Grinding Fluids Market Share, Size, Trends & Industry Analysis Report

By Type (Water-soluble, Semi-Synthetic, Synthetic, Others), By Application, By Region; Segment Forecast, 2025 - 2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM4210

- Base Year: 2024

- Historical Data: 2020 - 2023

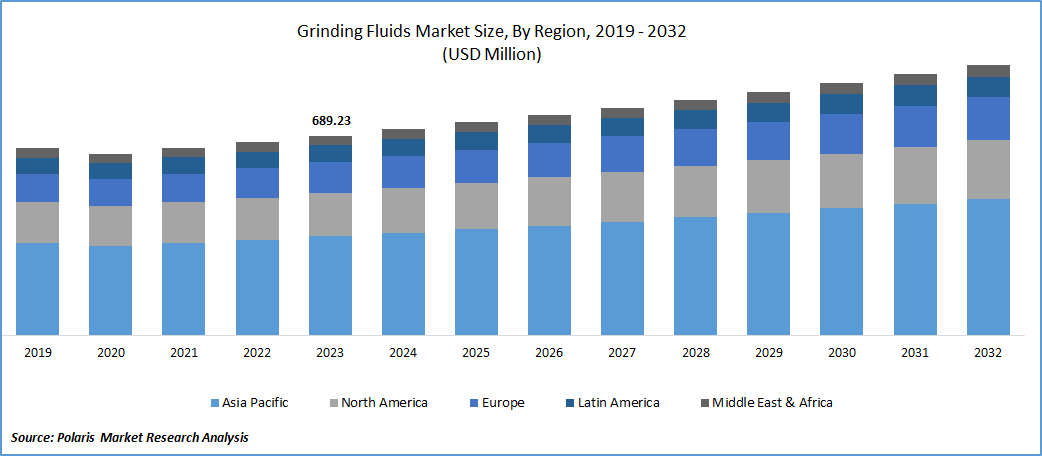

The global Grinding Fluids Market was valued at USD 725.5 million in 2024 and is expected to grow at a CAGR of 5.60% from 2025 to 2034. Expanding metalworking applications, industrial automation, and need for enhanced machining performance are supporting steady market growth.

This growth is driven by the widespread adoption of the grinding process across various industries, where precision in dimensions and smooth surface finishes are paramount, necessitating tight tolerances. Grinding fluids play a crucial role in this process as they serve dual functions: lubricating and cooling grinding tools and workpieces while removing chipped pieces. Functioning as both lubricants and coolants during the grinding process, these fluids contribute significantly to achieving the desired outcomes in terms of product quality.

To Understand More About this Research: Request a Free Sample Report

Furthermore, the increasing demand for industrial machinery, particularly in activities related to the extraction and processing of minerals and ores, is a key factor contributing to the rising demand for grinding fluids. The machinery used in these processes relies on precise grinding techniques, further emphasizing the importance of efficient lubrication and cooling provided by these fluids. Overall, the growth of the grinding fluids market is intricately linked to the expanding needs for precision and efficiency in industrial manufacturing processes.

As reported by the International Organization of Motor Vehicle Manufacturers (OICA), the automotive production sector in the United States experienced a notable expansion of 10%, reaching a total of 10.1 million units in 2022. Additionally, the U.S. stands as a significant contributor to more than two-thirds of the total steel demand in the North America. With moderate growth anticipated in the construction and automotive industries, there is a steady projection for an increasing demand for the grinding fluids.

Industry Dynamics

Growth Drivers

Growing Manufacturing Industries

The demand for grinding fluids is often tied to the overall growth of manufacturing industries, such as automotive, aerospace, and machinery. As these industries expand, the need for precision grinding and cutting processes increases, driving the demand for grinding fluids.

Heavy machinery, including excavators, bull dozers, crushers, & conveyors, plays a crucial role in mining operations. As per the Federal Ministry of the Republic of Australia, the global mining industry achieved a production of 17.9 billion metric tons in 2019, with Asia Pacific contributing significantly at 58.9% of this total output. Meanwhile, the Government of India's report indicates a substantial growth in mineral production within the country, rising from USD 1,010.5 million in 2020 to USD 1,400.4 million in 2021. These collective factors are expected to be key drivers for the increasing demand for grinding fluids on a global scale throughout the forecast period.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Synthetic segment accounted for the largest market share in 2024

Synthetic segment accounted for the largest share. This growth is attributable to the outstanding cooling and lubricating capabilities exhibited by synthetic grinding fluids, surpassing the performance of other fluid types. The advancement in additive technology has significantly contributed to reinforcing the preference for synthetic fluids in the product market. These fluids are further enriched with supplementary additives designed to inhibit corrosion. This enhancement not only prolongs their operational lifespan but also results in reduced maintenance needs and minimized downtime for fluid replacement.

Utilized in a diluted form with concentrations ranging from 3 to 20%, synthetic grinding fluids are recognized for their stability and compatibility with a diverse range of materials. Their application extends to the grinding of metals, encompassing both ferrous and non-ferrous materials, maintaining optimal performance without jeopardizing the integrity of the workpiece. As industrialization continues to expand, there is an expected surge in demand for synthetic grinding fluids throughout the forecast period.

Semi-synthetic segment will grow rapidly. It represents a blend of synthetic & mineral oil, resulting in a fluid that amalgamates the optimal characteristics of both types. This composition includes additives, emulsifiers, & surfactants in the portion, enhancing lubricity, cooling, and corrosion resistance. Simultaneously, the mineral oil base contributes excellent chip-carrying and flushing capabilities. A notable advantage of this product lies in its improved lubrication properties. These components within these fluids offer supreme lubrication, mitigating friction between the grinding wheel and the workpiece. This reduction in friction results in diminished tool wear, improved surface finish, and heightened dimensional accuracy in grinding operations.

By Application Analysis

Disk drivers segment held the significant market share in 2024

Disk drivers segment held the significant market share. This dominance is attributed to the pivotal role that grinding fluids play in the manufacturing of the disk drivers, specifically in the production of drive platters. Disk drivers, including HDDs, rely on the precise & efficient grinding processes to shape the drive platters, which serve as the housing for magnetic media used in data storage.

These fluids are particularly crucial due to their significant cooling properties, essential for dissipating the heat generated during the high-speed grinding involved in the production of disk drivers. This cooling capability plays a vital role in maintaining stable temperatures within the machinery, there-by safeguarding both the workpieces & grinding wheels from any damage caused by the operation of the equipment.

An additional notable advantage of the product lies in its capability to facilitate chip removal. During the grinding process, the generation of chips and debris is inevitable. These fluids play a crucial role in efficiently flushing away these chips, preventing any interference that could potentially disrupt the grinding process and safeguarding the components of disk drivers from damage. This efficient chip removal not only ensures the smooth operation of the grinding process but also contributes to the overall improvement of the manufacturing process for disk drives.

Metal substrates segment is expected to gain substantial growth rate. By employing grinding fluids, the risk of thermal damage to metal substrates is significantly reduced. This control over temperature not only ensures the dimensional accuracy of the metal substrates but also preserves the integrity of the materials used in their fabrication. In essence, the application of grinding fluids becomes instrumental in mitigating potential issues related to heat buildup and ensuring the overall quality of metal substrates.

Regional Insights

Asia Pacific dominated the global market in 2024

This dominance is attributed to the escalating production volumes observed in diverse sectors including automobile, defense, marine, and aerospace across the region. On a global scale, the production of key metals such as titanium and aluminum, as of 2022, was largely driven by China, as indicated by the International Aluminum Association.

Specifically, China dominated global aluminum production, reaching approximately 3,500 thousand metric tons in 2023. This substantial output was a result of production capacity expansions by multiple manufacturers in China. Consequently, the surge in aluminum production, driven by increased capacity, is expected to contribute to the growing demand for grinding fluids in the region over the forecast period.

Moreover, according to the India Brand Equity Foundation (IBEF), India holds the position of the world's second-largest producer of crude steel, achieving an output of 125.32 million tons in 2023. The abundance of resources, including a readily available workforce with cost-effective labor, and the presence of substantial iron ore reserves, have positioned India as a prominent player in steel production. This advantageous scenario has led to an increase in steel production, driven by rising demand from diverse end-use industries

Europe will grow with substantial pace. The increasing need for automotive components further fuels the demand for grinding fluids in Europe. As per the European Automobile Manufacturers' Association (ACEA), car production in the Europe experienced a 7.1% growth in 2022, in comparison to 2021.

Key Market Players & Competitive Insights

The market for the product is characterized by intense competition, as companies actively enhance their regional footprint through various growth strategies such as expansions, the introduction of new products, and forming strategic partnerships.

Some of the major players operating in the global market include:

- Benz Oil, Inc.

- Carborundum Universal Limited

- CASTROL LIMITED

- CGF, Inc.

- EnviroServe Chemicals, Inc.

- ETNA Products, Inc.

- ExxonMobil Corporation

- FUCHS

- Lincoln Chemical Corporation

- oelheld GmbH

- Sun Chem Pvt. Ltd

- TotalEnergies SE

Recent Developments

- In May 2025 – FUCHS unveils ECOCOOL GLOBAL 1000 cutting & grinding fluid for aerospace sector

- In August 2023, Amsoil has acquired Benz Oil. This strategic acquisition is anticipated to bolster Amsoil Inc.'s capabilities in the realm of metalworking fluids.

Grinding Fluids Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 765.68 million |

|

Revenue forecast in 2034 |

USD 1249.73 million |

|

CAGR |

5.60% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Explore the market dynamics of the 2025 Grinding Fluids Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Grinding Fluids Market extends to a comprehensive market forecast up to 2034, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Bestselling Reports:

Kaolin Market Size, Share Research Report

Home Solar System Market Size, Share Research Report

Tissue Diagnostics Market Size, Share Research Report

Tissue Engineering Market Size, Share Research Report

Cloud-Radio Access Network (C-RAN) Market Size, Share Research Report

FAQ's

The global grinding fluids market size is expected to reach USD 1249.73 million by 2034

Benz Oil, Carborundum Universal, CASTROL, CGF are the top market players in the market.

Asia Pacific region contribute notably towards the global Grinding Fluids Market.

The global grinding fluids market is expected to grow at a CAGR of 5.60% during the forecast period.

Type, application, and region are the key segments in the Grinding Fluids Market.