Online Dating Application Market Size, Share, Trends, Industry Analysis Report

By Revenue Generation (Subscription {Age, Gender, Type}, and Advertisement) and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 110

- Format: PDF

- Report ID: PM2224

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

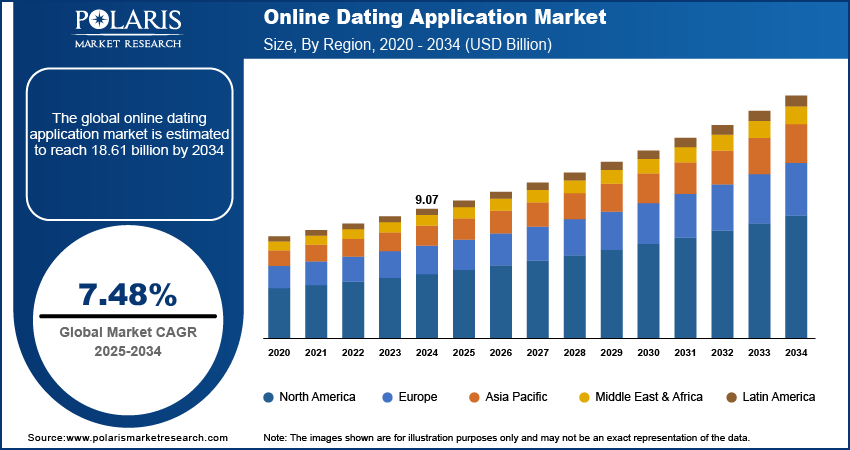

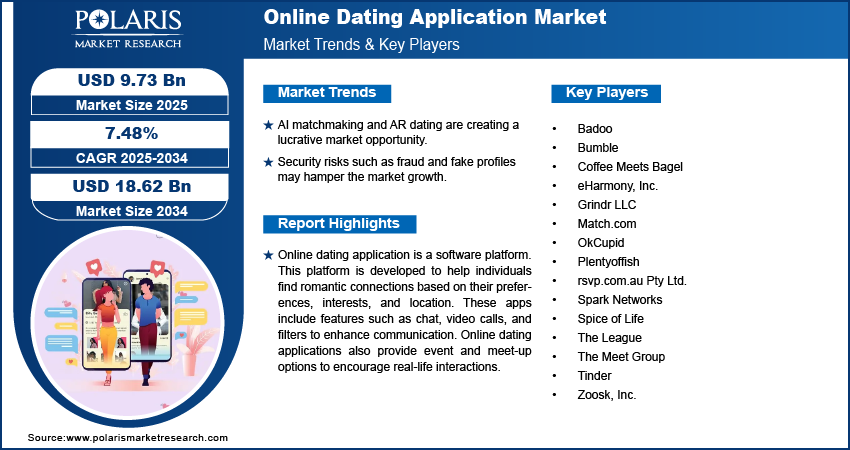

The global online dating application market size was valued at USD 9.07 billion in 2024. The market is projected to grow at a CAGR of 7.48% during 2025 to 2034. Key factors driving demand for online dating applications include growing smartphone usage, increasing internet penetration, and the rising population of single adults seeking quick and convenient ways to connect.

Key Insights

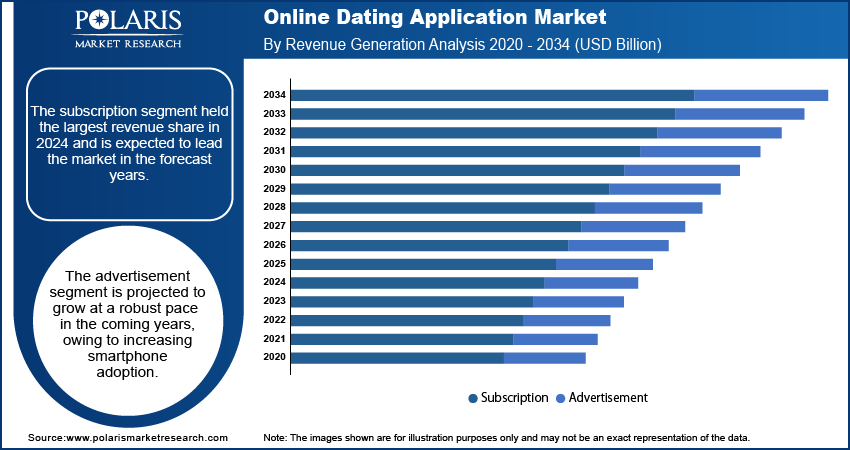

- The subscription segment held the largest revenue share in 2024 and is expected to lead the market in the forecast years. This growth is attributed to the broad presence of applications that charge a subscription fee for premium features.

- The advertisement segment is projected to grow at a robust pace in the coming years, owing to increasing smartphone adoption.

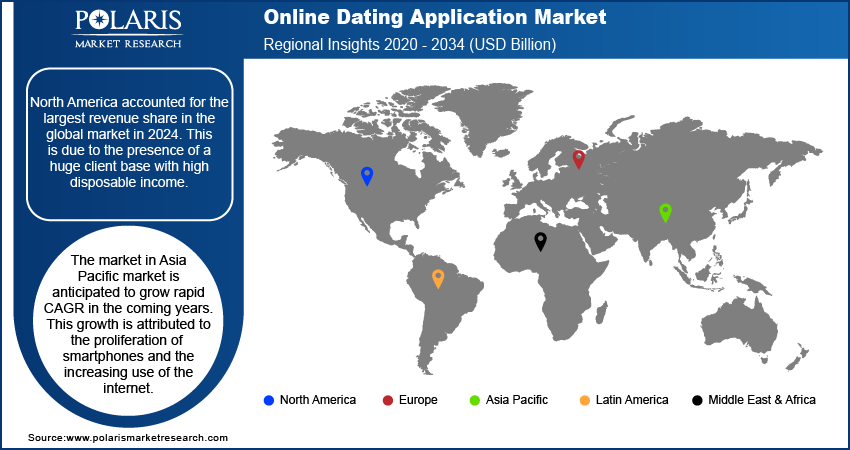

- North America accounted for the largest revenue share in the global market in 2024. This is due to the presence of a huge client base with high disposable income.

- The market in Asia Pacific market is anticipated to grow rapid CAGR in the coming years. This growth is attributed to the proliferation of smartphones and the increasing use of the internet.

Industry Dynamics

- The global online dating application market is fueled by a high population of millennials and Gen-Z.

- The growing disposable income across countries such as China, Japan, and India is also anticipated to increase demand for online dating applications.

- AI matchmaking and AR dating are creating a lucrative market opportunity.

- Security risks such as fraud and fake profiles may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 9.07 Billion

- 2034 Projected Market Size: USD 18.61 Billion

- CAGR (2025-2034): 7.48%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Online Dating Application Market

- AI helps in user preferences, behaviors, and swiping patterns.

- Advanced safety and fraud detection features powered by AI help identify and block fake profiles.

- AI improves communication flow through chatbots and conversation assistants.

- AI helps in sentiment analysis and multi-language chatting.

Online dating application is a software platform. This platform is developed to help individuals find romantic connections based on their preferences, interests, and location. These apps include features such as chat, video calls, and filters to enhance communication. Online dating applications also provide event and meet-up options to encourage real-life interactions. The growing adult population, along with the increasing proliferation of smartphones, is acting as a catalyzing factor for industry growth.

The rising usage of internet facilities is providing access to numerous digital or online dating services. Furthermore, rising acceptance for outer caste marriages & dating is also boosting the demand of the online dating application.

Industry Dynamics

Growth Drivers

The high population of millennials and Gen-Z acorss the globe is propelling the market growth. Millennials are widely using online dating application for selecting their better half on the basis of intellect insight and common interests like or dislike. Moreover, variety of online dating application companies has adopted artificial intelligence (AI) to offer suggestions and provide guidance to their users like which place is the best to go on a first date with a person that they have met online. This has propelld the demand for online dating applications powered by AI. For instance, eHarmony- the online dating services provider, declared the advancements of its AI-enabled feature, which recommend users to meet in person after they have been talking in these applications for a while.

Report Segmentation

The market is primarily segmented on the basis of revenue generation and region.

|

By Revenue Generation |

By Region |

|

|

Know more about this report: request for sample pages

Insight by Revenue Generation

The subscription segment held the largest revenue share in 2024 and is expected to lead the market in the forecast years. The growth is mainly attributed to the broad presence of free applications which offer limited features for free usage and charge a subscription fee for premium features. However, the subscription fees can vary depending upon the apps and their features. Individuals aged 18-25 years increasingly susbcribed online dating applications for using premium features such as unlimited chats, calls, and video calls. As per Survey Monkey Intelligence, Tinder is the leading player, followed by Bumble in the age group of 18-25 years. The rise in smartphone penetration among adults also contributed to the segment's dominance.

Geographic Overview

Geographically, North America accounted for the largest revenue share in 2024 and is likely to dominate the market over the upcoming year. This is due to the presence of a huge client base with high disposable income. Bureau of Economic Analysis stated that the disposable personal income in the US increased +0.6% in April 2025 from March 2025. The presence of major companies and dating culture in the region also contributed to the regional dominance. Moreover, the inuence of movies and presece of hollywood also boosted the dating culture in the region, which ultimately led to the market dominance.

The market Asia Pacific market is anticipated to grow with the highest CAGR in the coming years. This fast growth of the market is attributed to the proliferation of smartphones and the growing usage of the internet in the region. Busy schedules in countries such as Japan and South Korea have further contributed to the growing popularity of these online applications in the Asian region. Furthermore, the high percentage of young population and growing disposable income in countries such as India is leading to the market growth.

Competitive Insight

Some of the major players operating in the global market include Badoo, Bumble, Coffee Meets Bagel, eHarmony, Inc., Grindr LLC, Match.com, OkCupid, Plentyoffish, rsvp.com.au Pty Ltd., Spark Networks, Spice of Life, The League, The Meet Group, Tinder, Zoosk, Inc.

Industry Developments

In June 2025, Tinder introduced its double date feature. This feature allows a pair of friends to create a shared profile and swipe on other friend-pairs for group dates.

Online Dating Application Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 9.07 billion |

| Market size value in 2025 | USD 9.73 billion |

|

Revenue forecast in 2034 |

USD 18.62 billion |

|

CAGR |

7.48% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key Companies |

Badoo, Bumble, Coffee Meets Bagel, eHarmony, Inc., Grindr LLC, Match.com, OkCupid, Plentyoffish, rsvp.com.au Pty Ltd., Spark Networks, Spice of Life, The League, The Meet Group, Tinder, Zoosk, Inc |

FAQ's

• The global market size was valued at USD 9.07 billion in 2024 and is projected to grow to USD 18.62 billion by 2034.

• The global market is projected to register a CAGR of 7.48% during the forecast period.

• North America dominated the market in 2024

• A few of the key players in the market include Badoo, Bumble, Coffee Meets Bagel, eHarmony, Inc., Grindr LLC, Match.com, OkCupid, Plentyoffish, rsvp.com.au Pty Ltd., Spark Networks, Spice of Life, The League, The Meet Group, Tinder, Zoosk, Inc.

• The subscription segment dominated the market revenue share in 2024.