Osteopontin Market Share, Size, Trends, Industry Analysis Report

By Type (Human, Rat, Cow, Others); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Dec-2023

- Pages: 118

- Format: PDF

- Report ID: PM4148

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

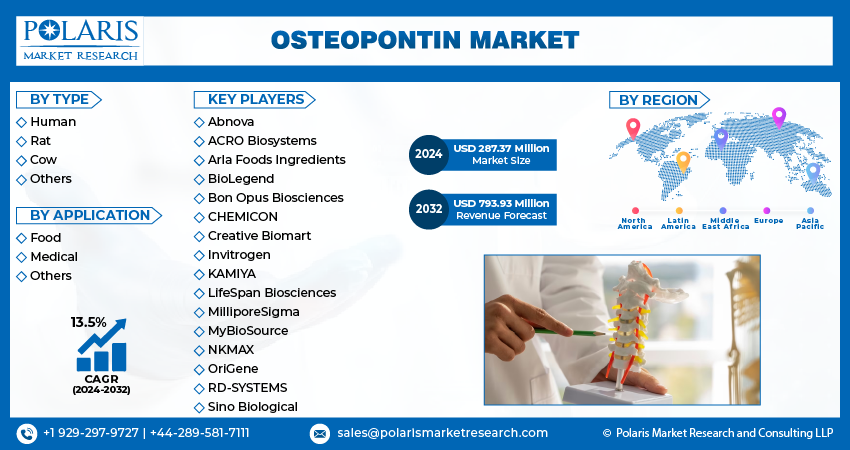

The global osteopontin market was valued at USD 253.59 million in 2023 and is expected to grow at a CAGR of 13.5% during the forecast period.

Osteopontin is widely used in infant formula, which will probably lead to an increase in consumer demand for the ingredient soon. As sales of infant food and newborn formula increase, the market for osteopontin is likely to expand. The market will benefit from the rise in demand for dietary formulas designed to boost babies' immune systems. According to preliminary studies, osteopontin may aid in the maturation of the immune system and defense against pathogenic infections, contributing to the development of infant immunological functions. Growing collaborations to gain a competitive advantage and enhance supply chain networks are fueling the expansion of the osteopontin market.

To Understand More About this Research: Request a Free Sample Report

- For instance, in December 2022, Milcobel, a dairy producer, and Arla Foods Ingredients, a Danish company, established a new supply agreement. As a part of the agreement, Arla will enhance the whey protein retentate Milcobel supplies and use it to create ingredients for high-end protein markets.

Furthermore, osteopontin has drawn a lot of attention recently owing to research findings revealing nutritional levels of osteopontin. It has undergone extensive characterization in human and bovine milk, but it has also been detected and quantified in the milk of several other mammalian species. In addition, it has the power to promote inflammation by communicating tissue damage to the immune cells, which can recover the damage. The presence of beneficial nutrients for treating diverse health issues is further boosting research activities and their demand in the future.

Moreover, as more people are affected by cancer, there will be a rise in research activities to innovate therapy formulations to cure this disease. A study published in PubMed Central reviewed the relationship between osteopontin and cancer. Drug resistance is one of the primary obstacles in cancer treatment. In order to lessen medication resistance in sensitive tumours, this study outlines the osteopontin-based mechanisms that may contribute to cancer drug resistance. These findings are further propelling the ongoing use of osteopontin in treating disease, primarily cancer, and fostering the demand for osteopontin in the coming years.

However, small companies established in the osteopontin market are experiencing low research activities due to an inability to fund them, restraining innovation in the coming years. In addition, limited awareness about this protein is hampering market demand and discouraging manufacturers from producing new products.

For Specific Research Requirements, Request for a Customized Research Report

Growth Drivers

- Rising scientific studies on osteopontin are creating awareness among consumers

Osteopontin (OPN) is a phosphor-glycoprotein generated from bone that has been linked to both physiological and pathological mechanisms. In recent years, its significance has increased due to its part in the immune system's response to chronic degenerative illnesses such as rheumatoid arthritis (RA) & osteoarthritis (OA). This protein contains extracellular matrix (ECM) glycoprotein, an essential component of bone remodeling. Growing innovations in the market are fueling new growth opportunities for the osteopontin market by revealing new applications of osteopontin.

Recently, a study published in PubMed focused on a scientific review of osteopontin use in RA and OA. According to some experimental trial results, OPN plays a preventive role in rheumatic diseases, despite substantial evidence that it considerably contributes to the immunopathology of RA and OA. Furthermore, this will fuel research and development activities on the use of osteopontin among companies specializing in human diseases like rheumatoid arthritis in the future.

The evolution of bone-related diseases like osteoporosis is driving scientific studies by researchers. The National Osteoporosis Foundation estimates that up to 80% of those who suffer from osteoporosis are female. The fact that women often have smaller and thinner bones than men is one of the key causes of the elevated risk. Another factor is that when a woman enters menopause, estrogen, the hormone in women that protects bones, dramatically declines, driving the research activities on the ability of osteopontin to treat osteoporosis diseases and driving its demand in the future.

Report Segmentation

The market is primarily segmented based on type, application and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- Human segment is expected to witness the highest growth during the forecast period

The human segment is projected to grow at a CAGR during the study period, mainly driven by evolving scientific studies and reviews by researchers on the uses of osteopontin in treating human health diseases. Manufacturers are more interested in creating new products with higher nutritional content for humans due to the lack of sufficient time to have a balanced diet and maintain the body's nutrition for effective functioning. For instance, a study published in the Proceedings of the National Academy of Sciences in 2023 focused on testing the relationship between Alzheimer's disease and osteopontin. This demonstrates the growing research studies on osteopontin to cure health issues primarily related to humans.

The rat segment led the market with a substantial revenue share in 2022, largely attributable to the prevalence of conducting research activities on rats before human trials. Rats are one of the most used organisms to conduct biomedical research. They are known to have similarities with humans, primarily genetically and physiologically, which drives experiments on rats by researchers. Due to the similar genetics, the results of biochemical experiments on rats will inform human-related effects and potential therapies.

By Application Analysis

- Medical segment is expected to have the largest market share in 2023

The medical segment accounted for the largest market share in 2023 and is likely to retain its market position during the study period. The presence of higher research activities in the medical and pharmaceutical industries is driving demand for the osteopontin market. It is known to be used in autoimmune diseases, oncology, and others. Companies and researchers are conducting research to include osteopontin in pharmaceutical formulations to find effective medicine to cure people's illnesses. Growing human trials on osteopontin-related diseases are related to the medical domain, as they are conducted to test the effectiveness of medical formulations.

Regional Insights

- North America region witnessed the largest share in the global market in 2023

The North America region witnessed the largest global market share in 2023 and is projected to maintain its market position over the study period. Increasing osteoporosis cases in individuals is driving the demand for osteopontin-infused food or medical formulations. According to the National Osteoporosis Foundation, there are up to 54 million cases of osteoporosis and low bone mass in the United States, which raises the risk of osteoporosis. A person's chance of developing osteoporosis is raised by several risk factors that are connected to the disease's onset. This is driving further research studies by pharmaceutical companies primarily focused on treating bone-related diseases and curing health issues. These factors are cumulatively driving the application of osteopontin and fueling the demand for it in the coming years.

Europe will grow at rapid pace, owing to the manufacturers willingness to design products and follow stringent regulations placed by the European Food Safety Agency. This is driving trust and quality assurance among consumers, driving future demand for osteopontin-infused products.

Key Market Players & Competitive Insights

Market is expected to have higher competition owing to the growing ongoing research findings suggesting various health benefits associated with the protein, primarily for infants. The rise in partnerships, mergers, and acquisitions activities is providing numerous opportunities for the expansion of the market.

Some of the major players operating in the global market include:

- Abnova

- ACRO Biosystems

- Arla Foods Ingredients

- BioLegend

- Bon Opus Biosciences

- CHEMICON

- Creative Biomart

- Invitrogen

- KAMIYA

- LifeSpan Biosciences

- MilliporeSigma

- MyBioSource

- NKMAX

- OriGene

- RD-SYSTEMS

- Sino Biological

Recent Developments

- In March 2023, Aela Food Ingredients, obtained the final Novel Food approval for the Lacprodan OPN-10 from the European Food Safety Agency (EFSA), one of the 1st osteopontin products marketed in the EU.

Osteopontin Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 287.37 million |

|

Revenue forecast in 2032 |

USD 793.93 million |

|

CAGR |

13.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The osteopontin market report covering key segments are type, application and region.

Osteopontin Market Size Worth $793.93 Million By 2032

The global osteopontin market is expected to grow at a CAGR of 13.5% during the forecast period.

North America is leading the global market

key driving factors in osteopontin market are Increased Research in Cancer Treatment.