Offshore Decommissioning Market Share, Size, Trends, Industry Analysis Report

By Services Type; By Structure; By Water Depth, By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 110

- Format: PDF

- Report ID: PM2216

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

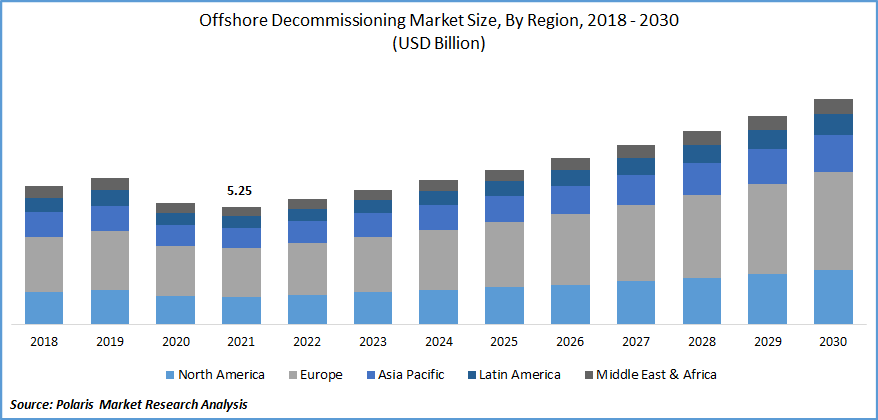

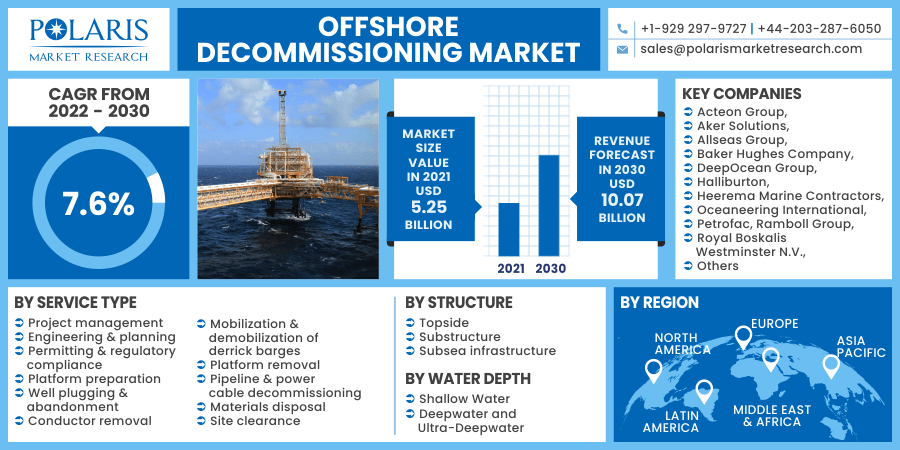

The global offshore decommissioning market was valued at USD 5.25 billion in 2021 and is expected to grow at a CAGR of 7.6% during the forecast period. The growth in the offshore discharging market is being driven by the rising government focus on well plug and abandoned activities and increasing government investment for such activities. For instance, in April 2021, a bill was presented in the US parliament, enabling USD 8 billion to clean up abandoned oil wells around the country to provide jobs for oil and gas workers while also lowering climate-warming emissions.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Besides, in August 2021, a new USD 4.7 billion initiative to address a huge environmental legacy of the fossil fuel sector, the plugging and remediation of orphan oil and gas wells are included in the bipartisan infrastructure plan currently being debated in Washington. As orphan wells have no owner, the cleanup burden falls primarily on the public. State and federal agencies have identified nearly 60,000 such wells, but there are possibly hundreds of thousands more scattered throughout more than two dozen states.

Further, in April 2020, In Alberta, Saskatchewan, and British Columbia, the Canadian government invested USD 1.7 billion to clean up unaccompanied and separated oil and gas wells. The initiative aims to assist the energy sector while maintaining or increasing job opportunities. The cleanup money is expected to generate 5,200 employments in Alberta alone. The federal government's goal in these provinces is to create immediate jobs while also assisting businesses in avoiding bankruptcy and achieving their environmental goals. Thus, the rising abandoned wells have led to an increase in the investment for decommissioning the wells by various governments across the globe. This is the factor boosting the offshore decommissioning market growth during the forecast period.

However, depending on the location, temperature, and laws, the expensive cost of decommissioning platforms can differ wildly. It is a difficult process that necessitates using various tools and competent operators. These operations on either side are carried out on oilfields that have become a burden for the corporation. Offshore decommissioning facilities are expensive. For instance, according to the Trade Association of Oil and Gas in the UK, though variations exist widely worldwide, decommissioning a complete platform in shallow seas like the Gulf of Mexico may cost USD 15 million to USD 20 million on aggregate. The present offshore decommissioning expenses of oil refineries in UK waters in the North Sea are expected to reach GBP 16 billion, by 2030 and GBP 19 billion, by 2040, according to an Economic Report by Oil and Gas UK. Thus, the high cost is one of the primary reasons limiting the offshore decommissioning market's growth.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The market has observed extensive developments in the last few decades, supported by factors such as the rising market demand for offshore decommissioning due to large mature offshore oilfields and a growing number of abandoned wells globally. When a well reaches the end of its useful life, it must be sealed and abandoned permanently. Several cement plugs are placed in the wellbore to segregate the reservoir as well as other fluid-bearing formations during plug and abandon (P&A) techniques. The number of wells that need to be permanently sealed and abandoned is growing substantially, particularly in mature offshore locations like the North Sea and the Gulf of Mexico.

For instance, according to the Oil and Gas UK, in 2020, decommissioning insight, decommissioning of wells will continue to account for the great majority of discharging expenditures during the next decade, accounting for 49% of overall decommissioning costs. This is up from the GBP 6.8 billion (45% increase) reported in Decommissioning Insight in 2019. While spending has grown, the number of wells set to be decommissioned over the next decade has decreased, from 1,630 last year to 1,616 by 2020. This shift can be attributed to the fact that this year's dataset contains a higher number of subsea wells, which are normally more expensive to decommission.

Further, as per the Oil and Gas UK, in the North Sea, 2,624 wells are projected to be decommissioned between 2019 and 2028. The majority of North Sea activity in the UK includes 60% of good activity, 73% of topsides, and 53% of the substructure activity. Also, well removal activity happened with 116 wells decommissioned in 2020. Thus, the offshore withdrawing market demand is rising as the abandoned wells have been increased across the globe, boosting the offshore decommissioning market growth during the forecast period.

Report Segmentation

The market is primarily segmented based on services type, structure, water depth, and region.

|

By Service Type |

By Structure |

By Water Depth |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Water Depth

Based on the water depth segment, the shallow water segment is expected to be the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance in the foreseen period. The offshore discharging market is divided into shallow and deepwater segments based on the water depth at which discharging initiatives occur. And for its lower operational expenses, the shallow water segment was the largest market and is expected to maintain its lead over the offshore segment. Nevertheless, as so many foundation installations are at deepwater and ultra-deepwater depths, the deepwater segment will conflict with shallow water in the long term.

Geographic Overview

In terms of geography, Europe garnered the largest revenue share. The market for the European region is anticipated to grow significantly as a result of the rising European government initiatives and investment in the region. Europe is one of the first regions to use offshore oil and gas infrastructure, most decommissioned in recent years. Over 950,000 tonnes of topsides are anticipated for removal across the North Sea in Europe, with over 605,000 tonnes coming from the UK.

Over the next ten years, the UK is estimated to spend roughly EUR 15.3 billion on offshore decommissioning. By 2027, around 2,400 wells in the North Sea and West of Shetland are projected to be decommissioned. There are around 914 of these wells in the Norwegian, Danish, and Dutch sectors. In 2020, around 10% of the total annual expenditure for discharging was around EUR 1.1 billion. Since the UK government recognizes this and the UK has the most advanced offshore decommissioning sector, the UK is poised to become the worldwide center for decommissioning. As a result, factors such as increased government investment in offshore decommissioning projects and the region's aging mature oilfield are projected to fuel market demand for offshore discharging services in the future years.

Moreover, North America is expected to witness a high CAGR in the global market in 2021. North America will also play a significant role in growing offshore discharging market demand. Each year, the region accounted for the largest number of oil-well commissioned in the U.S. and Gulg of Mexico, where they have been setting up “Ocean Program” to materialize efforts.

Competitive Insight

Some of the major players operating in the global market include Acteon Group, Aker Solutions, Allseas Group, Baker Hughes Company, DeepOcean Group, Halliburton, Heerema Marine Contractors, Oceaneering International, Petrofac, Ramboll Group, Royal Boskalis Westminster N.V., Schlumberger, Subsea 7, TechnipFMC, Weatherford, among others.

Offshore Decommissioning Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 5.25 billion |

|

Revenue forecast in 2030 |

USD 10.07 billion |

|

CAGR |

7.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Services Type, By Structure, By Water Depth, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Acteon Group, Aker Solutions, Allseas Group, Baker Hughes Company, DeepOcean Group, Halliburton, Heerema Marine Contractors, Oceaneering International, Petrofac, Ramboll Group, Royal Boskalis Westminster N.V., Schlumberger, Subsea 7, TechnipFMC, Weatherford |