Overactive Bladder Treatment (OAB) Market Share, Size, Trends, Industry Analysis Report

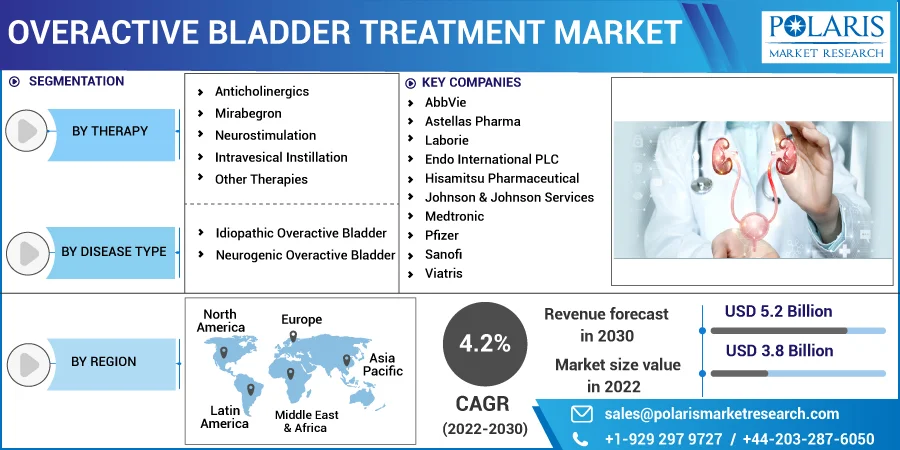

By Therapy; By Disease Type (Idiopathic Overactive Bladder, Neurogenic Overactive Bladder); By Region; Segment Forecast, 2022-2030

- Published Date:Nov-2022

- Pages: 117

- Format: PDF

- Report ID: PM2829

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

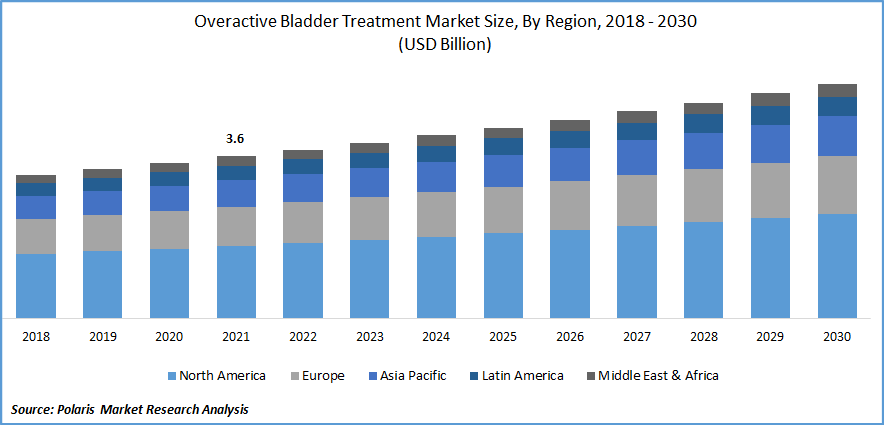

The global overactive bladder treatment market was valued at USD 3.6 billion in 2021 and is expected to grow at a CAGR of 4.2% during the forecast period.

The main factors driving the global market are the rising elderly population and the rising frequency of disorders like Parkinson's disease, which causes overactive bladder problems. For instance, the World Population Prospect estimates that 771 Mn people worldwide will be 65 or older in 2022. By 2030, 994 Mn people will be above the age of 65, and by 2050, 1.6 billion people will be aged population.

Know more about this report: Request for sample pages

Since urine incontinence typically worsens as people age, an overactive bladder causes a detrimental effect on the health and quality of life of the elderly population. Low diagnosis rates and a vast population base in emerging nations seeking cost-effective OAB medications will also provide substantial growth opportunities for the market.

Moreover, a robust pipeline of products is expected to favor market growth in the near future. Currently, around 30 candidates for the treatment of OAB are in the trial pipeline. In line with this, "Samsung Medical Center" has also studied significant biomarkers of nerve growth factor (NGF), prostaglandin E 2 & adenosine tri-phosphate in patients suffering from OAB and concerning effects of the drug on such biomarkers. This would help researchers in predicting the treatment responsiveness and personalized medication. Such initiatives also help in analyzing huge unmet medical needs in treating OAB.

Overactive bladder (OAB) is a condition rather than a disease that includes a variety of symptoms such as frequent urination, need to urinate, urine leakage, and the need to urinate at least twice per night. Overactive bladder can be brought on by several factors, including weak pelvic muscles, nerve damage from trauma or disease, urinary tract infections (UTI), obesity, hormonal imbalance after menopause, drugs, caffeine, and alcohol.

Additionally, the market is anticipated to rise as a result of factors including pharmaceutical companies' strong marketing campaigns and the development of novel intravenous medicines. For instance, Sumitovant Biopharma presented analysis from the phase 3 EMPOWER study of GEMTESA, an adrenergic receptor agonist for the treatment of the OAB in adults with slight symptoms of urinary incontinence and urinary frequency, at the 2022 annual meeting of the American Urological Association.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The neurostimulation segment is projected to contribute significantly to market revenue during the projected period. Women are especially susceptible to the disorder due to its high incidence, bladder muscle weakness following menopause, and other factors such as introducing new products.

Also, one of the critical factors anticipated to fuel the market segment's growth is the strategic actions performed by the market's participants. For instance, in March 2022, Valencia Technologies Corporation received FDA premarket approval for their eCoin leadless tibial neurostimulator for the treatment of urine urge incontinence, which affects more than 60% of patients with overactive bladder. It is anticipated that these approvals will aid in the market segment's expansion.

Report Segmentation

The market is primarily segmented based on therapy, disease type, and region.

|

By Therapy |

By Disease Type |

By Region |

|

|

|

Know more about this report: Request for sample pages

Mirabegron emerged as the industry's largest market segment.

Mirabegron had a majority share of the market in 2021, owing to its lower side-effect profile compared to other pharmacological classes. Mirabegron, commonly known as YM178, is a brand-new, once-daily, highly effective 3-AR agonist. Several nations are considering regulatory applications for mirabegron. For instance, Zydus won USFDA approval for its Mirabegron Extended-Release Tablets on October 20, 2022.

According to Emilio Sacco publication, Mirabegron received marketing permission in Japan in July 2011 and went on sale there in September 2011. Additionally, FDA authorized mirabegron in June 2012. (Myrbetriq, Astellas Pharma US, Inc.). The efficacy and safety of mirabegron were recently examined for marketing approval in reports from the FDA's Division of Reproductive and Urologic Products Office. Additionally, due to the introduction of novel SNM & PTNS for OAB, the neuromodulator category is anticipated to increase more quickly.

The Idiopathic overactive bladder segment accounted for largest market share.

The idiopathic segment held a larger market share due to the rise in cases of idiopathic bladder disorders and the rising usage of medications for treatment. Additionally, during the forecast period, the market for this segment is expected to increase more rapidly than average.

Women are more susceptible to the illness due to bladder muscle weakening following pregnancy and menopause. According to Rafet Sonmez's 2021 research, percutaneous tibial nerve stimulation (PTNS) & transcutaneous tibial nerve stimulation (TTNS) were more beneficial than bladder treatment alone in women suffering from idiopathic overactive bladder. This ought to encourage significant market players to make investments in this region. Due to greater rivalry among market rivals, the cost of therapy may be reduced overall during the projection period.

The demand in North America is expected to witness significant growth

North America is predicted to dominate the overactive bladder therapy market. The developed healthcare system in the nation is to blame for this. Due to the fact that overactive bladder treatment is covered by insurance, the disease is expected to become more prevalent as individuals age, and with the existence of major companies, the market is expected to grow over the course of the projection period.

The aging population is expected to contribute to the market's expansion. Around 7,021,430 people aged 65 and over were counted in the 2021 Census; 3,224,680 of them were men, and 3,796,750 were women. According to estimates from the National Association for Continence and other sources, about 25 million adult Americans suffer from either acute or chronic urine incontinence. Women over 50 are more prone than younger women to suffer UI, while it can happen at any age.

The market's expansion is also aided by actions taken by market participants to advance treatments and regulatory authority approvals. The North American region is therefore anticipated to project expansion in the market over the projected period as a result of the aforementioned factors.

Competitive Insight

Some of the major players operating in the global market include AbbVie, Astellas Pharma, Laborie, Endo International PLC, Hisamitsu Pharmaceutical, Johnson & Johnson Services, Medtronic, Pfizer, Sanofi, Viatris, Teva Pharmaceutical, Hisamitsu, Johnson & Johnson, Macleods Pharmaceuticals, Urovant Sciences, Lupin, Uro Medical, Sun Pharmaceutical, Glenmark, Intas Pharmaceuticals, Bayer AG, and Hugel.

Recent Developments

- A therapeutic generic version of Pfizer's Toviaz (fesoterodine fumarate) ER tablets was made available in the United States in July 2022 by Dr. Reddy's Laboratories. It is used to treat overactive bladder.

- Phase III “EMPOWUR Extension Study” of the overactive bladder drug GEMTESA 75 mg were presented in May 2022 by the Urovant Sciences, subsidiary of the Sumitovant Biopharma. It will also look at the product's long-term effects and further confirm the drug's potential utility & durability in the study population.

- Axonics, announces the first patient implants with the new recharge-free sacral neuromodulation system in Canada in September 2022. Following U.S. FDA approval, the Axonics F15 obtained regulatory approval from the Health Canada.

Overactive Bladder Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 3.8 billion |

|

Revenue forecast in 2030 |

USD 5.2 billion |

|

CAGR |

4.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Therapy, By Disease Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

AbbVie, Astellas Pharma, Laborie, Endo International PLC, Hisamitsu Pharmaceutical, Johnson & Johnson Services, Medtronic, Pfizer, Sanofi, Viatris, Teva Pharmaceutical, Hisamitsu, Johnson & Johnson Macleods Pharmaceuticals, Urovant Sciences, Lupin , Uro Medical, Sun Pharmaceutical, Glenmark, Intas Pharmaceuticals, Bayer Ag and Hugel |