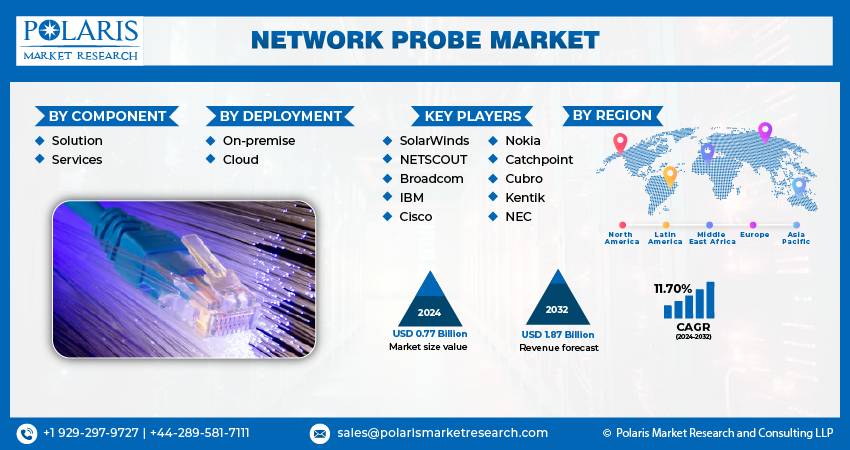

The global network probe market was valued at USD 0.69 billion in 2023 and is expected to grow at a CAGR of 11.70% during the forecast period.

The market's promising growth is attributed to the expansion of the industry might be ascribed to the complexity of networks and rising security concerns. As more companies move to the latest cloud-based technologies, the demand for established network frameworks is increasing.

To Understand More About this Research: Request a Free Sample Report

Network probe is a protocol and monitor analyzer that offers users real-time information about the status of network traffic. It helps users to find potential bottlenecks and problems in their computer network by providing information about the amount and type of network traffic. By choosing an appropriate time interval, users of network monitoring tools can keep an eye on both current and historical network information.

The frequency of cyberattacks is rising, which is causing a rise in the demand for network probes. Network probes are essential for identifying cyberattacks because they give users granular, context-rich access into network data. Ransomware cyber threats climbed by 435% in 2020, according to data released by Retarus, a provider of corporate blogs, followed by malware cyber threats, which rose by 35.8%.

One of the main drivers of market growth is the increasing number of connected devices worldwide. The data flow in connected devices is slowed down by problems or connection failures, which are monitored by network probe. Cisco estimates that the number of network devices will increase from 18.4 billion in 2019 to 29.3 billion by 2021. Furthermore, by 2023, 14.7 billion of the world's network-connected gadgets, or 50% of all devices, would support IoT applications.

For instance, IBM and Amazon Web Services (AWS) will collaborate on security for the hybrid cloud in December 2020. Through this collaboration, security visibility for AWS and hybrid cloud applications will be made simpler and more thorough.

Small organizations are increasingly using network probes because they help them avoid network disruptions, expedite troubleshooting, and enhance the performance of their IT infrastructure. Small firms also need network probes to stop cyberattacks and the resulting financial losses. The U.S. Small Business Administration's data show that 30.2 million small businesses in America face the threat of digital disruption and must have a strategy to defend against cyberattacks.

The COVID-19 pandemic epidemic has positively impacted market expansion. Network probes assist companies in real-time network traffic monitoring and reduce needless office trips. Additionally, the epidemic has altered how businesses run due to the growing popularity of the work from home model. In order to assist organizations in addressing their network performance and security concerns, network probes are increasingly being used.

The two main factors thought to be fueling the growth of the network probe market are an increase in the demand for cloud services and a rise in the construction of new data center infrastructures. Growing SDN integration into current enterprise networks is another factor expected to support the growth of the network probe market during the forecast period.

By enabling the user to gather and receive almost real-time information about the network incredibly quickly, network probes keep information up to date. This enables consumers to learn firsthand about any network issues and take quick action to fix them. A network probe aids in background device polling and is likely to collaborate with monitoring solutions to alert the user of any issues. A few network monitoring solutions provide a selection of standard probes. Some enable users to design their own probes as well to monitor various devices. Probes use SNMP and other Internet protocol types, such TCP, HTTP, or command-line, to poll a device in order to obtain data.

Industry Dynamics

Growth Drivers

A network probe is the best network monitor and protocol analyzer because it enables users to quickly pinpoint the cause of any network slowdowns and watch network traffic in real-time. It will show which protocols are now in use, which hosts are transmitting and receiving data, the origin of the traffic, and the time that each of these things occurred. The most active protocols, receivers, communicators, hosts, and discussions on the network are listed in a concise manner by Network Probe. A probe is a technique or an item used in communications to learn more about the network's status. One method is to send an empty message to check if the destination is real. A common tool for sending such a probe is Ping.

The increasing usage of cloud and IoT, as well as the rising demand for continuous network probes as a result of increased network complexity and security concerns, are the main factors propelling the growth of the network probe market. However, it is anticipated that the lack of technological granularity will somewhat impede market expansion.

Report Segmentation

The market is primarily segmented based on component, deployment, and region.

|

By Component |

By Deployment |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

In 2022, the solution segment dominated the market, accounting for the largest market share.

In 2022, the solution segment dominated the network probe market. Businesses may monitor network traffic, including evasive and encrypted communication, with the help of network probe technologies. Additionally, interruption in the IT system can result in annoyance, financial loss, and decreased productivity.

Over the projected period, the services segment is expected to develop at the fastest rate. Consulting services for network probes assist companies in handling the potential and difficulties of networking infrastructure. Additionally, they assist firms in prioritizing, strategically linking, and operating requirements for networking and business. Businesses in this sector offer a whole range of services, including evaluation, strategy, deployment, and design, as well as continuous management and monitoring.

The cloud segment will account for a higher share of the market.

Over the forecast period, the cloud segment is anticipated to grow at the fastest rate. The segment's expansion can be due to enterprises' increasing use of cloud-based software to reduce the burden and cost of system management. Furthermore, remote access to the platform is made possible through cloud-based network monitoring tools from any place or device. Additionally, the ease with which cloud-based software may be integrated is fueling demand for it.

Compared to cloud-based solutions, on-premise network monitoring offers a higher level of network control. This deployment style is mostly used by IT professionals since it allows them to customize solutions to precisely fit their needs. One of the key elements promoting the segment's growth is the benefit this deployment offers the service providers, such as performance reliability.

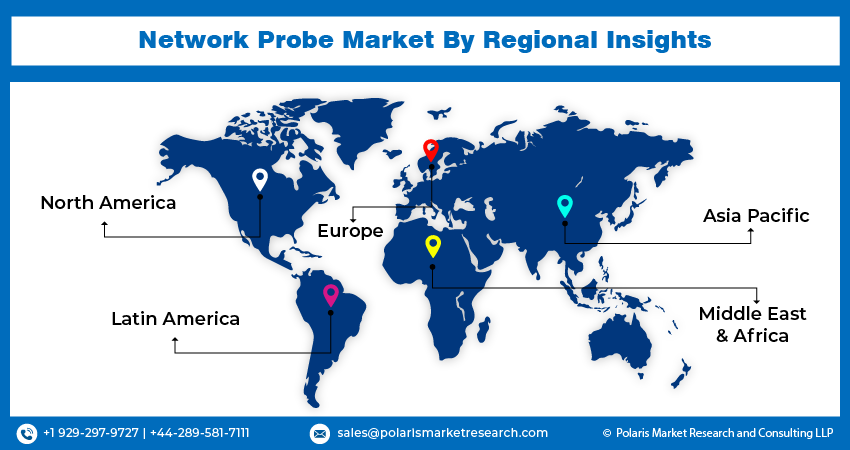

The demand in Asia-Pacific is expected to witness significant growth.

Over the course of the forecast period, Asia Pacific is anticipated to develop at the quickest rate of any regional market. Market expansion in the region is being driven by businesses like NTT DoCoMo and SoftBank who are increasing their investments in 5G networks. Furthermore, a number of suppliers of network infrastructure, like Huawei and ZTE, are based in China. Malware and DDoS attacks, which are constantly on the rise, are also helping the market expand in the area.

In 2021, North America dominated the market revenue. The expansion of the segment can be ascribed to the presence of major market players in the area, including IBM, Cisco, SolarWinds, and others. The region's expanding use of 5G technology is also fueling market demand. Network probes are being widely used by businesses to streamline internal procedures, transmit information more effectively, and streamline office operations.

Competitive Insight

Some of the major players operating in the global market include, SolarWinds, NETSCOUT, Broadcom, IBM, Cisco, Nokia, Catchpoint, Cubro, Kentik, NEC

Recent Developments

- Cubro collaborated with SilverEngine in March 2020. Through this collaboration, SilverEngine would leverage the information gleaned from Cubro's network probe to deliver actionable insights on how to enhance subscriber experience and mobile network performance.

- Catchpoint announced its connection with Google Cloud in March 2021. The Google IT team will be able to receive user-centric visibility into performance and infrastructure running on Google Cloud.

Network Probe Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD0.77 billion |

|

Revenue forecast in 2032 |

USD 1.87 billion |

|

CAGR |

11.70% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Component, By Deployment, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

SolarWinds, NETSCOUT, Broadcom, IBM, Cisco, Nokia, Catchpoint, Cubro, Kentik, NEC |

FAQ's

key companies in network probe market are SolarWinds, NETSCOUT, Broadcom, IBM, Cisco, Nokia, Catchpoint, Cubro, Kentik, NEC

The global network probe market is expected to grow at a CAGR of 11.7% during the forecast period.

The network probe market report covering key segments are component, deployment, and region.

key driving factors in industrial network probe market are growing adoption of the cloud and the internet of things (IoT).

The global network probe market size is expected to reach USD 1.87 billion by 2032.