Kaolin Market Share, Size, Trends, Industry Analysis Report

By Process (Delaminated, Water-washed, Airfloat, Surface-modified, Calcined, Others); By End-User; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4057

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

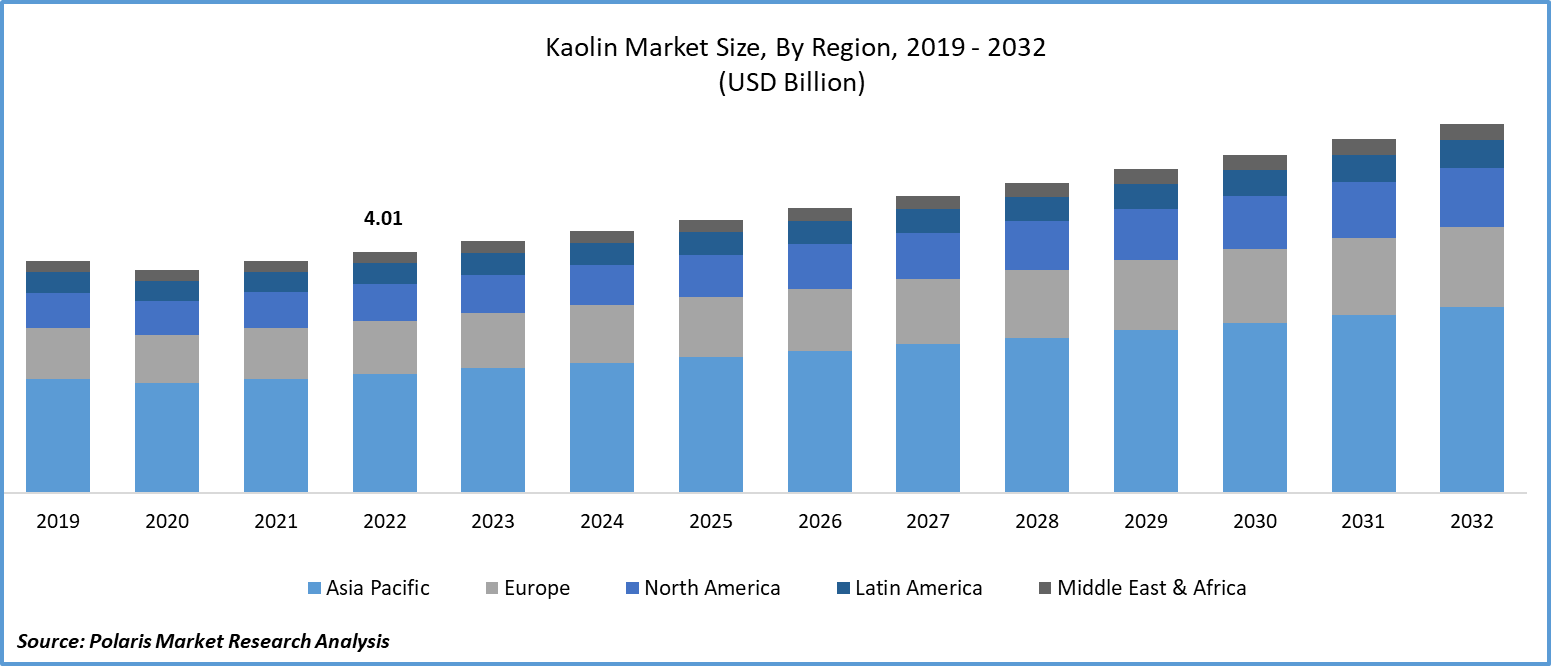

The global kaolin market size and share was valued at USD 4.17 billion in 2023 and is expected to grow at a CAGR of 4.4% during the forecast period.

The kaolin market has experienced significant growth in recent years, driven by a multitude of factors ranging from industrial demand to advancements in processing techniques. The kaolin market plays a crucial role in several industries, contributing to economic development and job creation. Its wide-ranging applications in ceramics, paper, paint, plastics, and construction materials have driven its demand globally. Additionally, kaolin's use in pharmaceuticals, cosmetics, and even the food industry showcases its versatility. Furthermore, kaolin's natural abundance and eco-friendly characteristics have positioned it as a sustainable alternative in various applications, minimizing environmental impact.

Kaolin is a supple white clay that is an important component in the making of china and porcelain and is extensively utilized for the making of rubber, paper, paint, and several other commodities. In its organic configuration, Kaolin is a supple powder comprising the chiefly mineral kaolinite, which under the electron microscope is observed to comprise approximately hexagonal, platy crystals ranging in size from roughly 0.1 micrometers or 10 micrometers or even bigger.

Roughly 40 percent of Kaolin manufactured is utilized in the filling and covering of paper. In filling, Kaolin is amalgamated with cellulose fiber and configures an intrinsic constituent of the paper sheet to provide it a body, color, opacity, and printability. In coating, Kaolin is plated together with a gummy on the paper's surface to provide luster, color, high density, and pronounced printability. The kaolin market size is expanding as the Kaolin utilized for coating is made, so the majority of kaolinite particles fall below 2 micrometers in diameter.

To Understand More About this Research: Request a Free Sample Report

For instance, in June 2023, BioPowder entered into a strategic partnership with Gebrüder Dorfner GmbH & Co. Kaolin- und Kristallquarzsand-Werke KG, located in Hirschau, Germany. Dorfner is renowned for its expertise in refining and utilizing minerals and filler systems. This alliance promises to bring together the strengths of both companies for mutual benefit and further advancements in their respective fields.

The kaolin market, fueled by its diverse applications and inherent properties, stands as a vital contributor to various industries. Its impact resonates across construction, paper, plastics, and many others, driving economic growth and employment opportunities. While environmental regulations and potential substitutions pose challenges, technological advancements, and emerging applications offer promising prospects. By navigating these dynamics strategically, the kaolin industry is poised to continue its growth trajectory and play a pivotal role in the global economy.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking the kaolin market on the basis of SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

Growth Drivers

Increased Expansion in the Paper Industry is Projected to Spur Product Demand

The paper industry is a major consumer of kaolin, using it as a filler and coating material to improve print quality. The increasing demand for paper products, driven by e-commerce and packaging requirements, has boosted the kaolin market. Moreover, the surge in construction activities, particularly in emerging economies, has propelled the demand for kaolin-based products like ceramics, concrete, and paints. Kaolin enhances the strength and workability of these materials, making it an essential component in construction.

Additionally, kaolin's use as a reinforcement agent in plastics and polymers improves mechanical properties and reduces production costs. With the growing adoption of lightweight materials in automotive and packaging industries, the demand for kaolin is on the rise. Innovations in mining and processing technologies have led to improved quality and purity of kaolin, expanding its applications across industries. Advanced beneficiation techniques have enhanced the extraction process, making kaolin more accessible.

Report Segmentation

The market is primarily segmented based on process, end-user, and region.

|

By Process |

By End-User |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Process Analysis

Water-Washed Segment is Expected to Witness the Highest Growth During the Forecast Period

The water-washed segment in the kaolin market has witnessed significant growth due to its superior quality and versatility across a wide range of applications. Water-washed kaolin is produced through a meticulous purification process, involving sedimentation and washing to remove impurities, resulting in a refined, high-grade product. Water-washed kaolin is widely employed in critical industries like ceramics, paper, paints, and plastics, prioritizing attributes of purity and brilliance. Within the ceramics sector, its fine particle size and exceptional plasticity make water-washed kaolin indispensable in crafting ceramics, tiles, and sanitaryware, driving its high demand. In the paper industry, it serves as a crucial filler and coating material, enhancing printability and opacity in various paper products.

The paints and coatings sector also benefits from water-washed kaolin's superior whiteness, contributing to improved opacity, gloss, and viscosity control. Additionally, it is widely utilized in the plastics industry for its reinforcement properties, which enhance mechanical strength and reduce costs.

Moreover, water-washed kaolin is finding increasing applications in the pharmaceutical and cosmetics industries due to its purity and inert nature. It is utilized in formulations for tablets, ointments, and cosmetic products.

The growth of the water-washed segment in the kaolin market is further fueled by the escalating demand for high-quality raw materials in various industries, coupled with the stringent quality standards imposed by end-users. As a result, manufacturers are investing in advanced processing technologies to meet this burgeoning demand, thereby contributing to the continued expansion of the water-washed kaolin market.

By End-User Analysis

Paper Segment Accounted for the Largest Market Share in 2022

The paper segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. The paper segment in the kaolin market has experienced substantial growth driven by the unique properties of kaolin that enhance paper quality and performance. Kaolin, when used as a filler and coating material in paper production, significantly improves properties like opacity, printability, and smoothness. This leads to higher-quality paper products that are essential in industries ranging from printing and publishing to packaging.

Kaolin's ability to enhance ink receptivity and reduce ink bleed on paper surfaces is particularly valued in the printing industry. It allows for sharper and more vibrant print results, making it crucial in the production of high-quality magazines, brochures, and packaging materials.

Furthermore, kaolin aids in reducing the overall weight of paper products without compromising on thickness or performance. This is especially important in packaging applications, where lightweight yet durable materials are in high demand due to cost and environmental considerations.

As the demand for eco-friendly and sustainable packaging solutions continues to rise, the use of kaolin as a natural and renewable filler in paper production becomes increasingly attractive. It helps reduce the dependency on synthetic materials while maintaining or even enhancing paper quality.

Furthermore, the booming e-commerce sector has spurred an increased need for packaging materials, further amplifying the demand for top-notch paper. This surge in demand positions the paper segment within the kaolin market for sustained growth. Innovations in processing techniques and a growing recognition of the advantages of kaolin are key contributors to this expansion. In essence, kaolin stands as a linchpin in augmenting the quality and sustainability of paper products, securing its enduring significance across diverse industries.

Regional Insights

Asia Pacific Region Dominated the Global Market in 2022

The Asia Pacific region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. China, recognized as the world's foremost consumer and producer of kaolin, holds a central position in shaping the market's trends. The nation's thriving construction sector, in tandem with an escalating need for ceramics, paper, and paints, propels the demand for kaolin. India, another key player, demonstrates a growing need for kaolin in sectors like paper, ceramics, and pharmaceuticals.

Countries like Indonesia, Malaysia, and Thailand are also witnessing an upswing in the kaolin market. These nations benefit from their expanding industrial base and construction activities, further augmenting the demand for kaolin-based products. The region's increased focus on infrastructure development, including real estate and urbanization projects, bodes well for the kaolin market's growth.

Moreover, the paper and packaging industry's continuous expansion, driven by the e-commerce boom, is bolstering kaolin's role in providing high-quality and sustainable paper materials. These dynamics, combined with innovations in processing techniques and heightened environmental awareness, collectively contribute to the Asia-Pacific region's prominence in the global kaolin market. The outlook remains positive, with ample opportunities for market players to tap into this growing demand.

Europe's kaolin market has demonstrated steady growth, driven by diverse industrial applications. Countries like the UK, France, and Germany are notable contributors to this expansion. The region's well-established ceramics industry relies heavily on kaolin, while the paper sector benefits from its role as a filler and coating material. Additionally, kaolin's use in paints, plastics, and pharmaceuticals further bolsters market demand. Europe's focus on sustainable practices and eco-friendly materials also favors kaolin's adoption. With ongoing technological advancements and a push for environmental consciousness, the kaolin market in Europe is poised for sustained growth.

Key Market Players & Competitive Insights

The kaolin market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- BASF SE

- EICL Limited (English Indian Clays Ltd.)

- Imerys S.A.

- I-Minerals Inc.

- KaMin LLC

- Kaolin AD

- KERAMOST, a.s.

- LB MINERALS, s.r.o.

- Quarzwerke GmbH

- SCR-Sibelco N.V.

- Sedlecký Kaolin a.s.

- Sibelco N.V.

- Thiele Kaolin Company

- Unimin Corporation (Sibelco)

- W. R. Grace & Co.-Conn.

Recent Developments

- In November 2023, KaMin, a performance minerals company under the ownership of I-Minerals Partners entered into an agreement with BASF. This agreement entails KaMin's acquisition of BASF's kaolin minerals business, presently operating as a segment within BASF's Performance Chemicals division.

Kaolin Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.35 billion |

|

Revenue Forecast in 2032 |

USD 6.12 billion |

|

CAGR |

4.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Process, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Navigate through the intricacies of the 2024 kaolin market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.