Oxygen Scavengers Market Size, Share, Trends, Industry Analysis Report

: By Type (Inorganic and Organic), Form, End Use and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 125

- Format: PDF

- Report ID: PM2208

- Base Year: 2024

- Historical Data: 2020-2023

Oxygen Scavengers Market Overview

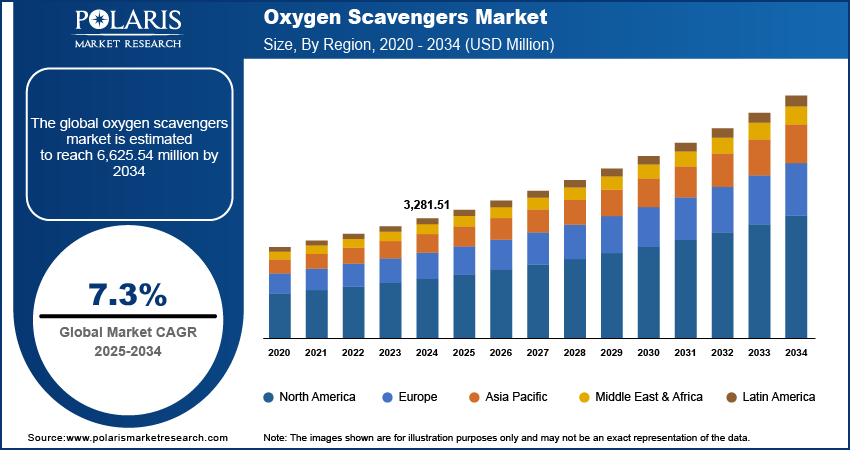

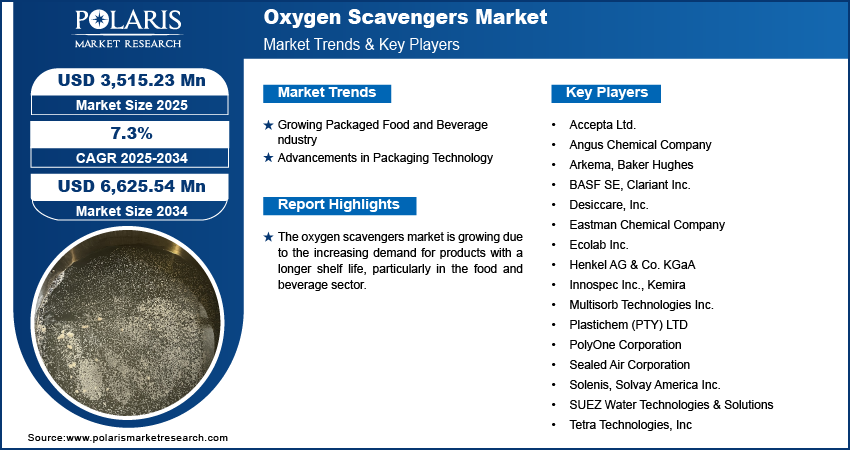

The global oxygen scavengers market size was valued at USD 3,281.51 million in 2024. The market is projected to grow from USD 3,515.23 million in 2025 to USD 6,625.54 million by 2034, exhibiting a CAGR of 7.3% from 2025 to 2034.

Oxygen scavengers are substances used to remove or reduce the presence of oxygen in packaging or environments, typically to preserve the freshness of food, pharmaceuticals, or other products sensitive to oxygen. They work by chemically reacting with oxygen, preventing degradation, discoloration, or spoilage caused by exposure to air.

The oxygen scavengers market is growing due to the increasing demand for products with a longer shelf life, particularly in the food and beverage sector. Oxygen exposure accelerates spoilage, causing food to lose flavor, texture, and nutritional value. Oxygen scavengers remove oxygen from packaging, slowing down the degradation process. Consumers are increasingly seeking fresher products with fewer preservatives, prompting manufacturers to rely on oxygen scavengers to preserve product quality. This trend is especially prominent in perishable items like meat, coffee, and baked goods, which are driving the demand for oxygen scavengers.

To Understand More About this Research: Request a Free Sample Report

The heightened awareness of food safety and quality is driving the oxygen scavengers market expansion. Consumers today are more conscious of what they eat and how it is preserved. Oxygen scavengers help maintain food safety by inhibiting the growth of spoilage microorganisms, such as bacteria and molds, which thrive in oxygen-rich environments. This makes oxygen scavengers critical in reducing contamination risks and ensuring that food remains safe to consume for longer periods. Additionally, as food safety standards become stricter globally, manufacturers are increasingly relying on oxygen scavengers to comply with regulations and deliver high-quality products, thereby driving market growth.

Oxygen Scavengers Market Dynamics

Growing Packaged Food and Beverage Industry

An increasing number of people are opting for convenience foods and ready-to-eat meals, driving the demand for effective preservation methods. For instance, according to the US Department of Agriculture, in 2021, the food and beverage manufacturing industry in the US employed 1.7 million people, highlighting the significant growth of the packaged food and beverage industry. Additionally, the rising popularity of snacks, beverages, and frozen foods, which are highly susceptible to degradation, is driving the demand for oxygen scavengers. Thus, the expansion of the packaged food and beverage industry is propelling the oxygen scavengers market revenue.

Advancements in Packaging Technology

Innovations in materials and packaging designs have made oxygen scavengers more efficient and cost-effective. Packaging solutions now commonly incorporate oxygen-scavenging properties, offering enhanced performance and sustainability. For instance, Mitsubishi Chemical Corporation's AGELESS OMAC integrates scavenging properties directly into the packaging structure. These innovations enable manufacturers to offer more environmentally friendly options, such as recyclable or biodegradable oxygen absorbers. Additionally, businesses are increasingly focused on reducing their environmental footprint and achieving sustainability goals, which is driving the demand for innovative packaging solutions, including oxygen scavenger systems. As a result, advancements in packaging technology are boosting the oxygen scavengers market development.

Oxygen Scavengers Market Segment Insights

Oxygen Scavengers Market Assessment by Type Insights

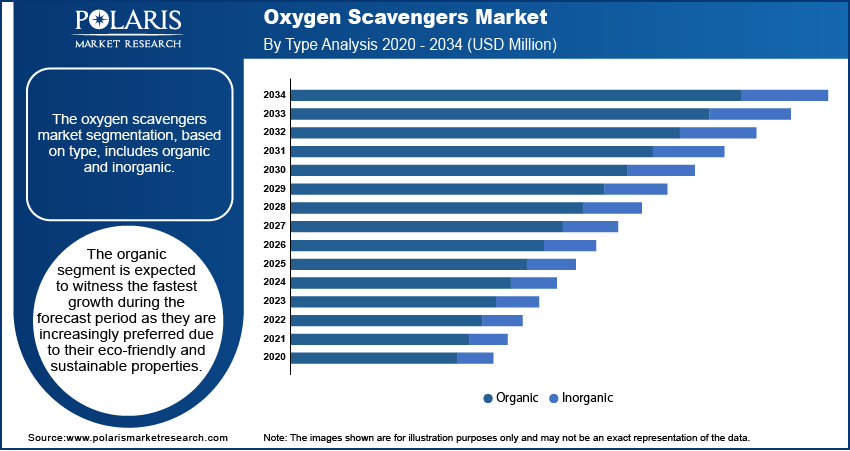

The oxygen scavengers market segmentation, based on type, includes inorganic and organic. The rapid growth of the organic segment in the oxygen scavengers market from 2025 to 2034 is driven by increasing consumer demand for eco-friendly and sustainable packaging solutions. Stringent environmental regulations and a shift toward biodegradable and non-toxic materials are pushing industries, particularly food & beverage and pharmaceuticals, to adopt organic oxygen scavengers. Rising awareness about the harmful effects of synthetic additives on health and the environment further accelerates this trend. Additionally, advancements in bio-based scavenger technologies, offering high efficiency and extended shelf life, are making them a preferred choice. The growing focus on reducing food waste and enhancing product preservation without synthetic chemicals also fuels the adoption of organic oxygen scavengers, boosting market expansion.

Oxygen Scavengers Market Evaluation by End Use Insights

The oxygen scavengers market segmentation, based on end use, includes food & beverage, pharmaceutical, power, oil & gas, chemical, pulp & paper, and others. The food & beverage segment dominated the market in 2024. Exposure to oxygen can lead to spoilage, which affects the flavor, texture, and nutritional value of food and beverages. Oxygen scavengers are widely used in food packaging to extend shelf life and maintain product quality without relying on artificial preservatives. Additionally, rising consumer demand for fresher and longer-lasting products is driving the demand for oxygen scavengers in the food and beverage industry, contributing to the segment’s leading position in the global oxygen scavengers market.

Oxygen Scavengers Market Regional Analysis

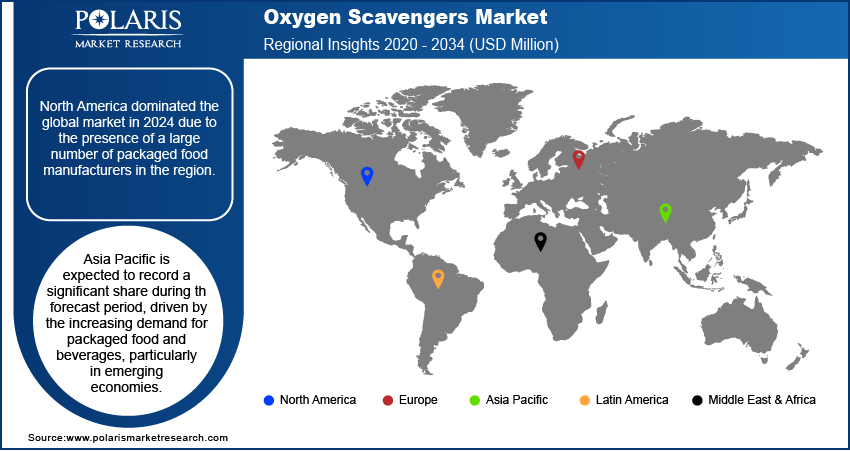

By region, the study provides the oxygen scavengers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market in 2024 due to the presence of a large number of packaged food manufacturers in the region. The well-established food industry relies heavily on packaging solutions to preserve the quality and extend the shelf life of food products. Additionally, consumer demand for convenient, long-lasting food continues to rise in the region, encouraging manufacturers to adopt oxygen-scavenger technologies. This surge in demand, along with a heightened focus on sustainability and food safety, is driving the growth of the oxygen scavengers market in North America.

Asia Pacific is expected to record a significant market share during the forecast period due to increasing demand for packaged food and beverages, particularly in emerging economies. Rapid urbanization, busy lifestyles, and rising disposable incomes are driving the demand for convenient and long-lasting food products. Oxygen scavengers help preserve the quality and shelf life of perishable items, making them essential in the region's food industry. Additionally, growing awareness of food safety and sustainability is encouraging manufacturers to adopt oxygen scavenger technologies, thereby driving the regional market growth.

The India oxygen scavengers market is experiencing substantial growth due to increasing industrialization in the country. The expansion of key industries, particularly in food processing, pharmaceuticals, and packaging, is fueling the demand for efficient preservation and packaging solutions. For instance, according to the Ministry of Statistics & Programme Implementation, India's Index of Industrial Production grew by 3.8% in 2023. This industrial growth has led to higher production volumes, creating a greater need to ensure products remain fresh and safe over extended periods. The rise in manufacturing activities, along with a greater emphasis on sustainability and food safety, is driving the need for oxygen scavengers in India.

Oxygen Scavengers Market – Key Players and Competitive Insights

The oxygen scavengers market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the oxygen scavengers market include Accepta Ltd.; Angus Chemical Company; Arkema; Baker Hughes; BASF SE; Clariant Inc.; Desiccare, Inc.; Eastman Chemical Company; Ecolab Inc.; Henkel AG & Co. KGaA; Innospec Inc.; Kemira; Multisorb Technologies Inc.; Plastichem (PTY) LTD; PolyOne Corporation; Sealed Air Corporation; Solenis, Solvay America Inc.; SUEZ Water Technologies & Solutions; and Tetra Technologies, Inc.

BASF SE, based in Ludwigshafen, Germany, is a chemical producer operating in over 80 countries. Established in 1865, the company has developed a diverse portfolio organized into six main segments, which include chemicals, materials, industrial solutions, surface technologies, nutrition & care, and agricultural solutions. The chemicals segment includes products such as solvents, amines, resins, and industrial gases. The materials segment focuses on high-performance plastics and biodegradable materials. Industrial solutions provide essential ingredients for coatings and adhesives, while surface technologies offer catalysts and coatings for automotive and chemical applications. Nutrition & care addresses the need for personal care and nutrition, and agricultural solutions supply crop protection products. The BASF oxygen scavenger Cu-0226 S is a copper oxide impregnated on high-surface alumina, designed for oxygen removal in inert gases like nitrogen. It is utilized in various applications requiring low oxygen levels. The product is known for its high dispersion and effectiveness in gas purification processes. BASF operates across multiple regions, including Europe, North America, Asia Pacific, South America, Africa, and the Middle East.

Eastman Chemical Company, founded in 1920 and headquartered in Kingsport, Tennessee, is a significant player in the specialty materials and chemicals industry. Originally part of Kodak, Eastman became an independent company in 1994. The company operates through four main segments, which include additives & functional products, advanced materials, chemical intermediates, and fibers. The additives & functional products segment produces chemicals and adhesive resins for various applications, including coatings and tires. Advanced materials focus on specialty copolyesters and cellulose esters used in sectors like transportation and electronics. The chemical intermediates segment supplies a range of products for industrial applications, while the fibers segment manufactures acetate tow and plasticizers primarily for the cigarette filter industry and yarns for apparel. One of Eastman's notable products is diethylhydroxylamine (DEHA), an oxygen scavenger used to remove residual oxygen in boiler systems. DEHA is considered a cost-effective alternative to sodium sulfite and offers a better health and safety profile compared to hydrazine. Eastman operates across various regions, with significant activities in North America, Europe, and Asia Pacific.

List of Key Companies in Oxygen Scavengers Market

- Accepta Ltd.

- Angus Chemical Company

- Arkema

- Baker Hughes

- BASF SE

- Clariant Inc.

- Desiccare, Inc.

- Eastman Chemical Company

- Ecolab Inc.

- Henkel AG & Co. KGaA

- Innospec Inc.

- Kemira

- Multisorb Technologies Inc.

- Plastichem (PTY) LTD

- PolyOne Corporation

- Sealed Air Corporation

- Solenis, Solvay America Inc.

- SUEZ Water Technologies & Solutions

- Tetra Technologies, Inc.

Oxygen Scavengers Industry Developments

In July 2023, Mitsubishi Gas Chemical launched the PFAS-free AGELESS oxygen absorber technology, offering an eco-friendly packaging solution that meets global regulations while preserving food quality and extending shelf life.

Oxygen Scavengers Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Inorganic

- Organic

By Form Outlook (Revenue, USD Million, 2020–2034)

- Sachets/Canisters/Bottle Caps & Labels

- OS Films & PET Bottles

- Liquid

- Powder

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Food & Beverage

- Pharmaceutical

- Power

- Oil & Gas

- Chemical

- Pulp & Paper

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Oxygen Scavengers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3,281.51 million |

|

Market size value in 2025 |

USD 3,515.23 million |

|

Revenue Forecast by 2034 |

USD 6,625.54 million |

|

CAGR |

7.3% from 2025–2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The oxygen scavengers market size was valued at USD 3,281.51 million in 2024 and is projected to grow to USD 6,625.54 million by 2034.

The global market is projected to register a CAGR of 7.3% from 2025 to 2034.

North America had the largest share of the global market in 2024.

A few of the key players in the market are Accepta Ltd.; Angus Chemical Company; Arkema; Baker Hughes; BASF SE; Clariant Inc.; Desiccare, Inc.; Eastman Chemical Company; Ecolab Inc.; Henkel AG & Co. KGaA; Innospec Inc.; Kemira; Multisorb Technologies Inc.; Plastichem (PTY) LTD; PolyOne Corporation; Sealed Air Corporation; Solenis, Solvay America Inc.; SUEZ Water Technologies & Solutions; and Tetra Technologies, Inc.

The food & beverage segment dominated the oxygen scavengers market in 2024 due to its wide use in food packaging to extend shelf life and preserve product quality.

The organic segment is expected to witness the fastest growth during the forecast period as they are increasingly preferred due to their eco-friendly and sustainable properties