Network Monitoring Market Share, Size, Trends, Industry Analysis Report

By Offering (Equipment, Software, Services); By Bandwidth Type; By End-use; By Technology; By Region, And Segment Forecasts, 2023-2032

- Published Date:Jul-2023

- Pages: 114

- Format: PDF

- Report ID: PM2750

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

The global network monitoring market was valued at USD 2,350 million in 2022 and is expected to grow at a CAGR of 7.4% during the forecast period. The network monitoring market refers to the technological solutions and services designed to monitor, analyze, and manage network traffic and infrastructure. It involves continuously surveilling networks to ensure optimal performance, detect anomalies, and address potential security threats. Network monitoring tools and systems provide real-time visibility into network activities, allowing organizations to identify and resolve issues promptly, optimize network performance, and enhance overall network security.

To Understand More About this Research: Request a Free Sample Report

With modern networks' increasing complexity and scale, network monitoring has become crucial for businesses of all sizes and industries. It enables organizations to proactively monitor network health, identify bottlenecks, monitor bandwidth usage, and ensure network availability. By monitoring network traffic and analyzing data, organizations can make informed decisions, optimize network resources, and ensure smooth operations.

The market encompasses a range of solutions and technologies, including network monitoring software, hardware appliances, probes, analyzers, and network traffic monitoring services. These solutions can be deployed on-premises, in the cloud, or hybrid environments, depending on the specific needs and preferences of the organization.

Factors driving the growth of the market include the increasing adoption of cloud services, the rising demand for network security and compliance, the need for network performance optimization, and the growing complexity of network infrastructures. Additionally, the emergence of new technologies such as artificial intelligence (AI) and machine learning (ML) is bringing advanced capabilities to network monitoring, enabling intelligent analysis, anomaly detection, and predictive insights.

The COVID-19 pandemic has led to substantial shifts in priorities, policies, and behaviors across individuals, groups, and governments. These changes have acted as a catalyst for innovation and technology advancement. Implementing COVID-19-related lifestyle adjustments has heightened the demand for network monitoring software, workforce tracking systems, remote asset management solutions, and tools for remote employee collaboration.

Furthermore, many companies have expedited adopting Internet of Things (IoT) projects in response to the pandemic. Regulatory changes, such as tracking standards for businesses and stricter cleaning, have also driven the implementation of IoT technologies in smart buildings. These developments have had a positive impact on the growth of the network market.

Industry Dynamics

Growth Drivers

Increasing complexity of IT infrastructure

The market is expected to grow in the coming years due to mounting concerns regarding security risks across various industries, such as business, energy and utilities, healthcare, and medical. Additionally, the increasing complexity of IT infrastructure further contributes to the demand for network monitoring solutions. Organizations recognize the need to ensure the security and stability of their networks to safeguard sensitive data and maintain operational efficiency, driving the network monitoring market growth for network monitoring technologies.

Network monitoring involves overseeing the configuration, traffic, uptime, application performance, server performance, bandwidth usage, and other network-related processes to ensure optimal business performance. Various data collection techniques are utilized in network monitoring, such as scripts, Syslog, and Simple Network Management Protocol (SNMP) to evaluate network performance.

Corporations emphasize that downtime results in significant financial losses for organizations. To mitigate such costs, the adoption of network monitoring technologies proves beneficial. This increasing awareness regarding the cost implications of downtime is expected to drive the demand for network monitoring tools in the foreseeable future.

Report Segmentation

The market is primarily segmented based on offering, bandwidth, end-use, technology, and region.

|

By Offering |

By Bandwidth |

By End-use |

By Technology |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

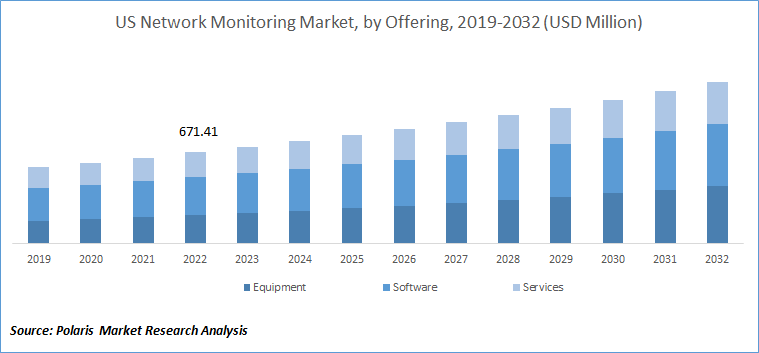

The software segment held the fastest market share in 2022

In 2022, the software held the fastest market share for deploying effective network monitoring solutions. Network monitoring software is crucial in continuously tracking, analyzing, and reporting on networks' overall health, availability, and performance. It includes monitoring storage devices, networking gear, interfaces, virtual environments, and other critical components that contribute to the smooth operation of the network infrastructure. The expanding need for reliable and efficient equipment to support comprehensive network monitoring solutions has fueled the rapid expansion of the equipment segment in the market.

The 40 Gbps segment held the largest market share in 2022

In 2022, the 40 Gbps segment held the largest market share. Data centers and core network installations extensively utilize monitoring equipment with a 40 Gbps capacity. The increasing demand for servers, virtualization technologies, and the expanding data center industry has increased the need for higher bandwidth. Optimized network monitoring tools with 40 Gbps capacity offer cost-effective switching alternatives, reducing the number of switches required within the same network. This efficiency improvement contributes to the significant market share held by the 40 Gbps capacity segment.

The North America dominated the global market in 2022

In 2022, North America dominated the global market for network monitoring tools and is projected to maintain its dominance. The advanced utilization of artificial intelligence (AI) and the well-established IT infrastructure in the region contributed to North America's market dominance in 2020. Within North America, the United States held most of the market share, driven by significant industry players and the increasing integration of data centers.

The U.S. market is expected to experience rapid growth fueled by various factors. Many companies opt for cloud services instead of investing upfront costs to build their data centers. This shift towards cloud-based solutions allows for greater flexibility, scalability, and business continuity.

Competitive Insight

The major global market players include APCON, VIAVI Solutions, Gigamon, NetScout Systems, Garland Technology, Keysight Technologies, Big Switch Networks, Garland Technology, Broadcom, Cisco, Arista Networks, Zenoss, Juniper Networks, Inc., Network Critical, Netgear, CLIENT, LogicMonitor, Accedian Networks, Riverbed Technology, ManageEngine, Auvik Networks, LiveAction, Flowmon Networks, Zabbix Juniper Networks, AppNeta, Broadcom, and Network Critical.

Recent Developments

- In June 2022, Arista Networks launched the 7130 Series, a range of integrated systems with ultra-low latency and high configuration. This new product line aims to enhance customer agility by consolidating multiple devices, reducing complexity, costs, and power consumption. The 7130 Series includes two new models that offer advanced features such as L2/3 switching, open programmability, and high-performance L1 connectivity.

- In December 2020, Juniper Networks acquired Apstra, a provider of intent-based networking software. The acquisition aimed to accelerate the development of a self-driving network by helping private and public cloud vendors optimizes their operations to deliver enhanced application experiences.

Network Monitoring Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2,520.5 million |

|

Revenue forecast in 2032 |

USD 4,772.2 million |

|

CAGR |

7.4% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Offering, By Bandwidth, By End-Use, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

APCON, VIAVI Solutions, Gigamon, NetScout Systems, Garland Technology, Keysight Technologies, Big Switch Networks, Garland Technology, Broadcom, Cisco, Arista Networks, Zenoss, Juniper Networks, Inc., Network Critical, Netgear, CLIENT, LogicMonitor, Accedian Networks, Riverbed Technology, ManageEngine, Auvik Networks, LiveAction, Flowmon Networks, Zabbix Juniper Networks, AppNeta, Broadcom, and Network Critical |

FAQ's

The global network monitoring market size is expected to reach USD 4,772.2 million by 2032.

Top market players in the Network Monitoring Market are APCON, VIAVI Solutions, Gigamon, NetScout Systems, Garland Technology, Keysight Technologies, Big Switch Networks.

North America contribute notably towards the global Network Monitoring Market.

The global network monitoring market expected to grow at a CAGR of 7.4% during the forecast period.

The Network Monitoring Market report covering key are By Offering, By Bandwidth,End-use,Technology and region.