Offshore Support Vessel Market Size, Share, Trends, & Industry Analysis Report

By Type, By Application (Shallow Water, Deepwater), By End Use (Oil & Gas, Offshore Wind), and By Region -Market Forecast, 2025 – 2034

- Published Date:Sep-2025

- Pages: 112

- Format: PDF

- Report ID: PM2401

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

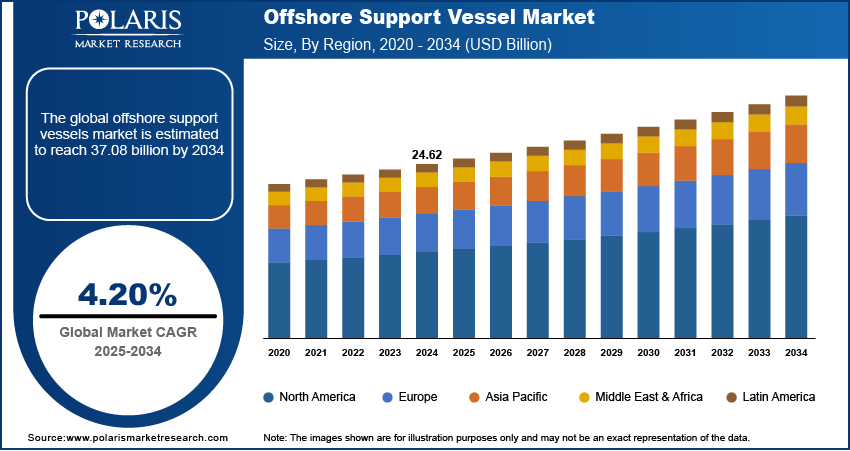

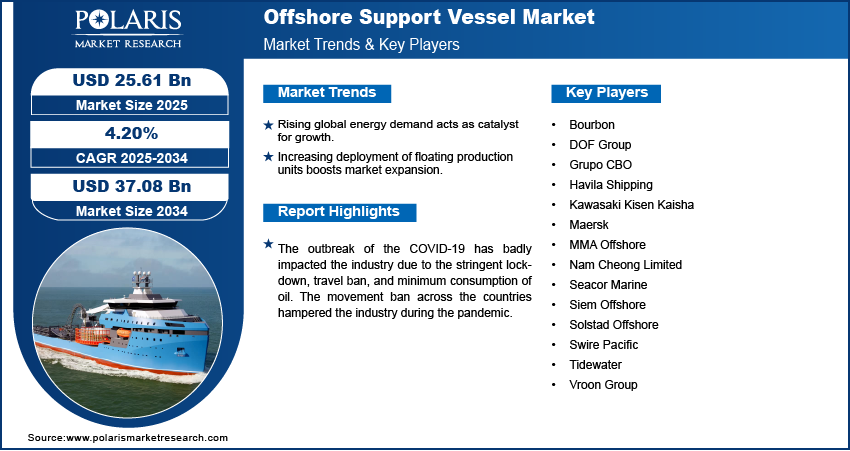

The global Offshore Support Vessel market size was valued at USD 24.62 billion in 2024. The market is projected to grow at a CAGR of 4.20% during 2025 to 2034. Key factors driving demand for offshore support vessels include rising offshore oil and gas exploration and production, expansion of offshore renewable energy projects, and advancements in vessel technology.

Key Insights

- The anchor-handling tug supply (AHTS) segment held the largest revenue share in 2024, due to its high-volume capacity.

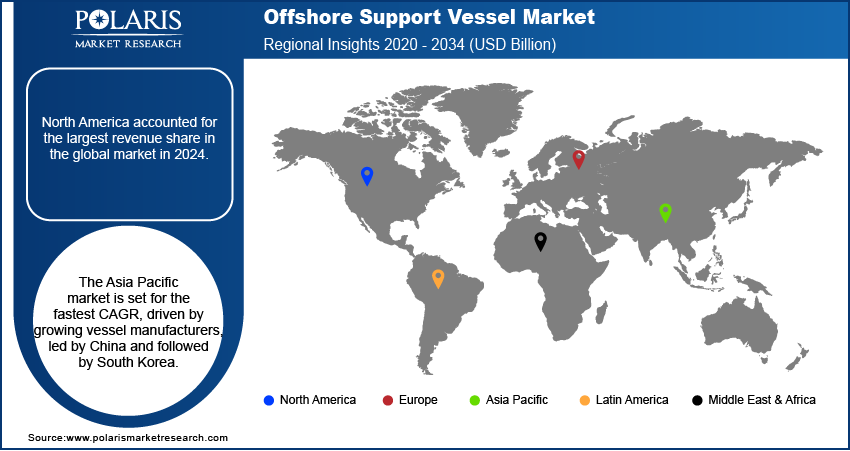

- North America accounted for the largest revenue share in the global market in 2024. The rising construction activities, inspections, maintenance, and operations in the region resulted in the growing demand for the offshore support vessel market.

- Asia Pacific market is anticipated to exhibit the fastest CAGR over the forecasting years, owing to the rising number of vessel manufacturers.

Industry Dynamics

- The surging energy demand across various countries is acting as a catalyzing factor for industry growth.

- The growing need to position offloading and floating production units in shallow, deep, and ultra-deep waters is propelling the market growth.

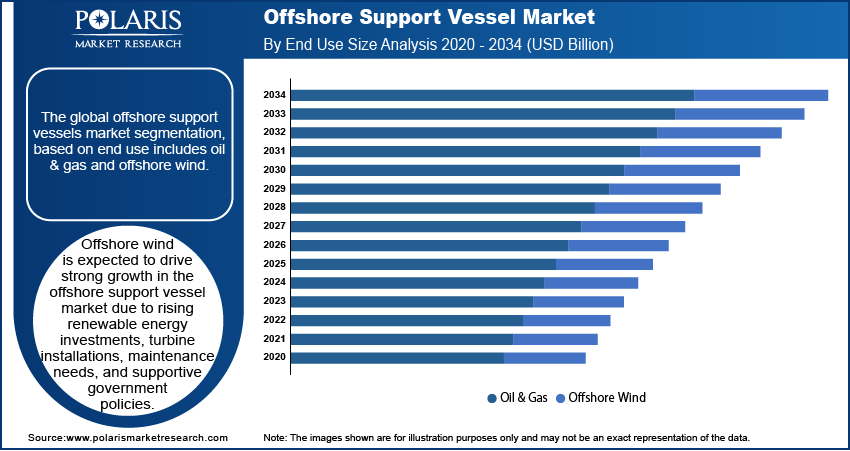

- The increasing spending on the development of wind farm construction is creating a lucrative market opportunity.

- Fluctuations in oil prices and huge capital requirements for offshore projects may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 24.62 Billion

- 2034 Projected Market Size: USD 37.08 Billion

- CAGR (2025-2034): 4.20%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

The major driving factor for the offshore support vessel market is robust investments in the oil & gas and renewable sectors, and the rising number of deep-water activities. In addition, decommissioning of traditional offshore infrastructure, coupled with the growing investment in wind farm construction owing to the huge potential for oil and gas exploration, is also creating favorable growth in the industry. Moreover, the growing population, as well as surging demand for energy such as oil, gas, nuclear power, etc., leads to the rising adoption of the offshore support vessel market in order to meet the rising consumer needs for energy sources, further accelerating the growth across the globe.

The outbreak of the COVID-19 has badly impacted the industry due to the stringent lockdown, travel ban, and minimum consumption of oil. The movement ban across the countries hampered the industry during the pandemic. Various industry players also experienced several delays because of the crew changes, disruption in the supply chain, implementation of stringent quarantine protocols worldwide, and creation of the requirement. As a result, this pandemic has negatively affected industry growth. However, the gradual opening of the lockdowns is expected to create growth possibilities for the industry over the forecast period.

Industry Dynamics

Growth Drivers

The surging energy demand across various countries is acting as a catalyzing factor for industry growth in the forthcoming years. The growing need to position offloading and floating production units in shallow, deep, and ultra-deep waters for the bulk production of hydrocarbons is supporting the demand. In addition, this offshore support vessel produces low carbon emissions, thus rising implementation by various countries to promote the deployment of low carbon power generation fosters the demand. Additionally, increasing spending on the development of wind farm construction propels the market. Also, growing deep-water activities, technological advancement, and rising investments in E&P activities by the key players are further leading to the market expansion.

Report Segmentation

The market is primarily segmented on the basis of type, application, end use, and region.

|

By Type |

By Application |

By End Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by Type

The anchor-handling tug supply (AHTS) segment held the largest revenue share in 2024, due to its high-volume capacity. These are used to transport heavy goods, equipment, and rig crew to the production and drilling platforms. The rising investment by various countries enhanced the segment demand. Moreover, the rapidly growing drilling activities in deep water by various countries offer beneficial growth to the segment. For instance: in December 2020, Reliance Industries and BP initiated the production from the R Cluster. These gas fields are anticipated to attain around 15% of India's gas demand by 2023. Therefore, with the abovementioned factors, the segment held the largest revenue share.

Geographic Overview

North America accounted for the largest revenue share in the global market in 2024. The rising construction activities, inspections, maintenance, and operations in the region resulted in the growing demand for the offshore support vessel market. The increasing activity in deeper water and supportive government protocols and initiatives also offered various lucrative opportunities for market growth across the region. For instance, in 2018, the Trump government allowed gas & oil development activities in the United States. Moreover, various regulatory bodies have also promoted the opening of around a billion acres in the Arctic and Eastern seaboard. Thus, rising government initiatives and investments provide an impetus for growth in the market across the region.

The Asia Pacific market is anticipated to exhibit the fastest CAGR over the forecasting years owing to the rising number of vessel manufacturers in the various countries of the region, which includes China as the leading country, followed by South Korea. The increasing technological advancement in the ultra-deep-water activities across the region fosters market growth. For instance, according to the International Support Vessel Owners Association 2018, the projects for the development of offshore support vessels are rising globally. It includes developing and developed countries of the Asia Pacific, such as Indonesia’s Gehem project, Australia’s Scarborough, Laverda, and Briseis, projects India’s KG-D6 complex, and Malaysia’s Rotan & Gumusut-Kakap project. Hence, the penetration of novel technologies and the rising number of offshore support vessel development and E&P projects are fueling the regional market growth in the near future.

Competitive Insight

Some of the major players operating in the global market include Bourbon, DOF Group, Grupo CBO, Havila Shipping, Kawasaki Kisen Kaisha, Maersk, MMA Offshore, Nam Cheong Limited, Seacor Marine, Siem Offshore, Solstad Offshore, Swire Pacific, Tidewater, and Vroon Group.

Offshore Support Vessel Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 24.62 Billion |

| Market size value in 2025 | USD 25.61 Billion |

|

Revenue forecast in 2034 |

USD 37.08 Billion |

|

CAGR |

4.20% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

Bourbon, DOF Group, Grupo CBO, Havila Shipping, Kawasaki Kisen Kaisha, Maersk, MMA Offshore, Nam Cheong Limited, Seacor Marine, Siem Offshore, Solstad Offshore, Swire Pacific, Tidewater, and Vroon Group |

FAQ's

• The global market size was valued at USD 24.62 billion in 2024 and is projected to grow to USD 37.08 billion by 2034.

• The global market is projected to register a CAGR of 4.20% during the forecast period.

• North America dominated the market in 2024.

• A few of the key players in the market are Bourbon, DOF Group, Grupo CBO, Havila Shipping, Kawasaki Kisen Kaisha, Maersk, MMA Offshore, Nam Cheong Limited, Seacor Marine, Siem Offshore, Solstad Offshore, Swire Pacific, Tidewater, and Vroon Group.

• The anchor-handling tug supply (AHTS) segment dominated the market revenue share in 2024.