Nitrile Butadiene Rubber Market Share, Size, Trends, Industry Analysis Report

By Product (Hoses, Belts, Cables, Molded & Extruded Products, Rubber Compounds, and Others); By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4438

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

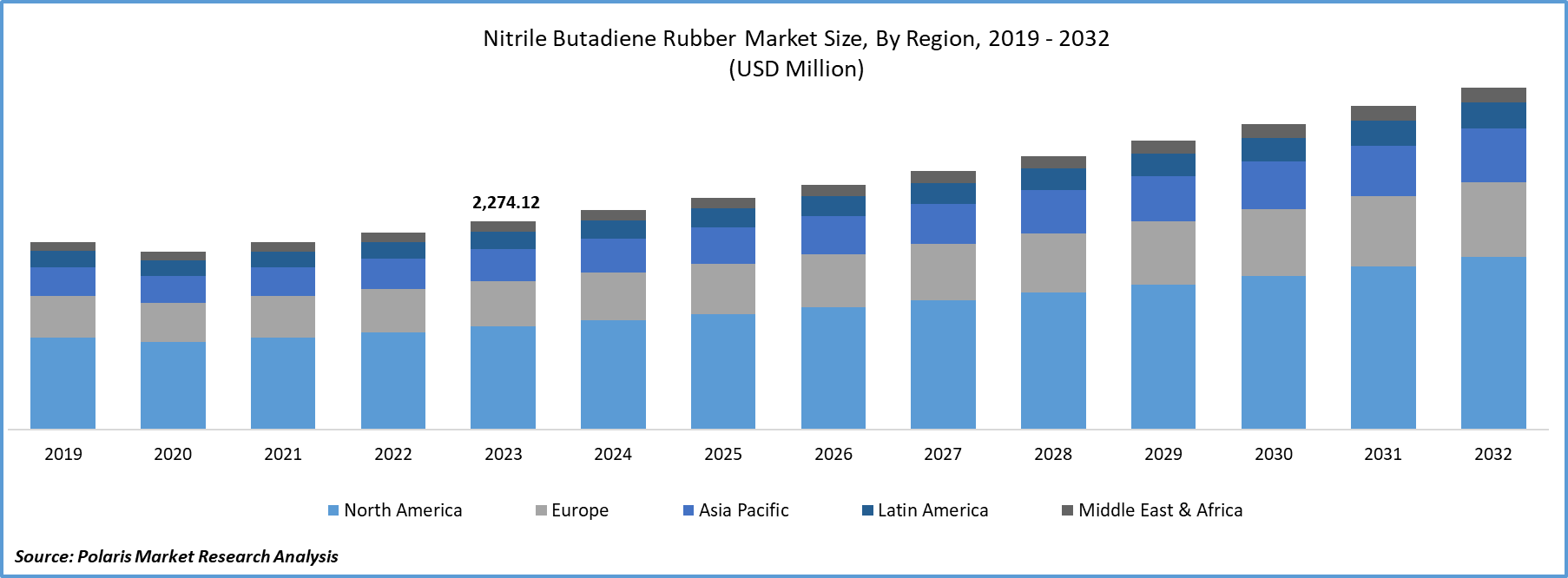

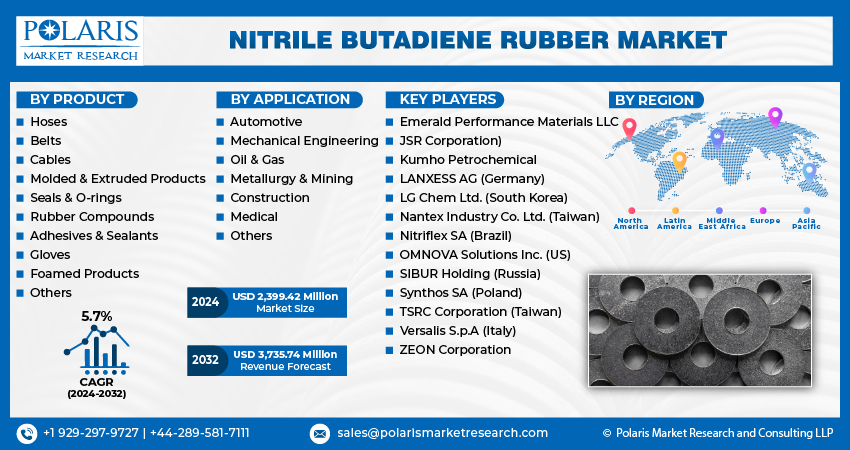

Nitrile butadiene rubber market size was valued at USD 2,274.12 million in 2023. The market is anticipated to grow from USD 2,399.42 million in 2024 to USD 3,735.74 million by 2032, exhibiting the CAGR of 5.7% during the forecast period.

Market Overview

Growing utilization of NBR (Nitrile Butadiene Rubber) in the automotive and transportation sector and rising usage across gaskets and hoses in the oil and gas industry worldwide are anticipated to boost the market’s growth. Moreover, with the growing awareness about several outstanding properties of NBR, such as good abrasion resistance, high tensile strength, and oil resistance, the product is gaining huge traction across numerous end-use industries. The rising industrialization and urbanization trends, particularly in developing nations, contribute to the demand for NBR in several applications, such as construction and manufacturing. Also, growing research and development activities worldwide focused on improving the performance of existing NBR products and developing new sustainable solutions while reducing the environmental impact will likely bode well for the market’s growth.

The research report offers a quantitative and qualitative analysis of the Nitrile Butadiene Rubber Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

- For instance, in February 2022, Synthos announced that they have entered into the next phase in the development of innovative bio-butadiene technology for the production of sustainable rubber. The company said that the bio-butadiene technology is now ready for implementation, and the company is moving toward the engineering and design phase of the project.

To Understand More About this Research: Request a Free Sample Report

Growth Factors

Increasing use of NBR in automotive & transportation industry to drive market growth

The surging use of NBR in various automotive applications, such as belts, cables, and O-rings, due to its heat abrasion resistance, oil and gas resistance, and water and gas permeability. Also, NBR is highly employed in the production of vibration isolation mounts, which are mainly used in vehicles to minimize the transmission of vibrations from various automotive components. Thereby, with the rapid increase in automobile production, the demand for NBR is also projected to increase substantially.

- For instance, according to the Society of Indian Automobile Manufacturers, the total production of vehicles stood at 2,59,31,867 units between the period of April 2022 to March 2023, with an increase from 2,30,40,066 units produced during the same period of the previous year.

Development of customized and specialty NBR grades fostering the global market growth

A significant number of product manufacturers are heavily focusing on the creation or development of specialized and customized NBR grades in order to meet specific application requirements from various end-use industries, leading to a substantial increase in demand for the product globally.

Restraining Factors

Growing availability of substitute products and fluctuation in raw material prices to hamper market growth

The widespread and easy availability of alternative products to NBR, such as polyurethane, fluoroelastomers, and ethylene propylene rubber, coupled with the constant fluctuation in prices of raw materials used in NBR production, are key factors expected to restrain market growth.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Insights

Seals & O-rings segment accounted for the largest share in 2023

The seals and O-rings segment accounted for the largest share in 2023. Segment’s dominance is attributable to the growing use of seals and O-rings in several pressure-sensitive applications for preventing the loss of gas or fluid. Additionally, they are also widely employed in different automobile components like doors, engines, power steering systems, braking systems, and batteries; thus, the increasing number of vehicles on the road led to greater demand for seals and O-rings as well.

The molded and extruded segment is expected to witness the highest growth. This growth is due to the growing utilization of nitrile rubber in the manufacturing of molded nitrile gaskets, washers, and other products because of its low permeability of fuel and gas, abrasion resistance, corrosion resistance, and wear resistance.

By Application Insights

Automotive segment held the majority share in 2023

The automotive segment held the maximum market share in 2023. This dominance is accelerated by a continuous rise in automotive production that requires NBR as a key material for the manufacturing of various components like seals, hoses, and gaskets. Additionally, the drastic shift of the automotive industry towards electric vehicles worldwide also creates a huge demand for NBR in vehicle battery systems.

The mechanical engineering segment is also expected to hold a substantial share. This is attributed to the growing use of NBR in several mechanical systems because of its excellent resistance to fuel, oil, and chemicals. Growing research and development activities and advancements in technology that led to improved mechanical properties and create new product applications in mechanical engineering will also propel the segment’s growth.

Regional Insights

Asia Pacific region dominated the global market in 2023

The Asia Pacific region dominated the global market in 2023. The region’s dominance is attributed to significant product demand from various end-use industries and the presence of numerous favorable FDI norms by government agencies in the region. As the region is the manufacturing hub for various industries, including automotive and oil and gas, the demand for NBR has witnessed drastic growth over the years. For instance, according to the China Association of Automobile Manufacturers, vehicle production and sales in December 2023 in China stood at 3.079 million and 3.156 million units, with an increase of 29.2% and 23.5% on a year-on-year basis, respectively.

The Europe region is anticipated to witness the highest growth during the forecast period. This growth is fueled by rising consumption of nitrile rubber across various applications and increasing innovations in NBR technology, including the development of new processes and product formulations. Moreover, rising adoption or sales of electric vehicles and advancements in the transportation sector in the region are driving the need for NBR at a rapid pace. For instance, according to a report by the World Economic Forum, electric values are growing in Europe, and the sales of EVs in Europe grew by more than 62% in the last 12 months.

Key Market Players & Competitive Insights

Strategic partnerships and development of new solutions driving competing in the market

The nitrile butadiene rubber market is highly competitive in nature with the robust presence of global and regional market players. Companies are competing on factors such as improving product quality, building their brand reputation, diversification of product offerings, and developing cost-effective solutions, that allow them to gain competitive edge in the market. For instance, in November 2023, Synthos, announced that they are signing a Memorandum of Understanding with leading South Korean manufacturer of tires ‘Kumho Tire’. Under this agreement, the companies will jointly conduct a R&D project for butadiene rubber and will expand the use of eco-friendly synthetic rubber in the tire manufacturing.

Some of the major players operating in the global market include:

- Emerald Performance Materials LLC (US)

- JSR Corporation)

- Kumho Petrochemical (South Korea)

- LANXESS AG (Germany)

- LG Chem Ltd. (South Korea)

- Nantex Industry Co. Ltd. (Taiwan)

- Nitriflex SA (Brazil)

- OMNOVA Solutions Inc. (US)

- SIBUR Holding (Russia)

- Synthos SA (Poland)

- TSRC Corporation (Taiwan)

- Versalis S.p.A (Italy)

- ZEON Corporation

Recent Developments in the Industry

- In November 2023, SKF, announced about the development of its first spherical roller bearings specially for food & beverage industry. The newly developed bearing features a high-performance nitrile butadiene rubber which is both EC and FDA approved, and protecting against the water, contaminants, and detergent.

- In April 2022, Dynasol Group, announced about the expansion of its production capacity in Santander, Spain, through the installation of a brand-new line for producing styrene-butadiene rubber. Company’s expansion plan includes a capacity increase of their current styrene-butadiene-copolymer range, located at Altamira, Mexico by 10 KTA.

Report Coverage

The nitrile butadiene rubber market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, application, and their futuristic growth opportunities.

Nitrile Butadiene Rubber Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2,399.42 million |

|

Revenue forecast in 2032 |

USD 3,735.74 million |

|

CAGR |

5.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Delve into the intricacies of Nitrile Butadiene Rubber in 2024 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2032 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Center Stack Display Market Size, Share 2024 Research Report

Decarbonization Market Size, Share 2024 Research Report

Grinding Fluids Market Size, Share 2024 Research Report

Term Insurance Market Size, Share 2024 Research Report

Abrasive Blasting Nozzle Market Size, Share 2024 Research Report

FAQ's

The global nitrile butadiene rubber market size is expected to reach USD 3,735.74 million by 2032

Key players in the market are Kumho Petrochemical Group, Nantex Industry, SIBUR Holding

Asia Pacific contribute notably towards the global Nitrile Butadiene Rubber Market

Nitrile butadiene rubber market exhibiting the CAGR of 5.7% during the forecast period.

The Nitrile Butadiene Rubber report covering key segments are product, application, and region.