Oral Rinse Market Size, Share, Trends, Industry Analysis Report

By Indication (Periodontitis, Mouth Ulcers, Gingivitis, Dry Mouth), By Product, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM6138

- Base Year: 2024

- Historical Data: 2020 - 2023

Market Overview

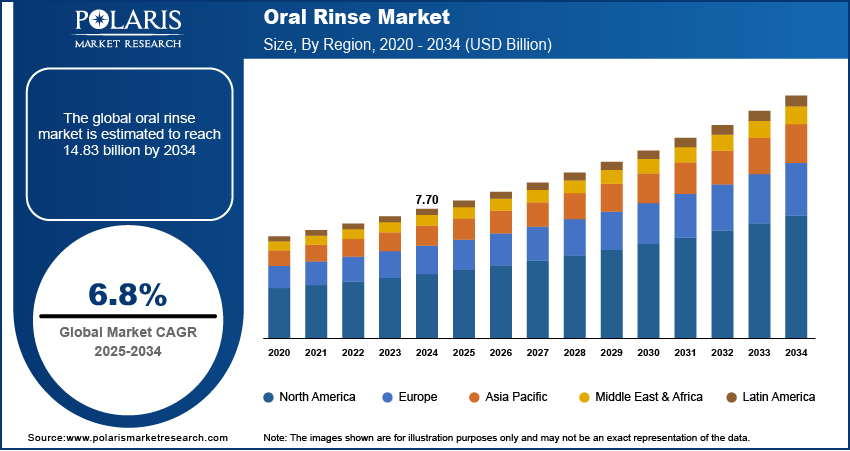

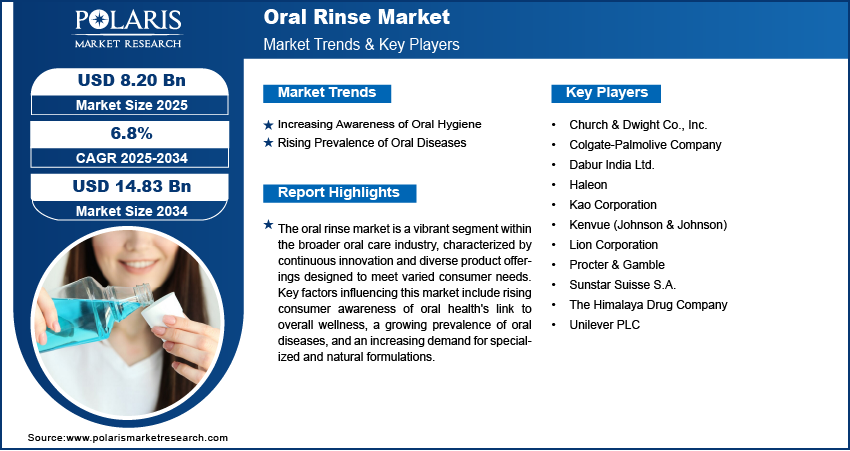

The global oral rinse market size was valued at USD 7.70 billion in 2024 and is anticipated to register a CAGR of 6.8% from 2025 to 2034. The industry witnesses growth driven by rising awareness of oral hygiene and the increasing prevalence of various dental diseases. Additionally, the growing consumer preference for therapeutic and specialized formulations, including natural and alcohol-free options, propels demand for oral rinse.

Key Insights

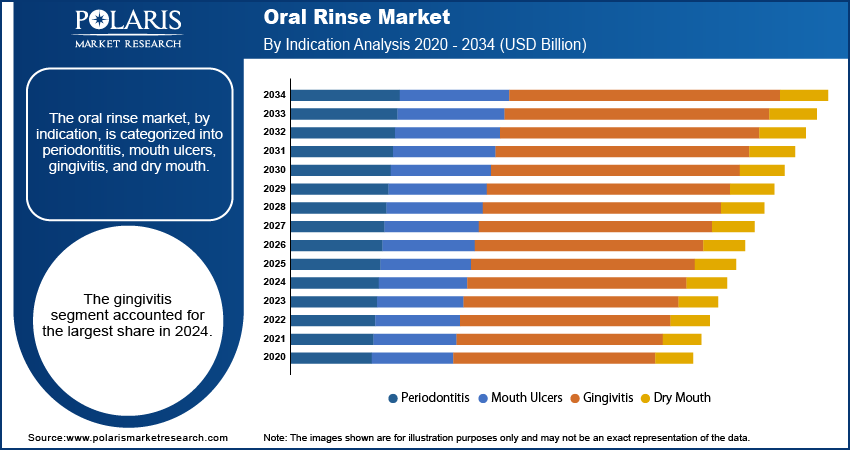

- By indication, the gingivitis segment held the largest share in 2024, primarily due to the widespread occurrence of this early form of gum disease and the broad adoption of antiseptic and therapeutic rinses designed for its management and prevention.

- By product, the antiseptic mouthwash segment held the largest share in 2024, driven by its strong antibacterial properties that are highly valued for reducing plaque and preventing gingivitis. These formulations are a staple for many consumers seeking a comprehensive clean and enhanced oral health beyond basic brushing.

- By distribution channel, the retail stores segment held the largest share in 2024, benefiting from their extensive accessibility and established consumer purchasing behaviors. Supermarkets and hypermarkets provide convenient one-stop shopping where consumers can easily purchase oral care products alongside other daily necessities.

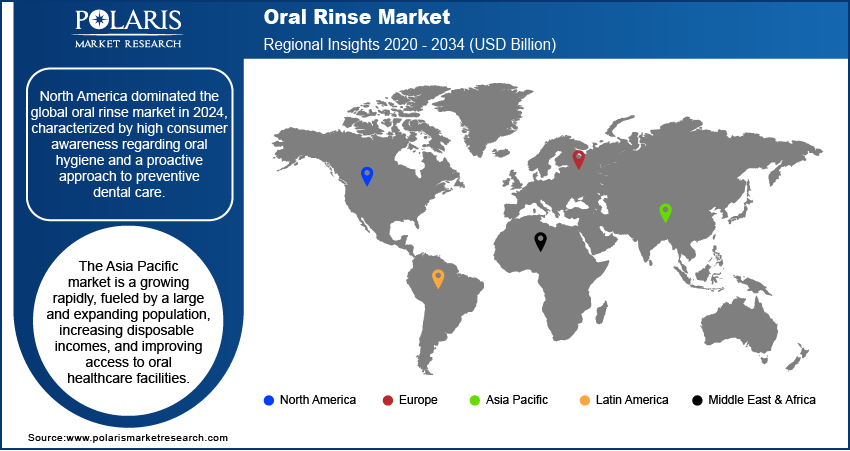

- By region, North America dominated the global oral rinse market in 2024, characterized by high consumer awareness regarding oral hygiene and a proactive approach to preventive dental care.

Industry Dynamics

- The industry growth is attributed to the increasing global awareness regarding maintaining good oral hygiene. Consumers are becoming more educated about the benefits of regular oral care practices, including the use of rinse products to supplement brushing and flossing. This growing understanding of preventive dental health contributes to higher adoption rates.

- The rising prevalence of various oral health conditions, such as gingivitis, periodontitis, and dental caries, is strongly driving demand. As these issues become more common, people are actively seeking solutions that can help manage symptoms, prevent progression, and improve overall oral wellness, leading to increased product consumption.

- Growing consumer preference for specialized and therapeutic formulations is a major factor. There is an increasing demand for products offering specific benefits such as sensitivity relief, gum health improvement, or breath freshening. Innovations in alcohol-free and natural ingredient options cater to diverse consumer needs.

Market Statistics

- 2024 Market Size: USD 7.70 billion

- 2034 Projected Market Size: USD 14.83 billion

- CAGR (2025–2034): 6.8%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

An oral rinse is a liquid solution used to promote oral hygiene by swishing it around the mouth. These products help reduce bacteria and freshen breath. They also offer therapeutic benefits such as cavity prevention or gum health improvement. They are available over-the-counter or by prescription, serving as a supplement to regular brushing and flossing.

Some impactful drivers include continuous product innovation and targeted marketing strategies. Product innovation involves developing new formulations, ingredients, and delivery systems that cater to evolving consumer preferences and specific oral health concerns. This constant development introduces more effective and appealing options, stimulating consumer interest and purchases.

Another significant driver is strategic marketing and promotional activities by manufacturers. Through various advertising channels, companies educate consumers about product benefits, create brand loyalty, and encourage routine use. These campaigns often highlight unique selling points, such as natural ingredients or specific therapeutic effects, influencing consumer perception and purchasing decisions.

Drivers and Trends

Increasing Awareness of Oral Hygiene: Increased public awareness regarding the importance of comprehensive oral hygiene practices is a significant driver of demand. Consumers are becoming increasingly aware of the connection between oral health and overall well-being, leading them to adopt a broader range of oral care products. Educational initiatives from health organizations and dental professionals consistently highlight the benefits of maintaining healthy gums and teeth, which encourages the regular use of oral rinses. This heightened understanding is transforming oral care from a reactive approach focused on treatment to a proactive approach centered on prevention.

The growing understanding translates into a greater willingness to invest in preventive dental solutions. The World Health Organization's "Oral Health" fact sheet, updated in March 2025, states that oral diseases are largely preventable and emphasizes that most oral health conditions can be treated in their early stages, underscoring the value of preventive measures such as using oral rinses. This reinforces consumer perception of oral rinses as essential tools for daily health maintenance rather than just occasional use. Therefore, the expanding consumer knowledge about oral health's role in general wellness actively drives growth of the oral rinse industry.

Rising Prevalence of Oral Diseases: The increasing global prevalence of various oral diseases, such as dental caries and periodontal conditions, represents a major driver. As more individuals face challenges such as tooth decay, gum inflammation, mouth ulcers, and gum disease, there is a heightened demand for products that can help manage symptoms, reduce bacterial load, and prevent the progression of these conditions. This widespread occurrence of oral health issues creates a consistent need for therapeutic and antiseptic rinse solutions.

Government health organizations consistently report high rates of these conditions, which directly impact the demand for supportive oral care products. A systematic analysis for the Global Burden of Disease Study 2021, published in PubMed in March 2025, titled "Trends in the global, regional, and national burden of oral conditions from 1990 to 2021," found that untreated dental caries of permanent teeth and severe periodontitis were among the most common oral conditions globally, affecting billions of people. This persistent burden of oral diseases drives ongoing innovation and consumption within the oral rinse category as people seek effective ways to manage their oral health.

Segmental Insights

Indication Analysis

Based on indication, the segmentation includes periodontitis, mouth ulcers, gingivitis, and dry mouth. The gingivitis segment held the largest share in 2024. Products targeting gingivitis are widely used due to the high global prevalence of this early stage of gum disease, making them a staple in many oral care routines. These rinses are designed to reduce plaque buildup and inflammation, offering an accessible and effective way for individuals to manage their gum health. The broad consumer base, including those looking for daily preventive solutions and those with specific gum concerns, significantly contributes to the dominance of this segment. Manufacturers have also heavily invested in developing a wide range of antiseptic and therapeutic rinses aimed at gingivitis, further solidifying its leading position in the overall oral rinse landscape.

The dry mouth segment, also known as xerostomia, is anticipated to register the highest growth during the forecast period. This acceleration is largely driven by factors such as the increasing geriatric population, who are more prone to dry mouth symptoms, and the rising incidence of chronic diseases and medications that can lead to reduced saliva flow. Consumers experiencing dry mouth seek specialized oral rinses that give dry mouth relief as the rinses provide lubrication, stimulate saliva production, and offer relief from discomfort. As awareness of this condition grows and more tailored solutions become available, demand for these specific formulations is expanding rapidly. The focus on comfort and symptom relief, coupled with an aging demographic, positions the dry mouth indication as a swiftly growing area within the oral rinse offerings.

Product Analysis

Based on product, the segmentation includes antiseptic mouthwash, cosmetic mouthwash, natural mouthwash, and fluoride mouthwash. The antiseptic mouthwash segment held the largest share in 2024. This dominance stems from their strong antibacterial properties, making them effective in reducing plaque, preventing gingivitis, and combating bad breath. Many consumers, often guided by dental professional recommendations, prioritize these formulations for their ability to provide a deeper clean and maintain overall oral health beyond what brushing alone can achieve. The widespread awareness of the benefits associated with controlling oral bacteria, coupled with a broad availability across retail channels, has solidified the leading position of antiseptic products in the daily oral hygiene routines of many individuals seeking comprehensive dental care.

The natural mouthwash segment is anticipated to register the highest growth during the forecast period. This surge is fueled by a rising consumer preference for products with naturally derived ingredients and a growing skepticism toward synthetic chemicals and artificial additives. Consumers are increasingly seeking alternatives free from alcohol, dyes, and harsh preservatives, opting instead for formulations that include essential oils, herbal extracts, and other plant-based components. This trend aligns with broader movements toward natural and organic personal care products, with a focus on perceived safety and environmental considerations. As more brands introduce innovative natural options, and as consumers become more informed about ingredient choices, the demand for these gentler yet effective rinses continues to accelerate, driving significant expansion in this particular product category.

Distribution Channel Analysis

Based on distribution channel, the segmentation includes retail stores, pharmacies, and online stores. The retail stores segment held the largest share in 2024, primarily attributed to their widespread accessibility and established consumer purchasing habits. Supermarkets, hypermarkets, and convenience stores offer a vast reach, allowing consumers to easily purchase oral rinses alongside their regular groceries and household items. The immediate availability of products, the ability for consumers to visually inspect items, and the frequent promotional displays in these physical locations contribute significantly to their leading position. For many consumers, the convenience of picking up oral care products during routine shopping trips makes retail stores the preferred choice.

The online stores segment is anticipated to register the highest growth during the forecast period. This rapid expansion is driven by the increasing shift toward e-commerce, offering consumers unparalleled convenience, a wider selection of products, and often competitive pricing. Online platforms allow for easy comparison of different brands and formulations, access to customer reviews, and direct delivery to one's home, which has become particularly appealing in recent years. The expanding digital infrastructure and rising comfort level of consumers with online shopping are accelerating this trend, positioning online channels as a crucial and dynamic avenue for the sale of oral rinses.

Regional Analysis

The North America oral rinse market accounted for the largest share in 2024. North America is a significant region for oral rinse consumption, characterized by high consumer awareness of oral hygiene and strong emphasis on preventive care. Consumers in this region are generally proactive about their dental health, often incorporating mouthwashes as a routine part of their daily regimen. This widespread adoption is supported by robust healthcare infrastructure and consistent public health campaigns promoting comprehensive oral care. North America also benefits from ongoing product innovation, with a diverse range of specialized formulations, including alcohol-free and therapeutic options, readily available to meet varied consumer needs and preferences for advanced oral health solutions.

U.S. Oral Rinse Market Insights

The U.S. stands out as a key contributor to the North America oral rinse market. The industry growth in the country is influenced by a strong consumer focus on both therapeutic benefits, such as gum health and cavity protection, and cosmetic aspects, including breath freshener and teeth whitening. Americans are generally receptive to new oral care technologies and premium products, driven by an aesthetic consciousness and a desire for optimal dental wellness. The presence of major industry players and extensive distribution networks, including traditional retail and rapidly expanding online channels, further solidifies the U.S. position as a prominent country within the global oral rinse landscape.

Europe Oral Rinse Market Trends

Europe represents a substantial region for the oral rinse segment, driven by increasing awareness of oral health and the rising prevalence of specific dental conditions across its diverse countries. Consumers across Europe are showing a growing interest in oral hygiene beyond basic brushing, with a notable shift toward specialized and preventive products. This region also sees a strong demand for natural and eco-friendly formulations, reflecting broader consumer trends toward sustainable and health-conscious choices. Different countries in Europe exhibit varied preferences, with some showing a higher adoption of therapeutic rinses while others lean more toward cosmetic solutions, reflecting the varied cultural and health priorities across the region.

The Germany oral rinse market stands out as a major contributor in Europe. The country exhibits a high level of oral health awareness, coupled with a preference for clinically proven and effective oral care products. German consumers tend to be discerning, often opting for high-quality, scientifically backed formulations that provide specific benefits, such as targeted support for gum health or cavity prevention. The well-developed healthcare system and the emphasis on preventive medicine also play a role in driving the consistent demand for oral rinses, ensuring a steady and mature presence for these products across the nation.

Asia Pacific Oral Rinse Market Overview

Asia Pacific is a rapidly growing regional market for oral rinses, fueled by a large and expanding population, increasing disposable incomes, and improving access to oral healthcare facilities. As economies develop and urbanization increases, there is a significant rise in awareness regarding personal hygiene, including oral health. This burgeoning consumer base is increasingly adopting modern oral care practices, moving beyond traditional methods to incorporate specialized products such as oral rinses into their daily routines. The region's diverse markets also see a mix of demand for both basic hygiene products and advanced therapeutic solutions, driven by varying levels of oral health education and affordability.

China Oral Rinse Market Overview

In Asia Pacific, China is a major country driving the expansion of the oral rinse segment. The country's immense population and rapidly expanding middle class contribute significantly to the overall consumption of oral care products. There is a noticeable trend toward premium and specialized oral rinses, particularly those offering cosmetic benefits such as whitening, as well as therapeutic properties for common oral issues. Digitalization and the strong penetration of e-commerce platforms also play a crucial role, providing convenient access to a wide array of oral rinse brands for a vast consumer base across both urban and rural areas.

Key Players and Competitive Insights

The oral rinse segment features a dynamic competitive landscape, with major players such as Colgate-Palmolive Company, Procter & Gamble, Haleon, Kenvue (Johnson & Johnson), and Unilever PLC driving innovation and consumer engagement. These key participants focus on product differentiation through advanced formulations, targeted benefits, and effective marketing strategies. The competitive environment is further intensified by the presence of numerous regional and local brands, which often cater to specific consumer preferences or offer niche solutions, leading to a diverse range of products available to consumers worldwide.

A few prominent companies in the industry include Colgate-Palmolive Company; Procter & Gamble; Haleon; Kenvue (Johnson & Johnson); Unilever PLC; Church & Dwight Co., Inc.; Sunstar Suisse S.A.; Dabur India Ltd.; Lion Corporation; Kao Corporation; and The Himalaya Drug Company.

Key Players

- Church & Dwight Co., Inc.

- Colgate-Palmolive Company

- Dabur India Ltd.

- Haleon

- Kao Corporation

- Kenvue (Johnson & Johnson)

- Lion Corporation

- Procter & Gamble

- Sunstar Suisse S.A.

- The Himalaya Drug Company

- Unilever PLC

Oral Rinse Industry Developments

June 2025: Colgate-Palmolive (India) announced plans to introduce more brands from its global portfolio into India.

June 2025: Haleon PLC announced the completion of its acquisition of the remaining 12% equity interest in Tianjin TSKF Pharmaceutical Co. Ltd., its OTC joint venture in China.

Oral Rinse Market Segmentation

By Indication Outlook (Revenue – USD Billion, 2020–2034)

- Periodontitis

- Mouth Ulcers

- Gingivitis

- Dry Mouth

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Antiseptic Mouthwash

- Cosmetic Mouthwash

- Natural Mouthwash

- Fluoride Mouthwash

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Retail Stores

- Pharmacies

- Online Stores

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Oral Rinse Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.70 billion |

|

Market Size in 2025 |

USD 8.20 billion |

|

Revenue Forecast by 2034 |

USD 14.83 billion |

|

CAGR |

6.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.70 billion in 2024 and is projected to grow to USD 14.83 billion by 2034.

The global market is projected to register a CAGR of 6.8% during the forecast period.

North America dominated the share in 2024.

A few key players include Colgate-Palmolive Company; Procter & Gamble; Haleon; Kenvue (Johnson & Johnson); Unilever PLC; Church & Dwight Co., Inc.; Sunstar Suisse S.A.; Dabur India Ltd.; Lion Corporation; Kao Corporation; and The Himalaya Drug Company.

The gingivitis segment accounted for the largest share in 2024.

The natural mouthwash segment is expected to witness the fastest growth during the forecast period.