Neurology Clinical Trials Market Size, Share, Trends, Industry Analysis Report

By Phase (Phase I, Phase II, Phase III, Phase IV), By Study Design, By Indication, By Value Chain, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6420

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

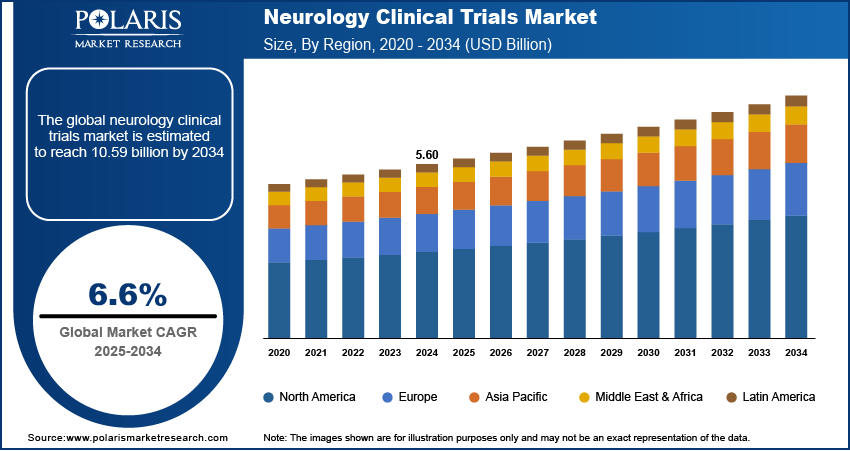

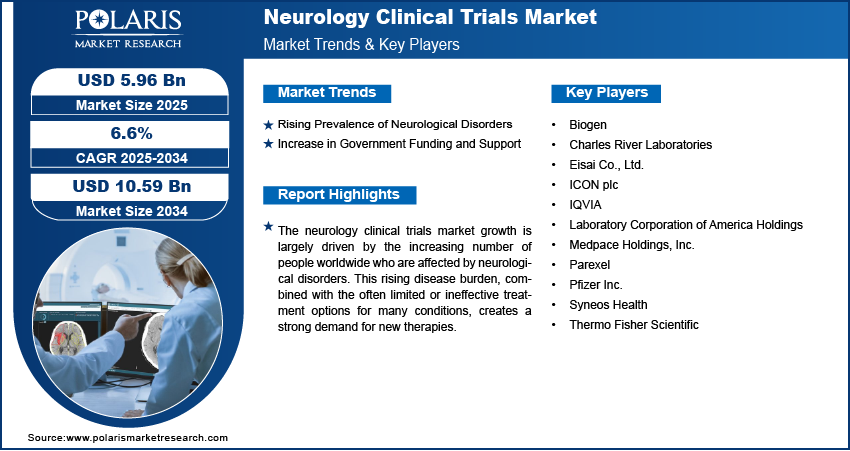

The global neurology clinical trials market size was valued at USD 5.60 billion in 2024 and is anticipated to register a CAGR of 6.6% from 2025 to 2034. The increasing prevalence of neurological diseases, such as Alzheimer's and Parkinson's, drives the demand for neurology clinical trials. There is a growing need for new and effective treatments for these conditions. Another key factor is the rise in research and development funding from both public and private sources, which is helping to speed up the creation of new therapies.

Key Insights

- By phase, the phase III segment held the largest share in 2024, as these trials are the final and most extensive step before a drug can be submitted for regulatory approval.

- By study design, the interventional studies segment held the largest share in 2024, as these trials are the standard method for testing new drugs and medical devices.

- By indication, the Alzheimer's disease segment accounted for the largest share due to the large number of people affected by this condition.

- By value chain, the in-house segment held the largest share as many large pharmaceutical and biotech companies have the internal resources, expertise, and funding.

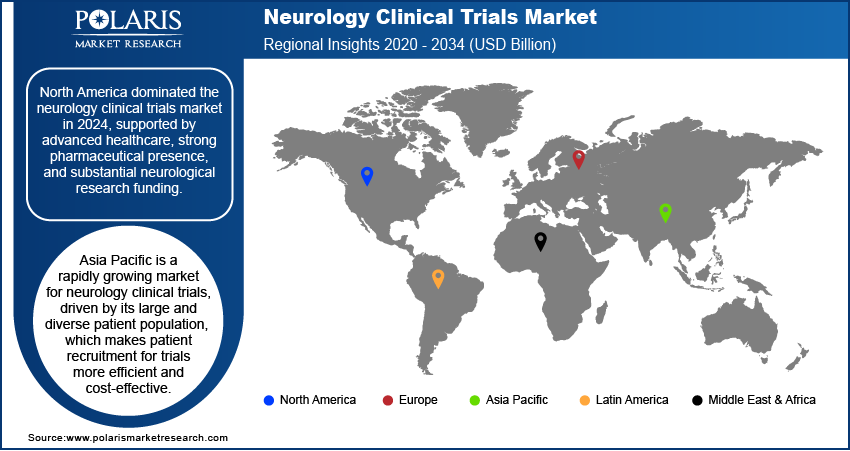

- By region, North America is the leading region due to its well-developed healthcare system, a high concentration of key pharmaceutical and biotechnology companies.

Industry Dynamics

- The rising number of people affected by neurological disorders such as Alzheimer's and Parkinson's disease boosts the market demand. This is fueled by an aging global population, as these age-related conditions are becoming more common, creating a greater need for new treatments and therapies.

- Increased spending on research and development by both public and private groups is also driving growth. This funding helps to speed up the discovery of new drugs and medical devices, pushing forward the development of clinical trials for these conditions.

- Advances in technology, such as the use of artificial intelligence and advanced imaging techniques, are making clinical trials more effective. These new tools are helping researchers better understand diseases, leading to improved trial design and more precise patient selection.

Market Statistics

- 2024 Market Size: USD 5.60 billion

- 2034 Projected Market Size: USD 10.59 billion

- CAGR (2025–2034): 6.6%

- North America: Largest market in 2024

AI Impact on Neurology Clinical Trials Market

- As EEGs, neuroimaging, and behavioral data are difficult to interpret manually, AI tools help in extracting patterns from these high-dimensional datasets.

- The technology helps identify eligible patients from real-world data, which improves inclusivity and speeds up recruitment.

- Many pharma companies are partnering with AI startups to focus on late-stage assets with better predictive modeling.

The neurology clinical trials industry involves the research and development of new drugs, therapies, and medical devices to treat conditions of the nervous system. The goal of these trials is to create and test new and more effective treatments for complex neurological illnesses related to the brain, spinal cord, and nerves.

A driver is the growing use of clinical trial technology and services. Tools such as wearable devices and remote monitoring platforms are changing how studies are done. These technologies make it easier for patients to participate from home, which can help with patient recruitment and retention, especially for conditions that make it hard to travel. This makes the trials more flexible and accessible to a wider group of people.

Another key factor is the increasing number of government programs and public-private partnerships focused on neurological research. For example, the National Institute of Neurological Disorders and Stroke (NINDS), a part of the National Institutes of Health (NIH), actively funds and supports a wide range of clinical research studies. These initiatives provide the necessary money and resources to push forward the development of treatments for difficult-to-treat diseases and help make new therapies available to the public.

Drivers and Trends

Rising Prevalence of Neurological Disorders: The number of people suffering from neurological disorders is increasing significantly around the world. As the global population ages, conditions such as Alzheimer's, Parkinson's, and stroke are becoming more common, which is creating a greater need for new treatments. This growing disease burden is a major factor pushing for more clinical trials to find effective ways to manage or cure these illnesses.

The demand for better therapies is high due to the serious nature of these diseases, which often lead to disability and a lower quality of life. This creates a strong incentive for pharmaceutical and biotechnology companies to invest in research and development. The need to find solutions for these widespread conditions is a primary force behind the growth of clinical trials.

Increasing Government Funding and Support: Governments and public health organizations are increasing their funding for neurology research, which is a major driver. This support often comes through grants, partnerships, and special programs designed to speed up the discovery and development of new treatments. This financial support reduces the risk for companies and research institutions, making it easier for them to start and run complex clinical trials.

These public initiatives often focus on diseases that have a big impact on society and for which there are few effective treatments. This targeted funding helps researchers tackle some of the most difficult conditions, leading to more clinical trials for new drugs and therapies. This consistent financial support is essential for the long-term growth and success of the clinical trials.

Opportunity Analysis

The neurology clinical trials market is poised for growth due to the rising global burden of neurological conditions, including Alzheimer’s disease, Parkinson’s disease, epilepsy, and multiple sclerosis. Increased funding in areas such as precision medicine, gene therapies, and treatments targeting neuroinflammation is driving new research directions. The integration of artificial intelligence, digital biomarkers, and remote monitoring tools is improving early detection, refining patient selection, and enabling real-time data tracking, which together enhance the efficiency and success rates of clinical trials.

Emerging economies in Asia Pacific and Latin America present strong opportunities, offering access to underrepresented patient groups and lower trial costs, which are attractive to global sponsors. Decentralized trial frameworks and wearable cognitive testing solutions are further supporting accessibility and adherence. Regulatory bodies are also showing more flexibility in the evaluation of therapies for neurodegenerative conditions, positioning neurology as a priority area for pharmaceutical firms, contract research organizations (CROs), and digital health solution providers.

Impact of U.S. Tariffs on Global Neurology Clinical Trials Market

The imposition of U.S. tariffs has indirectly impacted the global neurology clinical trials landscape by driving up costs and disrupting supply chains for critical resources, such as laboratory instruments, imaging technologies, and biologics. In particular, tariffs on Chinese imports have limited access to cost-effective reagents and medical components essential for trial execution. This has escalated operational expenditures for U.S.-based sponsors and CROs, leading some organizations to relocate trial activities to regions with fewer trade barriers and lower expenses.

The unpredictability of tariff policies has also created obstacles for long-term planning in international neurology trials, especially those requiring cross-border regulatory coordination or the shipment of biological samples and diagnostic equipment. To address these disruptions, stakeholders are increasingly turning to local sourcing, nearshoring strategies, and digital trial platforms to reduce dependency on imports. As a result, tariffs have introduced financial pressures and logistical challenges that are reshaping site selection, trial designs, and partnerships across the neurology research ecosystem.

Market Concentration & Characteristics

The neurology clinical trials market is in a moderate but accelerating growth stage, shaped by innovation, M&A activity, regulatory trends, service expansion, and regional diversification.

Innovations such as advanced biomarkers, digital endpoints, and neuromodulation approaches are redefining trial structures. Various technologies, including AI-powered diagnostics, brain-computer interfaces, and gene therapies for neurodegenerative disorders, are changing methodologies and supporting personalized medicine approaches. Adaptive designs and patient-centric tools are also improving trial efficiency and enabling recruitment for rare and progressive neurological conditions.

Evolving regulatory frameworks, stricter privacy standards, and heightened ethical oversight significantly influence neurology trials. Agencies such as the FDA and EMA maintain a strong focus on safeguarding patient safety, particularly in studies involving cognitive function or vulnerable groups. Increasingly, guidelines are providing clarity on the use of digital therapeutics and real-world data, supporting innovation while ensuring compliance and data quality.

Mergers and acquisitions are becoming more frequent, with pharmaceutical companies acquiring biotech firms that possess robust neurology pipelines, especially in areas such as Alzheimer’s, Parkinson’s, and rare central nervous system (CNS) disorders. These deals often focus on advancing gene therapies, neuroinflammation treatments, and digital neurotechnologies, aimed at portfolio diversification and risk reduction.

CROs and clinical trial networks are expanding service capabilities to manage the complexities of neurology trials. This includes incorporating wearables, remote assessments, advanced neuroimaging, and decentralized models, along with eConsent and virtual cognitive testing. Strengthening specialized neurology site networks is also a key trend in enhancing trial capacity and compliance.

Regional expansion is accelerating, with Asia Pacific, Eastern Europe, and Latin America gaining importance due to their large patient populations, cost advantages, and favorable regulatory environments. Sponsors are increasingly partnering with local CROs, deploying multilingual digital solutions, and adopting remote monitoring strategies to improve recruitment and streamline operations in these emerging regions.

Segmental Insights

Phase Analysis

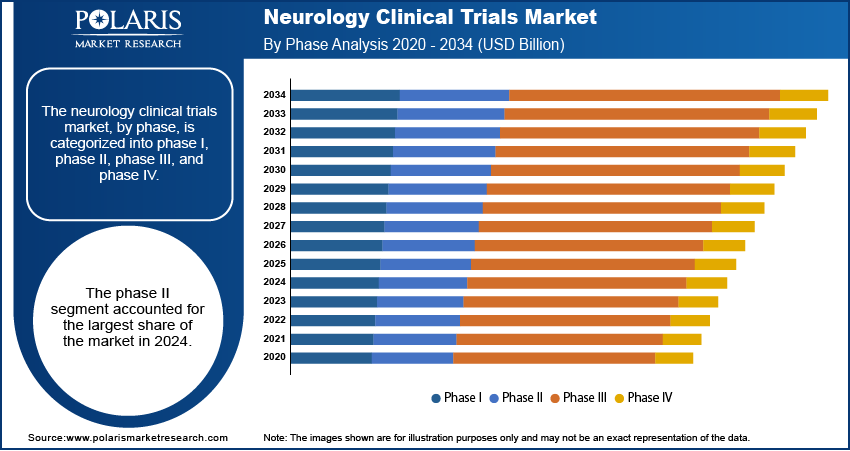

Based on phase, the segmentation includes phase I, phase II, phase III, and phase IV. The phase III segment held the largest share in 2024, as these trials are the most extensive and expensive part of the drug development process. They involve large groups of patients and are meant to confirm the effectiveness and safety of a new treatment before it can be approved for use by the public. Since these studies are the last major step before a new drug can be launched, they require significant investments in terms of time, resources, and a large number of participants. The high cost and large scale of these trials are the primary reasons for their dominance.

The phase I segment is anticipated to register the highest growth rate during the forecast period. This is because phase I trials are the first step in testing a new drug in humans, focusing on safety, dosage, and how the drug works in the body. The rapid growth in this segment is linked to an increase in early-stage research and development for new neurology treatments, especially those that use advanced technologies such as gene therapy and stem cell therapy. As more new and innovative therapies enter the development pipeline, the number of initial safety and dosage studies will also increase, which, in turn, will drive the growth of the phase I segment.

Study Design Analysis

Based on study design, the segmentation includes interventional, observational, and expanded access. The interventional segment held the largest share in 2024. This dominance is attributed to the fact that these trials are the most common type used for testing new drugs and medical devices. In an interventional trial, participants receive a specific treatment or intervention according to a research protocol, which allows researchers to directly measure the effects of the new therapy. Because the development of new drugs and devices for neurological conditions is a central part, a majority of research activities fall under this category. These trials are essential for proving the safety and effectiveness of new treatments, making them a significant part of the overall sector. They are necessary for meeting regulatory requirements to get new treatments approved for patient use.

The observational studies segment is anticipated to register the highest growth rate during the forecast period. While they do not test new interventions directly, these studies are becoming more important as they provide valuable data about diseases and real-world treatment outcomes. Observational studies track patient health and habits over time without a specific intervention, which can give researchers a deeper understanding of how neurological conditions progress and how existing treatments perform in a natural setting. The growing use of digital health tools, such as remote monitoring and patient registries, makes it easier to collect large amounts of data for these studies. This increased ability to gather long-term data on large groups of people is fueling the growth of this segment, as it provides new insights into disease management and helps shape future clinical trial designs.

Indication Analysis

Based on indication, the segmentation includes Alzheimer’s disease, depression (MDD), Parkinson's disease (PD), epilepsy, stroke, traumatic brain injury (TBI), amyotrophic lateral sclerosis (ALS), Huntington's disease, muscle regeneration, and others. The Alzheimer’s disease segment held the largest share in 2024. This is primarily driven by the significant global burden of the disease and the widespread lack of effective, long-term treatments. As the number of people affected by Alzheimer's grows, there is a strong and urgent need for new therapies. This has resulted in a large number of ongoing clinical trials aimed at finding a cure or a way to slow down the progression of the disease. These trials often require large numbers of participants and extensive resources, making the segment a dominant force. The high investment in research and development for this condition contributed to the dominance of the segment.

The segment for amyotrophic lateral sclerosis, or ALS, is anticipated to register the highest growth rate during the forecast period. This growth is linked to a growing interest in new research methods, such as gene and cell therapies, for conditions that currently have no cure. The focus on rare and severe neurological diseases has led to an increase in funding and research into potential treatments that could change how the disease is managed. Even though these trials are for a smaller group of people, the rapid development of new technologies and the urgency to find a solution for this devastating disease are driving quick growth in the clinical trials for ALS.

Value Chain Analysis

Based on value chain, the segmentation includes in-house, CROs, and investigator sites/clinical sites. The in-house segment held the largest share in 2024. This is because many large pharmaceutical and biotechnology companies have the necessary resources and expertise to manage their clinical trials from start to finish. These companies have significant control over every aspect of the research process, including study design, patient recruitment, data management, and regulatory submissions. By keeping these functions in-house, they can ensure a high level of quality control and maintain direct communication between their research teams and business goals. The complexity of neurological diseases often requires deep, specialized knowledge, which many major drug developers prefer to keep within their own organization.

The CROs segment is anticipated to register the highest growth rate during the forecast period. This is due to a rising trend of outsourcing clinical trial activities to specialized contract research organizations. Companies, both large and small, are increasingly turning to CROs to save costs, increase efficiency, and get access to a wider range of services and expertise. CROs offer a variety of services, from single tasks such as patient recruitment to full-scale trial management. This enables companies to focus on their core strengths, such as drug discovery, while letting experts handle the complex and time-consuming details of the trial. The demand for CROs is also growing because they can often help companies navigate different regulatory systems in various countries, which is important for large, global trials.

Regional Analysis

The North America neurology clinical trials market accounted for the largest share in 2024 due to its advanced healthcare infrastructure and a high concentration of major pharmaceutical and biotechnology companies. These companies have significant research and development budgets that are funneled into complex and costly clinical trials for neurological conditions. The region also benefits from a robust regulatory framework that, while strict, provides a clear path for drug approval. Furthermore, the high prevalence of neurological disorders in the aging population creates a constant demand for new and innovative treatments, which directly drives a high volume of clinical trial activity.

U.S. Neurology Clinical Trials Market Insights

The U.S. is the primary contributor to the North American industry. This is attributed to a well-established and well-funded ecosystem that includes top-tier academic research centers, a strong network of clinical research sites, and supportive government and private funding. The U.S. is characterized by a high number of ongoing trials for conditions such as Alzheimer's and Parkinson's disease. The country's emphasis on technological advancements and a strong focus on personalized and precision medicine also helps accelerate the development of new neurological therapies.

Europe Neurology Clinical Trials Market Trends

Europe represents a significant part of the neurology clinical trials, with many countries having advanced healthcare systems and a strong tradition of scientific research. The region's aging population and the resulting rise in prevalence of neurodegenerative diseases are creating a continuous need for new therapies and clinical research. European countries benefit from a large pool of well-trained researchers and a supportive framework for clinical studies. While Europe is a major player, some industry reports indicate a slight loss of its global share in clinical trials, particularly to emerging sector, due to factors such as varying regulatory processes and challenges with patient recruitment across different countries.

The Germany neurology clinical trials market is a major contributor to the European landscape. It has a high volume of clinical trials due to its strong economy and well-regarded research institutions. The country also has a supportive regulatory environment and a large network of hospitals and clinics, which makes it an attractive location for conducting complex clinical studies. This combination of strong infrastructure and a focus on scientific innovation helps to make Germany a key hub for neurology research and a major player in the regional landscape.

Asia Pacific Neurology Clinical Trials Market Overview

The Asia Pacific market is a rapidly growing region for neurology clinical trials. The region's growth is driven by its large and diverse patient population, which makes patient recruitment for trials more efficient and cost-effective. Additionally, many countries in this region are seeing improvements in their healthcare systems and research capabilities, with governments actively supporting clinical research through supportive policies and increased funding. These factors, combined with lower operational costs compared to North America and Europe, are making Asia Pacific an increasingly attractive destination for global pharmaceutical companies.

China Neurology Clinical Trials Market Analysis

In Asia Pacific, China is a major country for clinical trials. The country has a vast and diverse patient population, which helps speed up the recruitment process for large-scale studies. The Chinese government has also put in place a number of new regulations and policies aimed at streamlining the approval process for clinical trials, which has made it more appealing for international companies to conduct research there. This, along with growing investments in healthcare and research infrastructure, has positioned China as a significant contributor to the regional expansion.

Key Players and Competitive Insights

The competitive landscape of the neurology clinical trials market includes a mix of major pharmaceutical and biotechnology companies, as well as specialized contract research organizations (CROs). Major players such as IQVIA, ICON plc, Syneos Health, and Laboratory Corporation of America Holdings compete by offering a wide range of services, from early-stage research to full trial management. Pharmaceutical firms such as Pfizer and Biogen also play a significant role, focusing on developing their own drug pipelines. The competition revolves around expertise in complex neurological conditions, technological capabilities for data management and patient recruitment, and the ability to conduct trials on a global scale. Companies are constantly investing in new technology and forming partnerships to gain an edge in this highly specialized and complex.

A few prominent companies in the industry include IQVIA, ICON plc, Syneos Health, Laboratory Corporation of America Holdings, Charles River Laboratories, Thermo Fisher Scientific, Parexel, Medpace Holdings, and pharmaceutical companies like Pfizer, Biogen, and Eisai Co.

Key Players

- Biogen

- Charles River Laboratories

- Eisai Co., Ltd.

- ICON plc

- IQVIA

- Laboratory Corporation of America Holdings

- Medpace Holdings, Inc.

- Parexel

- Pfizer Inc.

- Syneos Health

- Thermo Fisher Scientific

Neurology Clinical Trials Industry Developments

February 2025: Thermo Fisher Scientific launched a new clinical registry and biorepository for Systemic Lupus Erythematosus through its CorEvitas business.

September 2024: Thermo Fisher Scientific's PPD clinical research business announced an expansion of its bioanalytical laboratory services in Europe.

Neurology Clinical Trials Market Segmentation

By Phase Outlook (Revenue – USD Billion, 2020–2034)

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design Outlook (Revenue – USD Billion, 2020–2034)

- Interventional

- Observational

- Expanded Access

By Indication Outlook (Revenue – USD Billion, 2020–2034)

- Alzheimer’s Disease

- Depression (MDD)

- Parkinson's Disease (PD)

- Epilepsy

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Huntington's Disease

- Muscle Regeneration

- Others

By Value Chain Outlook (Revenue – USD Billion, 2020–2034)

- In-house

- CROs

- Investigator Sites/Clinical Sites

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Neurology Clinical Trials Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.60 billion |

|

Market Size in 2025 |

USD 5.96 billion |

|

Revenue Forecast by 2034 |

USD 10.59 billion |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.60 billion in 2024 and is projected to grow to USD 10.59 billion by 2034.

The global market is projected to register a CAGR of 6.6% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include IQVIA, ICON plc, Syneos Health, Laboratory Corporation of America Holdings, Charles River Laboratories, Thermo Fisher Scientific, Parexel, Medpace Holdings, and pharmaceutical companies like Pfizer, Biogen, and Eisai Co.

The phase II segment accounted for the largest share of the market in 2024.

The observational segment is expected to witness the fastest growth during the forecast period.