Organic Baby Food Market Size, Share, Trends, Industry Analysis Report

By Product (Infant Milk Powder, Prepared Baby Food, and Dried Baby Food), By Distribution Channel, and By Region -Market Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 117

- Format: PDF

- Report ID: PM2762

- Base Year: 2024

- Historical Data: 2020-2023

Overview

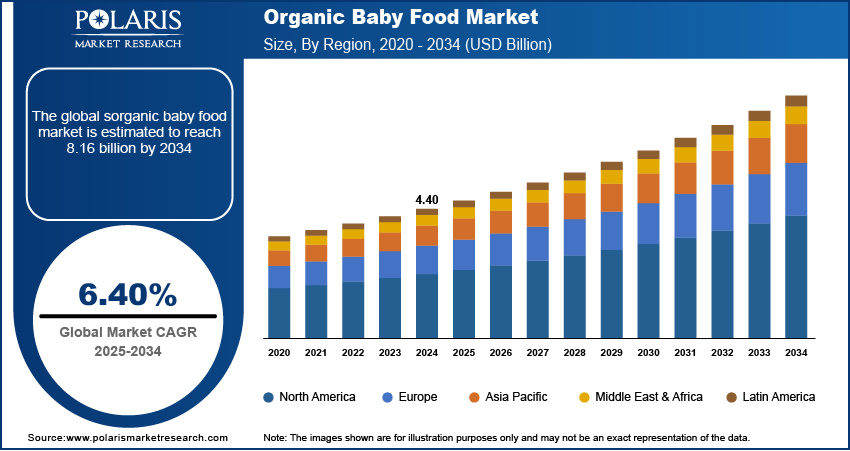

The global organic baby food market size was valued at USD 4.40 billion in 2024. The market is projected to grow at a CAGR of 6.40% during 2025 to 2034. Key factors driving demand for organic baby food include a greater understanding of the risks of pesticides and additives, increased parental health consciousness, and rising disposable incomes.

Key Insights

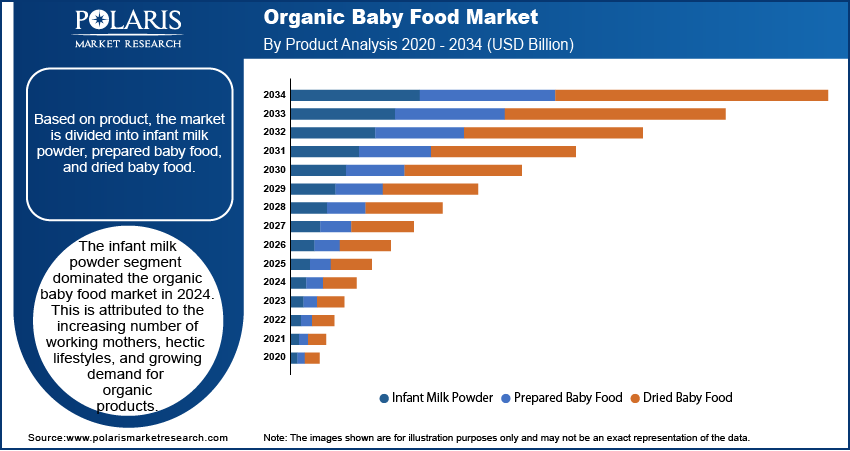

- The infant milk powder segment dominated the organic baby food market in 2024. This is attributed to the increasing number of working mothers, hectic lifestyles, and growing demand for organic products.

- The supermarket/hypermarket segment held the largest revenue share in 2024, due to improved distribution channel networks and inventory management.

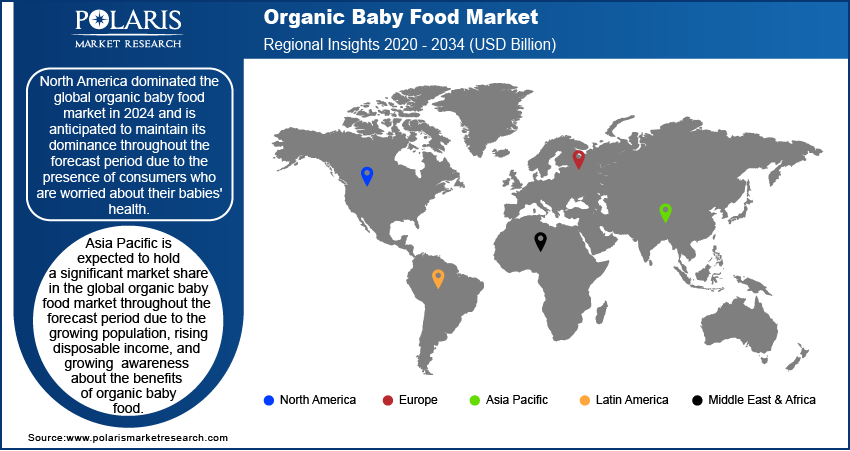

- North America dominated the global organic baby food market in 2024 and is anticipated to maintain its dominance throughout the forecast period due to the presence of consumers who are worried about their babies' health.

- Asia Pacific is expected to hold a significant market share in the global organic baby food market throughout the forecast period due to the growing population, rising disposable income, and growing awareness about the benefits of organic baby food.

Industry Dynamics

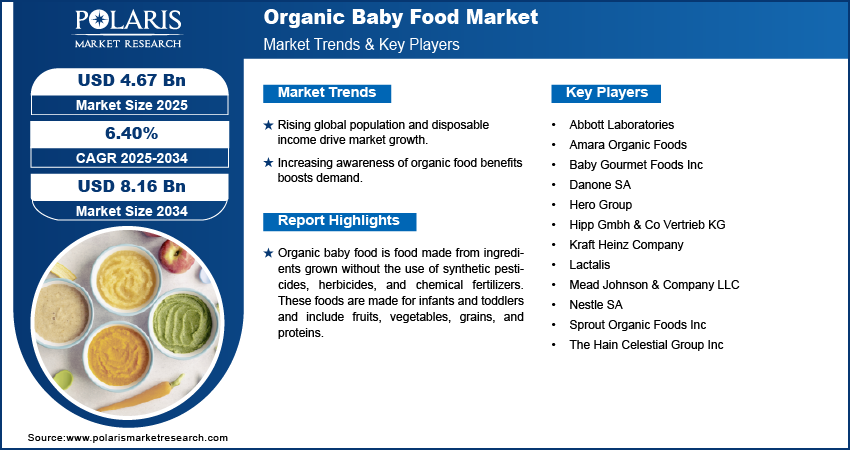

- The global organic baby food market is fueled by the growing global population, coupled with increasing disposable income.

- The increasing awareness about the benefits of organic foods in emerging countries such as India, Brazil, and others is also anticipated to increase demand for organic baby food.

- Increasing urbanization and expansion of e-commerce are creating a lucrative market opportunity.

- The high cost of organic food may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 4.40 Billion

- 2034 Projected Market Size: USD 8.16 Billion

- CAGR (2025-2034): 6.40%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Organic baby food is food made from ingredients grown without the use of synthetic pesticides, herbicides, and chemical fertilizers. These foods are made for infants and toddlers and include fruits, vegetables, grains, and proteins. The primary goal of these foods is to provide infants with safe, nutritious, and wholesome meals. Parents across the globe are now choosing organic baby food to promote better digestion and reduce the risk of allergies.

Babies are soft and sensitive in general; they react differently to every stimulus. Babies are especially vulnerable to foodborne sickness because their immune systems are not fully developed to combat infections. The reasons stated above have given rise to the organic baby food sector, which is produced with great care.

Growing parental concerns about children's health and nutrition in industrialized and developing nations have been significant market drivers in recent years. Additionally, consumer knowledge of the advantages of organic food products is growing, which is fueling market expansion. The growing demand for packaged organic food, such as ready-to-eat, foreshadows the expansion of the global industry. Additionally, the expected expansion of the market over the forecast period is attributed to the growing number of working women around the world. Additionally, trends like clean-label production and nutrient-dense infant food regimens drive the industry.

Industry Dynamics

Growth Drivers

The global organic baby food market is fueled by the growing global population, coupled with increasing disposable income. According to the United Nations, the world's population is projected to continue growing for the next 50 to 60 years, peaking at approximately 10.3 billion by the mid-2080. This is projected to encouraging parents with high disposable income to purchase organic baby food for ther children as these foods promote better digestion and reduce the risk of allergies. The expansion of e-commerce and supermarkets/hypermarkets, driven by growth in urbanization is fueling the demand for baby organic food as e-commerce platforms and supermarkets makes the accessbility of these foods easy. United Nations stated that the global urban population is projected to increase to around two-thirds of the total population in 2050.

Report Segmentation

The market is primarily segmented based on form, product, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

Know more about this report: Request for sample pages

Product Insight

Based on product, the market is divided into infant milk powder, prepared baby food, and dried baby food. The infant milk powder segment dominated the organic baby food market in 2024. This is attributed to the increasing number of working mothers, hectic lifestyles, and growing demand for organic products. Moreover, the suboptimal breastfeeding rate on account of premature birth and hormonal disorders contributed to the segment's dominance. The expansion of e-commerce platforms along with quick delivery services, increasing urbanization, rising disposable income, key nutritional benefits of infant milk powder helped in segment's dominance.

Distribution Channel Insight

In terms of distribution channel, the segmentation includes supermarket/hypermarket, convenience store, online retails, and others. The supermarket/hypermarket segment held the largest revenue share in 2024, due to improved distribution channel networks and inventory management. The economic growth and rapid urbanization in especially in emerging countries such as India and Brazil furthe led the segment dominance. Moreover, the increasing adoption of packaged foods and growing literacy acorss the globe also contributed to the high adoption of organic baby foods from supermarket/hypermarket.

Regional Insight

North America dominated the global organic baby food market in 2024 and is anticipated to maintain its dominance throughout the forecast period due to the presence of consumers who are worried about their babies' health. The increasing disposable income, particulary in the U.S. also led the consumption of organic baby foods as high disposable income allow people to purchase these products which are rich in nutrition to promote healthier child development. Bureau of Economic Analysis stated that the disposable personal income in the US increased +0.6% in April 2025 from March 2025. Moreover, the presence of various supermarkets and retails outlets specilized in baby foods contributed to the regional dominance in the market.

Asia Pacific is expected to hold a significant market share in the global organic baby food market throughout the forecast period due to the growing population, rising disposable income, and growing awareness about the benefits of organic baby food. India has the world's largest population at 1,463,865,525, followed by China at 1,416,096,094. The increasing literacy rate and growing awareness about the benefits of organic baby food encouraged parents in the region purchase organic baby food for their children o promote better digestion and reduce the risk of allergies.

Competitive Insight

Some of the major players operating in the global market include, Abbott Laboratories, Amara Organic Foods, Baby Gourmet Foods, Danone SA, Hero Group, Hipp GMBH, Lactalis, Mead Johnson & Company, LLC, Nestle, Sprout Organic Foods, Hain Celestial, and Kraft Heinz Company.

Recent Developments

July 2020, Gerber Organic released its new product, puffed corn and in the right size for young fingers.

June 2020, Heinz updated their baby food line with the introduction of HEINZ BY NATURETM baby food, a new line-up of baby food that includes organic and natural ingredients, as well as acerola cherry.

Organic Baby Food Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.40 billion |

| Market size value in 2025 | USD 4.67 billion |

|

Revenue forecast in 2034 |

USD 8.16 billion |

|

CAGR |

6.40% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

Abbott Laboratories, Amara Organic Foods, Baby Gourmet Foods Inc., Danone SA, Hero Group, Hipp Gmbh & Co Vertrieb KG, Lactalis, Mead Johnson & Company, LLC, Nestle SA, Sprout Organic Foods, Inc., The Hain Celestial Group Inc., and The Kraft Heinz Company. |

FAQ's

• The global market size was valued at USD 4.40 billion in 2024 and is projected to grow to USD 8.16 billion by 2034.

• The global market is projected to register a CAGR of 6.40% during the forecast period.

• North America dominated the market in 2024

• A few of the key players in the market include Abbott Laboratories, Amara Organic Foods, Baby Gourmet Foods Inc., Danone SA, Hero Group, Hipp Gmbh & Co Vertrieb KG, Lactalis, Mead Johnson & Company, LLC, Nestle SA, Sprout Organic Foods, Inc., The Hain Celestial Group Inc., and The Kraft Heinz Company.

• The supermarket/hypermarket segment dominated the market revenue share in 2024.