North America Gaucher Disease Treatment Market Size, Share, Trends, & Industry Analysis Report

: By Type (Type 1, Type 3, Type 2), By Therapy, By Distribution Channel, By Country – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5757

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

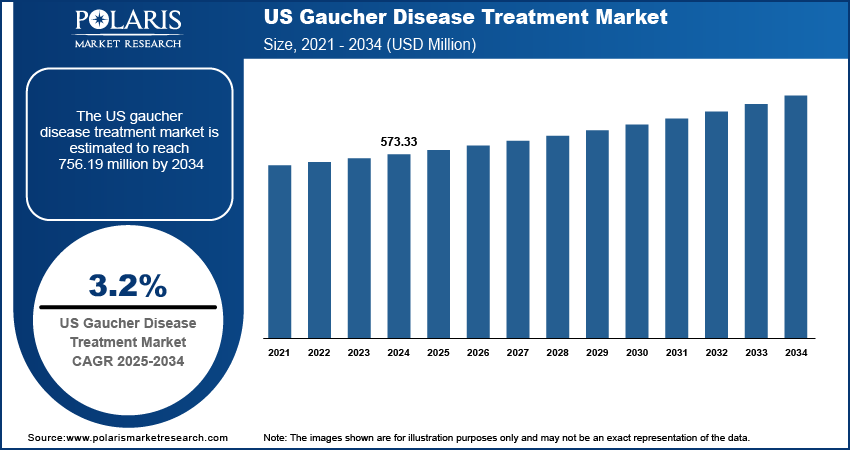

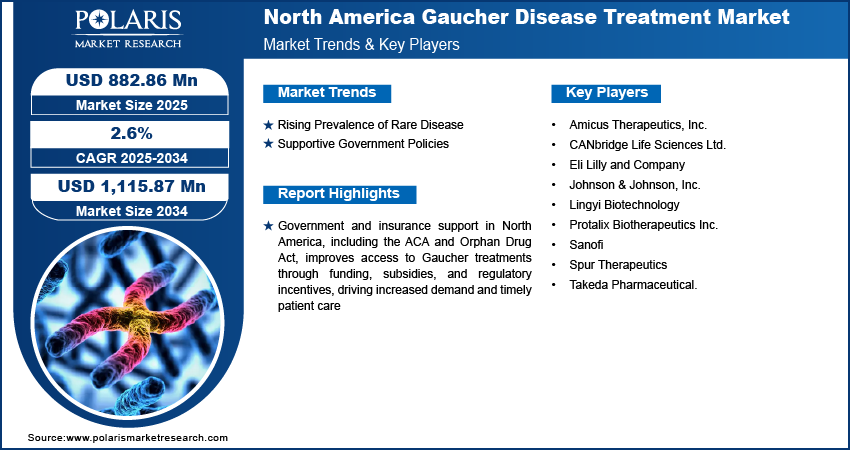

The North America Gaucher disease treatment market was valued at USD 865.02 million in 2024 and is expected to register a CAGR of 2.6% during the forecast period. The growth is driven by the rising prevalence of rare diseases and supportive government policies.

Gaucher disease is a rare genetic disorder that occurs due to a deficiency of the enzyme glucocerebrosidase. This deficiency causes the accumulation of glucocerebroside in cells, particularly in the spleen, liver, bone marrow, and occasionally the brain. As a result, individuals with Gaucher disease may experience symptoms such as enlarged organs, anemia, fatigue, bone pain, and, in severe cases, neurological complications. The treatment for Gaucher disease aims to manage these symptoms, replace the missing enzyme, or reduce the accumulation of the substrate. A few primary treatment options include enzyme replacement therapy (ERT), substrate reduction therapy (SRT), and supportive care.

Awareness of rare genetic disorders such as Gaucher disease has significantly improved across North America. Government agencies, nonprofit organizations, and healthcare providers are educating the public about symptoms, genetic risks, and available treatments. This growing awareness encourages individuals to seek early diagnosis, which is crucial for better disease management. Earlier identification means patients begin treatment sooner, reducing long-term complications. Consequently, the demand for Gaucher disease treatments is increasing. Improved diagnostic tools, such as genetic testing and biomarker analysis, further support this trend by enabling more accurate and timely diagnoses, thereby driving growth.

Industry Dynamics

Rising Prevalence of Rare Disease

Rising cases of rare diseases in North America, including Gaucher disease, are driving the demand for effective treatment options. According to the US Food and Drug Administration (US FDA), approximately 7,000 rare diseases affect 30 million people in the US. This growth in the pool of patients suffering from rare diseases is driving the demand for treatment options. Additionally, government initiatives and awareness regarding rare disease diagnostics and screening are further fueling the demand for therapies and drugs as more cases of rare disease are identified, thereby driving the industry's growth.

Supportive Government Policies

Government programs and health insurance providers in North America are offering greater support for patients suffering from rare diseases. This includes funding for research, subsidies for expensive medications, and better insurance coverage for treatments such as ERT and substrate reduction therapy (SRT). According to the National Organization for Rare Disorders, the ACA implemented essential protections for individuals affected by rare diseases, including a ban on insurers denying health coverage. The US Orphan Drug Act and similar initiatives in Canada encourage pharmaceutical companies to develop treatments for rare diseases by offering tax incentives and faster regulatory approvals. These supportive policies reduce the financial burden on patients and make treatments more accessible. As a result, more people are receiving timely care, boosting demand for the Gaucher disease treatment options.

Segmental Insights

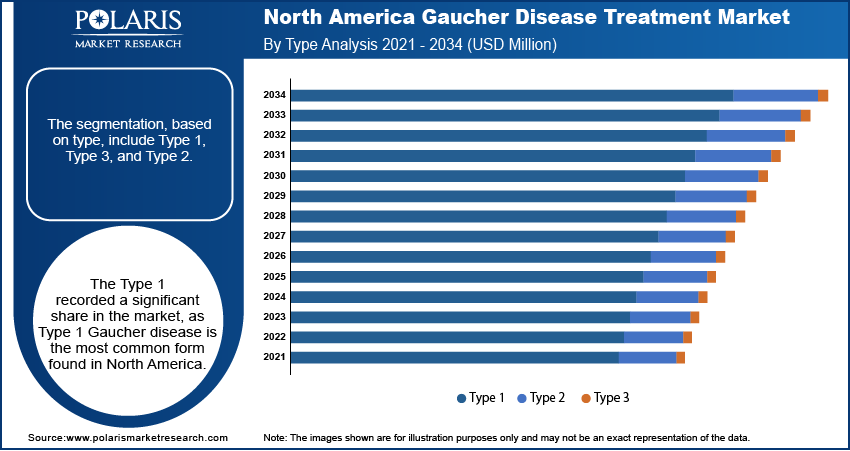

By Type Analysis

The segmentation, based on type, include type 1, type 3, and type 2. The type 1 segment dominated with the largest share and was valued at USD 718.40 million in 2024. Type 1 Gaucher disease is the most common form found in North America. It affects the spleen, liver, and bones but does not involve the brain. Since it can appear at any age and varies in severity, it often requires lifelong treatment. Early detection of Type 1 is increasing with advancements in diagnostic tools and growing awareness. This leads to a higher demand for treatments such as enzyme replacement therapy (ERT), which helps manage symptoms effectively, thereby driving the segment growth.

The type 2 segment is projected to reach USD 20.53 million by 2034. Type 2 Gaucher disease is the rarest and most severe form, usually appearing in infants. It affects both the body and the brain, leading to rapid neurological decline. Unlike Type 1 and Type 3, enzyme replacement therapy (ERT) has little effect on the brain symptoms in Type 2. Because of this, the treatment focus is mainly on supportive and palliative care. Although the market size for this segment is small, ongoing research into gene therapy and brain-targeted drugs is expected to fuel the segment growth during the forecast period.

By Therapy Analysis

The segmentation, based on therapy, includes enzyme replacement therapy (ERT), substrate reduction therapy (SRT), and others. The enzyme replacement therapy segment accounted for a 74.18% share in 2024 as ERT is widely used for treating Gaucher disease, especially for Type 1 patients. Major pharmaceutical companies like Sanofi and Pfizer offer FDA-approved ERT drugs such as Cerezyme and Elelyso, which are widely available across the US and Canada. The region benefits from a strong healthcare infrastructure and broad insurance coverage, making ERT accessible to many patients. Infusion centers and home-based infusion options are also common, improving patient convenience and adherence, thereby driving the growth of the segment.

The substrate reduction therapy segment is expected to reach USD 229.87 million by 2034, as SRT is gaining traction in North America as an oral alternative to traditional infusion-based ERT. Drugs such as Cerdelga and Zavesca are FDA-approved and increasingly prescribed, particularly for patients affected by mild to moderate symptoms or those who cannot tolerate ERT. The convenience of oral administration fits well with North America’s preference for at-home, patient-centered care. The US, in particular, has seen growth in SRT due to strong clinical support, physician awareness, and growing patient demand for noninvasive options. Ongoing innovation and rising adoption are positioning SRT as a complementary and, in some cases, preferred treatment approach.

By Distribution Channel Analysis

The segmentation, based on distribution channel, includes hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment accounted for a 38.93% share in 2024 as hospital pharmacies play a major role in the distribution of Gaucher disease treatments, especially enzyme replacement therapies (ERT), which often require specialized handling and administration. These pharmacies are typically connected to major healthcare institutions that treat complex and rare diseases, ensuring that patients receive high-quality, monitored care. Hospitals also manage infusion services, which are essential for ERT delivery. In both the US and Canada, reimbursement systems support in-hospital treatments, making hospital pharmacies a reliable and trusted channel, thereby driving segment growth.

Country Analysis

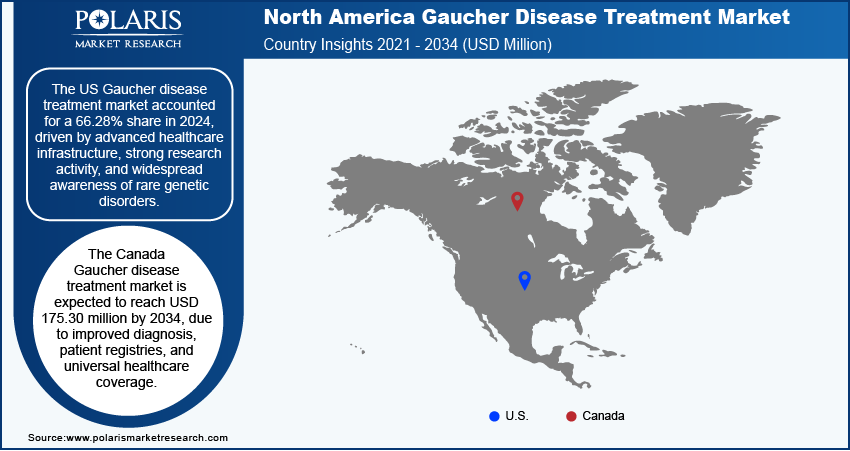

Gaucher Disease Treatment Market in US

The US Gaucher disease treatment market accounted for a 66.28% share in 2024, driven by advanced healthcare infrastructure, strong research activity, and widespread awareness of rare genetic disorders. FDA-approved therapies such as Cerezyme and Cerdelga are readily available, supported by comprehensive insurance coverage and orphan drug incentives. The US has a high rate of early diagnosis due to access to genetic testing and specialty care. Additionally, biotech companies based in the US continue to invest heavily in research and clinical trials, thereby driving the growth in the country.

Gaucher Disease Treatment Market in Canada

The Canada Gaucher disease treatment market is expected to reach USD 175.30 million by 2034 due to improved diagnosis, patient registries, and universal healthcare coverage. Canada offers strong support for rare disease patients through national health plans and special drug access programs. Enzyme Replacement Therapy (ERT) is commonly provided through hospital settings, and newer oral therapies such as Cerdelga are increasingly used. Canada further collaborates in international research and clinical trials, helping patients access advanced therapies. Public health initiatives and advocacy by rare disease organizations have helped increase awareness and ensure better care access for those affected by Gaucher disease, which is driving the industry growth in country.

Key Players & Competitive Analysis Report

Companies are focusing on strategic licensing, collaborations, and regional expansion to secure their market share and enhance their product pipelines. Several investigational molecules are being developed to address the central nervous system manifestations of diseases, with a growing preference for small-molecule oral agents that modulate glycosphingolipid biosynthesis. Research and development efforts are primarily aimed at therapies that reduce the need for frequent infusions and improve accessibility in underserved areas. Market participants actively seek regulatory designations, such as orphan drug status, to expedite the development process and gain market exclusivity. The emergence of biosimilars introduces additional competition, particularly in regions with cost-sensitive healthcare systems. Therapeutic approaches increasingly incorporate biomarker-driven strategies and personalized care. This dynamic environment fosters continuous innovation and intensifies competition across all segments of the North America Gaucher disease treatment market.

Key Players

- Amicus Therapeutics, Inc.

- CANbridge Life Sciences Ltd.

- Eli Lilly and Company

- Johnson & Johnson, Inc.

- Lingyi Biotechnology

- Protalix Biotherapeutics Inc.

- Sanofi

- Spur Therapeutics

- Takeda Pharmaceutical

Industry Developments

March 2025: Spur Therapeutics launched FLT201, a one-time gene therapy for Gaucher disease type 1, after completing its Phase 1/2 trial. The therapy showed sustained benefits, enabling patients to stop standard treatments while maintaining or improving key clinical markers.

North America Gaucher Disease Treatment Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Type 1

- Type 3

- Type 2

By Therapy Outlook (Revenue, USD Million, 2020–2034)

- Enzyme Replacement Therapy (ERT)

- Substrate Reduction Therapy (SRT)

- Others

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Country Outlook (Revenue, USD Million, 2020–2034)

- US

- Canada

North America Gaucher Disease Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 865.02 Million |

|

Market Size in 2025 |

USD 882.86 Million |

|

Revenue Forecast by 2034 |

USD 1,115.87 Million |

|

CAGR |

2.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 865.02 million in 2024 and is projected to grow to USD 1,115.87 million by 2034.

The market is projected to register a CAGR of 2.6% during the forecast period.

The US dominated the market share in 2024.

A few of the key players in the market are Amicus Therapeutics, Inc.; CANbridge Life Sciences Ltd.; Eli Lilly and Company; Johnson & Johnson, Inc.; Lingyi Biotechnology; Protalix Biotherapeutics Inc.; Sanofi; Spur Therapeutics; and Takeda Pharmaceutical.

The type 1 segment dominated the market share in 2024.

The substrate reduction therapy segment is expected to witness the fastest growth during the forecast period.