North America Omega 3 Market Share, Size, Trends, Industry Analysis Report

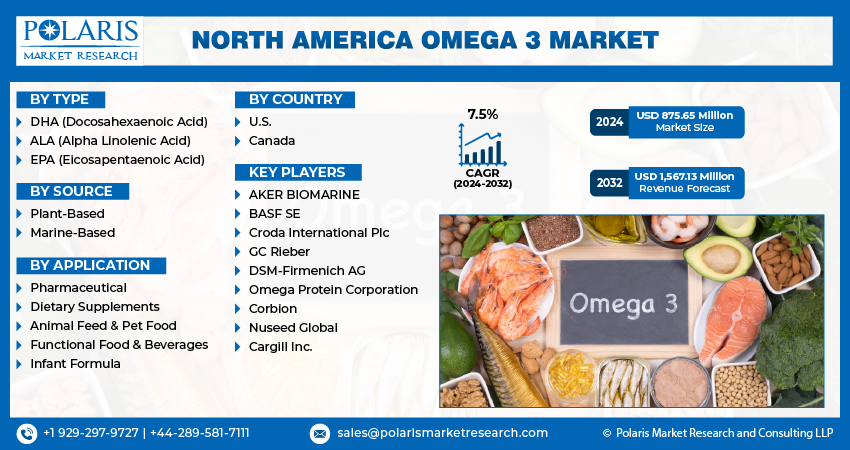

By Type (DHA (Docosahexaenoic Acid), ALA (Alpha Linolenic Acid), and EPA (Eicosapentaenoic Acid)); By Source; by Application; By Country; Segment Forecast, 2024- 2032

- Published Date:May-2024

- Pages: 116

- Format: PDF

- Report ID: PM4937

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

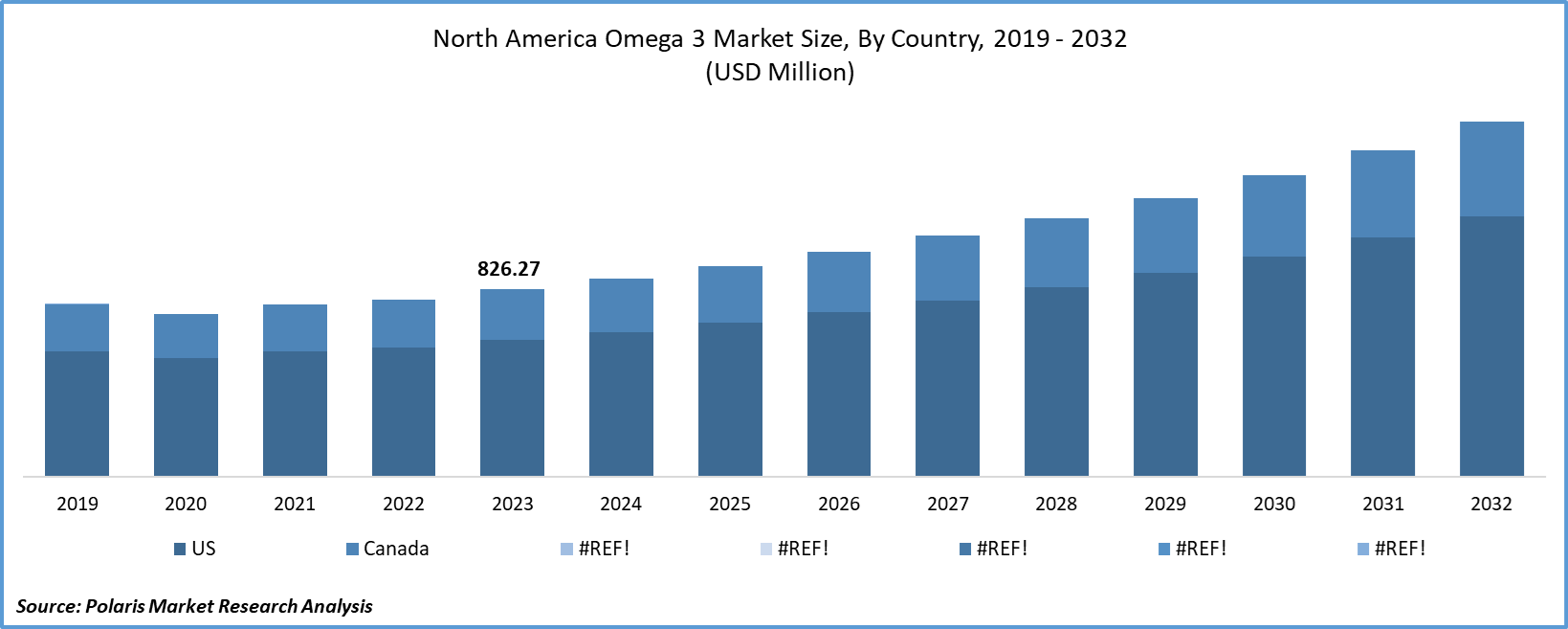

The North America omega 3 market size was valued at USD 826.27 million in 2023. The market is anticipated to grow from USD 875.65 million in 2024 to USD 1,567.13 million by 2032, exhibiting a CAGR of 7.5% during the forecast period.

Industry Trend

The Omega-3 market in North America is undergoing notable expansion, fueled by heightened consumer awareness regarding the health benefits linked to Omega-3 fatty acids and their widespread integration into various food and dietary supplements. A key driver behind this growth is the escalating prevalence of chronic diseases like cardiovascular disorders, arthritis, and cognitive impairments.

For example, in 2021, approximately 695,000 people succumbed to heart disease, as reported by the Centers for Disease Control and Prevention. Extensive research on Omega-3 fatty acids, notably EPA (eicosapentaenoic acid) and DHA (docosahexaenoic acid), has underscored their potential to mitigate the risk of such conditions and promote overall heart and brain health. Consequently, consumers in North America are increasingly embracing Omega-3-fortified products, including functional foods and supplements, as integral components of their daily dietary regimen.

To Understand More About this Research: Request a Free Sample Report

Furthermore, the escalating healthcare expenditure in North America serves as a significant market driver. As individuals become more health-conscious, they are turning to nutritional supplements and functional foods enriched with Omega-3 fatty acids. For instance, according to the Centers for Medicare & Medicaid Services, the United States' National Health Expenditure (NHE) surged by 4.1% to reach USD 4.5 trillion in 2022. This upsurge in healthcare costs has prompted individuals to adopt proactive measures to safeguard their health, thereby amplifying the demand for Omega-3 products.

Moreover, the Omega-3 market in North America is poised for sustained growth, propelled by factors such as heightened consumer health consciousness, ongoing product innovation endeavors by industry players, and supportive regulatory frameworks. With consumers continuing to prioritize health and wellness, the demand for Omega-3 fortified products is anticipated to remain robust, presenting lucrative opportunities for manufacturers and retailers operating in this market.

Anticipated strategic collaborations, partnerships, mergers, and acquisitions within the key industry players are expected to fuel market consolidation and stimulate innovation in both product development and marketing strategies.

Key Takeaway

- United States dominated the largest market and contributed to more than 38% of the share in 2023.

- By source category, the marine resources segment accounted for the largest market share in 2023.

- By application category, the pharmaceutical segment is projected to grow at the highest CAGR during the projected period.

What are the market drivers driving the demand for the North America omega 3 market?

The Rising Healthcare Expenditure Had Spurred the Product Demand

The rising healthcare expenditure in North America is a significant factor shaping consumer behavior and driving the demand for Omega-3 products. As healthcare costs continue to escalate, individuals are becoming more conscious of the need for preventive health measures to mitigate the risk of chronic diseases and maintain overall well-being.

With healthcare expenses consuming a larger portion of household budgets, consumers are seeking cost-effective ways to support their health and potentially reduce the need for expensive medical interventions. Nutritional supplements and functional foods enriched with Omega-3 fatty acids offer a convenient and accessible means for individuals to proactively manage their health. Omega-3 fatty acids have been extensively studied for their potential health benefits, including cardiovascular support, cognitive function enhancement, and inflammation reduction. As such, consumers view Omega-3 supplements as an integral part of their preventive healthcare regimen, aiming to address potential health concerns before they escalate into more serious conditions. Moreover, the proactive approach to health maintenance aligns with broader societal trends towards wellness and self-care. Consumers are increasingly taking charge of their health outcomes, seeking out products and lifestyle choices that promote longevity and vitality.

Which factor is restraining the demand for North America omega 3?

The Availability of Alternative Sources of Omega-3 Fatty Acids

While Omega-3 supplements derived from fish oil are popular, concerns about sustainability, environmental impact, and potential contaminants such as heavy metals and pollutants may deter some consumers. Additionally, fish-derived Omega-3 supplements may not be suitable for individuals following vegetarian or vegan diets. To address these concerns, alternative sources of Omega-3, such as algae-based supplements, have emerged. Algae-based Omega-3 supplements offer a sustainable and vegan-friendly option, providing similar health benefits to fish oil-derived supplements.

As consumers become more aware of these alternative sources and their benefits, they may opt for algae-based Omega-3 supplements over traditional fish oil supplements. This shift in consumer preferences could potentially restrain the demand for fish oil-derived Omega-3 products in the North American market.

Report Segmentation

The market is primarily segmented based on type, source, application, and country.

|

By Type |

By Source |

By Application |

By Country |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Source Insights

Based on source analysis, the market is segmented on the plant-based, and marine-based. Marine-Based held the largest market share in 2023. The North American region is rich in marine resources, including various fish species that are high in omega-3 fatty acids such as EPA and DHA. This abundance of marine sources makes it easier for manufacturers to produce marine-based omega-3 supplements and pharmaceuticals. This industry maturity allows for efficient production processes and supply chain networks, enabling manufacturers to meet the high demand for marine-based omega-3 products. particularly fish oil, contain high concentrations of EPA and DHA compared to plant-based sources like flaxseed oil or algal oil. EPA and DHA are the most biologically active forms of omega-3 fatty acids and are associated with numerous health benefits, including cardiovascular health, brain function, and inflammation reduction. Marine-based omega-3 products are widely available in various forms, including soft gel capsules, liquid oils, and fortified foods. This wide availability and product variety cater to diverse consumer preferences and dietary needs, further driving the dominance of marine-based omega-3 in the North American market.

By Application Insights

Based on application analysis, the market has been segmented on the basis of pharmaceutical, dietary supplements, animal feed & pet food, functional food & beverages, and infant formula. The Pharmaceuticals segment expected to be the fastest growing CAGR during the forecast period. There's a rising demand for prescription omega-3 pharmaceuticals due to their therapeutic benefits in managing various health conditions. Omega-3 fatty acids, particularly EPA and DHA, have been associated with cardiovascular health, reducing triglyceride levels, and even aiding in mental health disorders like depression. Pharmaceutical-grade omega-3 products are often prescribed by healthcare professionals for these purposes. Clinical studies continue to demonstrate the efficacy of omega-3 fatty acids in managing and preventing various health conditions. As more research supports the therapeutic benefits of omega-3s, pharmaceutical companies are investing in the development of new prescription drugs containing optimized formulations of EPA and DHA.

Regional Insights

United states

United states region accounted for the largest market share in 2023. The United States has a significant population with a high level of disposable income and a strong focus on health and wellness. As a result, there is a large consumer base willing to spend on dietary supplements and pharmaceuticals, including omega-3 products. The United States has a significant population with a high level of disposable income and a strong focus on health and wellness. As a result, there is a large consumer base willing to spend on dietary supplements and pharmaceuticals, including omega-3 products. The United States has a well-developed healthcare infrastructure with a network of healthcare professionals, including physicians, nutritionists, and pharmacists. These professionals often recommend omega-3 supplements to patients for various health conditions, further driving market growth.

Competitive Landscape

In the competitive landscape of the North American omega-3 market, several key players vie for market dominance. Competition in this market is fueled by factors such as product innovation, quality, pricing, and distribution strategies. Partnerships, mergers, and acquisitions further shape the landscape as companies seek to expand their market presence and meet the growing demand for omega-3 products among health-conscious consumers in North America.

Some of the major players operating in the market include:

- AKER BIOMARINE

- BASF SE

- Croda International Plc

- GC Rieber

- DSM-Firmenich AG

- Omega Protein Corporation

- Corbion

- Nuseed Global

- Cargill Inc.

Recent Developments

- In October 2023, DSM-Firmenich, a renowned leader in the fields of health, nutrition, and beauty, has recently announced the forthcoming launch of life’s OMEGA O3020 in North America. This revolutionary product is the foremost single-source algal omega-3 that delivers the same EPA to DHA ratio as standard fish oil, but with twice the potency.

Report Coverage

The North America omega 3 market report emphasizes to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions. The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, source, application, and their futuristic growth opportunities.

North America Omega 3 Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 875.65 million |

|

Revenue forecast in 2032 |

USD 1,567.13 million |

|

CAGR |

7.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By type, By source, By application, and By country |

|

Country scope |

United States, Canada |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The North America omega 3 market size is expected to reach USD 1,567.13 million by 2032

Key players in the market are AKER BIOMARINE, BASF SE, Croda International Plc., Pelagia Holding AS, GC Rieber

The North America omega 3 market exhibiting a CAGR of 7.5% during the forecast period.

The North America Omega 3 Market report covering key segments are type, source, application, and country.